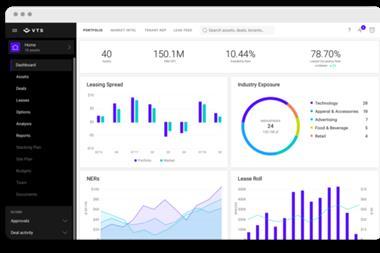

Brookfield Asset Management has raised $500m (€432m) to invest in companies that operate at the “intersection of technology and the built environment”.

The manager said it has raised more than half a billion dollars for its Brookfield Technology Partners II (BTP II) growth fund.

Josh Raffaelli, managing partner at Brookfield who oversees growth investing initiatives said: “Technology is changing the landscape for owners of real assets and increasingly becoming a critical component in every aspect of the economy.

“We are pleased with the support we’ve received from entrepreneurs and fellow investors who recognise Brookfield’s capabilities as a hands-on, value-add owner, operator and partner that strives to build lasting enterprise value together with our portfolio companies.”

To date the Brookfield growth strategy has made 14 investments across multiple industries and fund offerings, the manager said.

The investments include Latch, a smart access solution for residential and commercial buildings; GoodLeap, a point-of-sale payment platform for sustainable home solutions; and Deliverr, an ecommerce logistics platform.

To read the digital edition of the latest IPE Real Assets magazine click here.

No comments yet