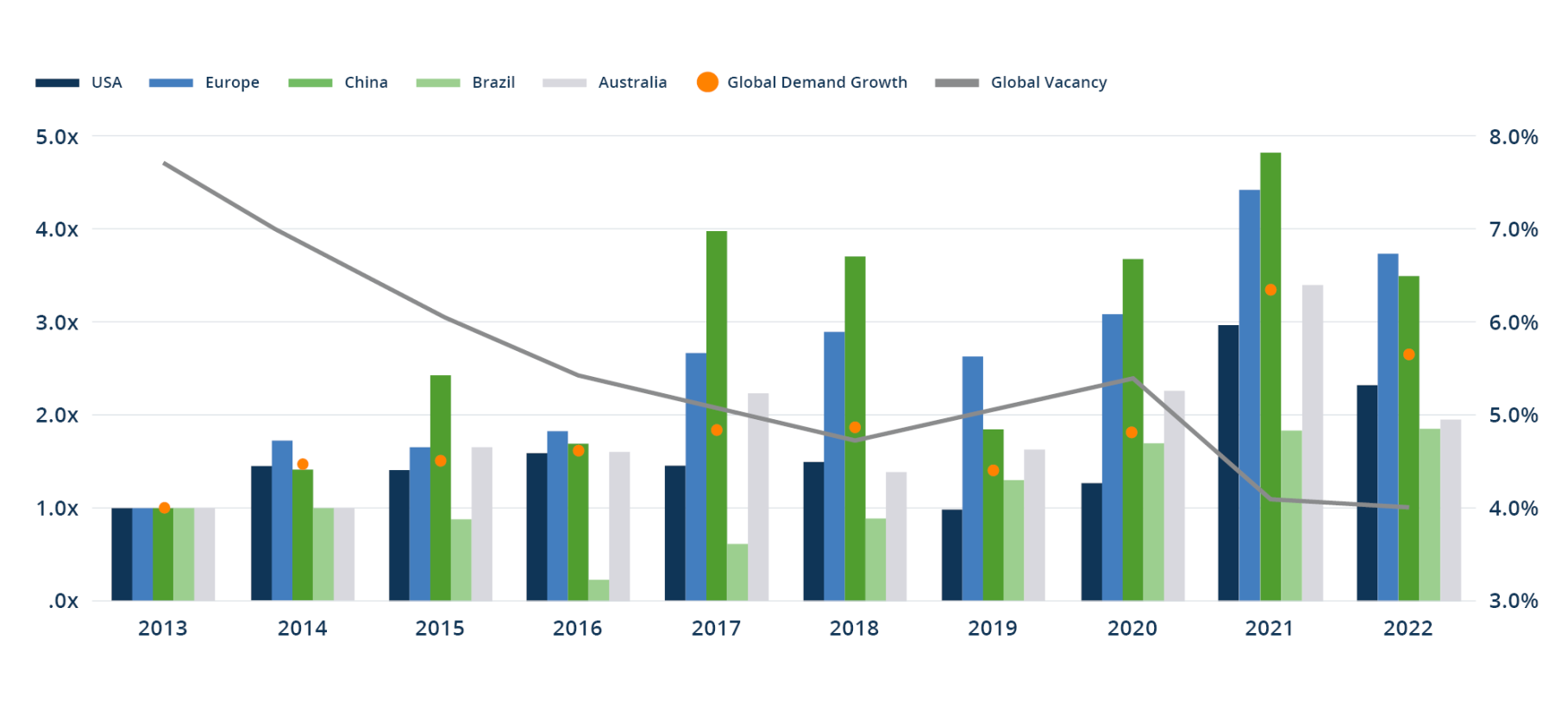

Similar trends are visible across Europe and Asia Pacific. In Europe, we believe the widening gap between the cost to own and the cost to rent will increase the number of renters as interest rates remain high and supply is scarce.3 China and India are both experiencing growing populations and continued urbanization, coupled with an ongoing housing shortage, which we expect will give rise to demand for institutional quality housing.4 With a median age of 28 years, India has one of the largest millennial populations, which is driving demand for rental housing among this demographic.5

When we think about housing, we see attractive opportunities not only in the traditional sense—multifamily, affordable housing, single family rental—but also in alternative types such as student housing, senior living and manufactured housing. These are supported by similar sector tailwinds and a resulting supply and demand imbalance. For example, manufactured housing stock in the U.S. is expected to decline 14% over the next 10 years, from 6.7 million units to 5.7 million units, further reducing the supply of affordable housing and strengthening occupancy.6

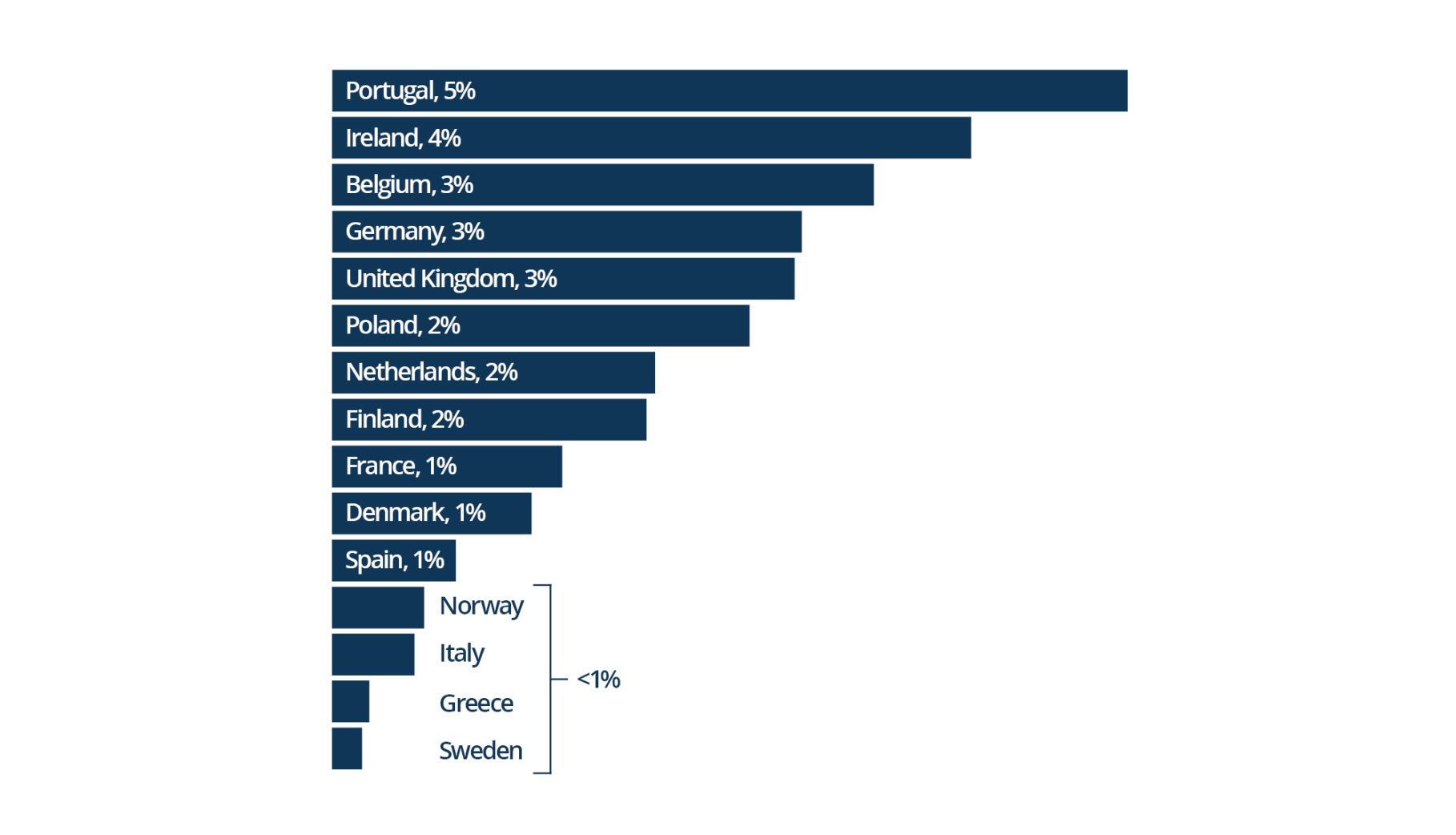

Students are seeking newer, modern accommodations with amenities, and we think there are opportunities to buy for value, renovate older stock and build modernized portfolios of scale. Across the U.K. and Continental Europe, increased demand from international students and interest in English-taught programs are coming up against a lack of higher quality purpose-built student accommodation. For example, in major university cities like London and Amsterdam, the provision rate of students to beds is roughly 30% and 27%, respectively.7

In the U.S., top university cities are seeing supply and demand imbalances with college-age or near-college-age populations exceeding U.S. averages.8 There are about 2.7 million purpose-built student housing beds compared with 20 million undergraduate students in the U.S. today, a provision rate of about 13%.9

Australia has also become an increasingly popular higher education destination, with one of the largest proportions of international enrollment. This is driving demand for purpose-built student accommodations.

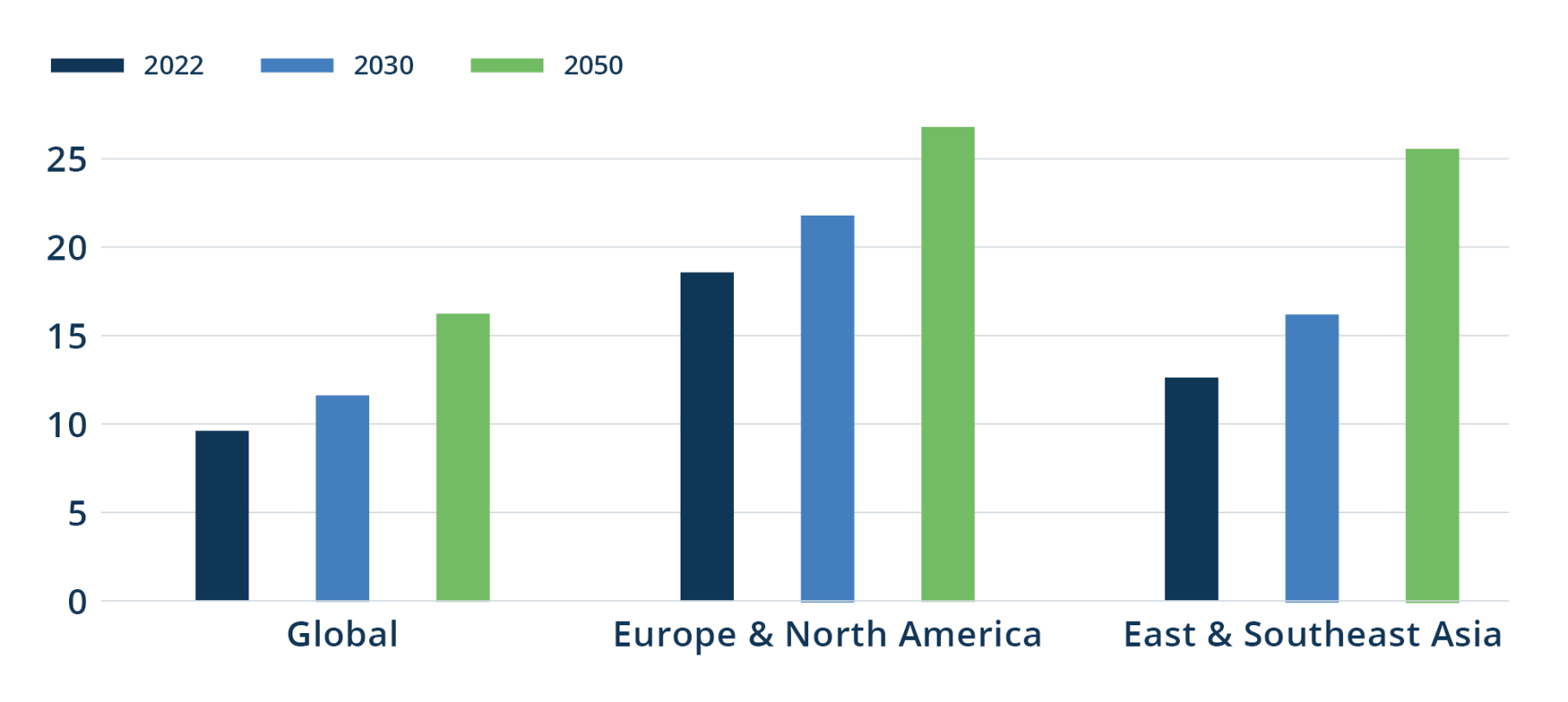

Aging populations are also increasing demand for senior living properties, particularly in developed countries (see Figure 5). Meanwhile, the average cost to develop senior housing has increased by 17.8% since 2020.

Senior living is a relatively fragmented sector with high barriers to entry. We see opportunities to capture growing demand for high-quality properties—from senior apartments to higher acuity needs—by renovating assets. For example, Australia presents a very compelling opportunity, with 17% of Australians age 65 and over. That share is expected to reach 20% over the next 10 years, with less than 1,000 new units being delivered each year.10