We bring an ownership mindset to everything we do, focusing on long-term wealth creation for institutions and individuals.

Built on more than a century of experience, we actively strengthen and grow the businesses we invest in around the world.

Assets Under Management

Professionals

Countries

Operating Employees

Explore Other Ways We Partner

Institutions

We partner with global institutions and family offices to provide investment solutions aligned with their growth objectives.

Financial Advisors

We partner with financial intermediaries and advisors to deliver solutions and insights to help improve investor outcomes.

Individuals

We help individuals create wealth and secure their financial futures, guided by an investment approach focused on enduring value.

Leveraging the Brookfield Ecosystem

One of the keys to our success is the Brookfield Ecosystem—the collective intelligence and insights we gain through our operational expertise, global reach and deep relationships around the world.

Together, this enables us to identify and act on opportunities few others can, while strengthening the businesses across our platform.

Recent Highlights

Brookfield’s Connor Teskey Live at Bloomberg Invest

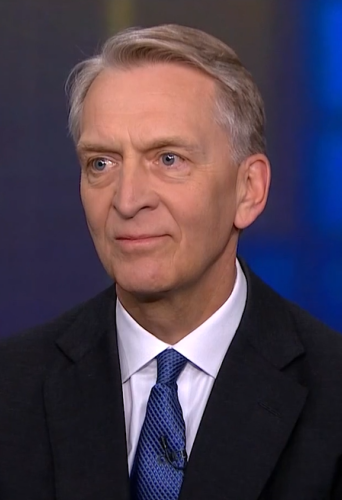

Brookfield CEO Bruce Flatt on The Pulse with Francine Lacqua

Bruce Flatt on AI Infrastructure

Brookfield Is Raising $10 Billion for New AI Infrastructure Fund

Bruce Flatt on the Future of Nuclear Energy

Brookfield aims to triple real estate AUM in Asia-Pacific in five years

Our teams are empowered to think and act like owners—collaborating across disciplines to build what’s next and create lasting value.

We're pleased to be recognized by PEI Group

Firm of the Year: Global

Fund Manager of the Year: Global

Multifamily Lender of the Year

Capital Raise of the Year: Global

Energy Transition Investor of the Year: Global

Logistics Investor of the Year: Asia-Pacific

Equity Fundraising of the Year: Global

Infrastructure Debt Manager of the Year: Americas

Energy Transition Investor of the Year: North America