Harness Local Insights

Our established presence in key global markets gives us deep insight into local market conditions and trends, as well as access to proprietary deal flow.

Enhance Strategic Flexibility

We move nimbly—turning ideas into action, deploying capital where it’s needed most and applying deep operating expertise to create value.

Contribute to Communities

We are deeply involved in the communities in which we operate—creating jobs and supporting local initiatives to drive those neighborhoods forward.

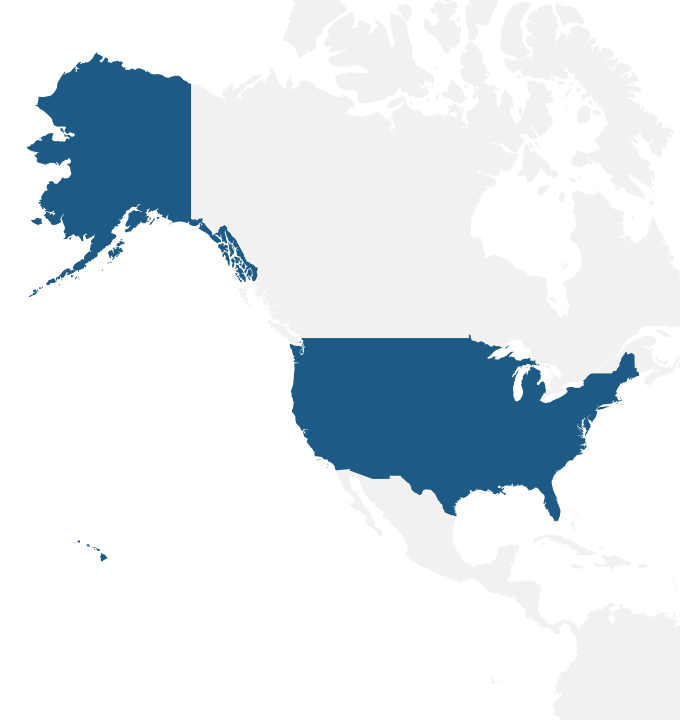

Where We Are

United States

Headquartered in New York, our deep and diversified presence combines operational expertise with long-term investment discipline to build and manage the assets that power the United States' economic growth and resilience. Whether providing energy generation, critical infrastructure networks, advanced industrial capabilities or owning and operating high-quality real estate assets, we create lasting value that supports communities, drives innovation, and strengthens the foundations of the nation’s economy.

Europe & Middle East

With deep roots in Europe and strategic momentum in the Middle East, we are helping to shape key markets throughout both regions. Our portfolio includes critical infrastructure networks, innovative energy solutions, essential business services and landmark real estate that support growing and shifting demands. We focus on deploying capital to build and support the infrastructure backbone in well-established and fast-growing markets, creating long-term value for economies across these regions.

With corporate offices in London and Dubai, we have regional centers in Amsterdam, Doha, Dublin, Frankfurt, Luxembourg, Madrid, Paris, Riyadh, Stockholm and Zurich.

Asia Pacific

For nearly 20 years, Brookfield's commitment to investing in the Asia Pacific region has been embedded in our local operations in Sydney, Beijing, Hong Kong, Mumbai, Seoul, Shanghai, Singapore and Tokyo. Our portfolio spans infrastructure, renewable power and transition, private equity, real estate, credit and insurance, and we continue to seek opportunities that drive growth and innovation in these dynamic markets.

Canada

We are a leading investor, owner, and operator in Canada, with regional offices in Toronto and Calgary. We leverage our long-term perspective and hands-on expertise to build and operate assets that drive sustainable growth, spark innovation, and support the foundation of local economies across the country.

South America

Anchored in São Paulo, our roots in South America date back to 1899 when we began operations in Brazil. Today, we are a leading investor, owner, and operator across the region, with a diversified portfolio spanning infrastructure, renewable energy, private equity, and real estate. We develop and manage assets that advance economic progress, foster innovation, and create lasting value for communities in Brazil, Chile, Colombia and Peru.

All numbers approximate. Map represents select regions. AUM as of June 30, 2025, employee numbers as of December 31, 2024.

Get in Touch

With over 250,000 people on the ground worldwide, we’re ready and able to meet our clients where they are.