Highlights

Our Approach

Operational Change

Our five-step process to enact operational change in our portfolio.

-

Set near-term targets aligned to our net zero commitments.

Demonstrate our progress towards meeting our obligations as a signatory to the Net Zero Asset Managers initiative.

-

Share best practices and operational excellence.

Articulate how we think about climate considerations and carbon reduction initiatives.

-

Apply a net-zero framework.

Build tangible roadmaps for our assets and businesses to achieve net-zero emissions.

-

Measure and report.

Demonstrate transparency to stakeholders and report on progress through our disclosures.

-

Evaluate our net-zero ambition and reset near-term targets.

Recalibrate and advance our ambition every five years.

See it in Action

Operating levers for decarbonization

Renewable Energy

Powering Brookfield businesses with green energy generated by our renewable power operations.

Capital Allocation

Investing towards maintenance or growth capital expenditure projects that can result in lower emissions intensity.

Electrification

Modifying or replacing traditional fossil fuel consuming processes with electrified methods.

Green & Transition Technology

Utilizing newer, lower-emitting technologies, including alternative sources of fuel, carbon capture and sequestration.

Decarbonization Investments

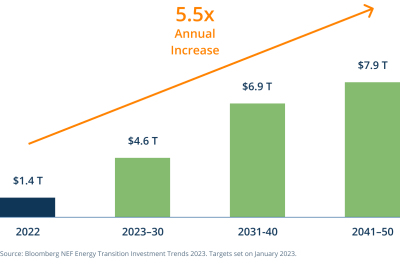

Annual Investment Must Accelerate

Achieving net zero by 2050 is estimated to require an increase of 5.5x in investments into energy transition and renewable asset classes every year.

Our Capital and Deployment

Brookfield is one of the world's largest investors in decarbonization technologies.

Renewable Energy Operator and Developer

Our leading global renewables and transition platform spans five continents, with deep expertise across every major decarbonization technology. The business produces over 25,000 megawatts of operating capacity - the equivalent of taking seven million cars off of the road.

For a more detailed overview of Brookfield’s sustainability strategy and approach, please visit our 2022 Sustainability Report.

For more information on Brookfield Corporation's sustainability progress, please click here.