Endnotes:

1. Flux Magazine, “Humanity Doubles Its Data Creation Every 18 Months, And It Has Powerful Implications,” Accessed April 4, 2024.

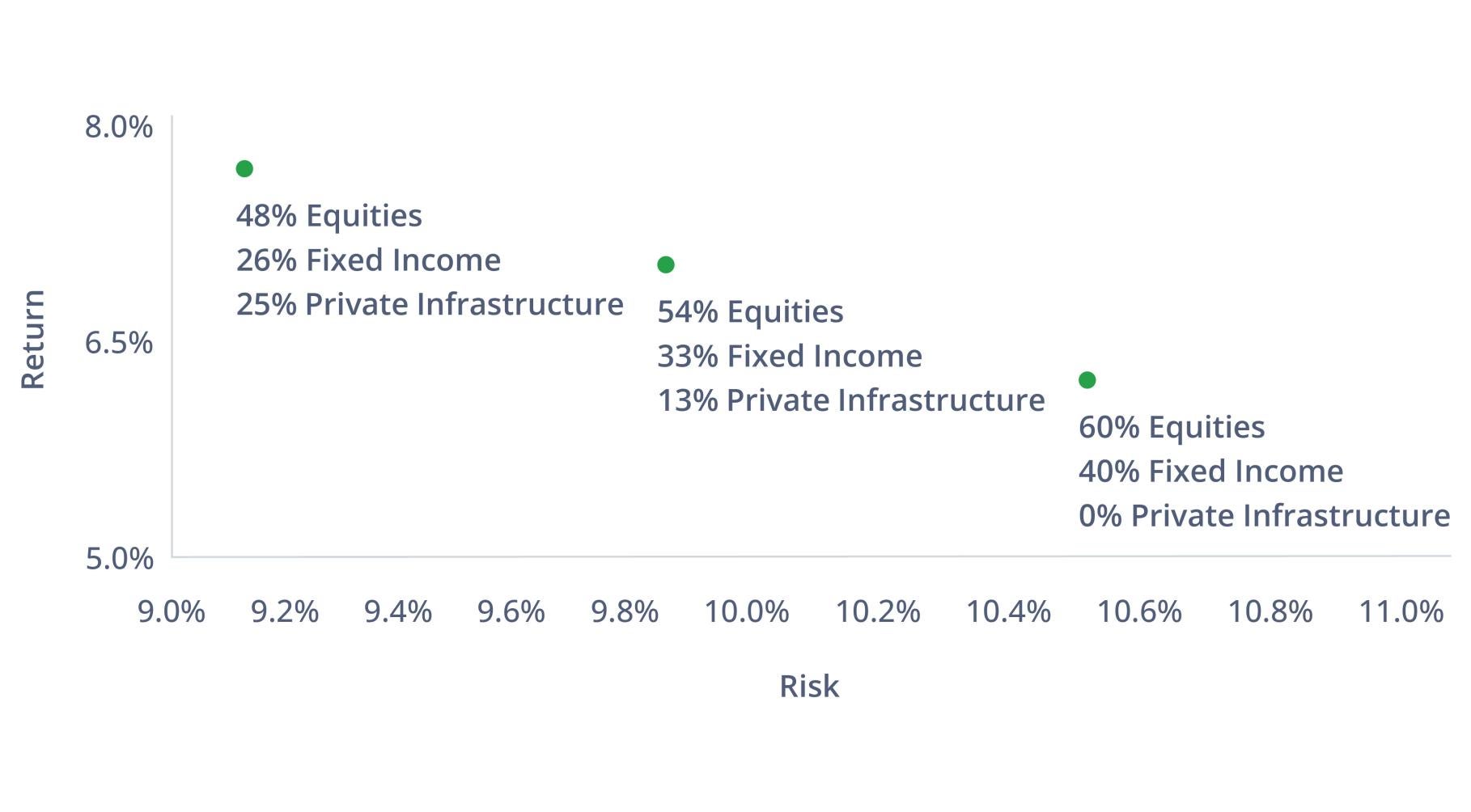

2. Past performance is not indicative of future results. For the period January 1, 2013 through June 30, 2023. Source: Bloomberg; Burgiss. Risk is defined as annualized standard deviation. Standard deviation is a commonly-used measure of the risk/reward profile of the risk/reward profile of traditional portfolios and broad market indices. As applied to alternative investment funds and strategies, however, these statistics may materially understate the true risk profile of an alternative investment because alternative investment funds are subject to a loss of principal which is not reflected in the standard deviation of returns, the only measure of risk used in calculating standard deviation. Equities represented by MSCI World Index; Fixed Income represented by the Bloomberg Global Aggregate Index; Private Infrastructure represented by the Burgiss Global Infrastructure Index. There are limitations to the data provided given limited coverage, reporting lag and different valuation methodologies. Further, private infrastructure funds that are included in the index choose to self-report. Thus, the index is not representative of the entire private infrastructure universe and may be skewed towards those funds that generally have higher performance. Over time, funds included and excluded based on performance, may result a “survivorship bias” that can result in a further misrepresentation of performance. The data shown here is presented for general market commentary and is not intended to represent the performance of Brookfield, any of its listed entities or sponsored investment vehicles. See disclosures below for full index definitions.

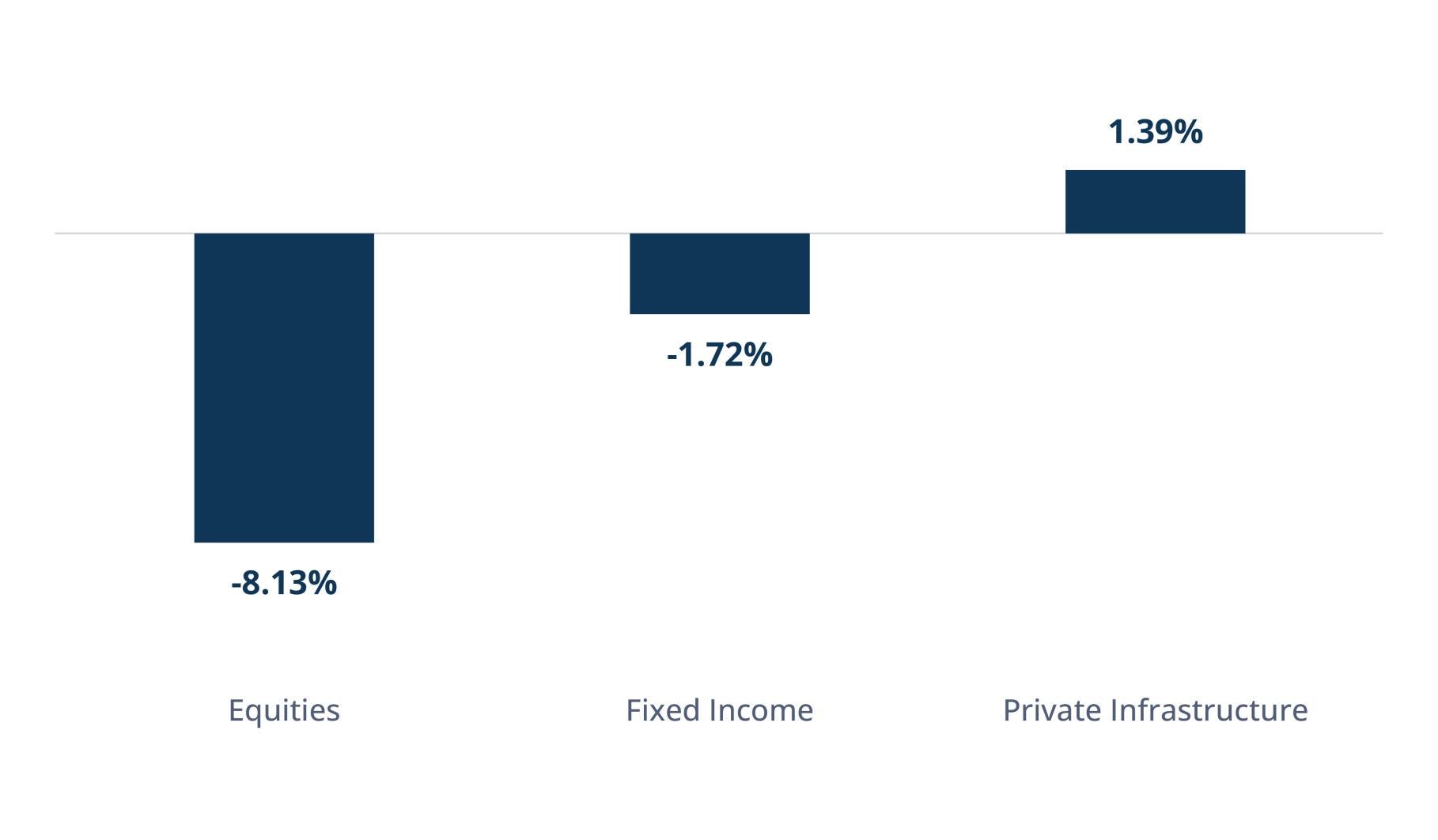

3. Past performance is not indicative of future results. For the period January 1, 2013 through June 30, 2023. Source: Bloomberg; Burgiss. Equities refers to MSCI World Index; Fixed Income refers to the Bloomberg Global Aggregate Index; Private Infrastructure refers to the Burgiss Global Infrastructure Index. The indexes are unmanaged and cannot be purchased directly by investors. Index performance is shown for illustrative and general market commentary purposes only and does not predict or depict the performance of any investment, including the performance of Brookfield, any of its listed entities or sponsored investment vehicles. See disclosures below for full index definitions.

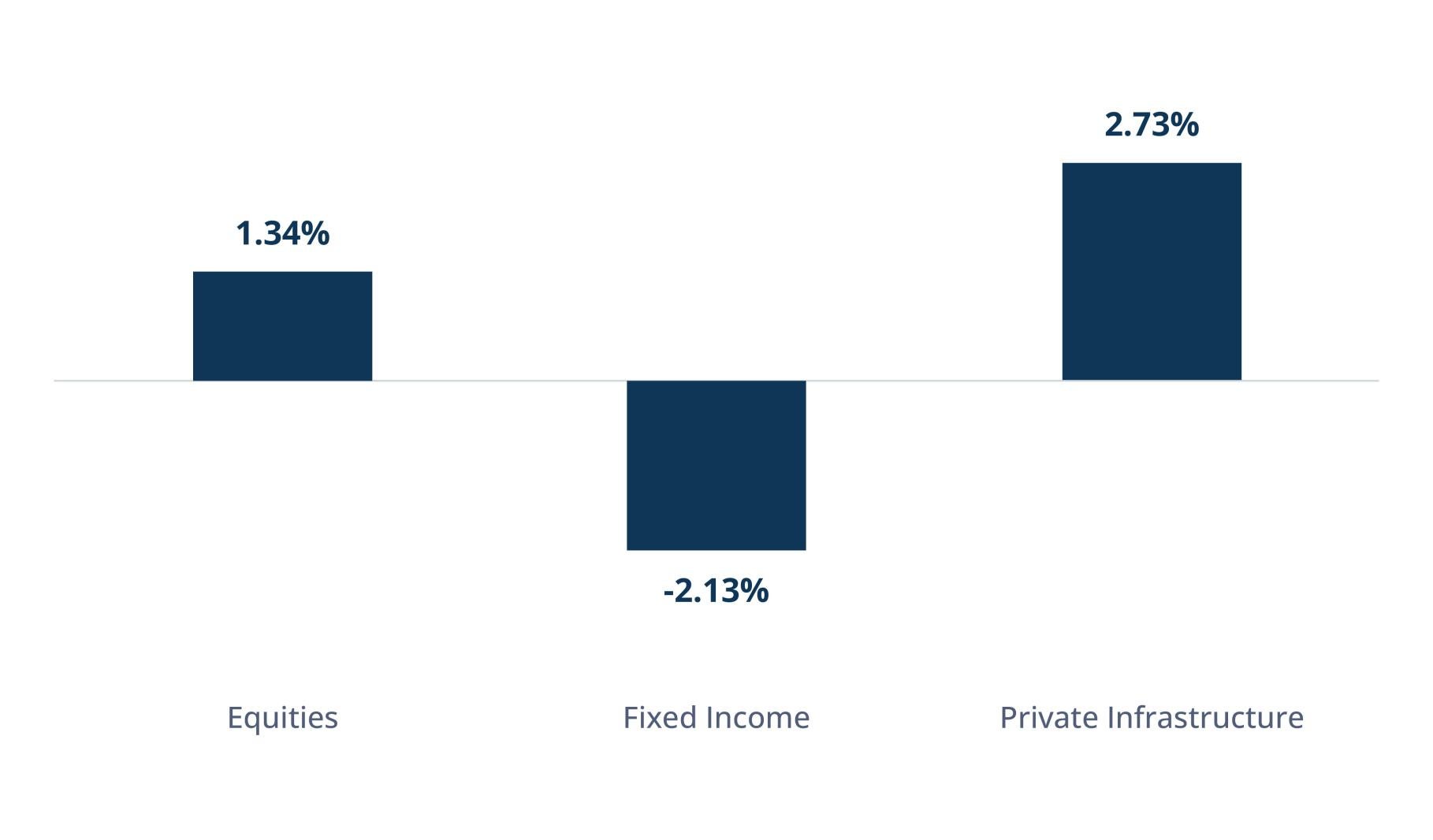

4. Past performance is not indicative of future results. For the period January 1, 2013 through June 30, 2023. Source: Bloomberg; Burgiss. Risk is defined as annualized standard deviation. Equities represented by MSCI World Index; Fixed Income represented by the Bloomberg Global Aggregate Index; Private Infrastructure represented by the Burgiss Global Infrastructure Index. There are limitations to the data provided given limited coverage, reporting lag and different valuation methodologies. Further, private infrastructure funds that are included in the index choose to self-report. Thus, the index is not representative of the entire private infrastructure universe and may be skewed towards those funds that generally have higher performance. Over time, funds included and excluded based on performance, may result a “survivorship bias” that can result in a further misrepresentation of performance. The data shown here is presented for general market commentary and is not intended to represent the performance of Brookfield, any of its listed entities or sponsored investment vehicles. See disclosures below for full index definitions. Inflation is defined as Seasonally Adjusted CPI-U. Periods of Above-Average Inflation are defined as quarters where CPI was above its historical average. During the time period analyzed, average CPI was 2.63% and there were 13 such quarters.

5. The Bloomberg Global Aggregate Index is a market-capitalization-weighted index comprising globally traded investment-grade bonds. The index includes government securities, mortgage-backed securities, asset-backed securities and corporate securities to simulate the universe of bonds in the market. The maturities of the bonds in the index are more than one year.

The Burgiss Infrastructure Index represents a horizon calculation based on data compiled from infrastructure funds, including fully liquidated partnerships. There are limitations to the Burgiss data provided given limited coverage, reporting lag and different valuation methodologies. Further, private infrastructure funds that are included in the index choose to self-report. Thus, the index is not representative of the entire private infrastructure universe and may be skewed towards those funds that generally have higher performance. Over time, funds included and excluded based on performance, may result a "survivorship bias" that can result in a further misrepresentation of performance.

Consumer Price Index (CPI) is a measure of the average change in prices over time in a fixed market basket of goods and services.

The MSCI World Index is a free float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed markets.

6. Bloomberg, LevFin Insights and the Federal Reserve for leveraged loan and high yield issuance changes since January 2021. Preqin, M&A decrease calculated based on all deal values in 2022 versus 2023 annualized.