The Opportunity Set Is Wide

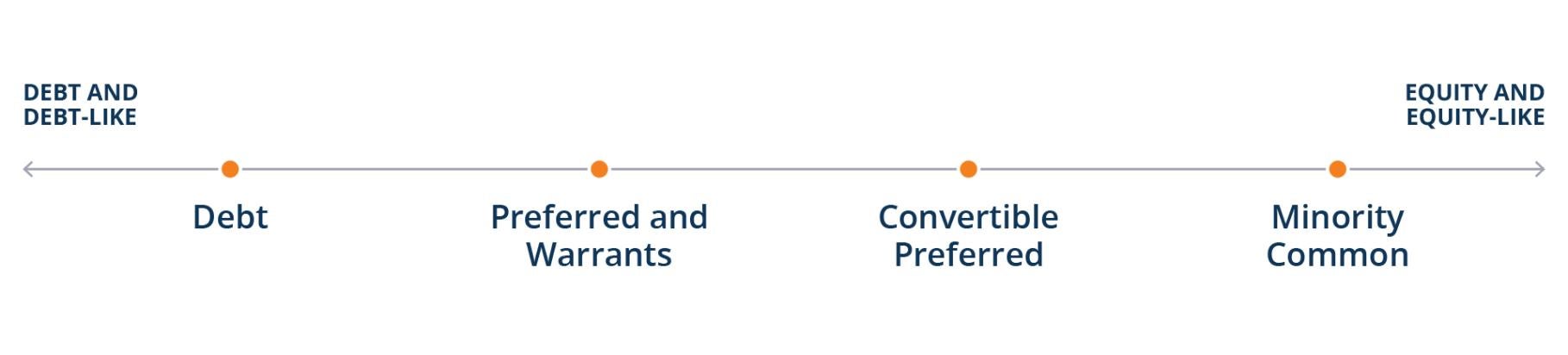

Today, structured capital solutions are essentially another capital source for both public and private companies to choose from. But importantly, they are more flexible than other options. They can:

- Maximize flexibility within a capital structure—and stabilize or repair a company’s balance sheet

- Provide growth capital to support a large strategic acquisition or a roll-up type acquisition strategy, or to provide development capital

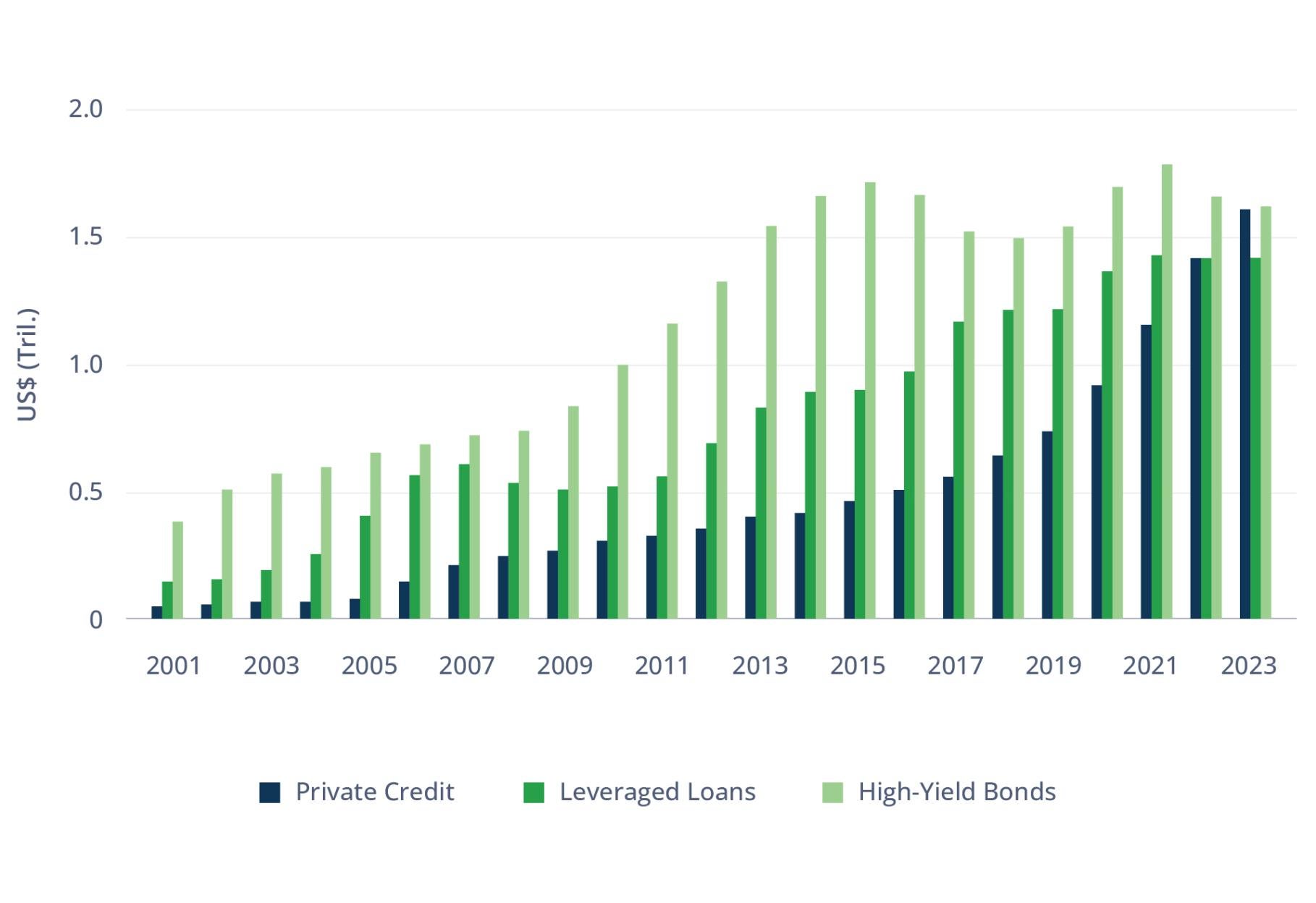

- Supply access to capital, especially where “blunt” instruments, like high yield bonds, leveraged loans or equity issuance, might not be the best option

- Limit the cost of capital and dilution for public companies that want to grow or acquire other businesses, but don’t want to take on more debt or issue more common equity

- Allow a company to gain a strategic partner—who can assist with operations, acquisitions, capital markets, etc.—while still maintaining control

As a result, structured capital solutions appeal to a wide variety of companies. These can include private, founder- or management-owned businesses that want to maintain control and upside, private-equity-backed companies where the sponsor is looking for access to incremental capital, and more.

Today, we see opportunities to provide flexible capital in several industries. Take the global healthcare services sector, which at $8 trillion is roughly equivalent to 33% of U.S. GDP. For higher growth, higher quality healthcare businesses, valuations can be in the mid- to high-teens—around 16x EV/EBITDA, for example. Many private equity sponsors like to put a good amount of leverage on businesses, but they will probably only get six turns of leverage from the banks (i.e., 6x debt/EBITDA). Thus, while a sponsor might view this flexible and strategic capital as relatively expensive, it also knows that high-quality healthcare businesses tend to grow and accrete value at a rate that would exceed this cost of this capital. In addition to the strategic value this capital partner might bring, the sponsor creates accretive leverage.

Aviation is another sector that could benefit from flexible capital. This sector, where private equity has historically been involved, should grow at a GDP-plus type rate. However, as a result of challenges caused by the pandemic, flight activity has been delayed, and world daily flights are still not back to 2019 levels (see Figure 5). With some players in the aviation space facing significant debt maturities in the next few years, flexible capital could be an option to fill a funding gap.