Volatility Calls For Flexible Capital Solutions

Market uncertainty has made it much more difficult for companies to secure traditional financing.

Key Takeaways

- Companies facing macroeconomic headwinds are increasingly turning to flexible capital solutions in today’s uncertain market environment.

- Obtaining flexible capital through a strategic partner can help companies reach their growth potential with a combination of private equity and debt solutions along with operational expertise.

- For investors, flexible capital strategies can offer portfolio diversification through private-equity-like returns combined with the downside mitigation benefits of private credit.

What’s Driving the Demand for Flexible Capital Solutions?

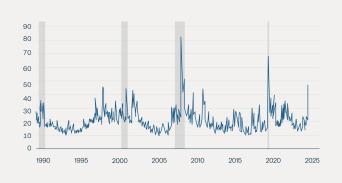

Companies are facing increasing macroeconomic uncertainty today from a combination of volatile trade policies, geopolitical uncertainty and elevated interest rates. Indeed, the VIX index—which measures market expectations of stock price changes over the next 30 days—has spiked to levels seen only a handful of times over the past 35 years (see Figure 1).

Figure 1: Market Volatility Is Spiking in 2025

CBOE Volatility Index (VIX)

Source: CBOE Global Markets, Macrotrends as of April 25, 2025. Shaded areas indicate recessions.

These uncertain market conditions have made it much more difficult for companies to secure traditional financing. Many are healthy but simply seeking capital to pursue growth opportunities. Others may be strained or overleveraged and are seeking to stabilize their balance sheets. This is opening up attractive opportunities for private investors to provide flexible capital that can blend both private equity and debt solutions to meet a company’s specific needs.

Traditional Capital Sources Are Falling Short

Since late 2021, the cost of issuing both equity and debt has increased, putting downward pressure on issuance volume. That pressure eased modestly last year as the Federal Reserve reversed course on rates, but recent market volatility and policy uncertainty may disrupt the recovery.

In the U.S. in 2022, for example, high-yield corporate bond and leveraged loan issuances combined slid to their lowest levels since the global financial crisis. Both asset classes regained ground in 2024 as the Fed reversed course, with leveraged loan issuance particularly robust.1 Yet the elevated market volatility and uncertainty over tariff, fiscal and monetary policies could stall the recovery in issuances, particularly if the economy faces stagflation.

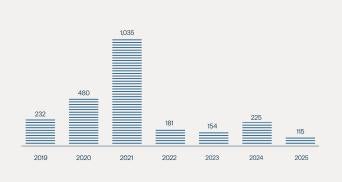

Meanwhile, IPO activity was subdued in 2022 and 2023 amid higher rates, lower valuations and recession fears, with a modest uptick in 2024 as rates reversed and valuations recovered (see Figure 2).2 Now uncertainty is also affecting IPOs, with some companies initially planning to list in early 2025 delaying to later this year or 2026.3

Figure 2 : The IPO Market Has Been Dormant Since 2022

Annual U.S. IPO Volume

Source: stockanalysis.com, accessed May 8, 2025.

Benefits for Companies

Flexible capital expands the borrower’s strategic playbook. While healthy companies can use it to play offense and grow—expanding product lineups or making acquisitions, for example—distressed companies can use it to play defense by shoring up balance sheets or paying down debt. Regardless of how the capital is used, flexible financing offers another key benefit: It requires no change of ownership, allowing companies to retain control of their businesses while avoiding excessive financial strains.

Yet, finding the right strategic partner is crucial, even if they don’t have control. They should be equipped to take on an active role in solving a company’s complex financial needs, offering capital at scale, a diverse platform of solutions and extensive structuring capabilities. In our view, the capital provider should also be aligned with the company’s goals and not rely on excessive leverage. And they should have a long-term track record of enhancing returns through operational improvements across a variety of asset classes.

In 2023, Brookfield acquired a minority stake in Sono Bello, a leading retail healthcare company serving 50,000 patients a year, through a flexible capital solutions partnership. The structure achieved the company’s goal of maintaining control while gaining a partner with extensive resources and operational expertise, including’s tapping Brookfield’s extensive real estate platform and expertise to identify new locations for expansion.

Benefits for Investors

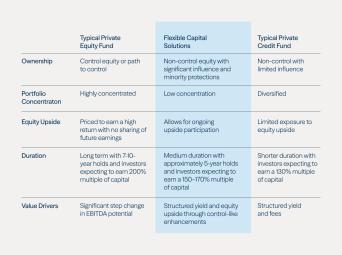

Flexible capital solutions can provide investors with private-equity-like returns, but with added downside mitigation characteristic of private credit investments (see Figure 3). These protections arise from the structured nature of the investment, with its priority preference in the capital stack as well as its potential governance and liquidity rights. Flexible solutions also tend to have lower buy-in multiples than common equity.

Governance rights can include board representation and consent/veto rights along with financial covenants or step-in rights that allow investors to maintain influence through control-like enhancements in an otherwise non-control investment.

Flexible capital solutions can help diversify portfolios because they sit high in the capital structure. While these solutions aim for higher absolute returns than private credit, much of those returns are contracted and include downside mitigation features.

Figure 3: Flexible Capital Offers Advantages Over Private Equity and Private Credit

Source: Brookfield internal research.

A Solution for All Cycles

Flexible capital offers an attractive solution for companies and investors alike—and expands the universe of solutions across private debt and private equity. While we believe that now is an especially compelling time to invest in a flexible capital strategy, it’s important to note that it can play an important role in any environment, no matter the economic cycle.

Endnotes:

1. Morningstar, “2025 US High-Yield Outlook: Animal Spirits Stir as Volume Ramps Higher,” December 31, 2024; Bloomberg, “US Leveraged Loan Sales Hit Record $986 Billion in Repricing Run,” October 24, 2024.

2. EY, “Nine factors that could drive the IPO market in 2025,” January 30, 2025.

3. EY, “How do you find the clarity to illuminate your path to IPO?,” April 9, 2025.

Disclosures

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, “Brookfield”).

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield's internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield's perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.