While remote work has proliferated in a COVID-19 environment, we believe vibrant physical workplaces will remain in demand—and key to corporate culture.

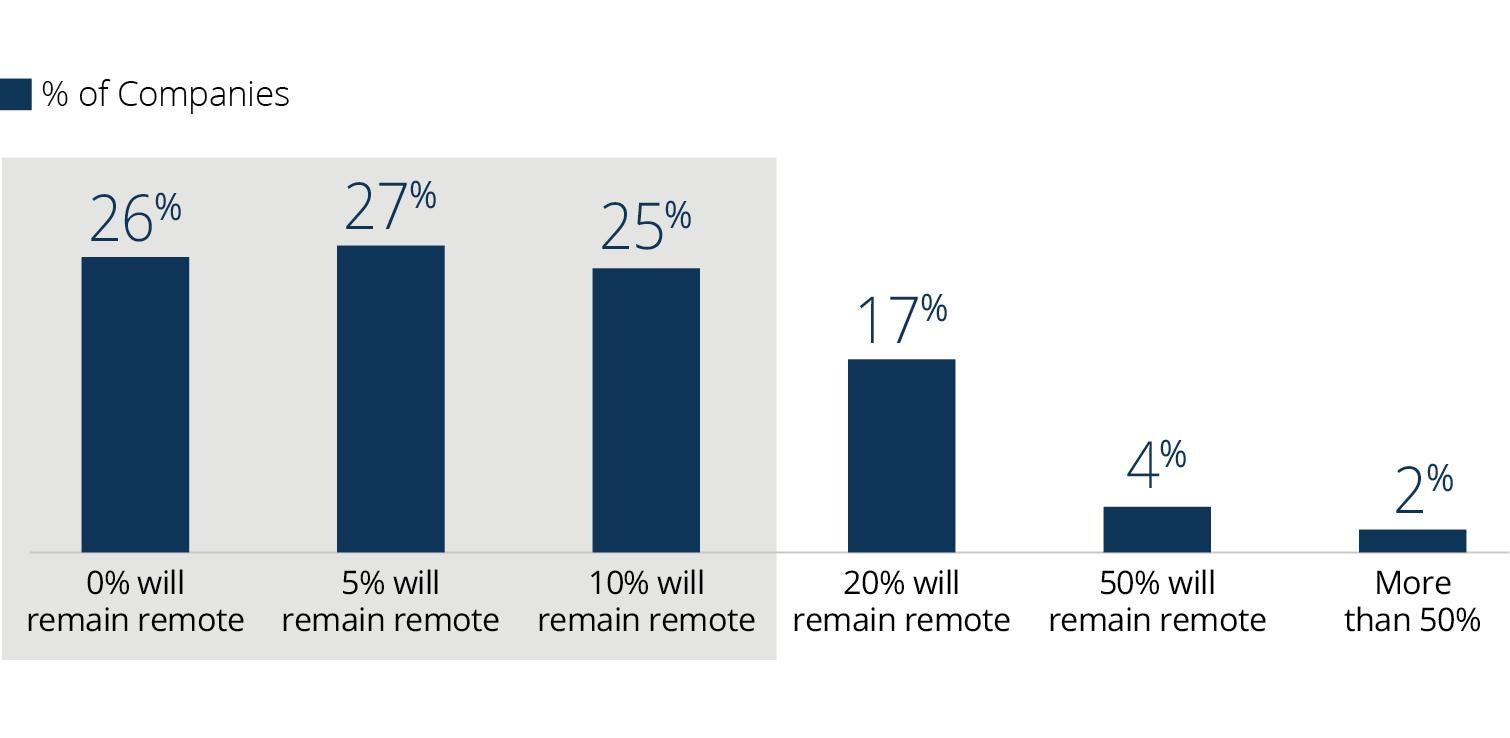

Members of today’s workforce likely never imagined that they would have to live—and work—through a pandemic. The lockdowns designed to slow the spread of COVID-19 spurred many companies to quickly leverage technology to shift their workforces to remote work. This experience has prompted a big question among industry observers: Will the quick fix of widespread working from home become a fixture over the longer term—and will it lead to a drop in demand for office space?

We believe the answer is no. In our view, successful companies value the power of in-person collaboration in shaping a dynamic corporate culture, and their employees do too. While remote work can be effective in the short and even medium term, it cannot replace human interaction forever, and can introduce a long list of risks. Ultimately, a company’s culture needs in-person connection—and the physical workspaces that support it—to thrive.

Our outlook is based on our experience working closely with our tenants around the world, our observations in regions that have already started to recover—such as South Korea and Germany—and our history as an owner-operator that dates back more than 100 years.

With a portfolio of more than 250 office properties globally, we have managed through many challenging periods, including the dot-com bubble (when technological advances such as telecommuting were expected to render physical offices obsolete), the September 11, 2001 terrorist attacks, the Global Financial Crisis and the Brexit referendum. Offices endured these and other shocks, and we expect this resilience to continue through and after the pandemic.

An important distinction is that our view focuses on the area in which we own and operate office assets: the Class A segment—top-quality buildings in major urban centers with amenities catering to a “live, work, play” environment. We expect these assets will fare much better than older office properties with high levels of deferred capital expenditures or those in less desirable locations.

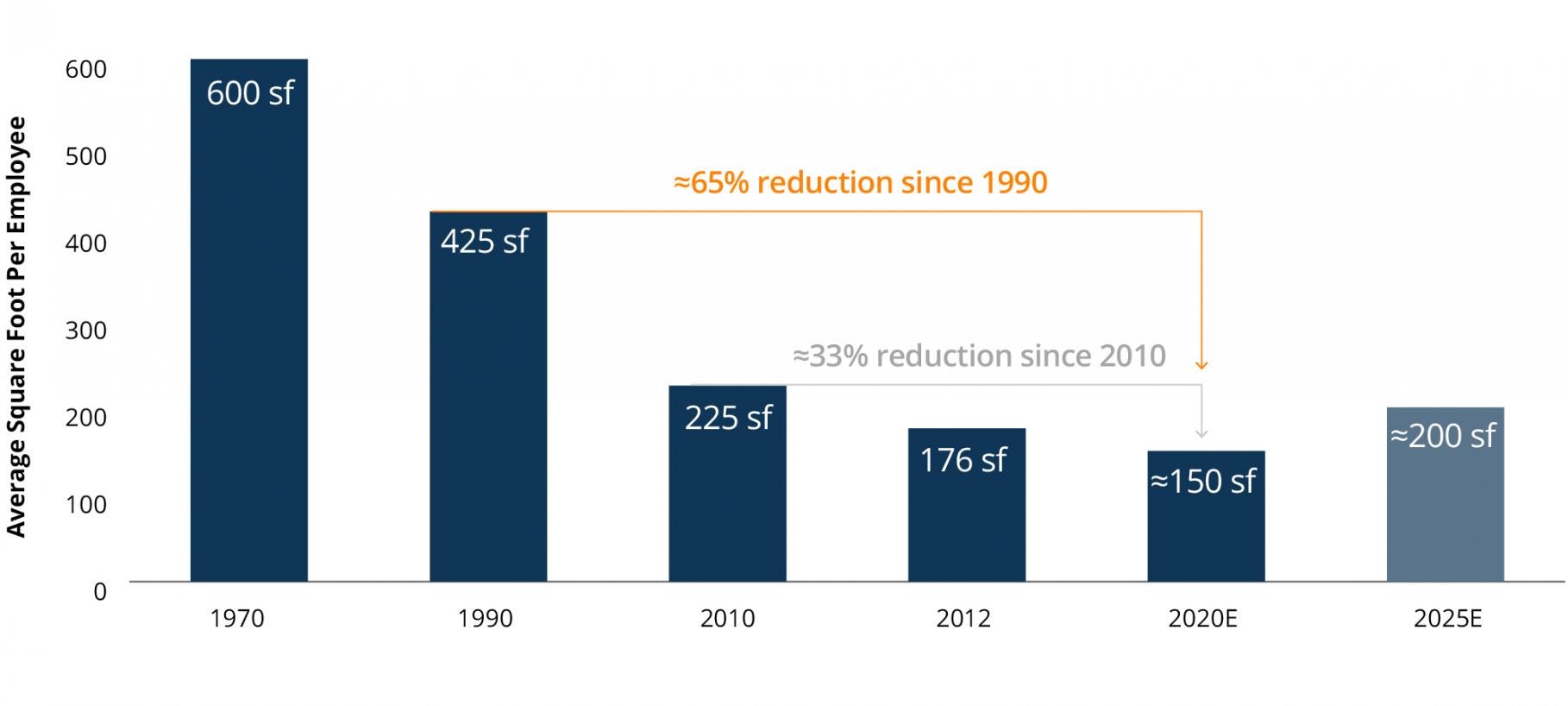

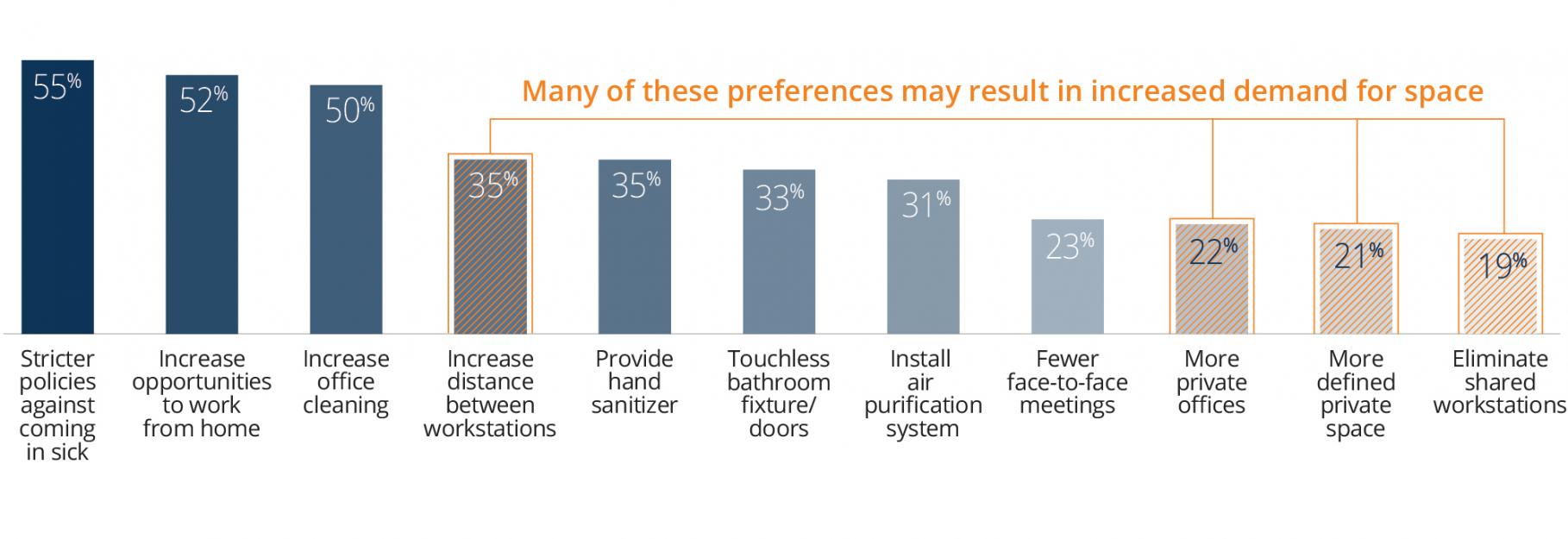

In fact, demand for high-quality office space may even increase in the long term as the psychological effect of the pandemic pulls back on the long-lived trend of office densification.