The financial infrastructure universe comprises the digital services and software that form the backbone of the global financial economy.

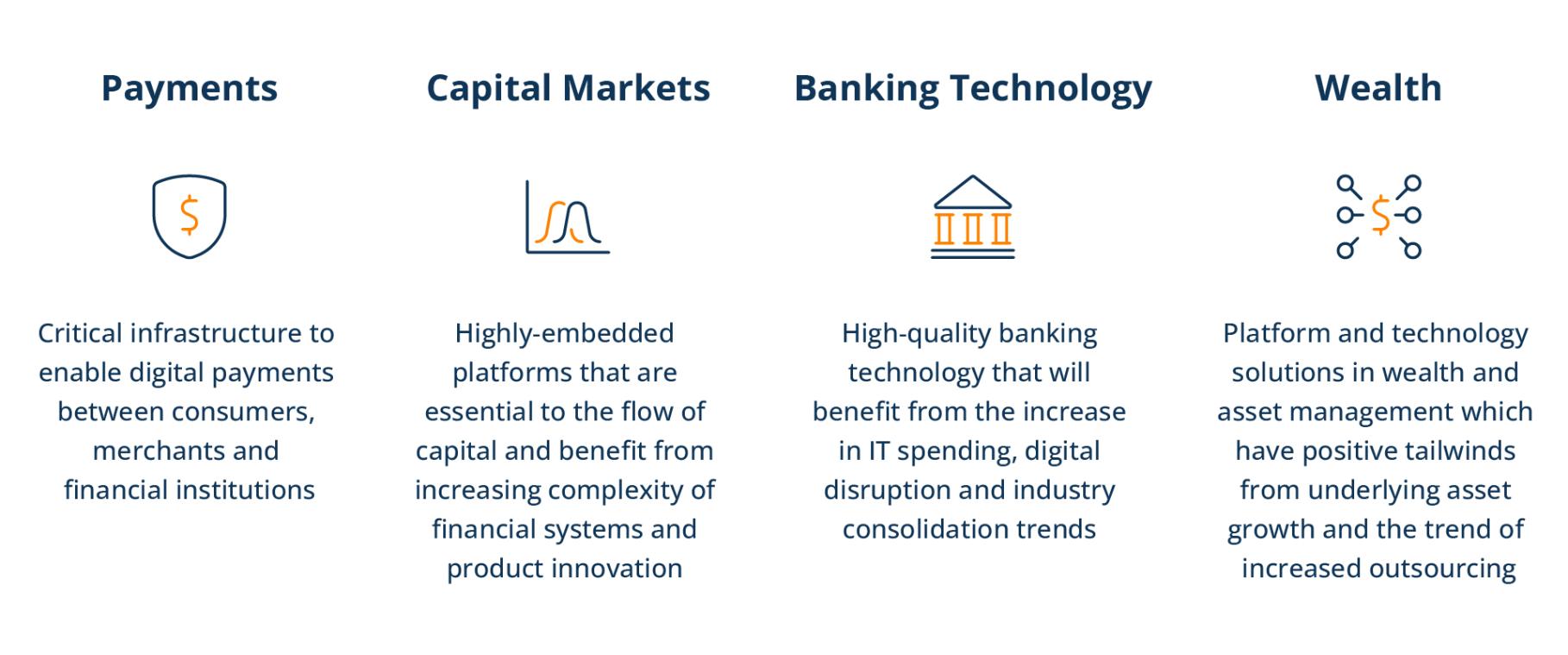

With markets transitioning to around-the-clock, around-the-globe movement of commerce, the world’s financial infrastructure needs to transform from legacy analog to digital, localized models across industries like payments, capital markets, banking technology and wealth management (see Figure 1).

Many of these businesses will require large-scale and operationally focused capital to enable automation and digitize legacy operating models—a global investment opportunity that Brookfield values at $4 trillion. Yet, unlike other industries facing rapid change and disruption, financial infrastructure assets and businesses provide critical services for their customers and tend to be highly embedded in their markets, which can benefit incumbent players.

Here, we explore the moving parts and players in the increasingly attractive financial infrastructure universe.