Endnotes:

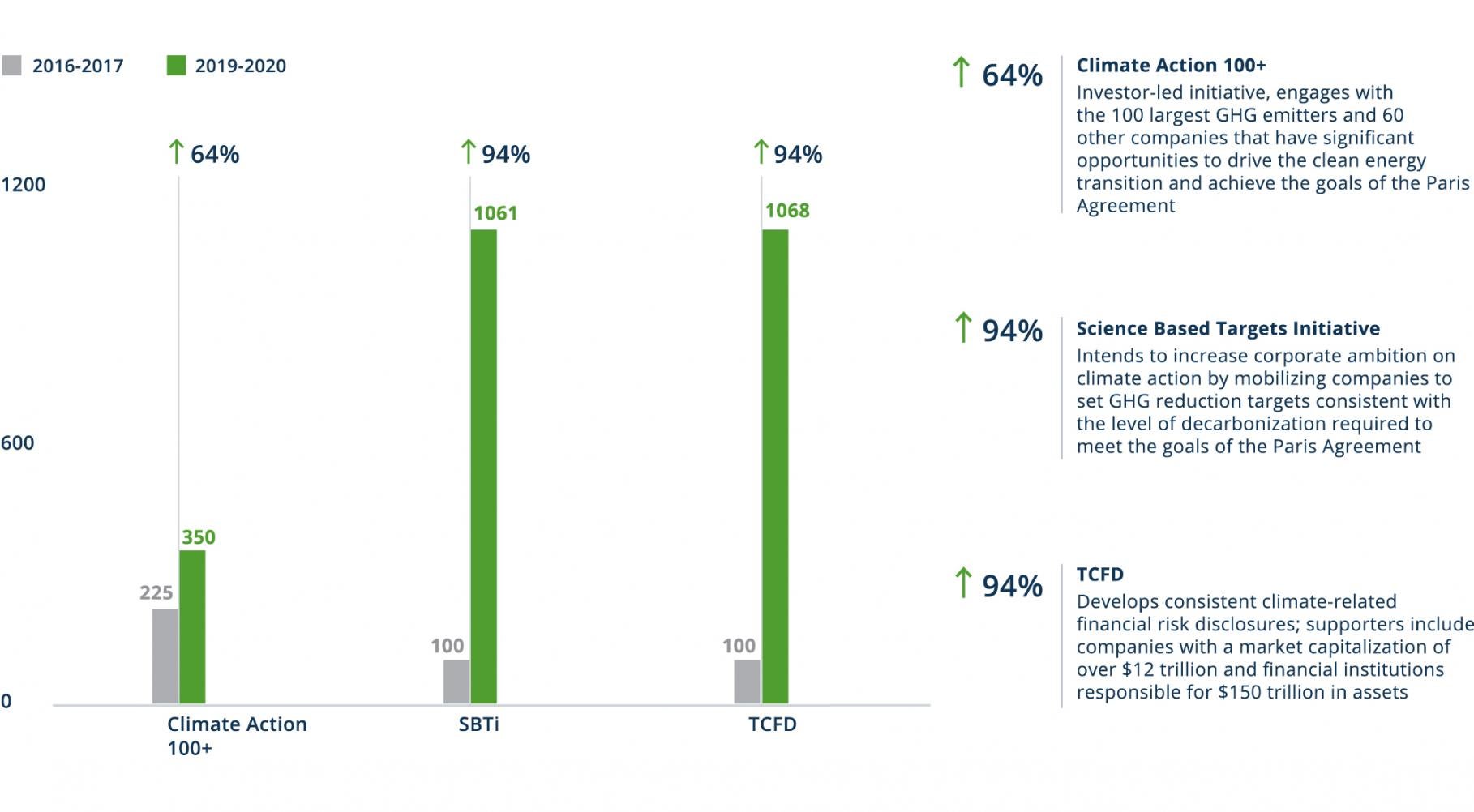

1. SBTi.

2. TCFD, “2020 Status Report,” October 2020.

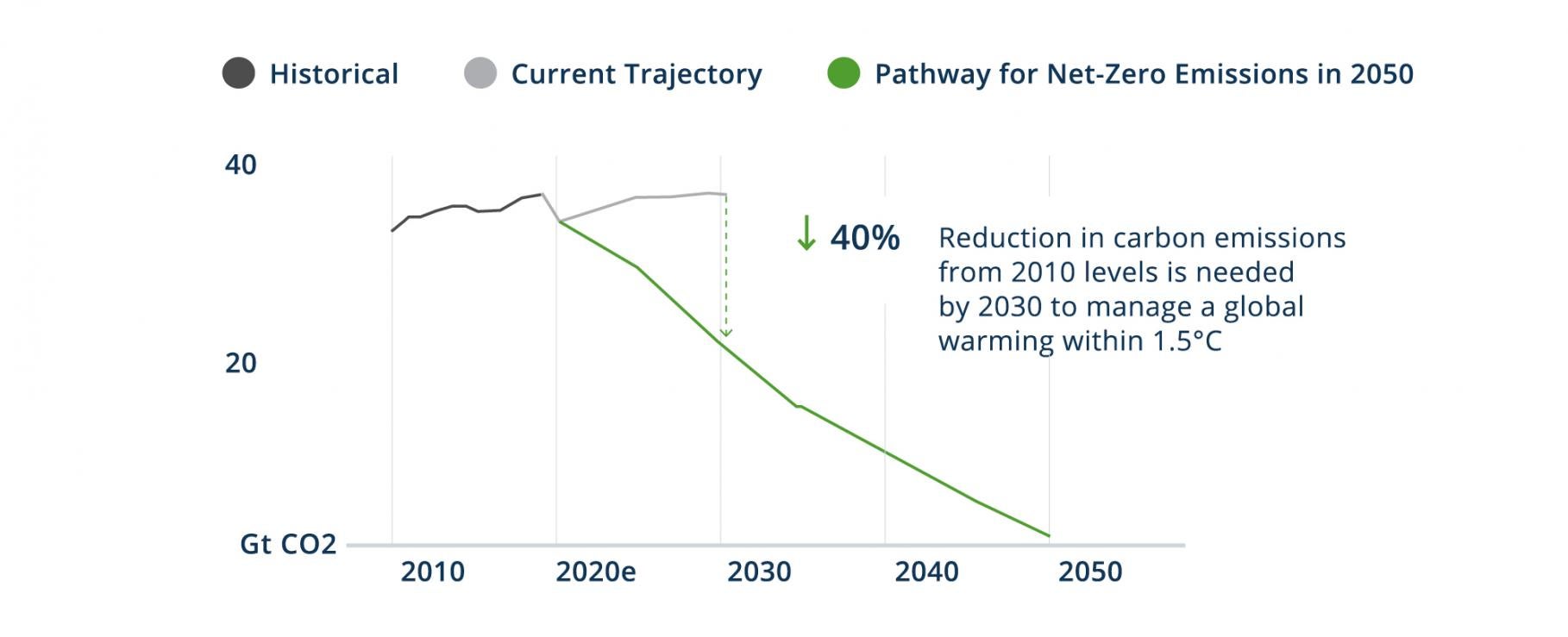

3. International Energy Agency, “World Energy Outlook 2020,” and Intergovernmental Panel on Climate Change (IPCC), “Global warming of 1.5°C,” 2019.

4. Greenhouse Gas Protocol (https://ghgprotocol.org/sites/default/files/standards_supporting/FAQ.pdf) and G30 Steering Committee and Working Group on Climate Change and Finance, “Mainstreaming the Transition to a Net-Zero Economy,” October 2020.

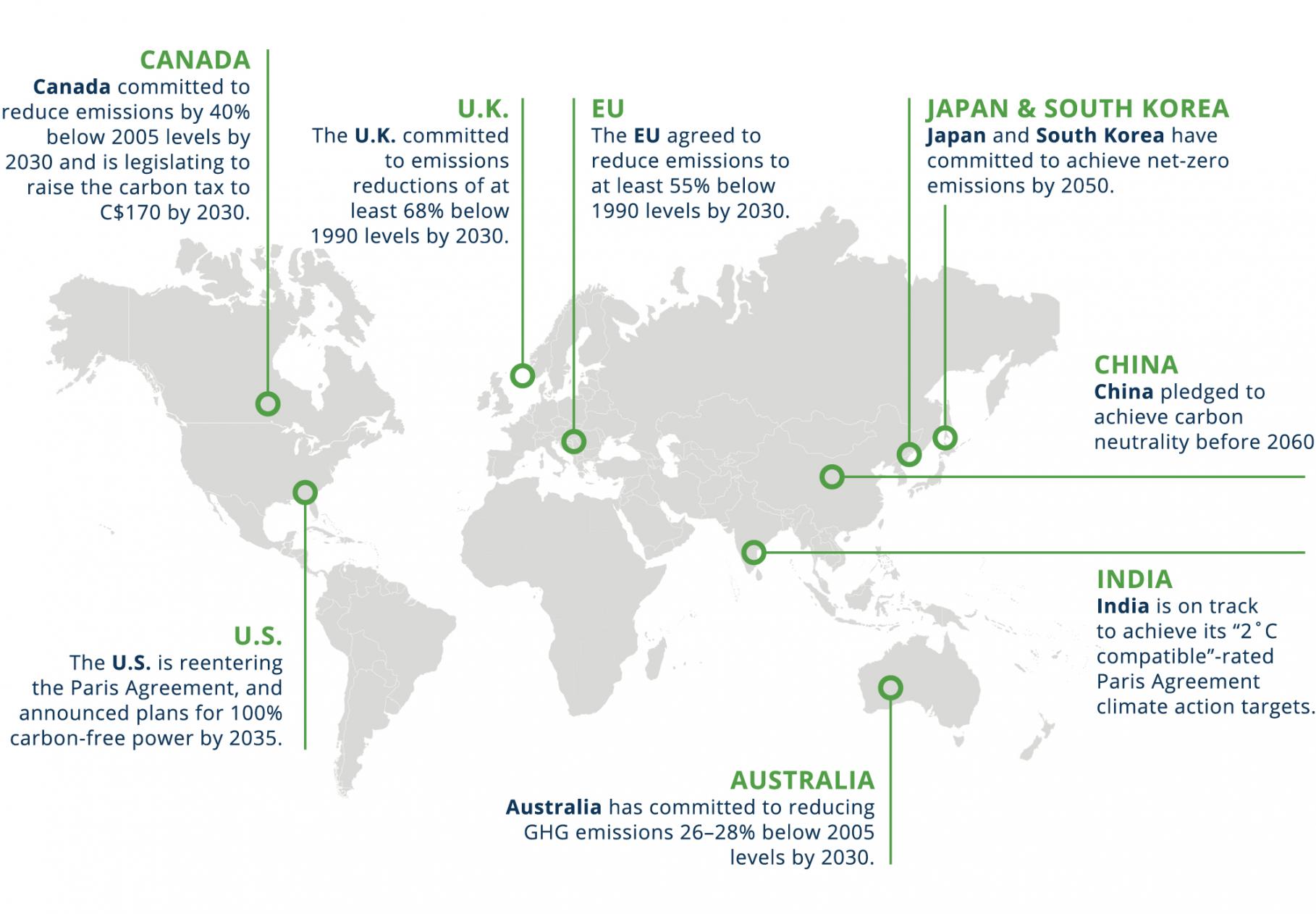

5.Financial Times, “Boris Johnson: Now is the time to plan our green recovery,” Nov. 17, 2020.

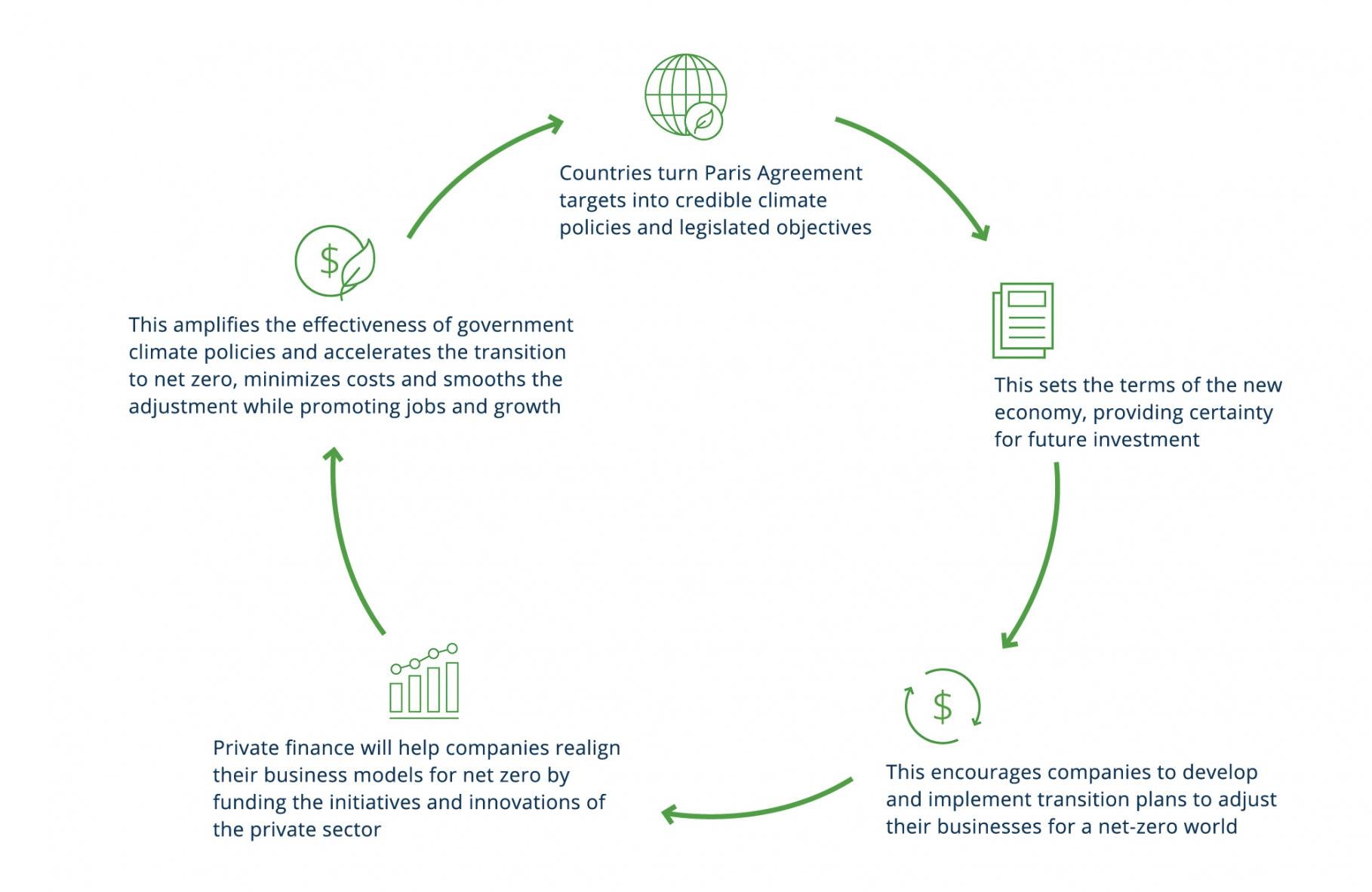

6.G30 Steering Committee and Working Group on Climate Change and Finance, “Mainstreaming the Transition to a Net-Zero Economy,” October 2020.

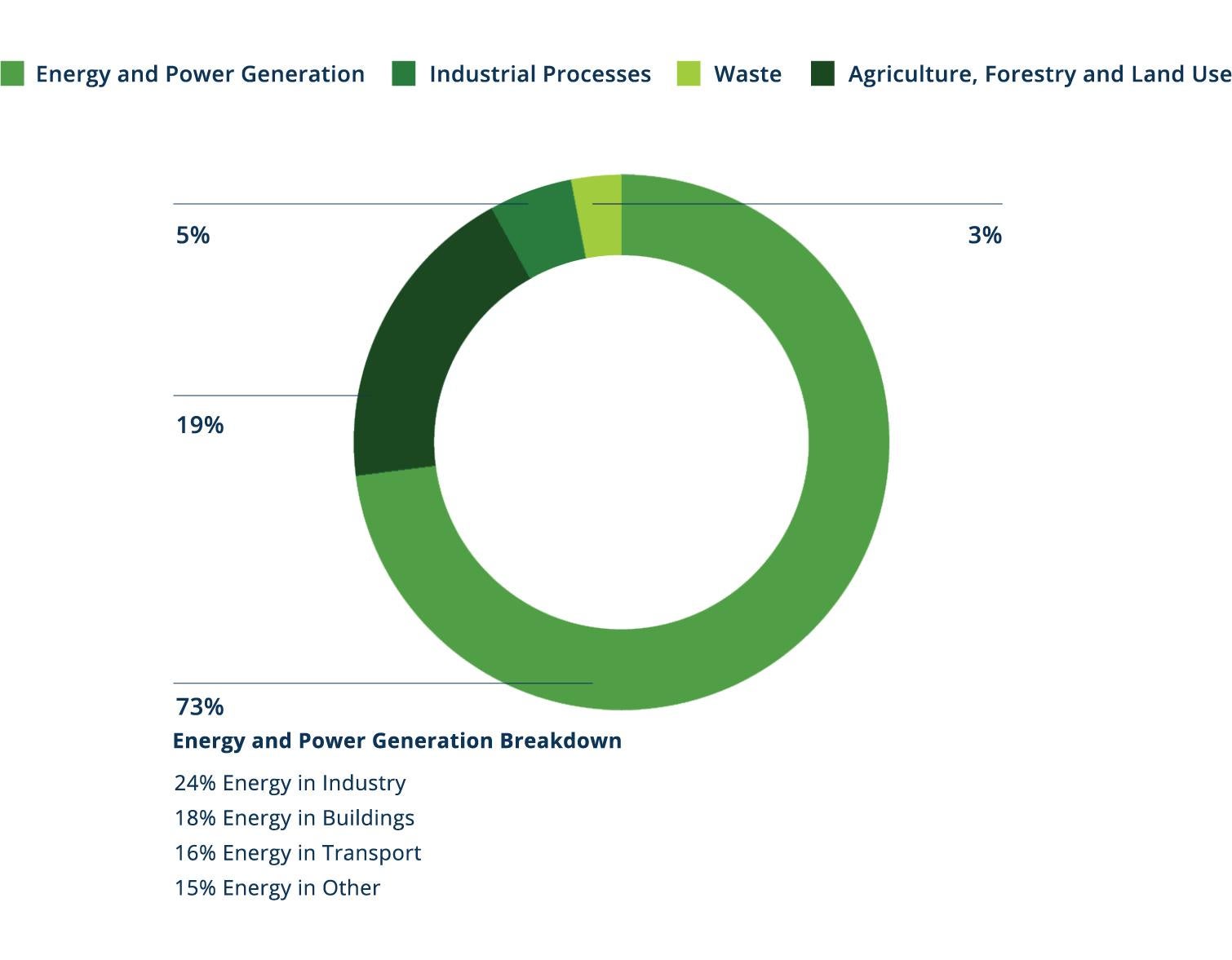

7.GHGs are gases in the atmosphere that absorb heat, thereby keeping the planet’s atmosphere warmer than it otherwise would be. Carbon dioxide (CO2) is the most common GHG emitted by human activities, in terms of the quantity released and the total impact on global warming. Source: Ecometrica.

8.In simple terms, stranded assets are those that turn out to be worth less than expected as a result of changes associated with the energy transition. The stranded assets concept has been interpreted as encompassing a range of different factors, including: 1) economic stranding due to a change in relative costs/prices, 2) physical stranding due to distance/flood/drought, and 3) regulatory stranding due to a change in policy of legislation. Source: Carbon Tracker Initiative, “Stranded Assets,” Aug. 23, 2017.

9. Financial Times,“Lex in depth: the $900bn cost of ‘stranded energy assets’,” Feb. 4, 2020.

10. Nature, “The geographical distribution of fossil fuels unused when limiting global warming to 2 °C,” Christophe McGlade and Paul Ekins, Jan. 7, 2015.

11. Amazon Sustainability.

12.Microsoft, “Microsoft will be carbon negative by 2030,” Jan. 16, 2020.

13. Principles for Responsible Investment, “Institutional investors transitioning their portfolios to net zero GHG emissions by 2050.”

14. https://www.climateaction100.org/whos-involved/investors/.

15.Forbes, “The World’s Largest Public Companies,” May 13, 2020, and Task Force on Climate-related Financial Disclosures, “2020 Status Report,” October 2020.

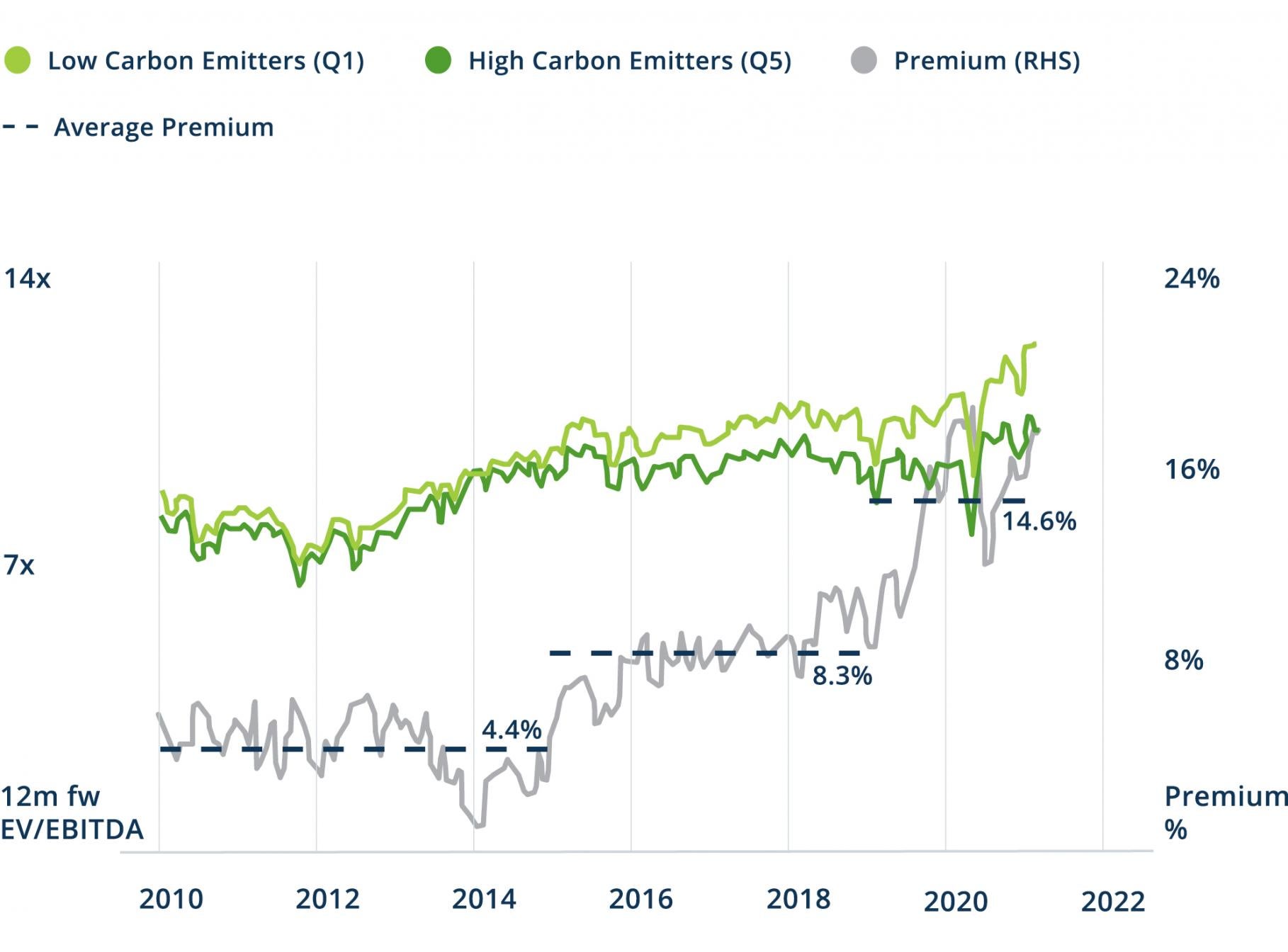

16.Imperial College Business School Centre for Climate Finance & Investment, “Transition Finance: Managing Funding to Carbon-Intensive Firms,” Sept. 17, 2020.

17. Goldman Sachs Research, “Carbonomics: 10 Key Themes From the Inaugural Conference,” Nov. 16, 2020.

18. Iberdrola, “Iberdrola pledges €75 billion to capitalise on energy transition,” Nov. 5, 2020.

19. S&P Global Market Intelligence, “Enel to invest €160B to protect ‘renewables supermajor’ status,” Nov. 24, 2020.

20. Bloomberg, "The New Energy Giants are Renewable Companies,” Nov. 30, 2020.

21. As of Jan. 20, 2021.

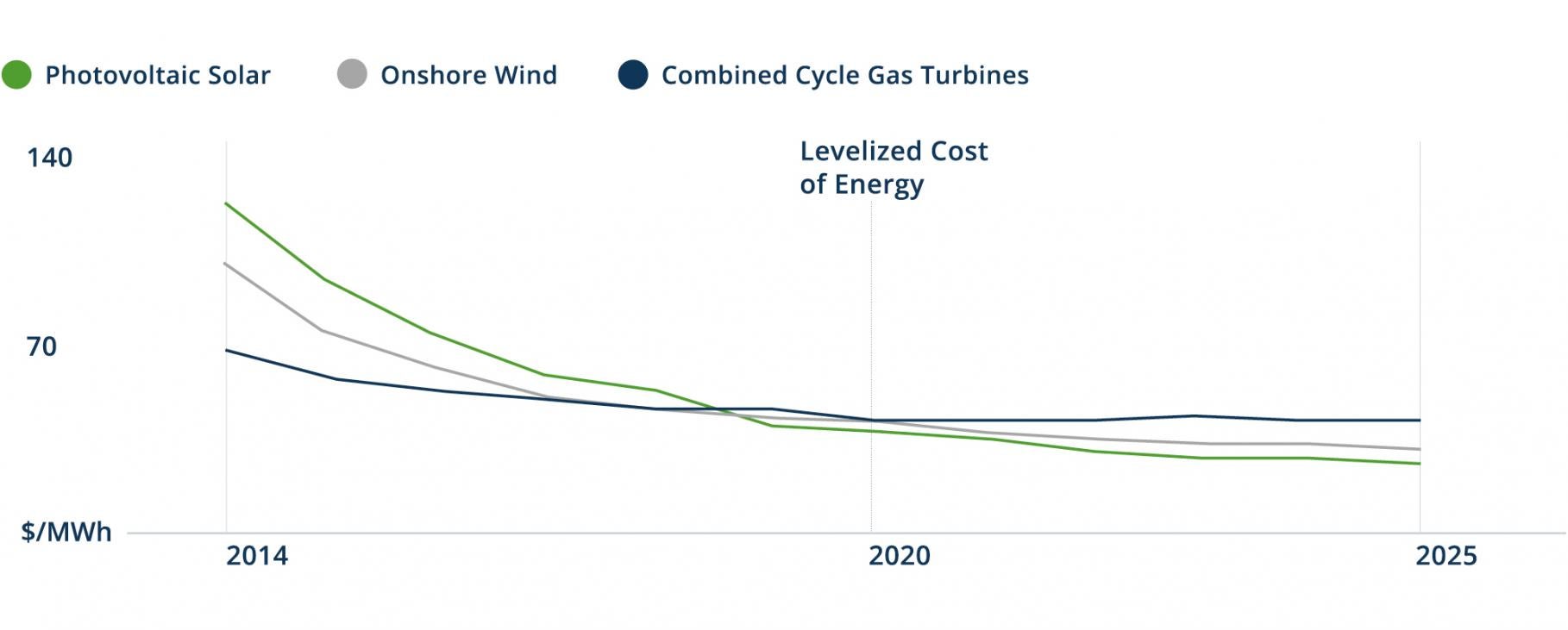

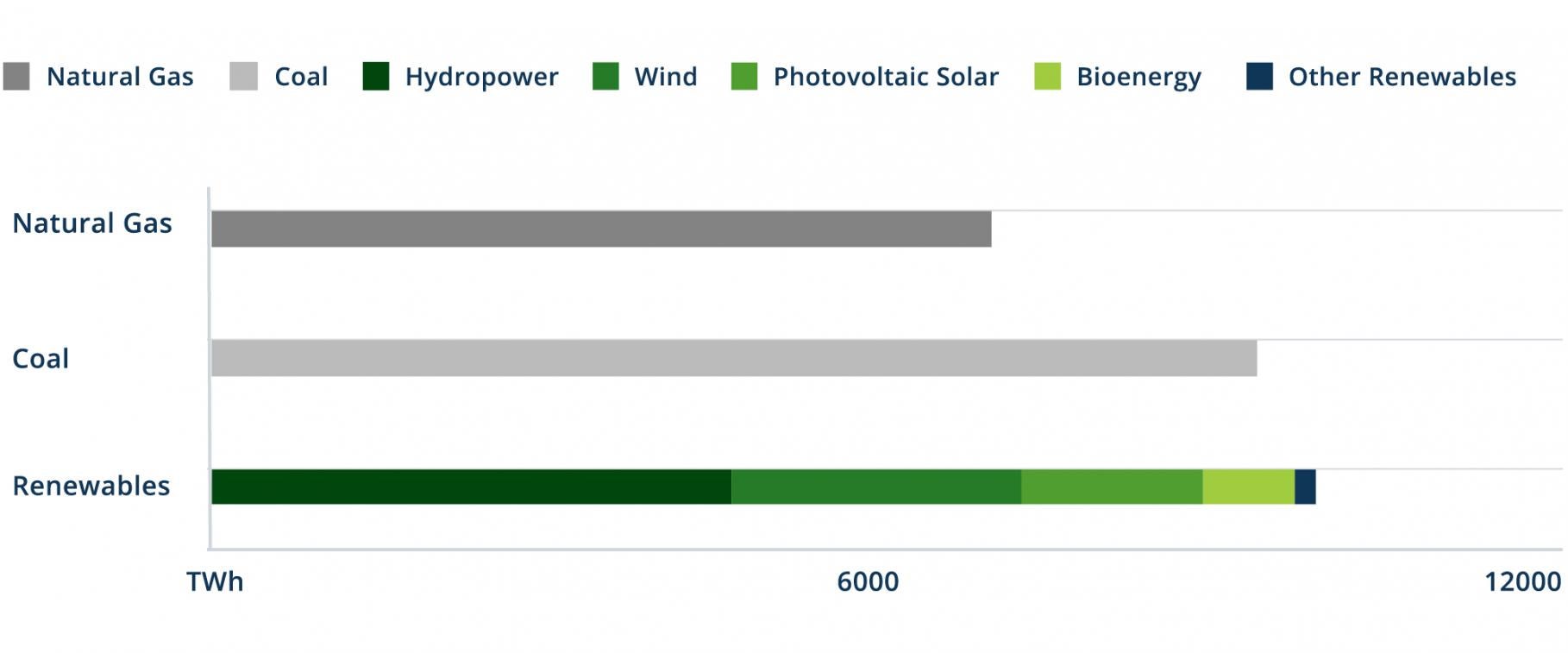

22. IEA, “Renewables 2020,” November 2020.

23. IEA, “Renewables 2020,” November 2020.

24. The White House, “Fact Sheet: President Biden Takes Executive Actions to Tackle the Climate Crisis at Home and Abroad, Create Jobs, and Restore Scientific Integrity Across Federal Government,” Jan. 27, 2021.

25. Financial Times, “Tesla and French energy group to build new Australia mega battery,” Nov. 4, 2020.

26. World Resources Institute, “This Interactive Chart Shows Changes in the World's Top 10 Emitters,” Dec. 10, 2020.

27. World Steel Organization; McKinsey, “Decarbonization Challenge for Steel,” June 30, 2020.

28. McKinsey. Study of 20 global steelmakers. The weighted average value at risk for the sample is 14 percent of net present value under a 2°C scenario, where global carbon prices rise to USD 100 per ton of carbon dioxide. Results range from 2 percent to 30 percent for individual companies.

29. Imperial College Business School Centre for Climate Finance & Investment, “Transition Finance: Managing Funding to Carbon-Intensive Firms,” Sept. 17, 2020.