Overview (as of February 10, 2022)

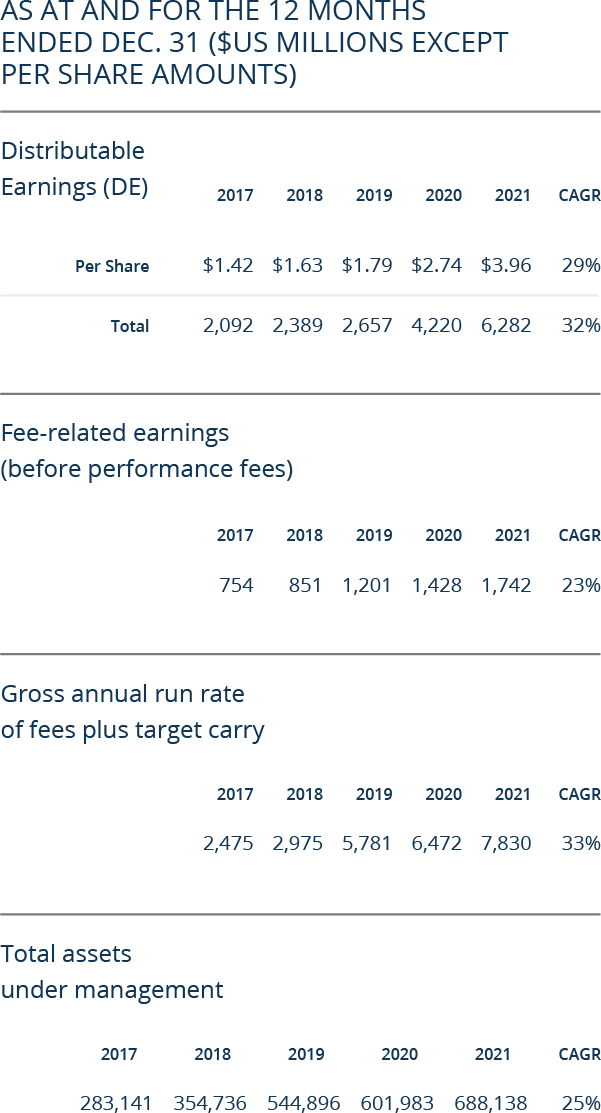

What a difference a year can make. In 2021, we generated a record $12.4 billion of total net income—compared with $707 million in 2020. Performance in our asset management business was very strong, resulting in total Distributable Earnings of $6.3 billion for the year. On a go-forward basis, annualized asset management revenues, including carry, are now running at $7.8 billion, and we are launching new funds across all our strategies—which means that 2022 is off to a good start.

We raised $71 billion of capital during the year. This latest round of funds was not only larger, but was raised more quickly than expected. We will soon close our $15 billion Global Transition Fund, which we launched a little more than a year ago. This shows both the power of the franchise and the interest from investors in achieving net zero globally.

The launch of Brookfield Reinsurance has been successful on many fronts. With the closing of the American National deal expected before the end of the second quarter, our insurance operations will now be heading towards $50 billion of assets. This gives us critical mass and the regulatory licenses to continue assisting our insurance clients in many ways. It is still early, but with interest rates looking to continue in a low-ish range for longer, this business could become significant to us.

Irrespective of global macro issues, which always arise, we own an incredible portfolio of real assets and businesses which provide both strong cash flow and inflation protection. Our asset management business continues to establish itself as one of the pre-eminent brands globally. In an inflationary environment, backbone real assets, private credit and transition-focused investments are where you want to be invested.

We generated a record $12.4 billion of total net income—compared with $707 million in 2020.

2021 Highlights

$12.4B

TOTAL NET INCOME GENERATED

$6.3B

DISTRIBUTABLE EARNINGS

$71B

CAPITAL RAISED IN 2021

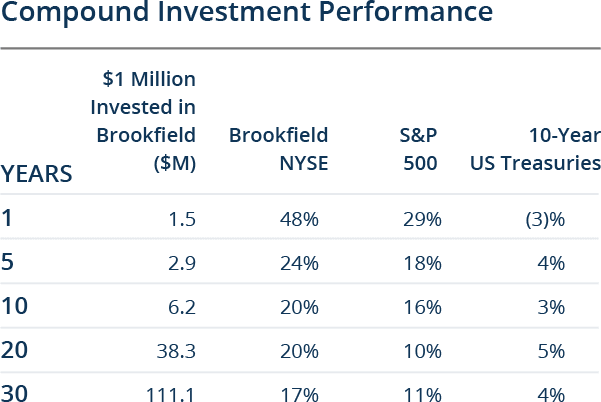

Performance in the stock market was exceptional; a 48% market return (the gain on our stock in 2021) does not happen very often. But, as an indication of the returns that can be generated over the longer term, below is our latest tabulation of annualized compound investment returns over the past 30 years. For reference, $1 million invested 30 years ago in Brookfield Asset Management is worth $111 million today. Please always remember that compounding reasonable returns over long periods of time is an incredible miracle of finance.

More importantly, our franchise is stronger and more durable today than it has ever been. This should help us achieve strong returns in the future. One advantage in that regard is that, despite the good returns over the past 30 years, we still trade at a discount to what we believe our businesses would be valued at if sold. If we can close the gap between share price and intrinsic value, a current stock owner will out-earn the underlying performance of the business.

The Market Environment was Better in 2021

All in all, 2021 was a pretty good year. It didn’t always feel that way, but according to the data, it was. GDP in every country recovered and the markets quit worrying about deflation or negative interest rates. In fact, by midyear the markets were worried about exactly the opposite! The bottom line is that markets always need something to worry about—and while rates are likely going higher (a bit) and inflation is going higher (a bit), we expect rate increases will be relatively muted this cycle. (Put into perspective, even eight rate hikes will bring the U.S. short rate only to around 2%.)

As we move into 2022, markets are strong, but recent volatility has brought some sanity back to areas of the markets that were overvalued. With money available and interest rates low, this is a very constructive environment for good businesses. Economies are normalizing as central bank intervention is withdrawn. And despite some setbacks with a new variant appearing in December, these are passing as we write. We expect that the global recovery will be back on track soon, and the level-set of valuations in areas such as China and in technology businesses presents great opportunities.

Our operations are highly geared to the economic recovery. As a result, we should be able to grow the value of our businesses coming out of this recession, while working towards narrowing the gap between the intrinsic value and the trading price of a Brookfield share. We are conservatively positioned, with very substantial liquidity, to continue to capitalize on the vast number of opportunities we see every day.

Business Fundamentals were very Good

Distributable earnings for the full year were a record $6.3 billion. This was an almost 50% increase compared with 2020, and all parts of our business contributed to the strong results.

Asset Management Performance Was Strong

Our asset management operations had an excellent year. We raised $71 billion of capital across our flagship and complementary strategies, which increased total fee-bearing capital to $364 billion at year-end. This included a final $16 billion close for our flagship opportunistic credit fund and $24 billion in aggregate to date for our global transition fund and our latest opportunistic real estate fund.

In addition to our flagship products, we have 35+ other strategies in the market raising capital. We recently had the final close for our sixth real estate debt fund, raising $4 billion—and in just the fourth quarter we raised over $1 billion for our open-end perpetual private infrastructure fund. We held a final close for our growth equity fund for over $500 million and expect to launch the next vintage in the first half of 2022.

Our non-traded REIT is now being distributed on four wealth platforms globally, with additional major platforms expected in the coming months. Our real estate secondaries strategy has raised $2 billion of capital, and we are now in the midst of raising our first commingled fund.

All combined, we have seen significant growth in our asset management earnings, with fee-related earnings growing by 33% in 2021, and we expect to see another step change in 2022. On top of that, we crystalized a record $1.7 billion of carried interest in 2021. With several of our earlier vintage funds having passed their preferred hurdles, we are now realizing carried interest across a variety of strategies, and we expect to continue this momentum into 2022.

Operations Keep Getting Better

Overall performance across our operating businesses continues to strengthen, as we remain well positioned around the economic recovery and own many inflation-linked assets that benefit from economic growth. Our renewable power and infrastructure businesses have been resilient over the last two years, delivering consistent, steady growth. Performance in our private equity business has been excellent, and the release of pent-up demand and debottlenecking of supply chains should contribute to even stronger results.

Our diversified real estate portfolio allowed us to reap the benefits of the continued reopening across most of our businesses. We saw increased activity within our hospitality assets as travel begins to return, a rebound in our retail assets due to higher foot traffic and spend per person, and a rebound in demand for our office properties and multifamily assets.

All of this drove very strong financial performance across our operations, underpinning the stable and growing distributions we receive. In total, we received $2.2 billion during the year and we expect this to continue increasing in line with the growth in the underlying businesses.

Our non-traded REIT is now being distributed on four wealth platforms globally, with additional major platforms expected in the coming months.

We Are Investing in 50 Shades of Green

We are in the final stages of closing our $15 billion Brookfield Global Transition Fund I. This fund was raised faster—and is larger—than expected, and we have already started putting the capital to work to help companies decarbonize their operations. We expect these opportunities to fit into three categories.

The first is our traditional new-build renewables business. For 30 years we have been developing renewable assets as a component of our infrastructure strategy, but given the sheer quantity of renewables required as the grid shifts generation to renewables, the capital required is now much larger than in the past. These new-build opportunities will provide a steady flow of investment for this Fund, and they have already begun for us with partners including Amazon, Enbridge and Scotiabank.

The second type of opportunity focuses on providing capital to industrial companies to enable them to decarbonize their operations. Industries such as steel, cement, chemicals and others require both renewable generation to lower their carbon footprint and capital to decarbonize their production processes. This investment cycle is just getting started, and we see a meaningful opportunity for investment in the years to come.

The third type is working with electricity generators, where we will help provide the capital to enable them to shift from coal to gas, and from gas to renewables. We are focused on funding the “transition”—across all 50 shades of green; those that are currently black, brown, dark green, olive, light green and all other shades of green—from coal generation all the way to solar generation. The main goal of our investments is to assist and accelerate the transition to net zero. However, a critical point in this is that everything does not have to become green today—in fact, not everything can be green today. But every business does need to transition to a cleaner future. It is therefore equally important to go where the emissions are and provide capital to convert a coal-based utility or a carbon-intensive industrial business. We intend to invest significant capital in these opportunities and bring our operating capabilities to bear, but always where we can be part of the solution, not part of the problem. That is the Transition.

We are at the start of a new era with a market leading fund and strategy that we believe will be very attractive for investment over a long period of time. As a result, this should become a very large business for us.

We have already started putting the capital to work to help companies decarbonize their operations.

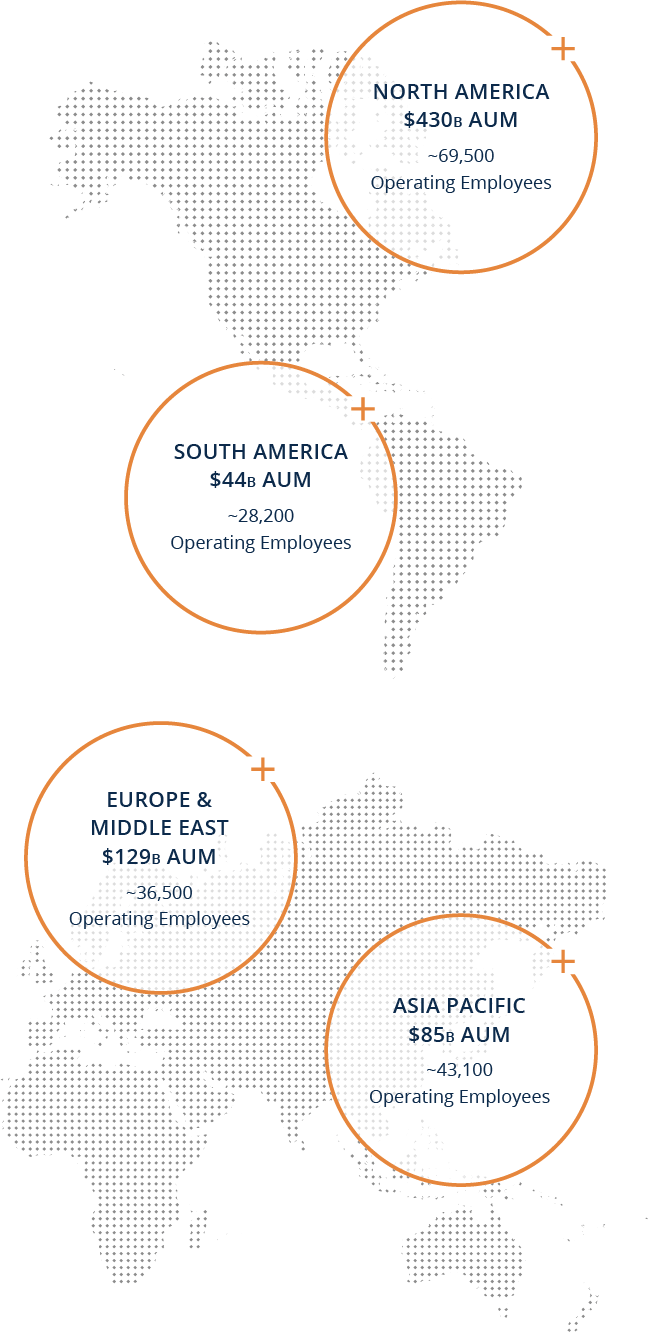

Our Asia Pacific Business is Growing Fast

We continue to grow our Asia Pacific business at a faster pace than any other region. Of course, this is in part because it is coming off a smaller base, but also because our operations there continue to build on their successes. We are heading towards $100 billion in total assets across the region and continue to grow in all of Australia, China, Korea, Japan and India.

Our initial business in Asia Pacific was in Australia, where today we have $30 billion of assets across our businesses. We own utilities, rail, ports, offices, hospitals, nursing homes, data centers, residential and industrial properties, and numerous industrial businesses. Most recently we committed to close our largest transaction to date: the purchase of a public company with an enterprise value of US$13 billion, which owns four utilities in Victoria. This transaction has further increased our presence in the country and opened up new adjacent opportunities. Today in Australia we have access to global capital, but truly are a local player.

$30B

OF ASSETS ACROSS BUSINESSES IN AUSTRALIA

$13B

OF ASSORTED ASSETS IN CHINA SUCH AS WIND & SOLAR PROJECTS

5.5M SF

OF SIGNATURE MIXED-USE SPACE IFC SEOUL, SOUTH KOREA

150,000

TELECOM TOWERS

THROUGHOUT INDIA

We have begun to see great progress in China following the build out of our business over the years, the current lack of capital for entrepreneurs in China, and a strategic decision to have a regional office on the ground in Shanghai. In total, our business now accounts for $13 billion of assets across wind and solar projects, distributed electricity generation, office, industrial warehouse, retail and mixed-use projects, multi-family residential, and industrial businesses. We have some great partners in the country and are looking to raise RMB-denominated capital. While the fund distribution market in China is small today on a relative basis, we believe that in the long run, it could become meaningful to us. We recently created a partnership with Sequoia Capital China to invest in “new economy” infrastructure. We believe that the local presence and technology prowess of Sequoia, and our experience in property and infrastructure, will create a powerful combination for Chinese entrepreneurs as they build out their operations.

We started in South Korea 10 years ago and have one of the strongest client rosters of any foreign manager in the country. We have completed numerous real estate transactions, including our extremely successful acquisition and turnaround of IFC Seoul, a 5.5 million square foot signature mixed-use complex. More recently, we acquired a number of new-build industrial logistics warehouse projects and land for data centers. We also hired both an infrastructure and a private equity team and are excited about the opportunities we see in South Korea.

Japan is becoming more interesting all the time and we continue to increase our presence there. We started with an experienced fundraising team, and are now building solar projects and industrial logistics real estate. We also have a number of industrial businesses. We have only scratched the surface and believe that Japan will become a very meaningful investment market for us.

In India, our 14 years have taught us that if you’re careful and patient, you can do extremely well. Our business today is vast, and we have earned strong returns on every investment. Today, with 40 million square feet of IT office park real estate, 150,000 telecom towers, toll roads, pipelines, solar and wind facilities, and an IT outsourcing business, we are a brand name in alternative investments. While always careful, we believe that our early success can lead to much more.

It is quite possible that one-third of our business could be in these markets one day. This will be led by China and India due to their vast populations and need for backbone infrastructure—and while this won’t be easy because there are many very strong local players, we believe that our access to capital enables us to complete our share of deals—sometimes as a great partner to the best-of-the-best locals.

REAL ESTATE MARKETS AND THEIR LIQUIDITY ARE STRENGTHENING

The tone of the real estate markets has improved dramatically since mid-2020. While most property fundamentals were largely unaffected as leases were in place and there were few bankruptcies this down-cycle, leasing and capital markets activities for virtually all assets ground to a halt for a period of time. Since then, the markets have come back as investors witnessed the resilience of prime real estate—and continue to be attracted to the cash yield it generates in a low interest rate world. Single-family residential responded first, driven by people being at home, with industrial and life sciences next, followed more recently by urban high-rise multifamily—and now office, with the balance of sectors to follow.

The growth sectors of property have been industrial and life sciences real estate, given e-commerce tailwinds and the biotech revolution taking hold. We have been both selling more mature industrial and life sciences properties, where excellent returns have been locked in, and are buying others. We just committed to buying two life science developers—one in the U.S. and one in the U.K., and are building out industrial logistics across the U.S., France, Germany, Italy, Poland, China, Korea, Japan, Brazil and Australia.

The areas of the property markets that have exhibited “value investment characteristics” (primarily office and retail) have been incredible places to acquire assets at a steep discount over the past two years, as there have been very few competitive buyers. We bought numerous assets at a fraction of their replacement cost, including a grocery anchored retail portfolio in the U.K. that now generates a running cash yield of 18% on our cost basis. Today, this portfolio could likely be sold for double our purchase price.

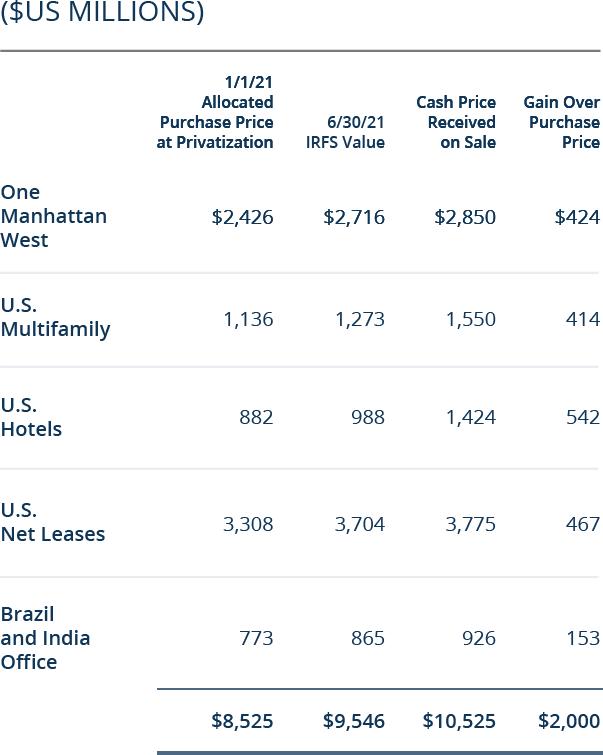

As you also know, we privatized our real estate business at around 70% of IFRS values in early 2021 and as planned, have now started to monetize some of the assets at premiums to these same IFRS values. As an example of the transaction markets today and where values have moved in a year, we note the following, which admittedly is a select group, but does represent $10 billion of assets, with a profit of $2 billion generated in the last year.

The below represents a total dollar gain of $2.0 billion for all of our constituents, or a 47% annualized gain on a gross asset basis over the year (equity returns are far higher). More importantly, however, the real estate investment markets are only now starting to regain a sense of normalcy, driven in large part by the attractiveness of the combined attributes of real estate—being income generation, and inflation protection. We acquired a lot of real estate early in 2021 and are now successfully unlocking value through the monetization of select assets.

To Be Asset-light, or Not—That is the Question

We are often asked if we would prefer to be “asset-light” or stay “asset-heavy.” For those not familiar with the nomenclature, in addition to our asset management business we have $50 billion (net of debt) of our own parent company investment capital. This capital is the result of both the retention of profits and growth in asset values over the decades. This makes us “asset-heavy” compared with most managers today, which are “asset-light”—as they were either founded more recently or have distributed their profits annually to their owners.

Our asset management business is now one of the largest and fastest-growing scale alternative investment businesses globally.

If we distributed most of our $50 billion of investment capital to shareholders, we could quickly and easily become asset-light. While to date that capital has been one of our great operating strengths, we sometimes hear that it makes it harder for an investor to value Brookfield, as he or she needs to both put a value on our asset-light business and understand our investments. Many of our long-standing shareholders appreciate the true value of our capital base and the benefits it brings to the broader franchise. In addition, these investors understand how and what we invest in, and have been comfortable with us making investment decisions with the capital. But for new investors who do not know us as well, this can be more time-consuming to understand.

Pure-play managers have been more in vogue across global markets because they are easier to value and have attracted higher multiples. For many decades our sole focus has been on compounding shareholder capital. In addition, our asset management business, started only 25 years ago, would not have been mature enough to consider separating it from our capital. In fact, our business has grown faster and become more profitable because of the capital we have to support it.

But our asset management business is now one of the largest and fastest-growing scale alternative investment businesses globally. This, together with the added benefit of having the longest duration of annuity-like cash flows of any asset manager, means that it could now simply be separated from our capital. Its growth path on its own is very compelling, as many of our strategies are still getting larger with each vintage and are compounding on each other.

Based on the comparable multiples of pure-play, asset-light alternative investment managers, the equity value of our separated asset management business (i.e., “our Manager”) would likely be in the range of $70 billion to $100 billion (circa $45-$60 per share). To be very clear, that excludes the equity capital that we have invested in our businesses, which today is around another $50 billion net (circa $30 per share).

Separating a part of our Manager in the public or private market, while ensuring it still benefits from the capital we have at overall Brookfield, could open up growth options to us that do not exist today, as we dislike ever issuing shares at less than what we believe to be at least their full fair value. In addition, as our reinsurance and investment operations grow, separating a part of the Manager might make sense in order to allow investors who only want exposure to the Manager, to own a separate security. As we consider these options (including possibly doing nothing), we will report in the quarters/years ahead—and will be pleased to hear any views that you have.

Closing

We remain committed to being a world-class asset manager, and to investing capital for you and the rest of our investment partners in high-quality assets that earn solid cash returns on equity, while emphasizing downside protection for the capital employed. The primary objective of the company continues to be to generate increasing cash flows on a per-share basis, and as a result, higher intrinsic value per share over the longer term. And do not hesitate to contact any of us should you have suggestions, questions, comments or ideas you wish to share.

— Bruce Flatt, Chief Executive Officer

Cautionary Statement Regarding Forward-Looking Statements and Information

All references to “$” or “Dollars” are to U.S. Dollars. This letter to shareholders contains “forward-looking information” within the meaning of Canadian provincial securities laws and “forward-looking statements” within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, Section 21E of the U.S. Securities Exchange Act of 1934, as amended, “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 and in any applicable Canadian securities regulations. Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, include statements which reflect management’s expectations regarding the operations, business, financial condition, expected financial results, performance, prospects, opportunities, priorities, targets, goals, ongoing objectives, strategies and outlook of Brookfield Asset Management Inc. and its subsidiaries, as well as the outlook for North American and international economies for the current fiscal year and subsequent periods, and include words such as “expects,” “anticipates,” “plans,” “believes,” “estimates,” “seeks,” “intends,” “targets,” “projects,” “forecasts” or negative versions thereof and other similar expressions, or future or conditional verbs such as “may,” “will,” “should,” “would” and “could.” In particular, the forward-looking statements contained in this letter include statements referring to the impact of current market or economic conditions on our businesses, the future state of the economy or securities market, the expected future trading price of our shares or financial results, the results of future fundraising efforts, the expected growth, size or performance of future or existing strategies, future investment opportunities, or the results of future asset sales. Our outlook on the equity value of “our Manager” is based on annualized fee-related earnings and target carried interest of approximately $1.8 billion and $2.2 billion, respectively (utilizing valuation multiples in the range of 25-40x for fee-related earnings and 10x for target carried interest), and our accumulated unrealized carried interest balance. In addition, forward-looking statements contained in this letter include statements regarding the American National deal, including the anticipated timing of such transaction and the impact that such transaction may have on Brookfield Reinsurance and on our business.

Although we believe that our anticipated future results, performance or achievements expressed or implied by the forward-looking statements and information are based upon reasonable assumptions and expectations, the reader should not place undue reliance on forward-looking statements and information because they involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, including the ongoing COVID-19 pandemic and related global economic disruptions, which may cause the actual results, performance or achievements of Brookfield Asset Management Inc. to differ materially from anticipated future results, performance or achievement expressed or implied by such forward-looking statements and information.

Factors that could cause actual results to differ materially from those contemplated or implied by forward-looking statements include, but are not limited to: (i) investment returns that are lower than target; (ii) the impact or unanticipated impact of general economic, political and market factors in the countries in which we do business including as a result of COVID-19 and related global economic disruptions; (iii) the behavior of financial markets, including fluctuations in interest and foreign exchange rates; (iv) global equity and capital markets and the availability of equity and debt financing and refinancing within these markets; (v) strategic actions including dispositions; the ability to complete and effectively integrate acquisitions into existing operations and the ability to attain expected benefits; (vi) changes in accounting policies and methods used to report financial condition (including uncertainties associated with critical accounting assumptions and estimates); (vii) the ability to appropriately manage human capital; (viii) the effect of applying future accounting changes; (ix) business competition; (x) operational and reputational risks; (xi) technological change; (xii) changes in government regulation and legislation within the countries in which we operate; (xiii) governmental investigations; (xiv) litigation; (xv) changes in tax laws; (xvi) ability to collect amounts owed; (xvii) catastrophic events, such as earthquakes, hurricanes and epidemics/pandemics; (xviii) the possible impact of international conflicts and other developments including terrorist acts and cyberterrorism; (xix) the introduction, withdrawal, success and timing of business initiatives and strategies; (xx) the failure of effective disclosure controls and procedures and internal controls over financial reporting and other risks; (xxi) health, safety and environmental risks; (xxii) the maintenance of adequate insurance coverage;(xxiii) the existence of information barriers between certain businesses within our asset management operations; (xxiv) risks specific to our business segments including our real estate, renewable power, infrastructure, private equity, credit, and residential development activities; and (xxv) and factors detailed from time to time in our documents filed with the securities regulators in Canada and the United States.

We caution that the foregoing list of important factors that may affect future results is not exhaustive and other factors could also adversely affect its results. Investors and other readers are urged to consider the foregoing risks, as well as other uncertainties, factors and assumptions carefully in evaluating the forward-looking information and are cautioned not to place undue reliance on such forward-looking information.

Expect where otherwise indicated, the information provided herein is based on matters as they exist as of the date hereof and not as of any future date. Unless required by law, we undertake no obligation to publicly update or otherwise revise any such information, whether written or oral, to reflect information that subsequently becomes available or circumstances existing or changes occurring after the date hereof.

Past performance is not indicative nor a guarantee of future results. There can be no assurance that comparable results will be achieved in the future, that future investments will be similar to the historic investments discussed herein (because of economic conditions, the availability of investment opportunities or otherwise), that targeted returns, diversification or asset allocations will be met or that an investment strategy or investment objectives will be achieved.

Certain of the information contained herein is based on or derived from information provided by independent third-party sources. While Brookfield believes that such information is accurate as of the date it was produced and that the sources from which such information has been obtained are reliable, Brookfield makes no representation or warranty, express or implied, with respect to the accuracy, reasonableness or completeness of any of the information or the assumptions on which such information is based, contained herein, including but not limited to, information obtained from third parties.

Cautionary Statement Regarding the Use of Non-IFRS Measures

This letter to shareholders contains references to financial measures that are calculated and presented using methodologies other than in accordance with IFRS. These financial measures, which include Distributable Earnings, its components and its per share equivalent, should not be considered as the sole measure of our performance and should not be considered in isolation from, or as a substitute for, similar financial measures calculated in accordance with IFRS. We caution readers that these non-IFRS financial measures or other financial metrics are not standardized under IFRS and may differ from the financial measures or other financial metrics disclosed by other businesses and, as a result, may not be comparable to similar measures presented by other issuers and entities.