Introduction

When thinking about the legacy of COP26, it helps to take a look back. Not to November 2021, when the conference took place in Glasgow, but to 2015, when COP21 concluded and the Paris Agreement was born.

That agreement was successful because it became the reference point for every investor focused on sustainability—on what it meant to contain climate change. We believe the outcome from COP26 will ultimately mainstream the climate transition so that the core of the global financial system takes climate change into account when making investment and lending decisions.

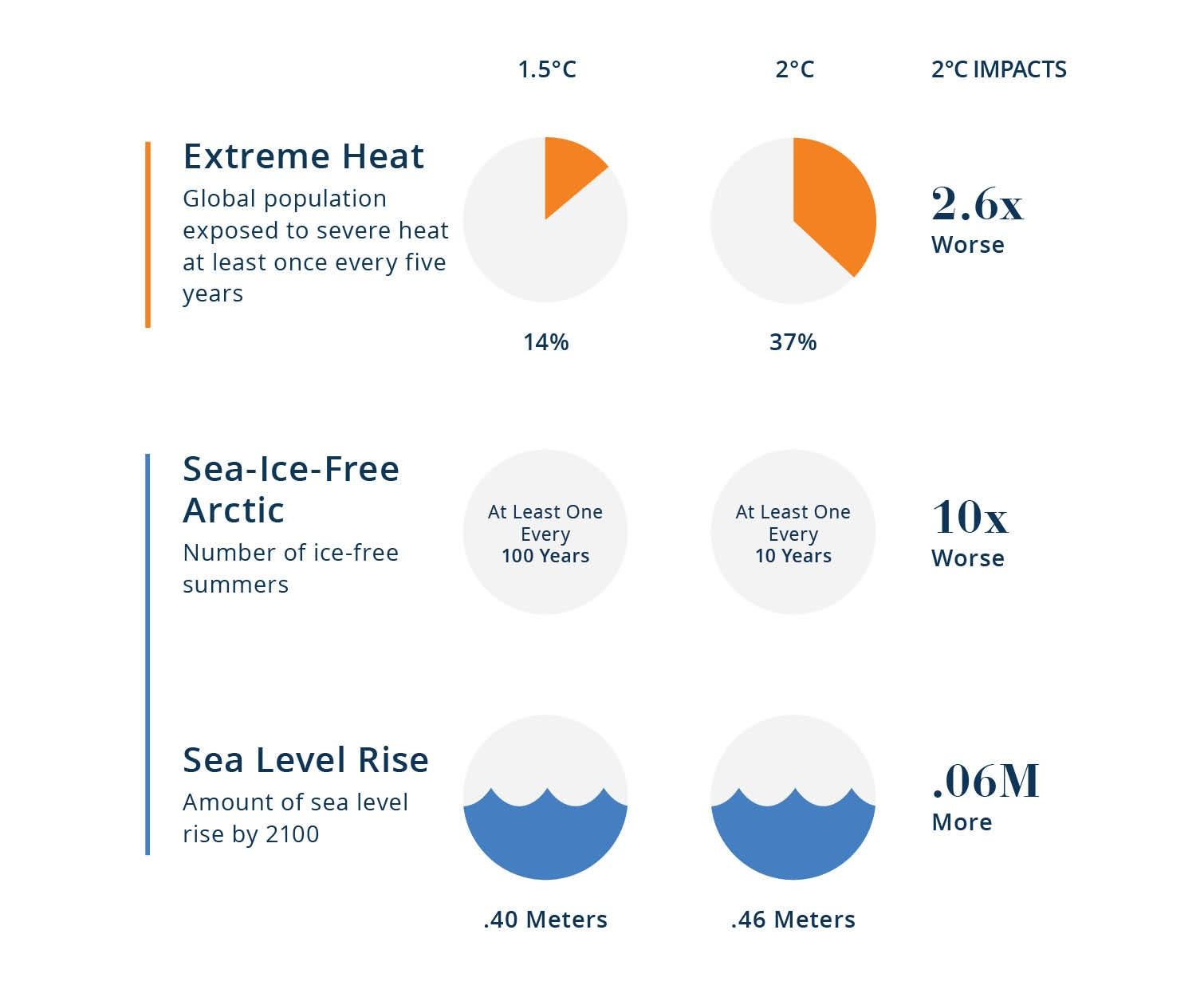

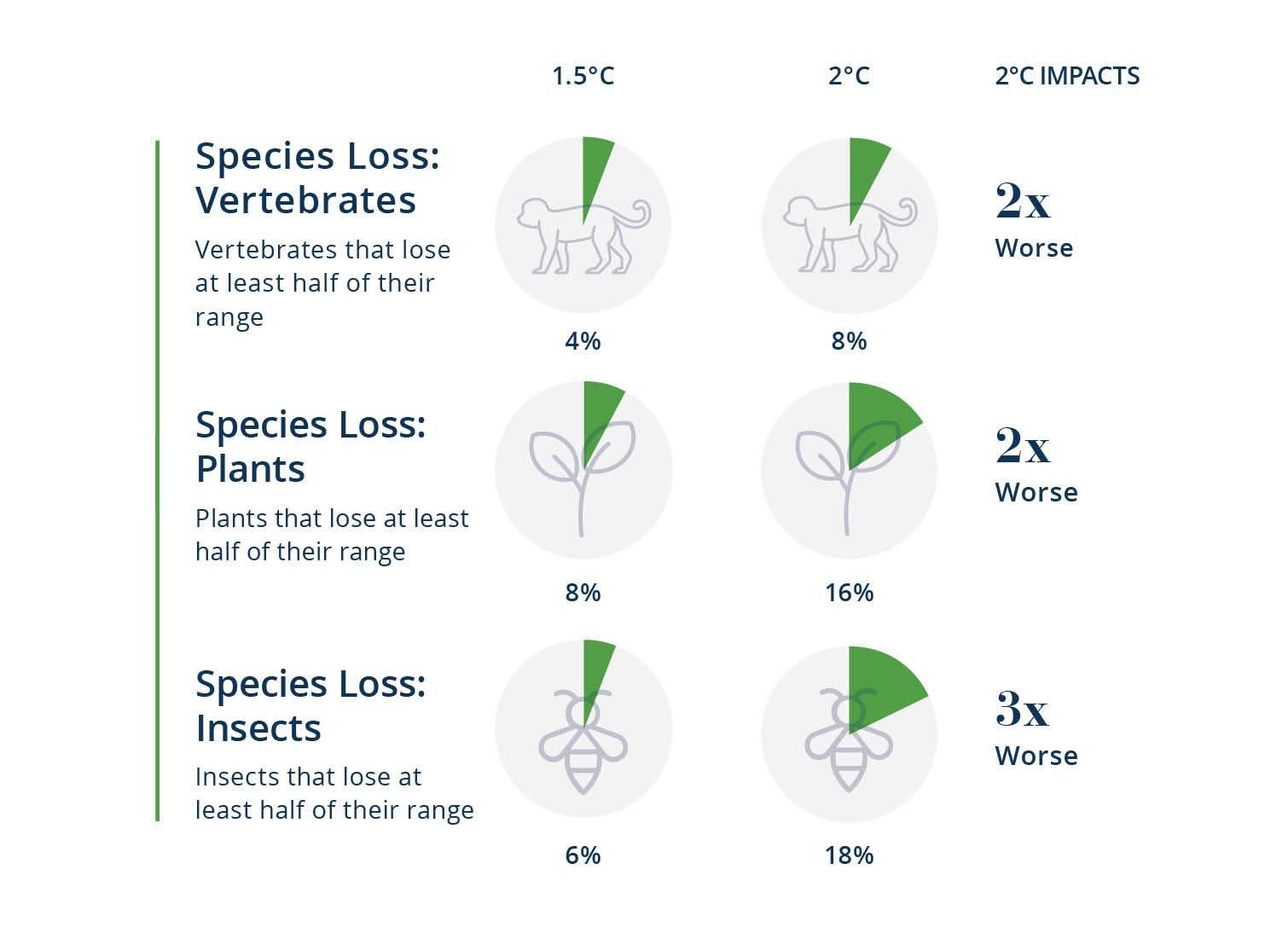

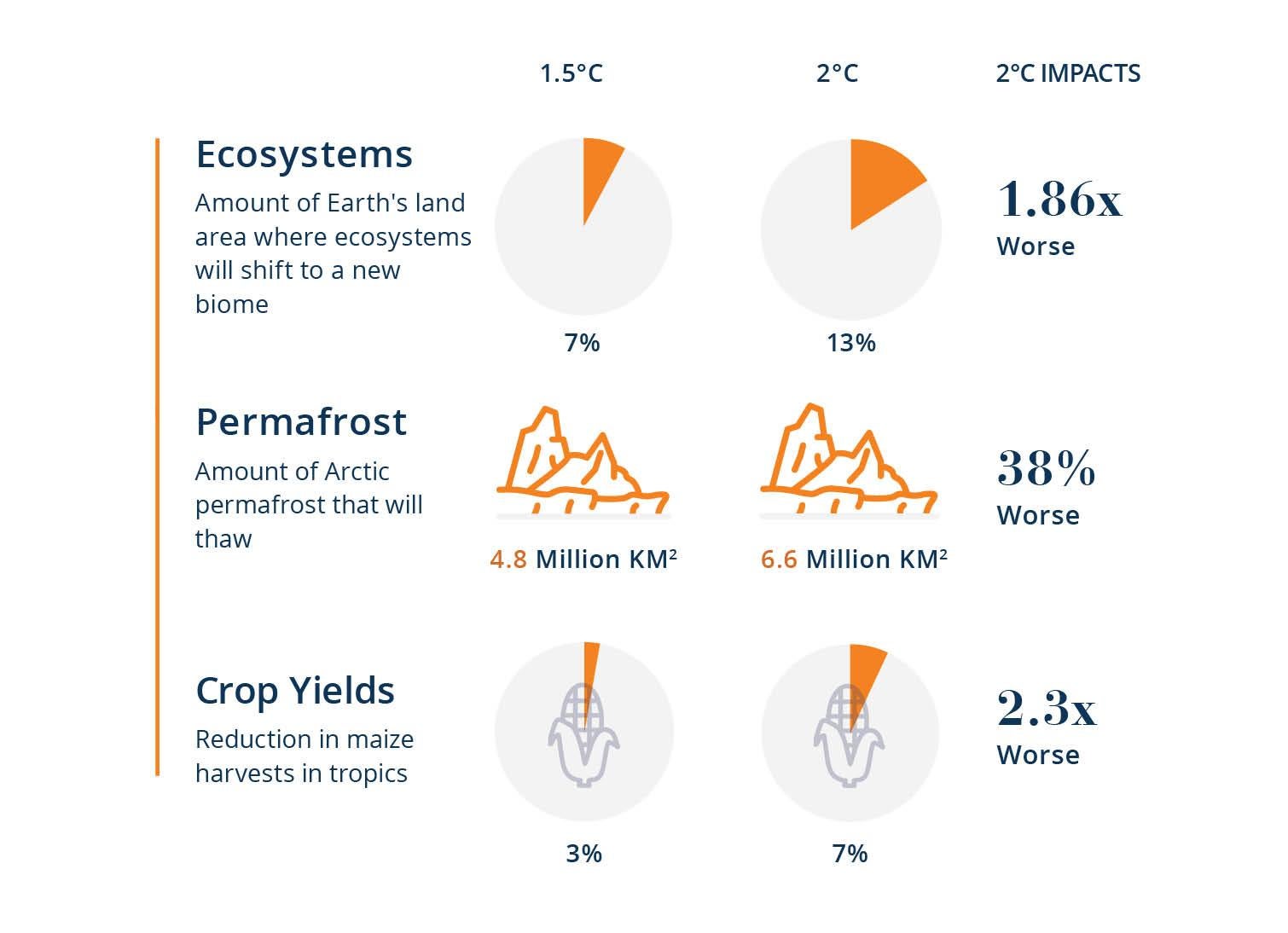

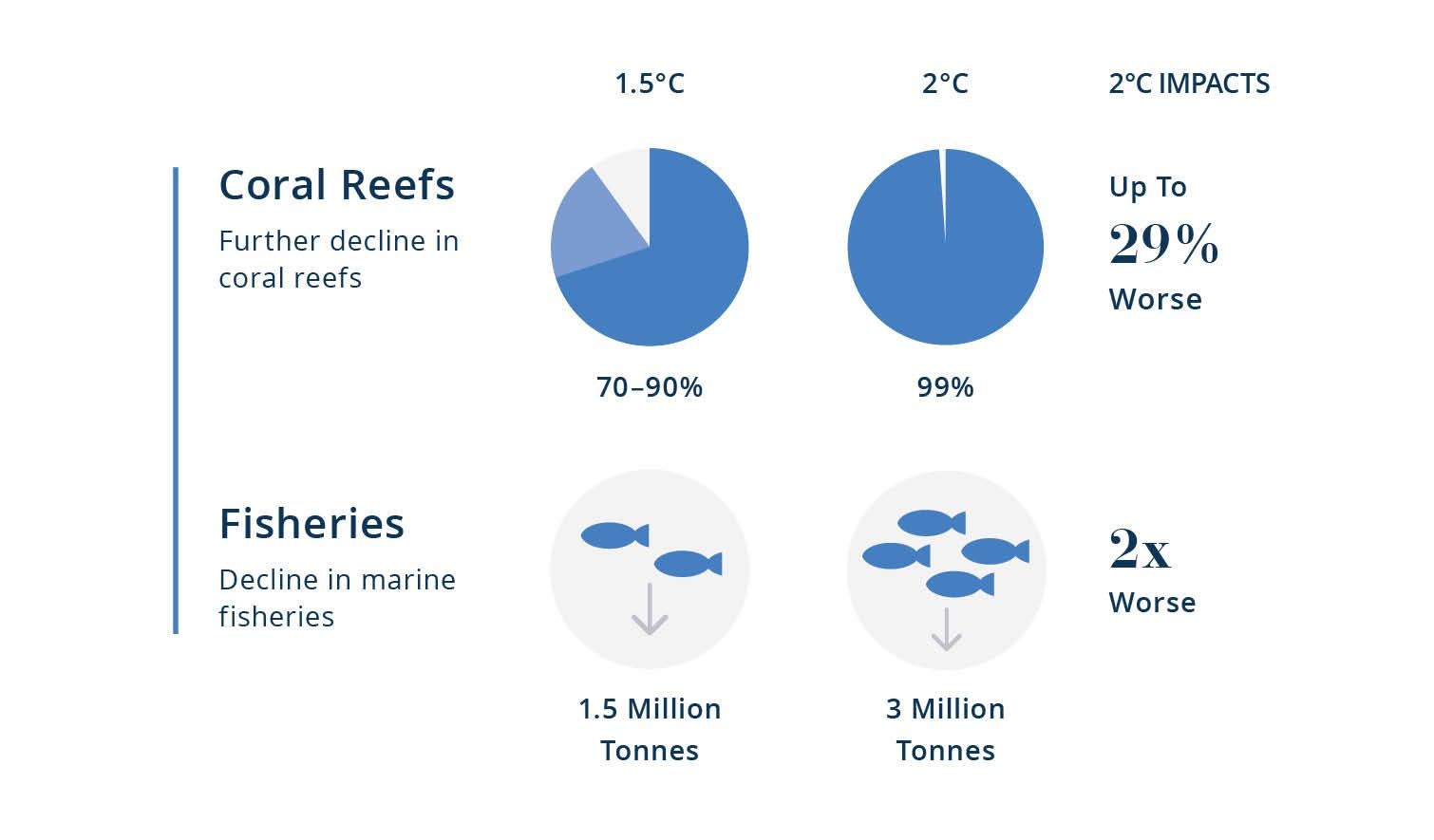

The Paris Agreement committed countries to limiting the global average temperature rise to well below 2 degrees Celsius above pre-industrial levels—with 1.5 degrees as a stretch target. Six years later, the G20’s Leaders pact in Rome, and the Glasgow Climate Pact at COP26, sharply increased country pledges. The new consensus is that we must limit the Earth’s temperature increase to 1.5 degrees Celsius above pre-industrial levels.

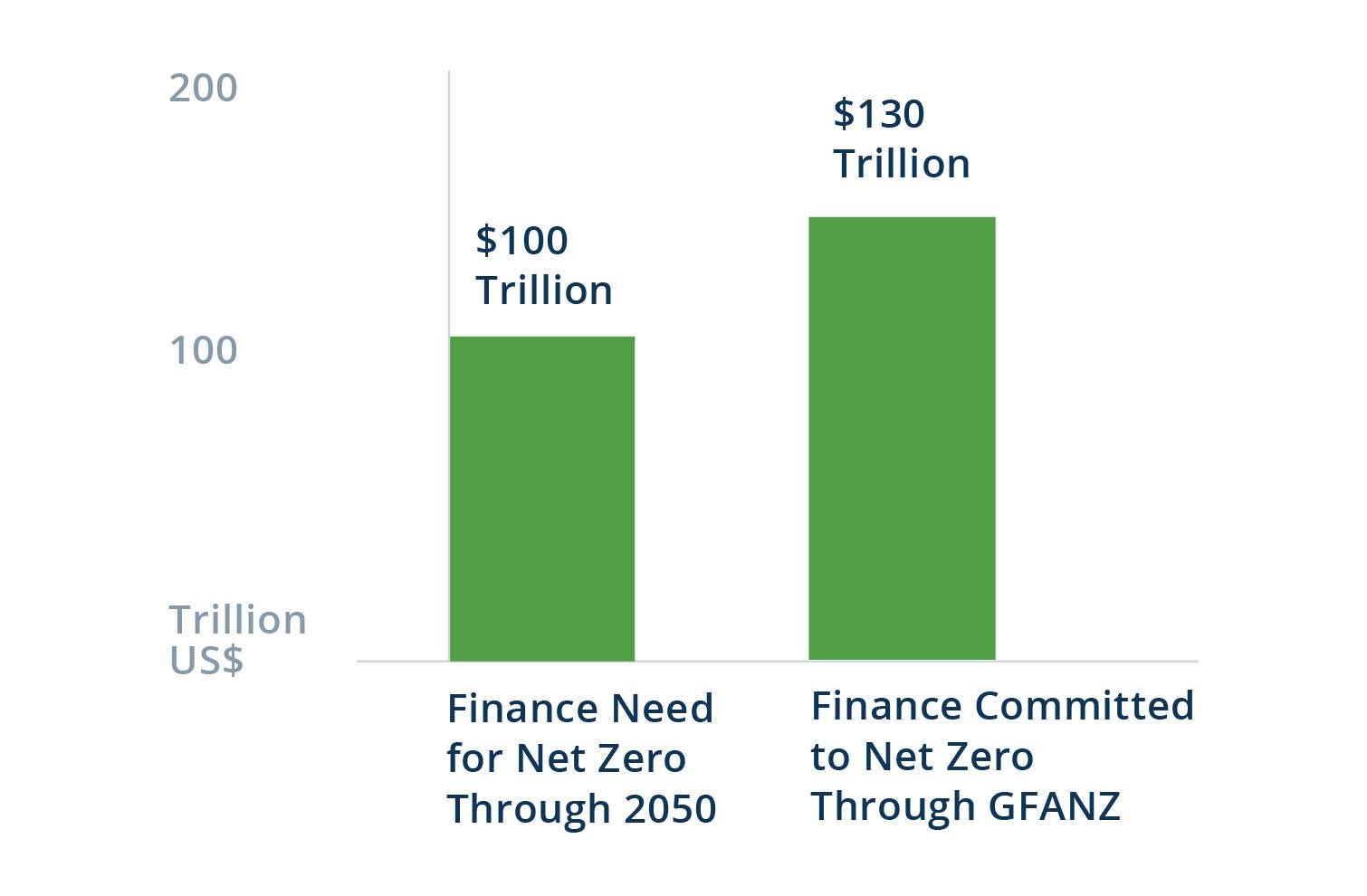

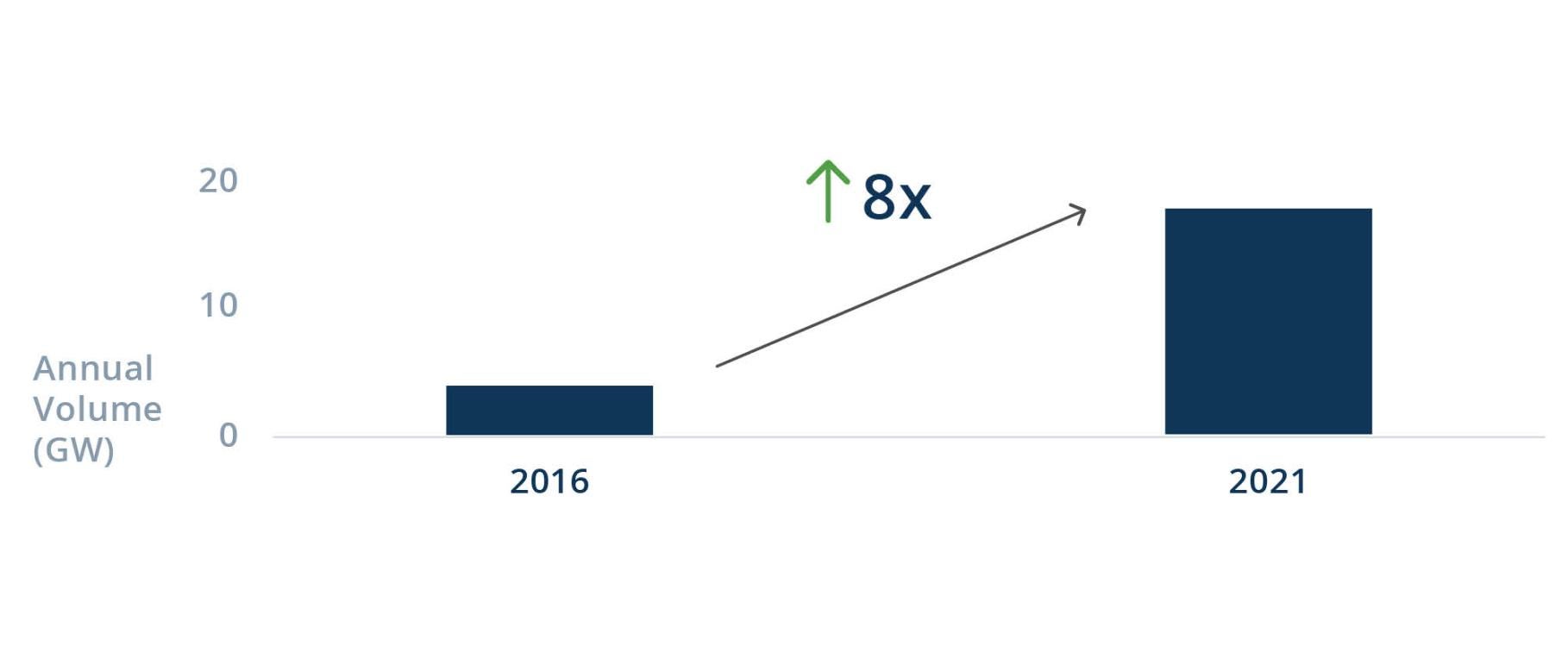

One of the most important achievements of COP26 was to provide a consistent framework for capital markets and companies to operate in. As a result of COP26, the “plumbing” is now being built for a net-zero financial system that will bring climate change into the core of financial decision-making. Already, leaders are allocating capital to seize the opportunities in the net-zero transition. These will only expand as the transition mainstreams.

COP26 has changed the incentive structure for companies to transition to net zero. This creates an enormous opportunity for investors, especially those who are able to tap into large-scale capital and leverage operational expertise.