Introduction

As an asset class, infrastructure has demonstrated its resilience throughout economic cycles. These assets can offer investors a compelling combination of income, diversification, inflation protection and downside risk mitigation.

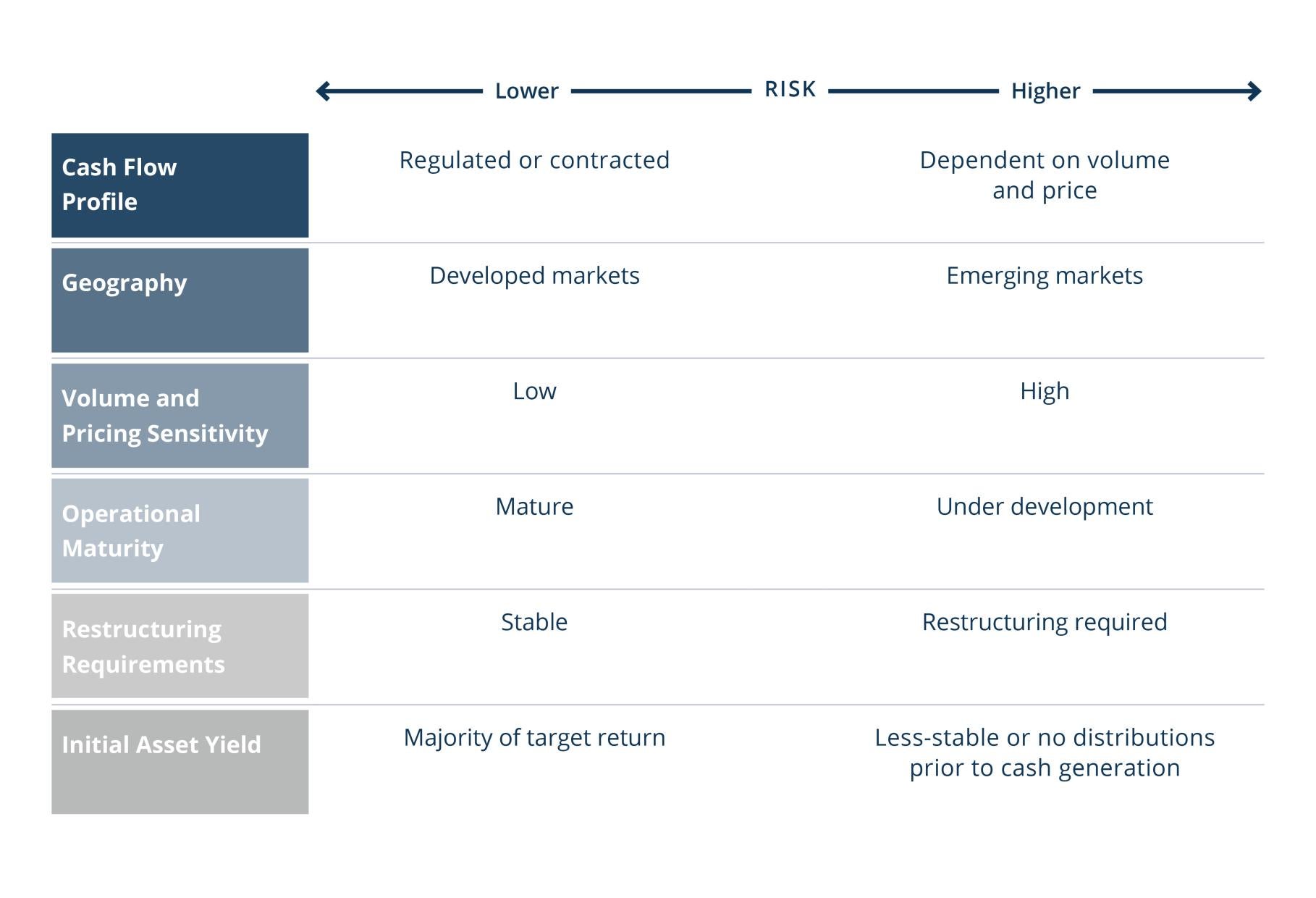

Yet not all infrastructure is created equal. Historically, the cash flow stability and performance of some infrastructure assets classified under the same risk profile category have varied during periods of market volatility. Depending on the magnitude and nature of the variability, the value of some assets has been affected as well.

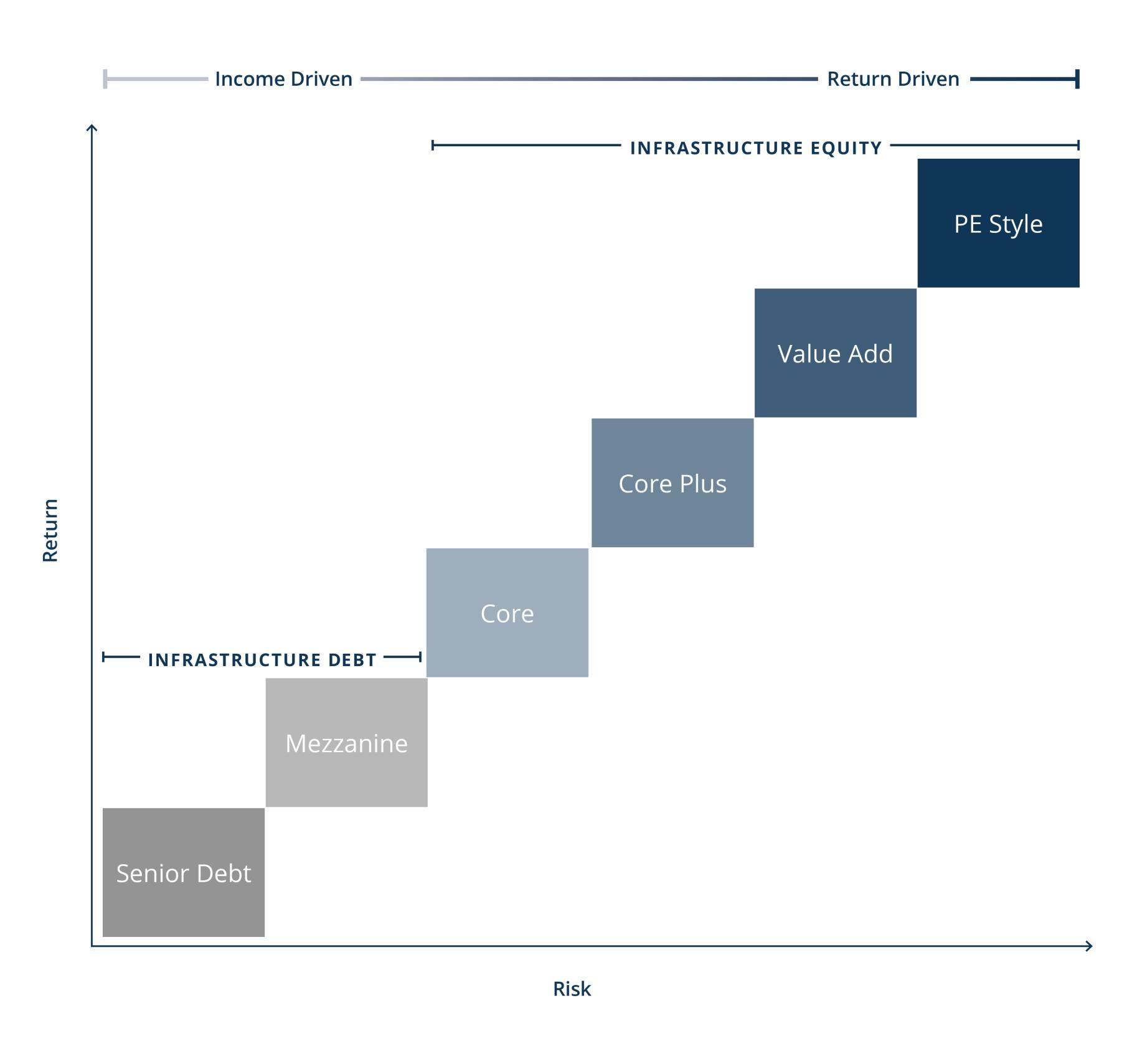

Across the infrastructure universe, investors have a wide range of risk profiles to choose from. Such strategies can focus on specific geographic or regulatory regimes, sectors or stages of development. We believe investors should closely evaluate the infrastructure strategies available to them to truly understand the underlying risk profiles—and whether the target returns are an appropriate reflection of those risks (see Figure 1).