Last week, Brookfield joined COP28—the UN Climate Change Conference hosted by the UAE—to advance progress on global climate action, particularly climate finance. COP28 was significant for many reasons beginning with The Global Stocktake—the first review since the Paris Accord of global efforts to limit global warming to 1.5 degrees Celsius.

The bottom line is that, while the world has made progress, efforts need to be redoubled. In that spirit, the UAE Presidency tackled many of the toughest challenges in climate change head on.

Breakthroughs included COP’s first explicit recognition of the need to transition away from fossil fuels. That overarching objective was backed by pragmatic, measurable commitments to triple renewable energy capacity this decade, double the rate of energy efficiency by 2030, achieve near-zero methane for oil and gas industries this decade, and triple nuclear capacity by 2050.

These and other COP28 initiatives have the potential to reduce emissions by 5-7 gigatons, equivalent to around one-third of the emissions reductions required by 2030 if the world is to get on track for 1.5 degrees.

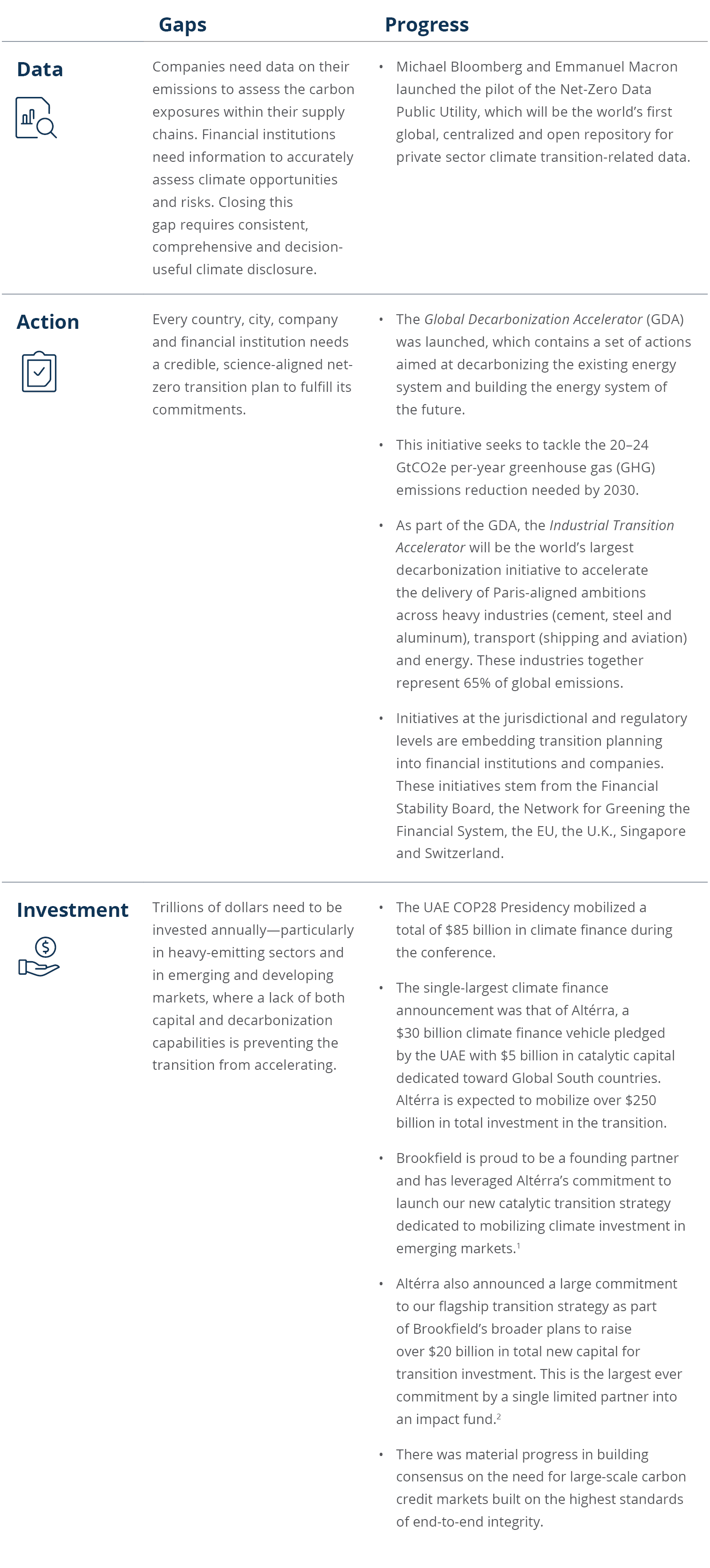

Heading into COP28, I highlighted in an op-ed in The Economist the need to address three gaps—those in data, action and investment. Significant progress was made on each: