European Real Estate: Opportunities Amid Volatility

We see a short window of opportunity to invest in European real estate for value.

Introduction

Many investors today are wondering when they should return to the real estate market. The hesitant sentiment is understandable, as 2023 began with uncertainty about the health of the banking system on both sides of the Atlantic, the impact of the war in Ukraine on energy costs, capital markets volatility and the future path of economic growth, interest rates and inflation.

But a closer look at the European real estate market—beyond the prevailing headlines—suggests that the next several years are poised to deliver a host of attractive opportunities. Europe’s macroeconomic picture has improved, and concerns over systemic risks stemming from the banking system have subsided. Meanwhile, real estate fundamentals are strong, particularly for high-quality assets in sectors where supply and demand forces are painting a compelling picture—including housing, hospitality, science & innovation and logistics. Europe’s position as a leader on the environmental, social and corporate governance (ESG) regulatory front is also providing attractive opportunities to create value and address strong demand for sustainable properties.

At the same time, we expect to see capital structures come under increasing stress in the near term as debt service rises and maturities loom. The ongoing dichotomy between capital markets volatility and supportive real estate fundamentals is producing a compelling dynamic not seen in past cycles. The increased stress on many property owners who were previously able to finance assets at historically low rates will drive capital needs and create attractive conditions for those seeking to acquire real estate assets on a value basis.

All of this is opening a short window of opportunity to invest in European real estate for value.

A Prime Time to Invest, Selectively

About a year ago, the consensus view on European economies was that things were going to get much worse and that a recession was essentially unavoidable. Europe was wrestling with the effects of the war in Ukraine and the resulting energy crisis.

This was most severe in Germany, where fears of energy rationing over the winter resulted in a dramatic decline in industrial activity. Rising inflation—and the march to ever higher interest rates—seemed unstoppable. And then in early 2023, failures of U.S. small-cap banks and the forced acquisition of Credit Suisse by UBS threatened to unleash systemic risks across the economy.

Today, the doomsday scenario has not played out. The European winter was milder than expected, Germany and its neighbors found alternative supplies of energy, and many economies were able to reduce overall energy consumption. As a result, the energy markets have stabilized since late last year. Headline inflation is forecast to continue declining on the back of reduced energy prices and relieved supply bottlenecks. This eventually echoes through interest rates, where the most recent forecasts expect the European Central Bank to continue to hike the deposit rate this year, with an ultimate peak in 2024 at moderate levels. Similarly, in the U.K., easing inflation is expected in the second half of 2023 due to a loosening labor market and the prospect of lower energy bills. The major European economies now appear to be trending in an encouraging direction, with most GDP growth forecasts through 2024 now positive in the region.

Worries about potential systemic risks in the financial markets have also calmed. The volatility in the banking sector appears not to have materially impacted credit conditions. For now, the likelihood of further contagion among European banks remains low—with some comfort taken from the fact that the sector remains well-capitalized relative to the Global Financial Crisis.

The transaction market ground to a halt in mid-2022 due to constrained capital and pessimism about the direction of the economy. Owners who did have to sell were forced to take significant discounts to entice buyers given the uncertainty and tight credit conditions. Today, we are in a period of adjustment as elevated interest rates translate to higher cap rates. Deals are slowly coming back to the market, many from motivated sellers with upcoming debt maturities or covenant breaches. Looking ahead, we expect these dynamics to continue to produce opportunities.

We expect bid-ask spreads to continue narrowing, particularly for high-quality real estate, at higher pricing than what’s implied in public markets, as public companies trade at significant discounts to intrinsic value. Demand remains robust from both investors and occupiers for the best-in-class assets—those that are well located and built to modern occupational standards with strong sustainability credentials. Demand for Class A real estate continues to grow while supply remains tight due to strict planning laws, land and capital constraints, and soaring construction costs. Vacancy levels remain at record lows and prime rents are growing at double digits across many sectors—even to the point of outpacing inflation.

Anticipated capital markets distress at a time when real estate market fundamentals remain strong presents an attractive confluence of events we have not seen in recent history—one that we believe will create significant buying opportunities in the near term. As a manager, it’s important to look beyond the noise and focus on what can be controlled in today’s environment: active asset management and investing in sectors with pricing power, where operational expertise is key to growing cash flow. In the long term, business plans will benefit from moderating rates in borrowing costs and valuation multiples once the market volatility settles.

It’s important to look beyond the noise and focus on what can be controlled in today’s environment: active asset management and investing in sectors with pricing power, where operational expertise is key to growing cash flow.

Where to Look in the Housing Sector

Across Europe, we see potential to build scale as existing housing supply cannot meet the growing demand and new development continues to undershoot government targets.

While population growth in Europe is forecast to level off in the medium term, household formations continue to expand. This is happening amid increased mortgage rates, which continue to affect the cost of homeownership. As a result, the number of residential renters has risen, as has upward pressure on rents, ultimately driving pricing power in the sector. We expect these trends will produce a range of opportunities across the housing market.

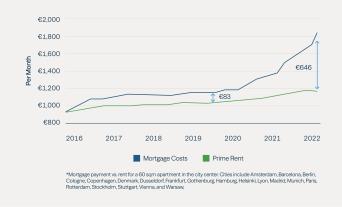

For most citizens in Europe, it is becoming increasingly cheaper to rent homes than it is to buy. Interest rate hikes in recent months, alongside rapid house price growth, have constrained affordability (see Figure 1). In the U.K., almost six out of 10 fixed-rate mortgages that are set to expire in 2023 were originated at interest rates of 2% or lower.1 This means that as approximately 1.4 million households look to renew their mortgages this year,2 they will soon face the prospect of much more burdensome mortgage payments. Similarly, in Germany, mortgage rates more than tripled during 2022, with the gap between average monthly mortgage payments and the cost to rent increasing from 30% to 100% over the last 12 months.3

Figure 1: Europe’s Mortgage Affordability Problem

Home Affordability in City Center, Ownership x Renting*

Source: CBRE Research 2023.

On the supply side, rising construction costs are constraining development and slowing delivery of new stock (see Figure 2). In Germany, for example, supply levels have consistently fallen short of the government’s targets by a wide margin: Only 295,000 new housing units were delivered in 2022, once again well below the government’s annual target of 400,000.4 This gap is expected to continue widening as developers postpone or cancel approved construction projects due to rising costs for financing and materials. This dynamic is playing out in a market that is experiencing record immigration levels, resulting in a historically low residential vacancy rate of 1.9% as of Q1 2023.5

Figure 2: Subdued Development Activity Further Slowed by Rising Financing and Construction Costs

EU-27 Residential Construction Costs vs. Building Permits

Source: CBRE Research 2023.

It’s no surprise that these factors are putting upward pressure on rents across the region, particularly in markets with more landlord-friendly regulations, such as the U.K., Finland and Belgium. In the U.K., rent growth reached 10% in 2022, roughly in line with inflation, and is forecast to outpace inflation over the next four years.6 These attractive fundamentals in the U.K. should support pricing power across the spectrum of rental housing—multifamily, single-family, co-living/flexible living and senior housing—as renting continues to be cheaper than buying.

Other markets, such as Germany and the Nordics, have a deep existing institutional rental housing sector and have historically been more difficult for institutional investors to enter at compelling pricing. However, these markets are now experiencing capital markets stress as the historically low cap rates are being repriced due to much higher interest rates.

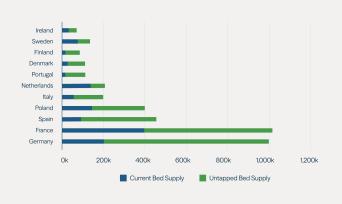

The structural shift in the housing market away from owning to renting is being exacerbated by demographic trends, as demand for alternative, tailored and transient forms of housing rises. Across Europe, the number of young people (15-19 years old) is forecast to rise ~6% by 2027,7 which is bolstering the student housing market and driving a need for higher quality and institutionally managed accommodations. France, Germany, Italy, Spain, Portugal and the U.K. are all home to some of the world’s most prestigious universities, which continue to draw interest from a burgeoning pool of international students. However, most don’t have enough beds to accommodate escalating enrollment, causing a significant supply/demand imbalance (see Figure 3), particularly for purpose-built stock meeting modern occupational standards.

Figure 3: Student Housing Demand Is Outpacing Supply

Untapped Bed Supply Benchmarked to the U.K.’s Provision Rate

Source: Savills (2023).

Many of Europe’s top-tier cities have dire student housing provision rates, including Rome (2%), Lisbon (4%), Valencia (5%) and Milan (6%).8 Even in the U.K., Europe’s most mature market for purpose-built student accommodation (PBSA), strong demographic tailwinds continue to support the long-term outlook, with an estimated 16% increase in full-time undergraduate numbers between now and 2030.9 With high occupancy levels alongside an influx of domestic and international students, PBSA is well positioned as a resilient asset class with an upward rent growth trajectory. In our own platforms, which span Germany, France, Spain and Portugal, we’re seeing low double-digit rental growth across markets.

A similar story holds true in the co-living segment, which can offer relatively flexible and convenient options for renters in European markets at competitive pricing. As the aging student populations enter the workforce, they are met with the same affordability challenges of other demographics. The growth of this segment would allow operators to cater to a broader market, including both students and young professionals who may be willing to trade apartment size for a prime location near city-center attractions and job opportunities. We expect this evolution to create consolidation opportunities to build scaled, well-managed platforms in the co-living segment.

Learn about Student Roost, the PBSA platform we built in the U.K., here.

Where to Look in the Science & Innovation Sector

Aging populations across Europe continue to put stress on the health care system, spurring both the public and private sectors to invest significantly into life sciences and the pursuit of medical breakthroughs.

In fact, across the EU, government research & development (R&D) budgets increased 6% to $109 billion from 2020 to 2021.10 In a similar fashion, in the U.K., venture capital funding reached record levels in 2021. We see venture capital support as a leading indicator of demand for real estate from innovative companies. Typically, space requirements arise 12-18 months after a company receives funding, with every €1 billion of funding leading to 500,000 square feet of life science occupier demand.11 While funding levels have stabilized since 2021, they are still more than double the annual average pre-pandemic.

Further, geopolitical tensions and scientific exigency are leading to greater onshoring of European biopharmaceutical supply chains. The pandemic highlighted the risk of offshore exposure by compromising access to medicine, spurring pharmaceutical companies to revisit their strategies. Now, some 80% of life science companies have adjusted or plan to adjust their global operations or supply chains.12

With heavy investment flowing into infrastructure and R&D driving occupier demand, the real estate market will have to provide more science-ready sites with premier facilities, co-working spaces and business support. The science sector is an ecosystem of public-private partnerships and collaborations. Specialized real estate facilitates these relationships and activities, creating centers of excellence around universities, hospitals and other top research institutions.

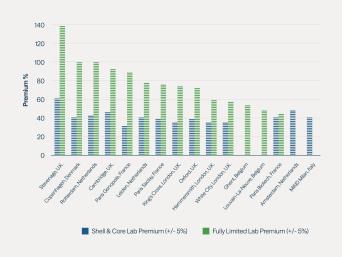

The U.K., Europe’s most established market for science & innovation, boasts slim vacancy rates for fitted laboratory space, notably in Cambridge (less than 1%), London (less than 1%) and Oxford (2.0%).13 According to Savills, take-up for science-related real estate across these markets totaled ~1.4 million square feet in 2022, the highest figure in the last five years.14 We believe tenants will continue to prioritize prime locations and Class A premier lab space, which will command significant rental premiums in what we believe will continue to be a growing sector for investment opportunities.

Learn about ARC, our science & innovation platform in the U.K., here.

We anticipate expanding opportunities across continental Europe, where strong demand and chronic supply shortages are bolstering nascent markets to expand science & innovation real estate. Germany, where more than 650 biopharmaceutical compounds are in clinical development, has invested more than €10.8 billion in biotech and R&D, and the number of employees working in the field has nearly doubled in the last eight years.15 And in France, €30 billion has been earmarked for biotech development as part of the government’s 2030 plan, while its private sector has witnessed an inflow of €1 billion in venture capital over the last five years, a material increase compared with prior years.16

The shortage of specialized, fully fitted lab spaces is driving rents higher, and giving landlords pricing power, across Europe as we see rental premiums well above prevailing office rates—76% higher on average (see Figure 4). While there is space under construction and a pipeline to help ease demand pressures, this sector continues to grow—suggesting that the imbalance between demand and supply will continue.

Figure 4: Fully Fitted Lab Space is Commanding Rental Premiums

U.K. & European Laboratory Rent Premiums (vs. Office Rents)

Source: Savills (2023).

Where to Look in the Hospitality Sector

Welcome to the “New Normal”: Trends in consumer behavior—such as a growing desire for experiences over material goods—are accelerating as lifestyle changes like working flexibility have become more prevalent.

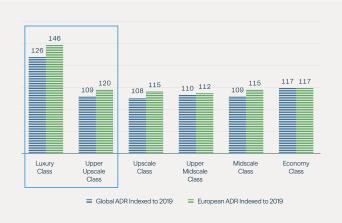

While we are seeing this trend globally, its strength is more pronounced in Europe, where average daily rates (ADR) have made an outsized recovery from pandemic levels across segments—particularly in the luxury and upper upscale segments (see Figure 5).

Figure 5: Luxury and Upper-Scale Hotels Have Outperformed Globally, With Particular Strength in European Markets

Source: STR 2023.

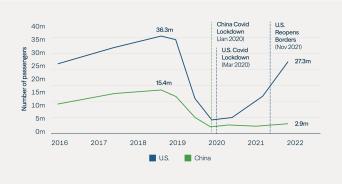

In addition, the relaxing of travel restrictions and reopening of international borders have driven a meaningful recovery in global tourism, particularly into European leisure destinations. Inbound tourists from the U.S. and Asia are expected to provide a material boost to occupancy in 2023 and beyond, as these key regions are still well below their prior peaks (see Figure 6). These travelers also tend to stay longer than tourists from shorter-haul markets.

Figure 6: Key Long-Haul Source Markets Still Have Runway For Growth

Inbound Travel to Europe by Origin Country (2016-2022)

Source: Green Street, April 2023.

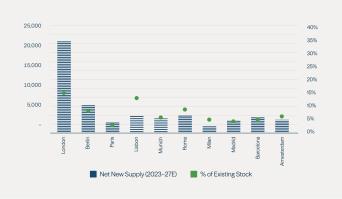

While demand is robust, the supply side remains at record lows due to the higher cost of land, rising construction costs and labor shortages (see Figure 7), with new supply at only ~3% of total stock17 and expected to increase by less than 10% over the next five years. Focusing on the luxury and upper upscale segments, which are exhibiting the strongest relative ADR growth, we see an even more prominent shortage in the availability of luxury hotels. For instance, almost one in three hotels in the U.S. qualifies as upscale; by comparison, just one in 10 European hotels can say the same.18 With these dynamics at play, we expect outsized demand for luxury hotel experiences and believe opportunities in this segment will be fruitful in the current environment.

Figure 7: Limited New Supply Due to Turbulent Capital Markets and High Construction Costs

European Hospitality Supply (No. of Keys)

Source: STR 2022.

Furthermore, hotel ownership in Southern Europe is fragmented; as a comparison, branded upscale/luxury hotels hold ~30% market share in the U.S., compared with only ~13% in Europe.19 And as branded hotels achieve occupancy and RevPAR premiums relative to non-branded hotels, we see local resources, scale and experience as key to successfully identifying and executing asset rebranding, and in turn creating best-in-class operations that drive revenues.

Many owners of hotel assets struggled through the pandemic and borrowed heavily to meet cash flow shortfalls, forcing them to delay required capital improvements in their assets. This may result in distress in a sector where capex investment drives success (the average capex reserve for hotels is estimated to be 32%, higher than other core sectors).20

Ultimately, we believe uneven recoveries across hospitality segments will create opportunities to acquire mispriced assets at attractive bases. We saw this during the pandemic, when we acquired a Spanish hospitality portfolio at a 29% discount to comparables. Opportunities like this arose because many value-add investors bought hotels shortly before the pandemic and found their business plans interrupted due to closures, refurbishment delays and increased construction costs. We expect situations like these to continue to unfold and, coupled with debt maturities, create further opportunities to buy hotels from transitional owners.

Where to Look in the Entertainment Sector

Younger generations are spending more on live performances and media—part of the shifting consumer preferences we’re seeing in the New Normal. This stimulates demand from content creators and producers for real estate assets, such as performance venues and soundstages, that they can use to create film and TV content.

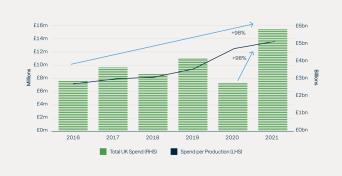

Competition among legacy media companies and streaming players is growing, fueling heavy investment into original content and product offerings. Many are now turning to international audiences in a bid to differentiate and expand their strategies for further growth and market share. Globally, content spend is expected to more than double from 2017 through 2024, equating to a 10% compound annual growth rate.21

In the U.K., total spend on the production of films and high-end TV (HETV) reached £5.6 billion in 2021, almost doubling over five years from £2.8 billion in 2016 (see Figure 8). The U.K.’s ~6 million square feet of general stage facilities as of 2022 cannot meet the rising demand for new content. While we’re seeing an increasing number of plans and proposals for new purpose-built studio space in the U.K., the projects that are approved are still subject to high development costs and ability to fund—suggesting that supply will continue to struggle to keep up with demand.

An estimated additional 6 million square feet of space will be needed by 2026 to meet the robust demand. If growth in the U.K. continues, forecasts expect spending to reach £11.2 billion by 2026.22 All this is causing surging rents and rising capital values.

Figure 8: Total U.K. Production Spend Doubled Over Five Years (2016-2021)

Spending on U.K. Film and HETV (GBP/year)

Source: British Film Institute, Knight Frank.

We suspect that a similar dynamic is playing out across broader continental Europe, where media-related demand is rapidly growing alongside minimal supply. For example, Spain is becoming a gateway to non-English speaking markets, leveraging high-quality content coupled with the maturity of the local production industry.

We see entertainment as an undersupplied, anti-cyclical and growing asset class and have already begun to capitalize on this sector. We have invested in performance venues and soundstages in the U.S. and are looking to apply a similar playbook in Europe, where the market is nascent but growing.

Where to Look in the Logistics Sector

In the logistics sector, manufacturers are moving from just-in-time inventory management to just-in-case to secure and optimize their supply chains.

This has become a priority in the wake of the pandemic-related disruptions that led to a broad shift toward deglobalization. More than ever, tenants are increasing their inventory levels to meet the needs of consumers (Figure 9). This dynamic is lifting demand for high-quality last-mile logistics facilities in already supply-constrained markets near major transportation and distribution centers and/or large population hubs.

Figure 9: Inventories Are Growing at a Record Rate

Source: Savills/Eurostat, March 2023.

Along with this shift, we are seeing an increased focus on automation, resilience and sustainability, which will further drive demand for high-quality, future-proof logistics facilities. Logistics assets resemble infrastructure investments in that they are low maintenance and can be used for a long time without significant capex. Yet they play a critical role in the overall supply chain network because they directly link physical goods to the end consumer.

Our experience shows that logistics tenants tend to be data driven and are incentivized to find the best location, which is often difficult to replicate given land constraints. A landlord needs to understand the tenant’s business and supply chain, as well as the market, to offer a product that meets the tenant’s needs. We have found that landlords with proprietary market intelligence and a local presence are best positioned to meet these needs and command premium rents.

Tenants are willing to pay these rent premiums in exchange for the ease of working with successful operators—landlords with whom they have existing relationships, who can offer speed and certainty of execution. We believe that landlords who can quickly adapt to their tenants’ evolving needs, and offer build-to-suit spaces in desired locations, will ultimately grow market share alongside their tenants.

From a supply perspective, land constraints and high replacement costs are limiting availability in key European logistics corridors. New starts have begun to slow as debt becomes more difficult to obtain, which should limit new space and keep vacancies low in 2023 and beyond. While cap rates are expanding, Europe’s historically low vacancy rate of approximately 3%23 should continue to support rent growth as tenants are forced to bid pricing higher in order to occupy the properties. Many logistics properties in European markets also benefit from the direct pass-through of inflation in the form of lease indexation. In some markets, this is a straight annual adjustment. In others, it’s tested over a longer time or once certain hurdles are reached, but is eventually captured by resetting to a higher base rent. Thus, the well-leased assets in strong markets are positioned to outpace inflation through market rent growth.

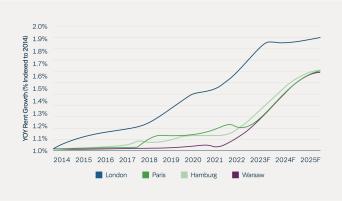

While rental growth has been strong, trends in Europe generally lag those in North America, where year-over-year rent growth exceeded 20% in 2022. Consequently, we see additional upside potential across continental markets in the near term (see Figure 10). Over the last 10 years, yields compressed and effectively created a subsidy to tenants such that rents did not need to increase to justify building logistics sites. Meanwhile, construction costs increased, mainly driven by increased regulations. Now, the fundamental demand for prime assets remains, but the rental level necessary to justify new build alongside increasing yield expectations is significantly above 2022 rental levels. We are already seeing over 20% growth in core markets like Paris and Berlin and expect similarly outsized rent growth for assets that are best-in-class and located in key logistics hubs.

Figure 10: We See Further Upside in European Logistics Rent Growth

European Logistics Rent Growth

Source: CBRE ERIX (Q2 2023).

Furthermore, certain transaction types, such as sale-leasebacks, present an attractive opportunity amid the lending market disruption. Many companies need cash and are using their own assets to raise capital at very attractive terms (i.e., high yielding with long contracts and creditworthy tenants) for the buyer. Timing is everything here; once the capital markets stabilize, companies will be less motivated to rotate out of balance sheet assets to unlock liquidity.

The Path to Long-Term Quality: ESG and Sustainability

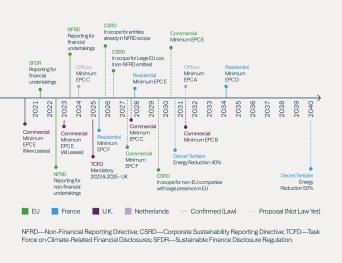

Investors must weigh another set of factors that are materially impacting European real estate: ESG and sustainability. Carbon neutrality will catalyze the decisions of governments, occupiers and investors indefinitely (see Figure 11).

In effect, the pursuit of energy conservation and efficiency will further bifurcate assets between those that meet the standards and those that don’t. This offers a window for experienced managers with the skills to reposition otherwise stranded assets—those in danger of losing economic viability because they cannot meet net-zero targets—into sustainable investments that capture pent-up market demand.

Figure 11: Investors Need to Plan for Tightening Regulations

NFRD–Non-Financial Reporting Directive; CSRD–Corporate Sustainability Reporting Directive; TCFD–Task Force on Climate-Related Financial Disclosures; SFDR–Sustainable Finance Disclosure Regulation.

Current infrastructure can and will serve as the foundation for net-zero carbon emissions. Reports have indicated that 80% of 2050’s projected global building stock already exists, accentuating the importance of refurbishing assets for long-term sustainability.24 However, it will be a steep uphill climb, especially in mature European markets with aging buildings.

Approximately 80% of offices in the U.K., for instance, fall short of an Energy Performance Certificate (EPC) rating of B—the minimum starting in 2030.25 In the residential sector, which contains some of the oldest housing stock in Europe, about six in 10 homes (13 million in total) fetch an EPC rating of D, far below the government’s 2025 target of C for rentals.26

For assets at risk of stranding, many owners do not have the capital, expertise or appetite to retrofit, and the development of new green buildings will slow due to macro headwinds. Early adopters can take advantage of these dynamics. Further, many assets require capex and a skilled team to make them not only leasable but also financeable. Many landlords are finding themselves hindered by higher rates, lower LTVs for new loans, or lower values—if lending is available at all. This inability to raise the cash for capex often leads them to have to sell.

We see these opportunities in many urban central business districts in Europe, where the opportunity exists to develop or redevelop mixed-use assets for higher and better use, as well as prime office properties with the amenities and ESG credentials that tenants and core investors are demanding.

The green premium

According to a survey of commercial real estate managers, more than half of respondents indicated that property values for “sustainable” buildings are up anywhere from 16% to 28% thanks to a “green premium.” Rents are rising too, as certified office buildings in Europe have seen an average rent premium of 21% in recent years.27 Anecdotally, we are also finding that leasing velocities are generally higher and vacancy rates lower in certified buildings. In other words, tenants understand the benefits of an efficient and more sustainable building—and are willing to pay more for it.

In the medium term, however, we believe green premiums will erode but “brown discounts” will become more punitive as regulatory deadlines around emissions and energy efficiency get closer. This presents an opportunity to purchase assets in prime locations at a discount.

Current infrastructure can and will serve as the foundation for net-zero carbon emissions.

Ready for a Comeback

Not all real estate can be painted with a broad brush—and as we look past the headlines, we see that prime real estate across Europe is fundamentally sound. Vacancy is low, rent growth is strong, and the supply/demand picture is favorable across certain segments, generating pricing power for owners who can implement a hands-on operational approach. Combine this with ongoing capital markets volatility and strain on current owners’ ability to manage debt, and we see a market that we believe will generate some of the most attractive opportunities we have seen in years.

Our view is informed by the proprietary data we collect from our platforms and assets across the globe. Through our teams on the ground, we are able to distinguish real data from noise and market sentiment, which allows us to formulate a view on value and opportunity earlier than many others.

Our experience shows us that uncertain markets—and investors who remain nimble and ready to deploy capital—often generate the most attractive returns. We believe that dynamic is at play today: Sentiment in the private markets will imminently catch up to what we’re seeing on the ground; transaction activity will soon rebound as the rate hike cycle calibrates; and core buyers who sat on the sidelines last year will be enticed by the prospect of strong income growth driven by headline rents and inflation indexing.

All together—and against a backdrop of a gradual recovery in the equity markets—opportunities to acquire high-quality real estate at attractive pricing will emerge.

Endnotes:

- Savills OCM 31 March 2023

- Savills, March 2023

- BNP, German Residential Real Estate Market, Q1 2023

- DeStatis May 2023

- Vonovia Q1 2023 Interim Report

- Savills UK 2023

- Savills European Student Housing 2022

- Savills European Student Housing 2022

- Savills European Student Housing 2022, Knight Frank Student Housing 2023

- World Economic Forum, 2022

- Savills, September 2022

- EY Survey, 2022

- Cushman & Wakefield, 2023

- Savills “Life Sciences: Trends & Outlook” March 2023

- Cushman & Wakefield, 2023

- Savills, September 2022

- Green Street Pan-European Hotels, February 2023

- Greenstreet Prospects for Hotel Demand Recovery, April 2023

- Green Street Pan-European Hotels, February 2023

- Green Street Pan-European Hotels, February 2023

- Eastil Secured, February 2022

- Knight Frank, May 2023

- Savills, March 2023

- JLL, November 2022

- Knight Frank, 2022

- React News, Jan 2023

- Environmental Leader, 2022

Disclosures

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, "Brookfield").

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield's internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield's perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.

Explore More

Real Estate Outlook: Investing Through the Next Cycle

"Waiting is Not a Strategy": A 2025 Real Estate Update