Industrial Opportunities Rise as Markets Thaw

After three years of virtually frozen capital markets, the backlog of private equity investment opportunities continues to build. And while global markets have become increasingly unpredictable, we still see a compelling long-term opportunity for private capital to help drive a transformation of the industrials sector, particularly in the U.S. and Europe.

Industrial companies are increasingly seeking private capital as they focus on their core businesses and take aggressive steps to elevate their strategic plans and transform their operations. Many of these companies or their business units operate in mature, stable industries and are attempting to compete using antiquated computer systems, manufacturing processes and back-office functions that need to be upgraded with innovative technology and forward-thinking business plans.

At the same time, two global megatrends are unfolding to help drive this industrial transformation:

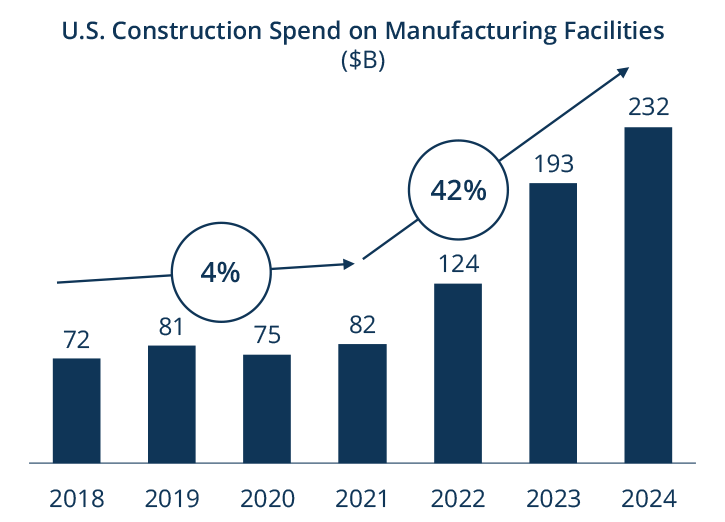

- Today’s tariffs and other protectionist trade policies—combined with Covid disruptions and geopolitical tension in recent years—have reinforced the critical need for supply-chain security. Reshoring, localizing and procuring essential materials will require deep industrial expertise and significant capital expenditures.

- Artificial intelligence (AI) and technological advancements such as robotics and sensors are contributing to the reindustrialization of the U.S. and Western Europe by reawakening industries that have been struggling, enabling them to be productive and competitive again. Some are calling this the Fourth Industrial Revolution (see Figure 1).

As these trends converge, the industrials sector stands at a crossroads. These companies face growing pressure to transform in order to remain competitive, yet many lack the requisite resources and capabilities to implement necessary improvements. This presents private equity managers with enormous opportunities, especially those with operational expertise and a long-term track record of unlocking value in their portfolio companies and enhancing returns for investors.