Going There: Why Investors Need to Get Their Hands Dirty in the Fight Against Climate Change

To help meet climate and financial objectives, investors should ‘go where the emissions are.’

Key Takeaways

- The transition of the global economy to net zero will require not only investment to build out more assets that are already perfectly green and clean, but also the transformation of critical but carbon-intensive industries to more sustainable business models. We call this investment strategy “going where the emissions are.”

- Utilities will need to increase their total clean energy capacity by around 19x to both transition to net zero and meet increasing overall demand for electricity. Investing in the utilities sector provides an opportunity to create significant impact by reducing millions of metric tons of carbon emissions.

- In other critical but hard-to-abate sectors—constituting nearly a third of global emissions—decarbonization is in the early days. New and more sustainable production methods are being researched and implemented. However, in the interim, new incentives for carbon capture and green hydrogen, as well as recent commitments by global industrial companies, could help propel these investment opportunities to the near term.

Getting Our Hands Dirty

There is no silver-bullet solution to keep our planet from warming beyond an average surface temperature of 1.5°C above pre-industrial levels. Building out new green energy capacity is a necessary place to start. But an incredible amount of work still needs to be done to reduce emissions and close the gap to achieve global decarbonization goals—work that can only be accomplished by also actively engaging with the global economy’s highest-emitting sectors and partnering with them to decarbonize their businesses.

The opportunity is in “going where the emissions are”—the “where” being not only power generation, but also other hard-to-abate industries such as steel, cement, chemicals and transportation. Rather than avoiding or divesting from carbon-intensive businesses, this strategy seeks them out with the objective of transforming them into low-carbon operations. In the case of utilities, it means converting their thermal capacity into clean power generation. In hard-to-abate industries such as cement and steel, this strategy aims to reduce emissions by changing the manufacturing processes.

Going where the emissions are is not easy. But not “going there” has a higher cost. For every dollar of financing for fossil fuels, $4 needs to be invested in the transition by 2030 to meet publicly stated net zero goals. As of 2022, just 73 cents was invested in the transition for each dollar invested in fossil fuels.1 Without rapid action, carbon emissions from these industries are likely to increase by more than 30% by 2050 compared with 2010 levels2—and the chances of meeting global climate goals will decline substantially.

At the same time, investors who are unwilling to take on initial carbon emissions can risk missing out on a transformational opportunity from both an economic and an environmental standpoint. Going where the emissions are enables investors to target a wider spectrum of transition opportunities, finding more situations to invest for more. It also allows investors to tie their decarbonization objectives to appropriate risk-adjusted economic returns that will make a meaningful contribution to our collective climate goals.

The Big Picture

Putting the global economy on a path to net zero by mid-century will require an average annual investment of US$7 trillion per year for the next 25-plus years. That’s roughly equivalent to 8% of current annual global GDP and more than triple the amount invested in 2021.3

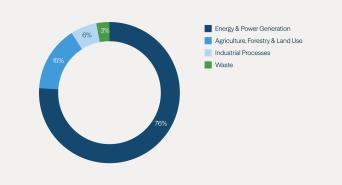

Given the scale of investment required, investors have started with areas where the technology is proven, where the financial incentives are most aligned, and where they can get full and immediate credit for their investment—in other words, the energy sector (see Figure 1). It’s where cost-effective, low-carbon alternatives like solar and wind are readily available. Thanks to technological advances and the economies of scale driven by the rapid buildout of renewable supply chains, renewables have become the cheapest form of bulk electricity production in almost every major market around the world.4

Figure 1: Net-Zero Efforts, By Definition, Have the Power Sector as a Major Focus

Share of Global Greenhouse Gas Emissions

Source: Climate Watch, World Resources Institute. As of 2019.

The way that markets and policymakers view green energy sources has also evolved over recent years. Following the disruption of global fossil fuel supply chains after the Russia/Ukraine conflict broke out, more stakeholders moved to adopt and promote renewables to reduce their cost of electricity, lessen their reliance on imported fossil fuels and improve energy security (since you don’t need to import or buy wind and sunlight to generate renewable electricity).

In February 2023, the carbon price on the EU Emissions Trading System exchange, which determines the tax that emitters must pay (or the credit that greener businesses can sell), topped €100 per metric ton for the first time (see Figure 2). And sweeping initiatives like the U.S. Inflation Reduction Act (IRA), Powering Up Britain and REPowerEU have unleashed billions in tax credits and other subsidies for wind, solar and battery energy storage system (BESS) developers. In the U.S., for example, based on our analysis, a generic 500-MW solar or onshore wind plant will see its levelized cost of electricity drop by about 20–30% purely as a function of the IRA.5

Figure 2: The Rising Price of Carbon

Price (€/tonne)

Source: Refinitiv via Financial Times.

Meanwhile, corporations—not governments—are driving demand for decarbonization and energy transition. Well over 8,000 companies have set net-zero targets,6 with many of the largest, most successful companies leading the way.

Globally, major corporations—especially utilities—are contracting directly to buy renewable power and build it themselves. That’s because renewable generation sources lower their costs, shrink their carbon footprint and reduce exposure to volatile fossil-fuel markets like coal.

The U.S. Energy Information Administration has estimated that 54% of new U.S. generation capacity would be solar in 2023. Yet much of the power and broader energy sectors are still incredibly carbon intensive. If left unabated, the current stock of fossil fuel infrastructure would exceed the world’s carbon budget by 2030.7

Solving that problem requires much more capital. To keep 1.5°C within reach, we need to replace, retire or retrofit these assets well before their operational and technical lives are up. Meanwhile, the environmental, social and governance (ESG) criteria of many financial institutions and mutual funds can exclude certain thresholds of coal- or gas-fired power generation and usage, making some of these opportunities essentially un-investable. Similarly, another portion of shareholder bases tolerates little change to the steady dividends that existing operating models produce.

These competing investor pressures have left many transitioning utilities caught in the “transition trap”—dependent on the very capital keeping them mired in the status quo and, therefore, unable to transition to a lower-carbon business model.

For strategic allocators of private capital, the structural frictions that this trap creates amount to an opportunity to activate—and capitalize on—a critical element of the global energy transition.

Utilities Need to Decarbonize While Meeting Increasing Demand

To better appreciate the importance of going where the emissions are, it helps to imagine our atmosphere as a giant pool filled with carbon that we’re trying to keep from lapping over the sides, and the global power sector as a hose pouring more in.

With over 60% of the world’s power sources as of 2023 running on fossil fuels,8 the carbon level in the pool is getting closer to the edge.9 But for every megawatt of electricity or heating produced with clean sources, less carbon is poured into the pool, buying us a little more time.

However, we must remember that, through electrification (for example, electric vehicles and using electricity to cook), the transition will also increase overall demand for electricity—demand that utilities will need to meet with new, and clean, energy capacity. We expect utilities will have to increase their total clean energy capacity by around 19x to both transition to net zero and meet increasing overall demand for electricity.10

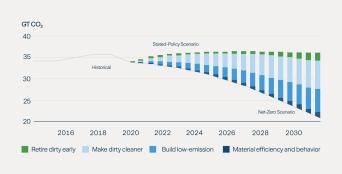

Yet there’s no way to get to net zero without attacking the problem from both ends: building new renewable capacity while also actively decarbonizing and replacing existing carbon-intensive infrastructure (see Figure 3).

Figure 3: No Way to Zero Without Attacking the Problem From Both Ends

Source: IEA. CO2 emissions reductions by type of measure in Net-Zero versus Stated-Policy Scenarios, 2015-2030. As of 2021.

Why building new renewable capacity alone is not enough

The electrification of the residential, industrial and transportation sectors will spur a multi-decade step change in electricity demand. For example, weaning off traditional carbon-intensive heating and transportation fuels like gasoline will require the addition of millions of electric heat pumps and electric vehicles. Even the emergence of green hydrogen, viewed as a critical input for decarbonizing industries such as steelmaking, will require a significant expansion of wind- and solar-generated electricity to split water into hydrogen and oxygen.

In addition, the role that variable weather conditions play in solar and wind power production means that certain fossil-fuel sources, such as natural gas peaker plants, will be required to smooth out supply/demand imbalances to help ensure the grid is stable and power prices are not compromised. Efficient natural gas with dispatch capabilities and an increasing benefit of batteries and other energy storage solutions will allow for a deeper and faster penetration of renewables.

The good news is that utilities are making emissions reduction and transformation plans. But in many cases their publicly stated goals are underfunded and not ambitious enough, particularly given increasing volatility in the capital markets. And even as clean energy capacity has expanded by terawatts each year, new global challenges have emerged. Regulatory and logistical hurdles can complicate the process of connecting all that new wind- and solar-generated electricity to the world’s power grids so that it can be delivered to customers.

Recent major government climate packages—including sections of the IRA, REPowerEU and the U.K.’s Great Grid Upgrade—include funding and incentives for new transmission lines and BESS aimed at eventually clearing these roadblocks. But until these grid challenges are solved, hundreds if not thousands of major projects remain on backlog or severely underutilized.11

The electrification of the residential, industrial and transportation sectors will spur a multi-decade step change in electricity demand.

The need to work with existing infrastructure

Meanwhile, carbon-intensive thermal power generators, often built 20–30 years ago, come with scarce, strategic infrastructure in well-located parts of the electricity grid. Examples include strong interconnection points, transmission rights and offtakes that a transition investor can use to develop new clean energy capacity.

In addition, these utilities’ underlying thermal assets were often permitted and built on very large parcels of land near population centers. Converting such sites to scaled-up clean energy hubs, while capital-intensive, can often be less costly, less cumbersome and quicker than working through the challenges of connecting new sites to the electricity grid. This can result in an acceleration of the energy transition. Even in cases where the sites don’t lend themselves to wind or solar generation, they tend to be ideally situated for a BESS because the grid was often built or expanded around these locations.

Transforming existing sites can also provide long-term benefits for local governments and communities. While a complete shutdown of a carbon-intensive site would likely cause job losses, a conversion can bolster employment in the area through construction and long-lasting cleaner-technology jobs and skills.

While new standalone capacity also needs to be accelerated, it is often more practical and economical to start with using the network and infrastructure built around fossil-fuel-fired assets rather than constructing the requisite web of new transmission lines and backup power sources from scratch. Of course, new infrastructure will still be required for the transition to occur because not all fossil fuel generation was built in locations where natural resources such as wind and solar are abundant.

Capturing the benefits of decarbonization

Successfully carrying out such a transformation requires significant and patient capital, an intimate understanding of power markets and deep experience in the power and clean energy development sectors. Longstanding relationships with equipment suppliers, regulators and other stakeholders in these sectors can help companies add value and de-risk their energy supply. And undertaking the journey in the private markets is useful due to the longer-term investment horizon and the insulation of business plans from the pressures of short-term investor requirements such as quarterly dividends and financial results.

In modeling the investment returns of utility phaseouts and transformations, we need to consider, too, that utilities are diverse businesses with multiple assets. Utilities not only own energy infrastructure but in some cases have large customer books that provide investors like Brookfield with ready-made offtakers. This substantially eliminates one aspect of development risk—finding a third-party contract—and increases the certainty that renewable developments will proceed apace.

Ultimately, private capital can bring in unified long-term shareholders and release utilities from the transition trap. It can help accelerate and expand on transition plans, capturing the returns that should accrue to those helping to fill the gap between clean energy demand and supply—while also reducing real economy emissions.

Lightening the Load for Heavy-Emitting Industries

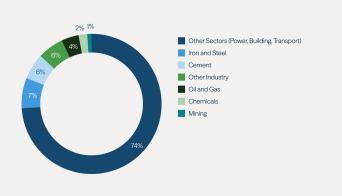

If the challenge of decarbonizing the power sector is defined by the sheer size of the task at hand, decarbonizing heavy-emitting industries is complicated both by their scale and the earlier stage of the underlying technologies. The opportunity set among industries is wide—including cement, steel, chemicals, transportation and more—but what they have in common is that they are all irreplaceable and serve critical functions of the economy (see Figure 4).

Figure 4: Breakdown of Global Industry CO2 Emissions

Source: IHS Markit, International Energy Agency (IEA), McKinsey. As of 2019.

If cement were a country, it would be ranked alongside India, the world’s third-largest emitter; cement’s share of global emissions is estimated at up to 8% today.12 And unlike internal combustion engines or coal- and gas-fired power plant turbines, cement has no readily available cost-effective replacements.

There’s another complication with cement: Most of its emissions result from chemical reactions in the manufacturing process, not from energy consumption. While cement makers can (and are) taking steps to increase efficiencies that decrease fuel usage and emissions, the core of the problem remains: There is no way to produce cement without producing carbon.

This makes the cement industry one of the earliest and largest use cases for carbon capture technologies. Cement companies around the world are now developing systems for separating and capturing carbon dioxide (CO2) from cement flue gas and piping it to carbon sinks or sites where it can sequester carbon or put it to use.

Germany-based HeidelbergCement, for example, has announced a plan with funding from the Swedish government to convert its massive factory in Slite, Sweden—currently responsible for 3% of the country’s emissions—into the world’s first CO2-neutral cement plant by 2030.13 Holcim, a sustainable building materials conglomerate based in Switzerland, has 30 pilot projects14 underway with a range of end uses for the carbon captured—from the production of a synthetic aviation fuel in Germany, to fertilizer for enhanced crop production in Spain, to piping the carbon produced at one Polish plant all the way to a sequestration site beneath the North Sea.15

Decarbonizing steel presents its own challenges. The main issue with steel is that the most prevalent form of steelmaking relies heavily on metallurgical coal—more specifically, the coal byproduct coke, which is used in blast furnaces to turn iron ore into molten steel.

The steel industry has developed a variety of lower-carbon alternatives to this process. The most common process involves a tweak to electric-arc-furnace steelmaking in which reducing gases are used instead of coal/coke to create direct-reduced, or “sponge,” iron. That sponge iron is then fed into furnaces powered around the clock by enormous volumes of electricity.

In the transition of steelmaking, the reducing gases themselves—typically carbon monoxide and hydrogen produced from the burning of natural gas or coal—are replaced by clean hydrogen produced by solar- or wind-powered electrolysis. When burned, hydrogen produces water instead of greenhouse gases.

But there is a catch: To make just two tons of steel this way requires an estimated 144 tons of clean hydrogen, a product that at the current state of electrolysis technology is not nearly cost-effective enough to compete with traditional steelmaking.16

Example: Accelerating Progress in Green Steelmaking

ArcelorMittal is working with the governments of Canada and Ontario to transform a steelmaking plant to reduce the carbon footprint and remove coal from the ironmaking process. The project is part of ArcelorMittal’s target to reduce the carbon intensity of the steel it produces by 25% by 2030.

“The project will fundamentally change the way steel is made at ArcelorMittal Dofasco, transitioning the site to direct reduced iron-electric arc furnace (DRI-EAF) steelmaking, which carries a considerably lower carbon footprint and removes coal from the ironmaking process. The new 2.5 million tonne capacity DRI furnace will initially operate on natural gas but will be constructed ‘hydrogen ready’ so it can be transitioned to utilize green hydrogen as a clean energy input as and when a sufficient, cost-effective supply of green hydrogen becomes available.”17

Policymakers are now seeking to change that equation through a clearer framework for green hydrogen subsidies. Much as with its acceleration of the carbon sequestration credits, the IRA offers green steelmakers and their clean hydrogen suppliers an opportunity to earn tax credits for both developing the clean energy sources that power green hydrogen-and-steel projects and US$3 for every kilogram of clean hydrogen produced by the same sources.

At Brookfield, we plan to go where the emissions are by partnering with industrial companies and innovators through long-term offtake contracts. Such investments fund the underlying assets or projects that then supply the output to the partnering industrial company.

For example, we have entered into a partnership to invest an initial $500 million in U.S.-based LanzaTech, whose carbon-capture-to-ethanol technology operates at commercial scale at three steel-related sites today, including ArcelorMittal’s 1.6 million-metric-ton blast furnace production asset in Ghent, Belgium.

‘Carbon Diem’

Investors who are willing to deploy their capital to fund the transition of heavy emitting industries—instead of pursuing blanket divestment policies and “paper decarbonization” portfolios invested solely in already clean assets—can potentially drive greater reductions in real economy emissions.

Opportunities in heavy-emitting industries such as steel and cement, while more complicated in many ways, also have tremendous potential when considering the size of the capital requirements and the growing commitments we are starting to see in the private sector.

Without doubt, for many of the most attractive and most impactful decarbonization investments globally, decarbonization and value creation are complementary. We feel these represent some of the largest and most attractive risk-adjusted return opportunities in the transition investing space.

Decarbonizing high-emitting companies presents a once-in-a-generation commercial opportunity for investors to go where the emissions are—and yield great outcomes from both an investment and a net-zero perspective.

Endnotes:

- BloombergNEF, “Financing the Transition: Energy Supply Investment and Bank-Facilitated Financing Ratios 2022,” December 14, 2023.

- Intergovernmental Panel on Climate Change (IPCC), Special Report on Global Warming of 1.5C (2018), “CO2 emissions from industry increase by 30% in 2050 compared to 2010 in baseline scenarios.”

- BloombergNEF, “The $7 Trillion a Year Needed to Hit Net-Zero Goal,” December 2022.

- International Renewable Energy Agency, “Renewable Power Generation Costs in 2020,” June 2021.

- ICF, How clean energy economics can benefit from the biggest climate law in US history,” September 16, 2022; Brookfield internal research.

- Race to Zero, March 2023.

- IPCC Sixth Assessment Report, March 20, 2023.

- International Energy Agency (IEA), Tracking Electricity, 2023.

- Based on the IEA’s September 2022 Electricity Sector Tracking Report, 95% of global electricity and heating was generated from the burning of coal or gas as of 2021.

- The IEA’s World Energy Outlook 2022 estimates global electricity demand will rise by 25%-30% by 2030 due to more electric motors, EVs, heat pumps, and hydrogen.

- The New York Times, “The U.S. Has Billions for Wind and Solar Projects. Good Luck Plugging Them In,” February 23, 2023.

- The Washington Post, “Cement emits as much CO2 as India. Why is it so hard to fix?” June 17, 2023.

- Reuters, “HeidelbergCement plans world’s first CO2-neutral cement plant in Sweden,” June 2, 2021.

- Holcim, Leading the Way to Green Building.

- Holcim, “LafargeHolcim expands carbon capture projects with funding from the U.S. and Germany,” October 14, 2020.

- Nixon Peabody, “Inflation Reduction Act, A big deal for green steel,” September 12, 2022.

- ArcelorMittal, “ArcelorMittal breaks ground on first transformational low-carbon emissions steelmaking project,” October 13, 2022.

Disclosures

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, "Brookfield").

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield's internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield's perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.