Battery Breakout: Enhancing Reliability in the Renewable Era

We view batteries as essential infrastructure, enabling renewable penetration and alleviating congested power grids.

Key Takeaways

- Renewable developers are increasingly pairing utility-scale batteries with their solar and wind projects to ensure uninterrupted delivery of power, enhancing the value of these intermittent clean energy sources.

- Falling costs and improved technology have helped batteries reach a commercial tipping point, increasing their economic viability across many power markets around the world.

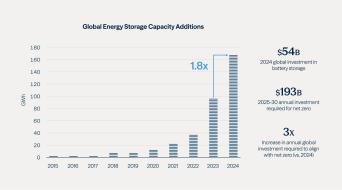

- An estimated $193 billion must be invested in energy storage globally each year through 2030 to boost the world’s battery storage capacity to meet net-zero targets and rising demand for electricity.

- Batteries offer developers and private market investors attractive opportunities to build and invest in global battery assets that can increase clean energy penetration, hedge risks, generate predictable revenue and potentially enhance risk-adjusted returns.

Clean Energy Limitations Boost Battery Opportunities

Renewable energy has emerged as the critical component to meet the enormous increase in demand for electricity and achieve global net-zero emissions goals. Yet the world’s cheapest sources of new bulk power—solar and wind—come with a significant limitation: They’re intermittent.

To address this challenge, batteries—specifically large-scale lithium-ion storage batteries—are charging ahead to play a vital role in the “any-and-all” approach to provide uninterrupted access to power. With global energy storage capacity nearly doubling in 2024, batteries have become an essential infrastructure asset class, as much for their ability to increase renewable power penetration and help stabilize overburdened electricity grids as for the long-term revenue generated by the services they provide.

The concept is simple: During windless periods or after sunset—or on peak power usage days—batteries can quickly discharge their stored electricity to help cover shortfalls and keep the grid running smoothly. Plummeting costs and rapid technology advancements have lifted batteries to a commercial tipping point, positioning them as a core component in global carbon-reduction strategies. To achieve net-zero targets, an estimated $193 billion must be invested in energy storage each year between now and 2030, according to Bloomberg New Energy Finance (see Figure 1).

Figure 1: Battery Storage Capacity Needs Are Rising Rapidly

Source: BNEF.

Batteries are playing an increasingly influential role in the evolving renewable energy landscape, boosting the value of solar and wind projects and providing developers with risk mitigation and new revenue streams. While battery developers could face headwinds, including tariffs and low barriers to market entry, we believe these challenges are manageable given the unstoppable trajectory of long-term electricity demand. This environment offers significant opportunities for developers and private market investors alike.

Utility-Scale Batteries: Size, Scope and Chemistry

Several types of battery technologies are used to store energy and many more are in development, but only one dominates the industry: lithium-ion. These storage batteries use essentially the same lithium-ion technology found in smartphones, laptops and especially electric vehicles (EVs), although they are much larger.

Typically, thousands of storage batteries are housed together in containers known as battery blocks. Battery developers organize these containers, which measure 20 to 40 feet long, in rows and often locate them next to solar energy or wind farms, allowing them to work in tandem and store hundreds of megawatt-hours of electricity that can provide power to thousands of homes and businesses.

Bollingstedt Battery in Germany demonstrates this configuration (see photo). It’s Germany’s largest battery storage facility and is co-owned by X-Elio, a leading global renewable energy provider and a Brookfield portfolio company. The battery is located next to an existing substation, provides 238 MWh of storage and can discharge 103 MW of power. It’s capable of supplying electricity to 170,000 multi-person households for two hours.

X-Elio’s Bollingstedt Battery is a Grid-Connected Energy Storage System in Germany

What’s Driving the Lithium-Ion Battery Boom?

Several dynamic trends are converging to accelerate lithium-ion battery growth. While costs are falling fast due to technological improvements, these batteries’ ability to provide essential support for intermittent renewables and mounting electricity grid constraints is also contributing to the demand.

Plunging prices

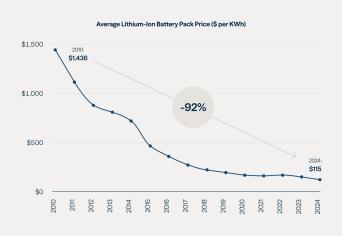

Approximately 90% of the demand for lithium-ion batteries is driven by the EV sector.1 The industry’s rapid growth over the years has helped drastically reduce the cost of EV components, including a 92% decline since 2010 to make lithium-ion batteries (see Figure 2) and a 50% drop in just the past two years.2 Battery storage developers are benefiting from the EV industry growth and falling costs, with battery prices expected to drop an additional 50% by 2026, according to internal Brookfield data.

Improved technology is a major contributor to this decline. Between 2014 and 2024, the density of lithium-ion battery cells doubled, which lowered costs by reducing the amount of raw material, labor and production time required for manufacturing. Batteries with higher density can store more electricity without increasing their size or weight.

These improvements and falling expenses have enabled battery makers to build more and larger manufacturing plants, achieving economies of scale that reduce costs further. It’s a concept known as the “learning curve,” which maintains that every doubling in manufacturing output for a particular technology coincides with a specific cost decline. For lithium-ion batteries, the learning curve reduces capital expenses by 17%,3 which is on par with the solar photovoltaic learning curve.

Figure 2: Lithium-Ion Battery Prices Have Plummeted Since 2010

Source: BloombergNEF, 2024.

Rising renewable penetration

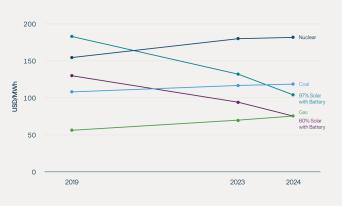

The ability to deliver power continuously is becoming increasingly vital as demand surges, driven by large technology companies’ need to power their expanding fleet of data centers around the clock and the broader electrification of industries. Renewable energy is capturing most of this growth because it’s the cheapest form of new electricity supply in most regions of the world, and pairing it with batteries only enhances the value (see Figure 3).

Figure 3: Pairing Batteries With Solar Is Growing Increasingly Reliable and Cost-Effective

97% uninterrupted solar generation with battery every hour of every day is now cheaper than coal and nuclear

Source: Ember LCOE calculations. Full methodology – key assumptions: CAPEX - $388/kW solar, $165/kWh battery, other costs: $76/kW grid connection, $48/kW inverter, 10% total cost markup for soft costs, 7.7% discount rate over 20-year lifetime. LCOE for Coal, Gas and Nuclear from Lazard’s Levelized Cost of Energy Analysis – Version 17.0, 2024.

The United Arab Emirates is embracing this trend, announcing plans in early 2025 to build the world’s largest solar-plus battery project, which is scheduled to run 24 hours a day. When completed in 2027, it will also be the largest renewable energy facility in the world with 19 GWh of storage, nearly three times the size of the next biggest battery storage system.4

Batteries are also beginning to play a key role as a backup power source for data centers, with many operators replacing their diesel generators with battery storage systems. While diesel generators are highly polluting, take several minutes to power up and require frequent maintenance, batteries are emissions free and can discharge electricity instantly.5 Two high-profile examples include Google replacing its diesel backup generators with battery storage at a data center in Belgium in 2022, with Microsoft following suit a year later at a data center in Sweden as part of its commitment to eliminate diesel as a backup power source around the globe by 2030.

It should be noted that several clean energy sources—including nuclear, hydroelectric and geothermal power plants—can provide the stable, consistent baseload electricity that companies increasingly require. Unlike batteries, however, these sources are designed for constant output, and they are more expensive and complex to build with significant location restraints.

Growing grid constraints

On peak power usage days, the high demand often strains the grid and sometimes leads to power supply shortages. The buildout of data centers to support artificial intelligence growth will only exacerbate this challenge. Batteries can provide the large volumes of power needed for these peak demand periods.

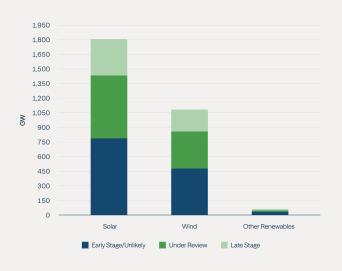

In response to surging energy demand, developers are advancing large-scale solar and wind projects; but the pace and volume of new projects has significantly increased grid connection requests, leading to approval delays and system congestion (see Figure 4). At the same time, the world’s aging power grids currently cannot handle the massive renewable buildout and higher load. Upgrading global grids will require nearly a two-fold increase in transmission investment by 2030—to more than $600 billion annually.6 Also, the buildout of new transmission lines takes time, with 5 to 10 years required to obtain a permit.

Figure 4: Renewable Project Expansion Has Created a Grid Connection Bottleneck

Source: International Energy Agency, September 2024.

In the meantime, batteries are stepping up to fill the power shortfall gap and alleviate congestion. On May 14 this year, for example, springtime temperatures in Texas climbed to the highest level in the past century. With many natural gas plants offline preparing for summertime service, batteries in the state discharged their stored electricity during peak demand hours that day to keep the power flowing—at one point covering 8% of the demand.7

Batteries also offer a cost-effective alternative to peaker plants, which are power plants typically fired by fossil fuels such as diesel or natural gas that can quickly ramp up and down to meet increased electricity demand during peak hours. However, peaker plants are expensive to operate and pollute more than clean energy sources. Battery storage systems can perform the same function at a lower cost without pollution.

How Do Batteries Benefit Developers and Investors?

While batteries are playing an increasingly important role in enhancing renewable energy penetration and alleviating grid constraints, they are also attracting attention from both developers and investors for their ability to reduce renewable project investment risks and generate predictable long-term revenue.

Hedge solar risks

For all the benefits solar energy offers, sometimes it’s too much of a good thing. As solar penetration increases rapidly in a given market, supply occasionally outstrips demand on sunny days, lowering power prices. It’s called price cannibalization. When this happens, building a new solar project becomes less attractive economically because the expected value of the power it would generate declines.

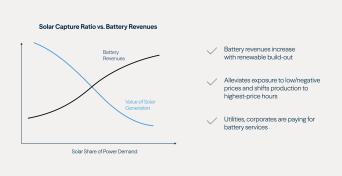

Batteries paired with these solar projects, or located in the same or a similar market, can hedge that risk. During periods of oversupply, battery systems can fully charge at low prices, store that energy and then dispatch it when needed. In other words, batteries help shift electricity usage from periods of low prices to periods of higher prices. The ability to hedge risk in regions with an overabundance of solar energy can enhance battery revenue and value (see Figure 5).

Figure 5: Batteries Can Effectively Hedge Solar Merchant Risks and Overbuilding

Source: Brookfield modeling.

Deliver consistent revenue

Batteries also can help developers generate predictable revenue. A key strategy—arbitrage—is related to solar energy risk-hedging, although the latter is not a revenue source. Energy arbitrage is essentially a trading strategy that calls for buying power at low prices, storing it in battery systems and then selling it when prices are high. While electricity demand and prices are typically low in the middle of the day and overnight, they usually rise in the morning when people are getting ready for work and school and again in the early evening when they come home. In short, energy arbitrage involves buying low and selling high at least once a day and sometimes twice.

Ancillary services—another revenue generator—are essential to ensure grid stability because they help provide uninterrupted power to homes and businesses. They typically include fast-response services such as voltage control or frequency regulation, which delivers small bursts of power quickly to maintain a certain frequency level on the grid. In California, batteries already cover 20% of the evening peak, cutting natural gas use and emissions with surgical precision.

It’s important to note that battery revenue increasingly can be solidified through long-term contracts at fixed prices. As grid operators and regulators have recognized the need for battery storage, they have developed contractual structures and regulated revenue streams that support the long-term economics of batteries, giving this asset class infrastructure-like characteristics.

Consider long-term capacity payments. Transmission system operators that are worried about keeping the lights on 24/7 can procure battery availability to deliver power through contracts that often span 15 to 20 years. Battery system owners receive fixed, recurring payments, regardless of whether their power is needed on any given day.

Enhance renewable energy value

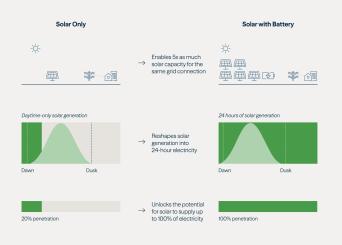

When procuring renewable energy, governments and corporations increasingly are prioritizing sources that co-locate batteries next to solar and wind projects and share a grid connection. These co-located systems tend to be more efficient and cost-effective than standalone solar and wind.

A standalone solar project, for example, may use its grid connection only about 20% of the time. Adding battery storage improves overall utilization, allowing the system to continue delivering power when the solar panels aren’t generating. It’s a complementary setup that enhances grid efficiency and renewable energy value (see Figure 6).

Figure 6: Batteries Unlock Solar Energy’s Potential to Deliver 24-Hour Power

Source: Ember, June 2025.

Batteries are now cheap enough that, when paired with solar, the sunniest cities in the world can get as close as 97% of the way for these co-located facilities to provide around-the-clock power every day of the year, according to Ember.8 Some of the cities on that list include Las Vegas; Mexico City; Muscat, Oman; and Johannesburg, South Africa.

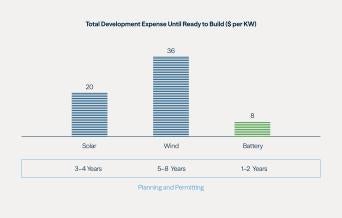

Batteries can also be built more quickly than any other power generation technology. It takes up to two years at a relatively low cost to plan and obtain permits for a battery project. In contrast, solar projects can take twice as long at more than twice the cost, and wind projects can take four times as long at more than quadruple the cost (see Figure 7).

Battery projects benefit from a smaller footprint, meaning developers don’t need to acquire as much land as solar and wind projects to generate the same amount of electricity. Battery systems are also easier to “plug and play.” When containers arrive on site, each holding thousands of connected batteries, virtually no assembly is needed.

Figure 7: Batteries Are Cheaper and Easier to Develop Than Solar and Wind Systems

Source: Brookfield internal research.

How Should Developers Manage Risk?

As battery storage scales rapidly in the renewable energy transition, developers face a shifting landscape of risks that include government policy uncertainty, rising competition and evolving technologies. Managing these challenges effectively is essential to achieve long-term goals and gain investor confidence.

Tariffs and tax incentives

Tariffs are attracting attention in almost all industries around the world, and battery storage is no exception. Three-fourths of the world’s lithium-ion batteries are made in China, according to the International Energy Agency, and the U.S. has proposed steep tariffs on China. Battery operators can mitigate this risk by diversifying their supply chains to other countries.

The Inflation Reduction Act of 2022 allowed battery storage operators and companies building wind and solar farms to claim a tax credit of up to 30% for eligible investments. Under the broad new tax and policy bill that Congress passed in July 2025, this credit will remain available for battery storage projects that start production before 2033. However, construction on solar and wind projects would need to begin by July 2026 to obtain the tax credit.

At Brookfield, we invest across the globe but closely monitor shifting local economic policies. However, we also take a long-term view, realizing that policies change and markets fluctuate over the short term. Looking ahead, the momentum behind our long-term investment themes remains strong.

Low barrier to entry

Because of the low cost and efficient approval process for battery storage systems, the barrier to entry is low. That means battery opportunities often attract a large number of developers. In our view, the most successful developers in a crowded marketplace are those with extensive renewable energy experience that know how batteries can complement solar and wind systems and alleviate grid congestion, along with how the market prices those services at any given time.

Additionally, developers that can pair batteries with existing solar and wind in their portfolios that are already connected to the grid increase their potential to deploy large-scale clean energy facilities, enhancing their competitive advantage.

Technology obsolescence

Even with lithium-ion batteries dominating the energy storage landscape, other technologies are available—including sodium-ion, thermal storage and compressed air—and many more are in development. While it’s important to monitor emerging battery technologies that could eventually rival market-leading lithium-ion, we believe developers should continue pursuing attractive near-term battery storage opportunities rather than wait for potentially lower-cost alternatives. As new technologies evolve, developers with deep industry expertise who entered the market early will be well-positioned to effectively navigate the changing landscape.

Brookfield’s Broad Battery Playbook

Brookfield Renewables is one of the world’s largest battery storage developers, with portfolio companies spread across five continents (see Figure 8). Our robust 80 GWh portfolio includes projects that are either operating or in development. Within two years, we expect to have commissioned another 20 GWh of battery projects as batteries continue to enhance our global transition strategy.

Neoen is a Brookfield portfolio company and one of the world’s leading developers of renewable and battery projects. Along with its solar power plants and wind farms, this Paris-based company develops, builds and operates large-scale battery facilities in Australia, Finland, France, Italy and Sweden. Batteries now make up approximately a third of the Neoen’s portfolio.

One of Neoen’s earliest and most significant battery projects emerged from a crisis. In September 2016, storms in South Australia knocked out power state-wide, sparking government interest in grid-stability solutions. The following July, the Hornsdale Power Reserve Consortium, led by Neoen with batteries supplied by Tesla, won a contract to build a 100 MW battery storage project before the upcoming summer arrived. On December 1, 2017, Hornsdale Battery was completed and connected to the grid ahead of the deadline. Just two weeks later, Hornsdale responded to a coal generator shutdown in less than one second to maintain grid stability.

Listen now to learn more about our acquisition of Neoen.

Figure 8 : Brookfield’s Global Portfolio of Battery Assets

Source: Brookfield.

Watts Next?

The ability of utility-scale batteries to efficiently store and quickly discharge electricity has positioned them not only as a foundational component in the renewable energy landscape but, in our view, has elevated them to an essential infrastructure asset class. While falling costs and improved technology continue to enhance batteries’ economic viability, their risk-hedging, revenue-generating and quick deployment benefits are redefining what it means to invest in energy infrastructure.

We see this environment as an opportune time for experienced developers to build and invest in global battery assets capable of enabling renewable energy penetration, stabilizing power grids, and potentially enhancing risk-adjusted returns for investors and private capital providers for decades to come.

Endnotes:

- Bloomberg New Energy Finance (BNEF), Contemporary Amperex Technology Co., Limited.

- BNEF, Contemporary Amperex Technology Co., Limited.

- “Are Batteries Too Expensive to Build to Meet Our Global Energy Demands,” RethinkX, July 11, 2023.

- “Masdar’s Solar-Plus-Battery Project Will Redefine Reliable Energy,” Forbes, February 9, 2025.

- “Replacing Diesel Generators With Battery Energy Storage Systems,” Arcadis, August 2, 2024.

- “Electricity Grids and Secure Energy Transitions,” International Energy Agency, October 2023.

- “How Big Batteries Could Prevent Summer Power Blackouts,” Bloomberg, June 17, 2025.

- “Solar Electricity Every Hour of Every Day Is Here and It Changes Everything,” Ember, June 21, 2025.

Disclosures

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, "Brookfield").

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield's internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield's perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.