Building the Backbone of AI

We see opportunities to invest in the infrastructure powering the next industrial revolution.

Technological progress has always hinged not merely on breakthrough ideas, but also on the infrastructure that scaled them into everyday life.

The steam engine unlocked mechanized industry, but only after railways, coal supply chains and factories were built to harness its power. The telephone revolutionized communication, but only after vast networks of wires, switches and operators connected households and businesses. Electricity changed every facet of daily life, enabled by a massive buildout of power plants and transmission lines. Each of these breakthroughs catalyzed new industries, boosted productivity and redefined economic potential.

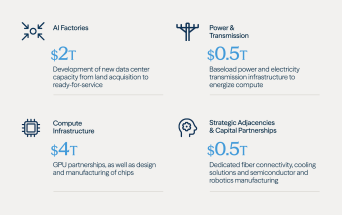

Today, artificial intelligence (AI) is poised to become the most impactful general-purpose technology in history—but only if it’s accompanied by a buildout of the necessary capital-intensive physical infrastructure to support its adoption. We estimate total spending on AI-related infrastructure will exceed $1 trillion this decade and $7 trillion in the next 10 years.

Our report delves into this once-in-a-generation opportunity to build the digital backbone of the future—one with the potential to reshape economies, drive innovation and deliver attractive risk-adjusted returns for those investors positioned to lead.

A $7 Trillion Opportunity

Infrastructure Investor Panel on AI

Our Global Head of AI Infrastructure Sikander Rashid joined an Infrastructure Investor webinar for a timely panel discussion on the impact of artificial intelligence and the scale and urgency involved in building out the backbone of this transformative technology. Hear Sikander’s insights on the massive investment opportunities over the next decade, the benefits private capital providers offer, and why investors should pay attention to changing regional and regulatory dynamics.

Disclosures

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, "Brookfield").

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield's internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield's perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.