A New Dawn for Nuclear Power

Nuclear power provides access to clean, safe, reliable and affordable energy—helping countries achieve their critical net-zero and energy-security goals.

Executive Summary

- The worldwide drive to net zero is shining a spotlight on nuclear, a clean, safe and mature source of electricity generation.

- Nuclear power is also gaining more support from policymakers and investors given its ability to promote energy security and energy independence.

- These trends are driving a global push to extend the lives and increase the capacity of existing plants, as well as build new reactors with state-of-the art designs and technologies.

Introduction

To reach net-zero emissions by 2050, a massive deployment of all available clean energy technologies is required. Hydro, solar, wind power and energy storage are all part of the solution, but as a clean source of baseload power, nuclear power will also play a key role. In fact, there is no credible net-zero scenario in which nuclear does not grow its capacity from today.

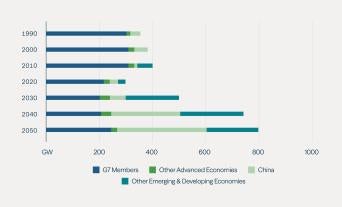

Nuclear has long been a reliable source of clean energy. Today, it provides roughly 10% of the world’s electricity from about 440 power reactors.1 As energy demand grows over the next 20-plus years, demand for clean energy will accelerate—and drive investment in nuclear power. In fact, in the IEA’s global pathway to reach net-zero emissions by 2050, nuclear power doubles between 2020 and 2050 with 400 gigawatts of additional capacity built (see Figure 1).2

Figure 1: Nuclear Capacity Doubles in the IEA’s Pathway to Net Zero

Source: IEA. Note: G7 members are Canada, France, Germany, Italy, Japan, U.K., U.S. and the EU.

The acceptance of nuclear energy as a key contributor to achieving net-zero targets is leading to a renewed focus on the development of new reactors. It is also leading to the likely extension of existing operating nuclear plants globally, as well as an increase in the amount of power they are allowed to generate through regulations (known as power plant uprates). The EU, U.S., U.K., France, China, Korea, Japan and many other nations have made recent announcements or public policy changes declaring nuclear as a critical part of meeting their clean energy goals.

Simultaneously, the combination of increasing prices for fossil fuels, geopolitical shifts and the growing desire for energy security and energy independence is also contributing to the renewed appeal of nuclear power. This echoes the 1970s oil crisis, following which 40% of today’s operating nuclear power plants were built. Now—after considerable upfront costs—nuclear power supplies some of the cheapest electricity in the world.3

Nuclear is also one of the safest power generation technologies globally, a distinction it will continue to hold due to the industry’s exceedingly high regulatory and safety standards. Yet common misconceptions have caused many to overlook all that nuclear has to offer.

We believe nuclear energy will grow in the coming decades because it provides access to clean, safe, reliable and affordable energy. And given the technology advances in nuclear reactors due in the coming years, nuclear power is back in the spotlight again.

Filling the Clean Energy Gap

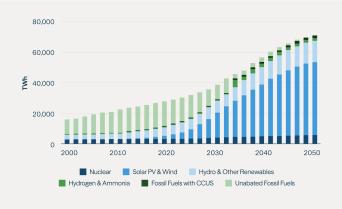

As decarbonization plans accelerate, fossil fuels will need to be phased out over time, with developed nations taking the lead. Traditional renewables, like solar and wind, will support growing energy demand and replace a significant amount of carbon-producing power generation (see Figure 2). But since these are intermittent sources of power, energy storage and clean sources of baseload power will also be necessary. And given its perpetual nature and dispatchability, hydropower will also play an important role.

However, traditional renewables will not be able to fill the clean energy gap completely. Energy storage remains a nascent solution. And for hydropower, existing plants often are in the optimal locations, making them a critical part of the decarbonization solution. However, for new-build hydropower plants, the right geography can be hard to find, permits can be difficult to obtain, and construction often takes multiple years and can be expensive—especially in developed nations.

Figure 2: Renewables Will Need to Displace Fossil Fuels Quickly

Electricity supply by source in the IEA’s net-zero by 2050 pathway

Source: IEA, 2021.

How Nuclear Helped Ontario Abandon Coal

Ontario was the first jurisdiction in North America to end coal power, representing the single largest GHG emissions reduction action in North America.4 Existing and new-build nuclear played a critical role in facilitating this phaseout.

Coal-fired electricity was replaced by a mix of baseload, intermittent and peaking capacity and a strong conservation and demand management approach. In the end, Ontario added a total of 1,500 MW of nuclear, 5,500 MW of natural gas and 5,500 MW of non-hydro renewables.

ELIMINATING COAL-FIRED ELECTRICITY IN ONTARIO5

- 2001: Ontario has five coal-fired generating stations, comprising 19 units totaling ~8,800 MW

- 2003: Coal represents approximately 25%, or 7,560 MW, of Ontario's supply mix

- 2003: Ontario commits to phase out coal-fired electricity entirely

- 2012: Two nuclear power units are refurbished and returned to service

- 2014: Coal’s share of Ontario’s power supply reaches 0%

- Today: Nuclear power now generates 60% of Ontario’s power

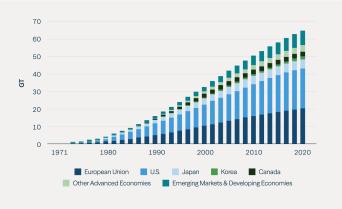

This means that nuclear—as a baseload source of clean energy—will need to fill a material portion of the gap. Over the past 50 years, nuclear power has displaced more than 60 gigatons of CO2 emissions—the equivalent of nearly two years’ worth of global energy-related CO2 emissions (see Figure 3).

In addition, nuclear takes advantage of the atom’s high energy density, meaning it can supply uninterruptible energy at scale.6 Beyond baseload power, nuclear can also provide inertia—a type of stored energy that’s a key source of grid reliability—and many can operate flexibly, ramping up or down in response to the needs of the electrical grid.

Figure 3: Nuclear Power Has Displaced Over 60 Gigatons of CO2 Emissions

Source: IEA.

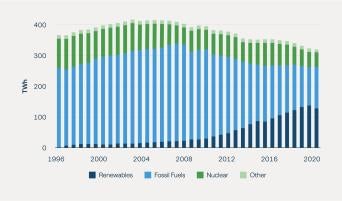

Given the benefits of nuclear power, it is a clear part of the solution for countries looking to generate new capacity in line with their carbon reduction goals. The U.K. is a key example of this. The U.K. relies on fossil fuels for 40% of its electricity generation, predominantly from gas, while nuclear power accounts for 16% of its electricity generation (see Figure 4).7 It will need to replace its existing fleet while increasing the share of energy coming from nuclear.

Currently, the country has outlined plans to develop up to eight new nuclear reactors. The government’s target is that, by 2050, nuclear will account for about 25% of the U.K.’s projected power demand—helping it to achieve its net-zero goals and make it more energy independent.

Figure 4: Fossil Fuels Still Account for Almost 40% of Britain's Electricity Generation Mix

Source: BEIS, Financial Times.

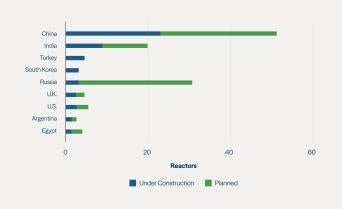

China is building out its nuclear capacity at an even faster pace (see Figure 5). It has pledged to peak its CO2 emissions before 2030 and achieve net-zero emissions before 2060. Today, it generates more than 60% of its power from coal as electricity demand continues to rise.

South Korea, meanwhile, is the fifth-largest nuclear power producer in the world, but it is still fossil-fuel heavy. In fact, South Korea is one of the world’s top-five importers of fossil fuels.8 To meet its emissions reduction goal, President Yoon Suk Yeol’s new government will reverse the country’s nuclear phaseout plan and increase the portion of atomic power in the energy mix.9

Figure 5: China Is in the Midst of a Massive Nuclear Power Buildout

Source: Bloomberg, World Nuclear Association, August 2022.

As renewable energy increasingly dominates the energy grid, new nuclear facilities can provide critical backup. New types of reactors are increasingly dispatchable and can meet baseload demand for clean generation on a utility or distributed energy scale. For example, micro modular reactors are under development that can replace the existing diesel generation infrastructure for smaller-scale applications. And replacing old fossil fuel units, especially coal-fired ones, will also go a long way to meeting clean energy demand globally.

Finally, nuclear could also support the shift to a hydrogen economy. It is difficult to imagine how we reach net zero without the use of hydrogen to replace fossil fuels in hard-to-decarbonize industries, where electricity or batteries are less effective due to their lower energy density. Also, in the U.S., the recently passed Inflation Reduction Act helps improve clean hydrogen economics, and an opportunity is emerging for nuclear plants to supply power to hydrogen production facilities.

In the coming years, new technology, like high temperature steam electrolysis (HTSE), which relies on steam and electricity released from nuclear reactors to ultimately produce what’s known as “pink hydrogen,” could play an important role.

Nuclear Energy—Today and Tomorrow

Nuclear energy originates from a process called fission. Put simply, fission is when an atom—most commonly uranium—breaks in two. Nuclear fission generates heat to produce steam, which is then used by a turbine generator to generate electricity.10 Essentially, nuclear power plants are a clean energy resource because they are not burning fuel or releasing carbon.

Two of the most common reactors in use globally are pressurized water reactors (PWRs) and boiling water reactors (BWRs). Both are light water reactors (LWRs), which use water to cool and heat the nuclear fuel.11

The nuclear industry continues to innovate. For example, small modular reactors (SMRs) are being developed that are designed to have a smaller project cost and be easier to deploy than more traditional large-scale reactors. While PWRs and BWRs are utility scale at over 1 GW, SMRs tend to be around 300 MW in size. However, in the next few years, it is unclear whether most SMRs will have meaningfully lower costs in generating cheap electricity compared with large-scale reactors.

Fusion is an emerging technology that could be a game-changer. Fusion is the process of generating energy by melding atoms. Nuclear fusion remains the great clean energy dream because, theoretically, it has no scarcity issues. In other words, the same fusion reaction that powers the sun could generate clean, cheap limitless power. While the technology remains in its infancy, investment into fusion grew rapidly in 2021, to $2.5 billion from just $300 million in 2020, according to Bloomberg NEF.

Promoting Energy Security and Energy Independence

The macroeconomic environment today—including the strategic isolation of Russia following the invasion of Ukraine, a disruption in the energy supply chain, as well as elevated energy prices—looks reminiscent of the 1970s.

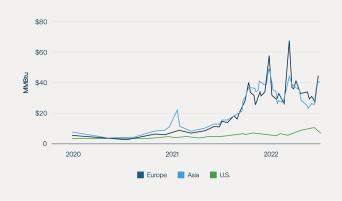

Similar to the situation then, the response from governments has been to prioritize rapid measures to enhance domestic energy production and to reduce reliance on foreign energy imports. Note that European natural gas prices have increased exponentially since the beginning of 2021 (see Figure 6).

The simple reality is that if a country does not have its own natural gas, nuclear energy is one of the best ways to achieve sovereignty over energy in the long run.

Figure 6: Benchmark Natural Gas Prices Have Skyrocketed in Europe and Asia

Indeed, European countries that import a substantial amount of gas from foreign producers are increasingly evaluating their options for nuclear power. Belgium, for example, announced its intention to extend the lives of its nuclear power plants, citing concerns about geopolitical instability.

However, progress on nuclear tends to zigzag in fits and starts, rather than moving in a straight line. In the U.K., for example, zero nuclear reactors have been built since the Sizewell B reactor was completed in 1995. Then, in September 2022, one of Boris Johnson’s final moves as prime minister was to announce that the U.K. government will take a 20% stake in the new Sizewell C nuclear power station planned for Suffolk, a project that will take over a decade to build. Meanwhile, U.K. households are facing a 65% increase in their gas and electricity bills this winter as a result of the energy crisis.12 While the Sizewell C project won't help U.K. consumers that quickly, it is a major step for the U.K. to provide more homegrown electricity.

With gas being a scarce commodity as a result of Russia’s invasion of Ukraine, Germany announced that it will significantly increase its use of highly polluting coal to preserve energy supplies ahead of the winter.13 Furthermore, Germany’s plans to shut down its last three nuclear power plants have been in flux—in September, the country announced its intention to postpone two of the three closures.14

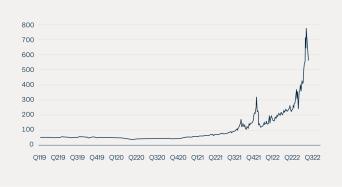

All of these geopolitical and macroeconomic events are connected, as power prices are heavily influenced by the cost of gas. German baseload power for delivery next year, the benchmark European price, topped €700 per megawatt hour in late August (see Figure 7). At current prices, the operating environment remains challenging for heavy consumers of energy, like German manufacturing businesses.15

The EU has introduced a plan to become independent of Russian energy. Called REPowerEU, the €300 billion plan includes more ambitious renewables deployment targets. Higher-capacity targets and EU grants and loans should support an estimated 5x acceleration in annual capacity additions by 2026-30.16

Given this environment, nuclear should benefit. France already generates almost 70% of its electric power needs from nuclear energy (although a series of maintenance issues has temporarily lowered that amount).17 This year, the country launched plans to increase its nuclear production with the proposed development of up to 14 new reactors. This move marks a stark reversal in policy from just four years ago, when France announced plans to shut down 20% of its reactor fleet.

Figure 7: Power Prices Are Soaring in Germany

Baseload electricity one year ahead (€ per megawatt)

Source: Bloomberg.

In the U.S., nuclear energy represents about 20% of total annual U.S. electricity generation. And while the U.S. has a natural gas advantage as a result of the shale revolution, it still needs to contend with the threat of power shortages. For example, the Diablo Canyon nuclear power plant in California provides reliable, low-cost and carbon-free electricity for more than 3 million people. While the plant was scheduled to shut down by 2025, California lawmakers recently voted to extend its life by five years.

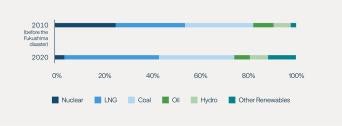

Japan also needs to improve its energy self-sufficiency. Japan’s heavy reliance on Russian gas imports has rekindled a debate over nuclear power in the world’s third-largest economy (see Figure 8).18

In a May 2022 speech to the City of London Corporation, Japanese Prime Minister Fumio Kishida remarked that “restarting just one existing nuclear reactor would have the same effect as supplying 1 million tons of new LNG per year to the global market.”19 This foreshadowed Japan's energy policy shift in August 2022, when Kishida announced that Japan will pivot back to nuclear power.

Figure 8: How Japan’s Energy Mix Has Changed

Source: Agency for Natural Resources and Energy under Ministry of Economy, Trade and Industry, Financial Times.

Ensuring Nuclear Is More Reliable Than Ever

Despite providing constant, reliable, carbon-free power, nuclear’s image has often struggled in the eyes of the public, particularly on safety. While no technology is foolproof, data shows that nuclear is a far safer technology than coal, oil and gas.20 But past accidents have led to a nuclear industry that is now, by necessity, more safety-conscious.

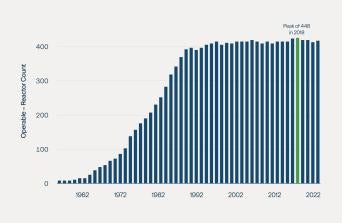

Another criticism focuses on the development of nuclear power. Historically, plans to build new nuclear reactors were, to some extent, the first of their kind. Because new supply chains had to be set up, they often turned out to be massive construction projects frequently beset by cost overruns and delays. This led to decreasing investor interest and a stagnating number of nuclear power projects (see Figure 9). And while interest in building new reactors waned, so did industry knowledge and expertise.21

Figure 9: The Number of Operable Nuclear Power Reactors Has Plateaued

Source: World Nuclear Association, IAEA PRIS.

But here too, nuclear is making significant strides forward. New reactors should not have the vulnerabilities of the old. Today, more than 50 reactors are currently under construction.22 Going forward, we believe that the construction of large-scale reactors will be more cost-effective and punctual, given that the nuclear supply chain is now more established.

To win popular support for nuclear, a social license is arguably a prerequisite—in some countries, building a broad consensus might be required. This includes educating the public about developments in nuclear technology, such as passive safety systems (see sidebar on Westinghouse).

New nuclear construction will also require a mobilization of investment, and an assurance of a more streamlined and reliable development process. Recent news out of the European Parliament should help with this endeavor. In early July, European lawmakers approved a law designating natural gas and nuclear as sustainable energy sources in the EU’s financial labelling taxonomy.23 This taxonomy is a system designed, in part, to steer private capital toward investments that support climate change targets.

Spotlight on Westinghouse

Westinghouse, a Brookfield portfolio company, serves as the core service provider for over 50% of the world’s 440 operating reactors. The company pioneered the commercial nuclear power industry and is the original equipment manufacturer for half of the world’s nuclear fleet.

Westinghouse provides nuclear operators with the mission-critical fuel, outage and maintenance services, instrumentation and controls systems, engineering services, and spare parts required to operate safely and effectively.

Westinghouse’s technology portfolio includes the AP1000, a 1,000-megawatt reactor that employs fully passive safety features. Rather than relying on active components, such as diesel generators and pumps, the AP1000 relies on natural forces—gravity, natural circulation and compressed gases—to keep the core and the containment from overheating. Four AP1000s are in operation in the Asia Pacific region and several new plants are being built around the world, including two in the U.S.

Westinghouse is also developing a micro modular reactor, called the eVinci, that will be 100% factory-built, fueled and assembled before it is shipped by truckload and deployed onsite. This very small modular reactor will require less than 30 days to install and provide more than eight years of continuous clean power, 24 hours a day, 365 days a year. Once commercialized, the eVinci can serve as an alternative and reliable energy source for remote communities and mining sites, clean hydrogen production, industrial power and off-grid applications.

Finally, Westinghouse is also working with other original equipment manufacturers’ designs on next-generation advanced reactor projects. These include SMRs, high temperature gas-cooled reactors (HTGRs) and lead fast reactors (LFRs).

Conclusion

Nuclear power is riding tremendous tailwinds: Demand for clean energy is growing rapidly while the importance of energy security has assumed a central position on the world stage. Policymakers and investors are increasingly recognizing nuclear’s role in reaching net zero by 2050.

The future is fast approaching, and it's important to remember that progress is cumulative in science and engineering. New reactors are already building on the lessons of the past—and ushering in a new dawn for nuclear power.

Endnotes

- World Nuclear Association, “Nuclear Power in the World Today,” June 2022.

- IEA, "Nuclear power can play a major role in enabling secure transitions to low emissions energy systems," June 30, 2022.

- World Economic Forum, “Nuclear energy can be the turning point in the race to decarbonize,” May 22, 2022.

- Ontario, “Ontario - First Place in North America to End Coal-Fired Power,” November 21, 2013.

- Ontario, “The End of Coal.”

- World Economic Forum, “Nuclear energy can be the turning point in the race to decarbonize,” May 22, 2022.

- Financial Times, “Ministers under fire for ‘last minute’ attempt to bolster Britain’s winter energy supplies,” June 5, 2022.

- Financial Times, “South Korea signals nuclear fuel U-turn as global energy crisis looms,” April 13, 2022.

- Bloomberg, “South Korea Looks to Nuclear Expansion in Bid to Meet Climate Targets,” June 16, 2022.

- Duke Energy.

- Duke Energy.

- Cornwell Insight via Financial Times, “UK energy bills to soar towards £3,400 a year this winter, suggests research,” July 8, 2022.

- Financial Times, “Germany fires up coal plants to avert gas shortage as Russia cuts supply,” June 19, 2022.

- Financial Times, "Germany to keep nuclear plants on standby in case of energy crunch," September 5, 2022.

- Bloomberg, "Many Winters Are Coming. Start Saving Energy Now." June 27, 2022.

- Goldman Sachs, “Europe Utilities: RePowerEU: a secular game-changer, if properly implemented,” May 18, 2022.

- Financial Times, “Power plant shutdowns hinder France’s ‘nuclear adventure’,” May 30, 2022.

- Financial Times, “Ukraine war is ‘best opportunity’ for nuclear comeback since Fukushima, industry says,” May 15, 2022.

- Nikkei Asia, “Transcript: Japan PM Kishida's speech in London,” May 5, 2022.

- Our World in Data, "What are the safest and cleanest sources of energy?" February 10, 2020.

- Wall Street Journal, “Nuclear Power Is Poised for a Comeback. The Problem Is Building the Reactors.” June 23, 2022.

- World Economic Forum, “Nuclear energy can be the turning point in the race to decarbonize,” May 22, 2022.

- Financial Times, "EU parliament votes to designate gas and nuclear as sustainable," July 6, 2022.

Disclosures

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Inc. and its affiliates (together, "Brookfield").

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield's internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield's perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.