Introduction

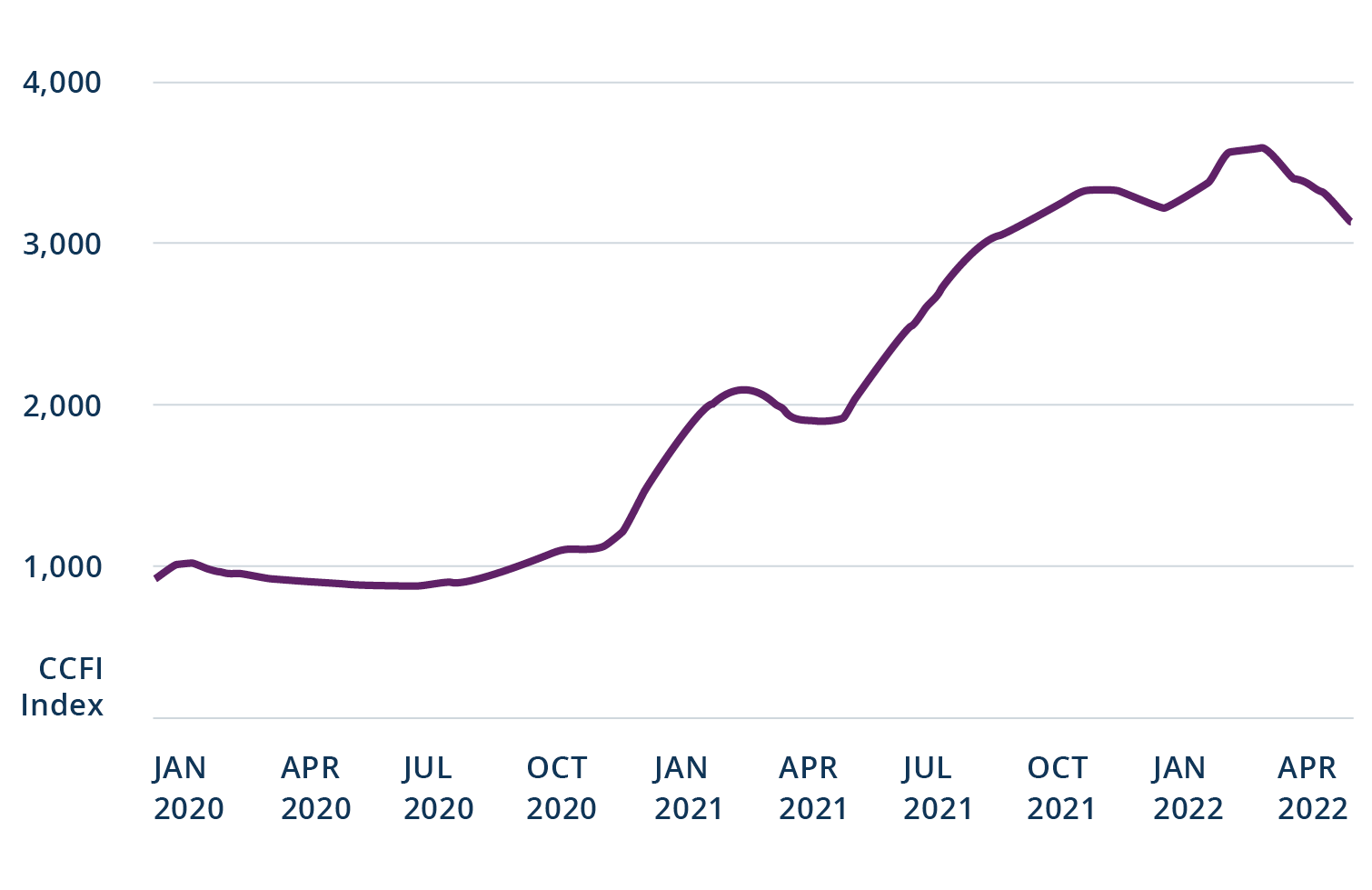

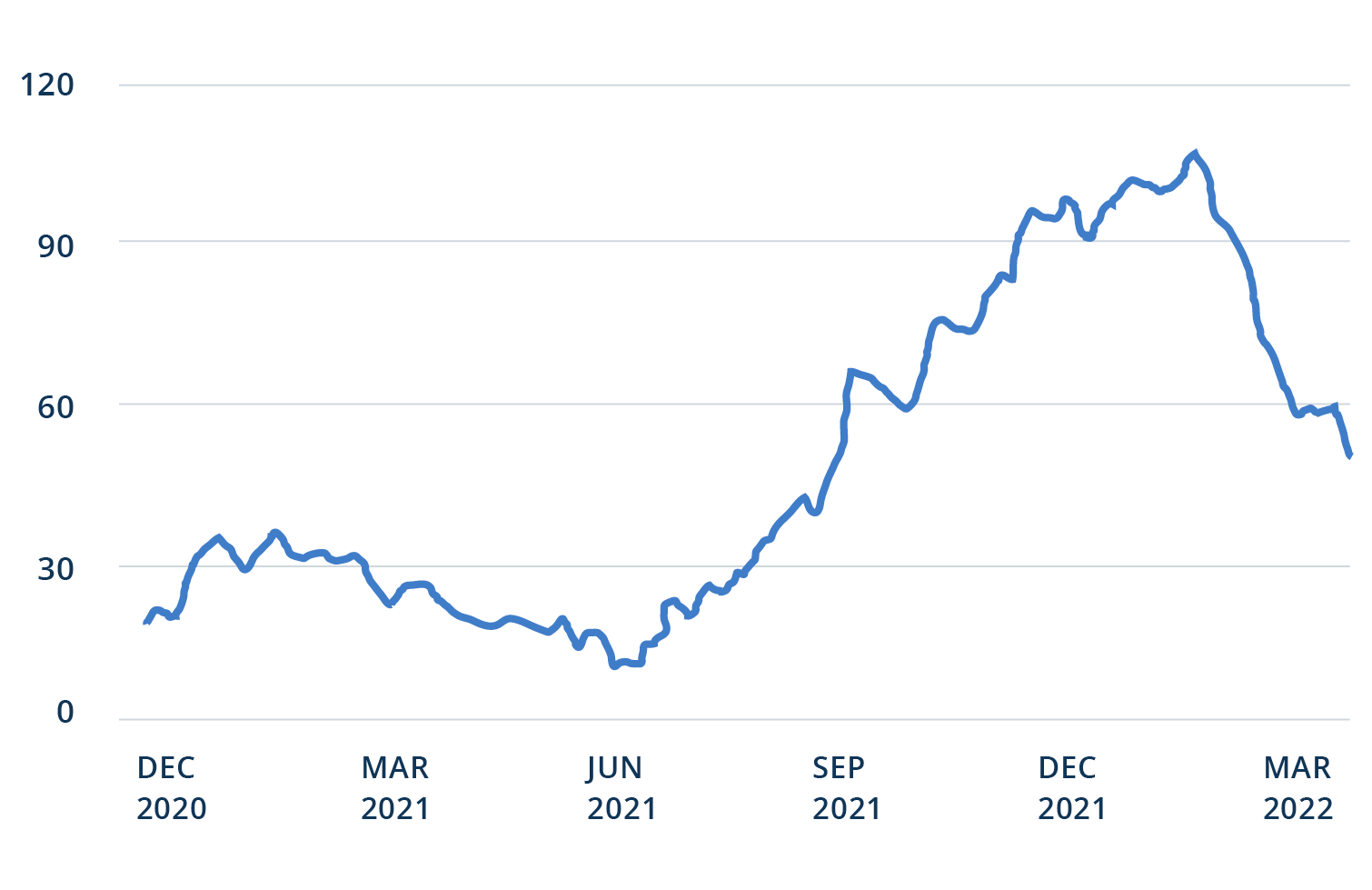

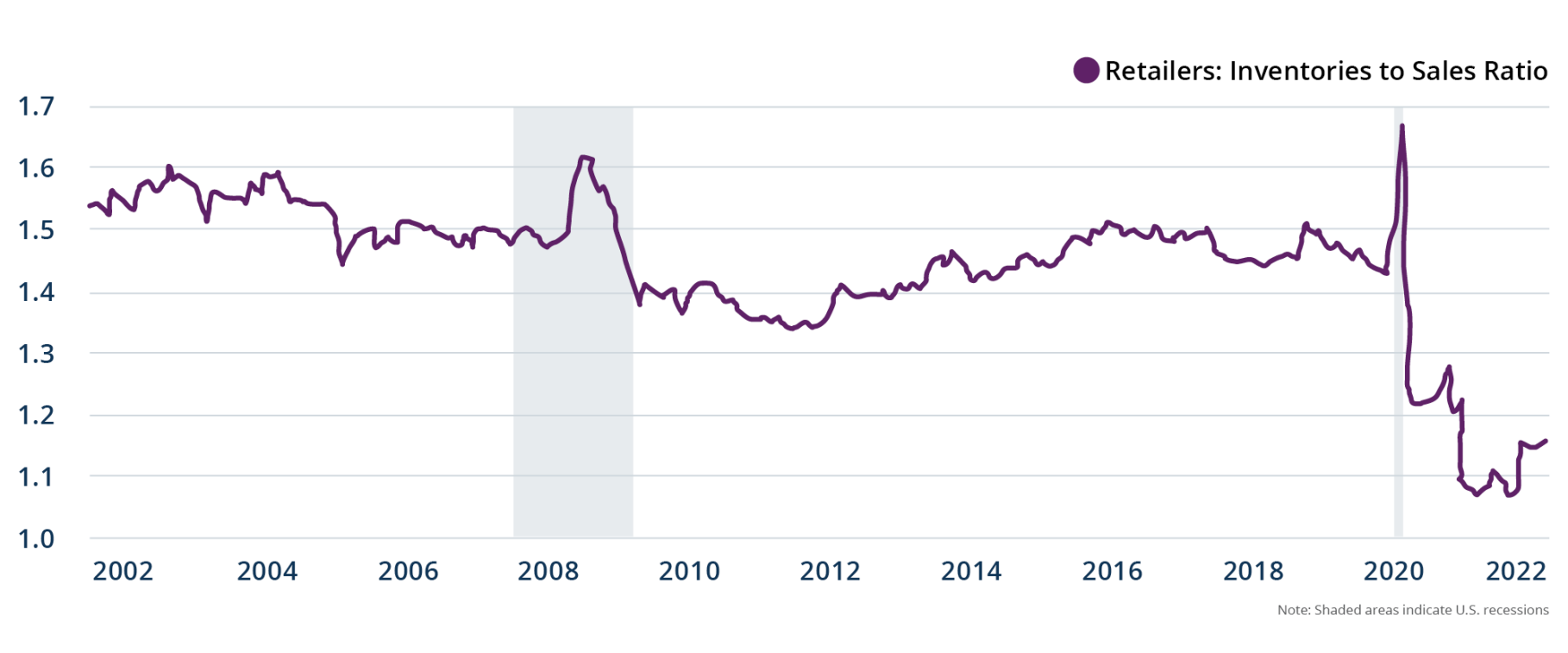

The steady stream of news about supply chain bottlenecks has put a spotlight on the essential nature of transport infrastructure and logistics assets around the world.

While the peak of the supply chain disruption is likely behind us, it exposed problems that persist, such as outdated infrastructure and insufficient capacity, flexibility and efficiency.

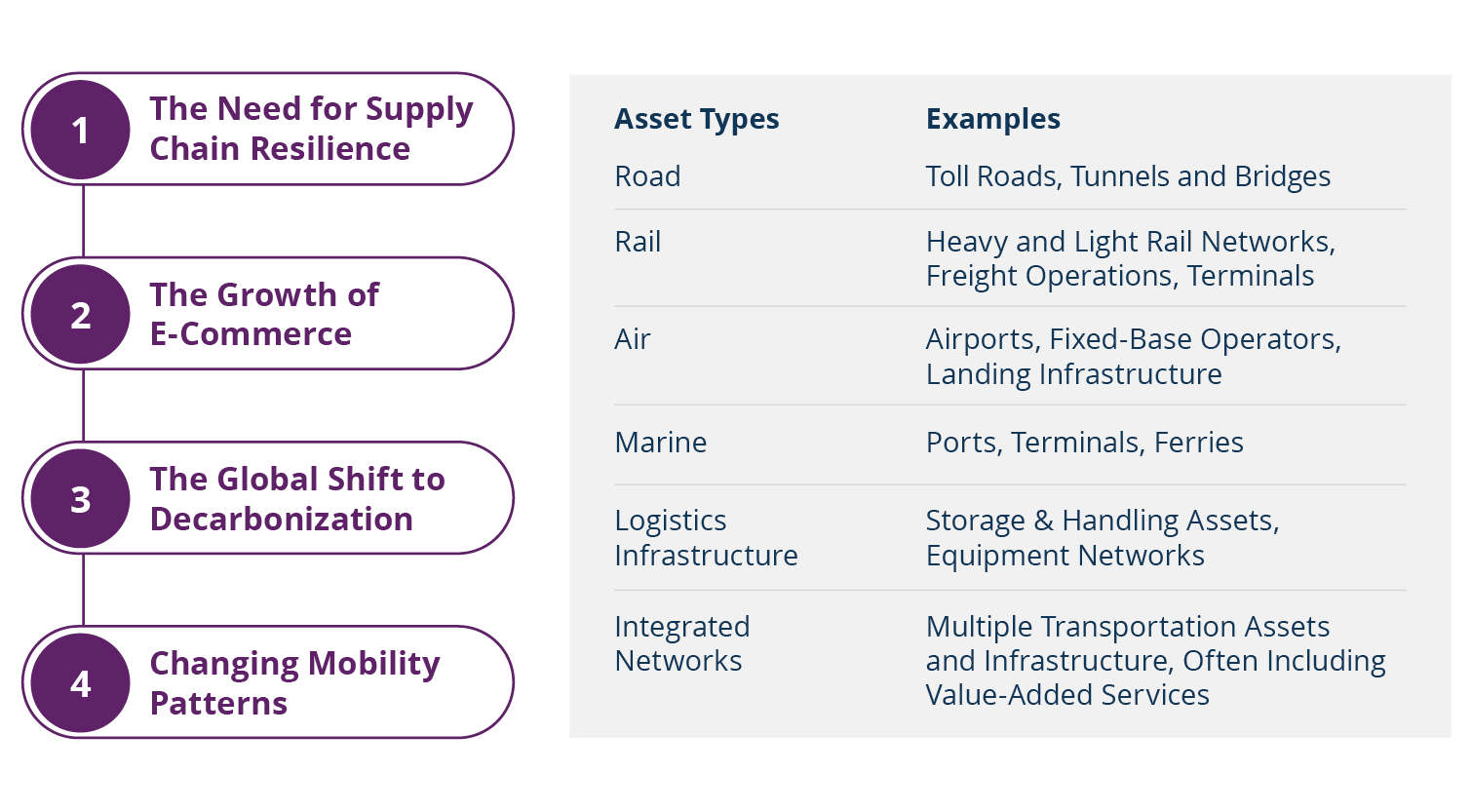

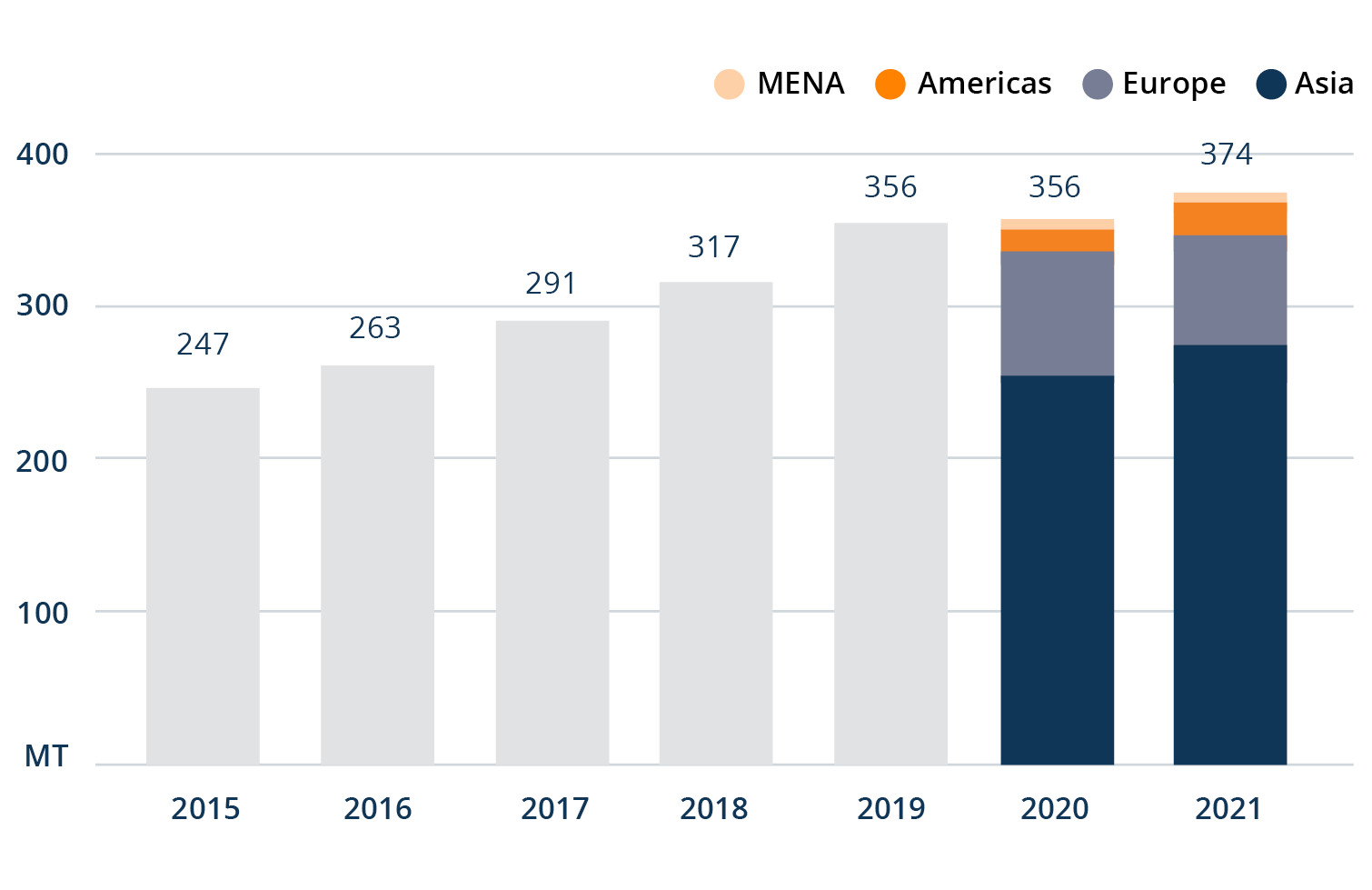

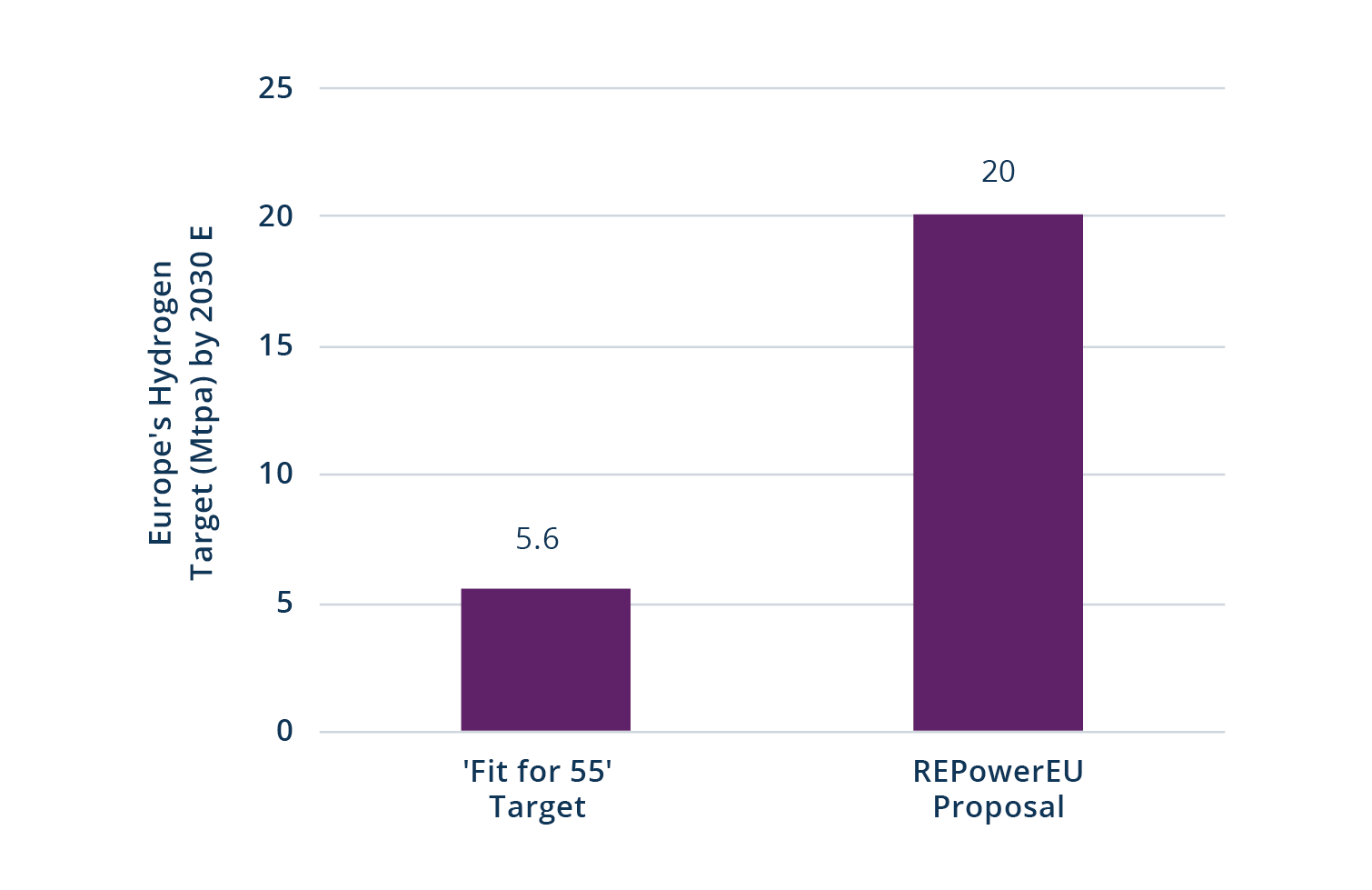

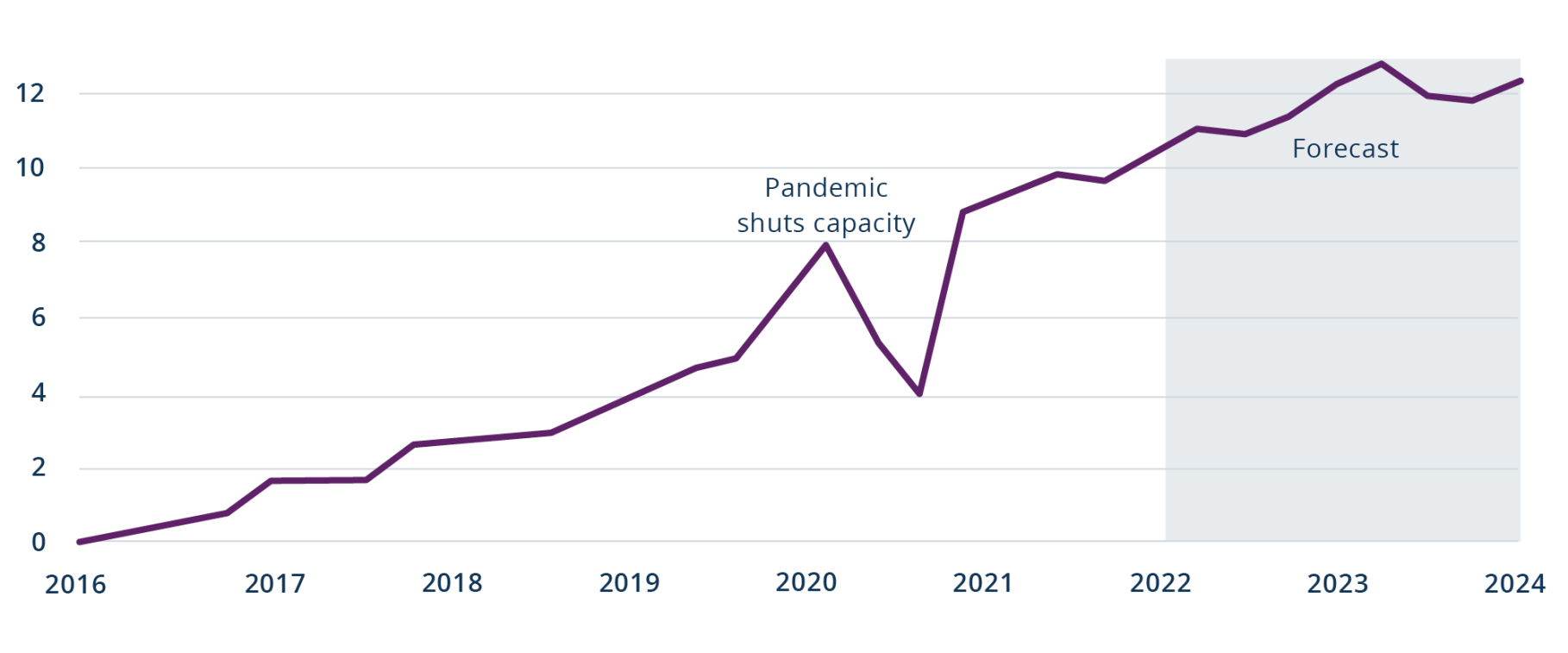

Yet, supply chain resilience is just the first big theme to watch in this space (see Figure 1). As e-commerce continues to grow and fundamentally changes the way goods move, transport logistics businesses will need to adapt. These businesses will also need to “green up” their assets and networks to meet emission reduction targets and emerging environmental regulations as global decarbonization initiatives take hold. Finally, changing mobility patterns will require advances in technology to unlock new time-saving and cost-effective options, catering to evolving passenger preferences.

Critical transport assets—road, rail, air, marine, logistics infrastructure and integrated networks—require substantial capital to eliminate inefficiencies, increase network capacity, decarbonize and provide greater reliability.

Investments are necessary to make supply chains more resilient—and to address significant expected changes in e-commerce, decarbonization and mobility. The last few years have also demonstrated the critical role logistics equipment networks play in global supply chains. But from an investor’s standpoint, large capital requirements often create attractive opportunities.

In addition, today’s elevated inflation and tight commodity environment further underscore the critical nature of transport infrastructure to the global economy—and the need for further investment.