Up Next for Industrials: An AI Transformation

Operational expertise can help shift AI from targeted applications to a scalable efficiency and growth driver.

Key Takeaways

- AI’s next phase of value creation lies in scalable efficiency gains, revenue growth and margin expansion—moving beyond the cost-cutting point solutions employed to date.

- Industrial companies are uniquely positioned to benefit from this shift, providing a use-case laboratory for AI implementation, but they must evolve from basic AI to more sophisticated AI that reimagines entire workflows.

- For private equity managers, industrials offer significant opportunities to deploy system-wide AI that could boost productivity, unlock growth and enhance returns for their investors.

- Our work at Clarios and Chemelex shows how deep operational expertise can help portfolio companies achieve transformational AI-driven change.

Embedding AI to Drive Revenue and Margins

In late 2022, ChatGPT captured the public’s imagination, demonstrating the power of artificial intelligence to draft documents, answer questions and simulate human conversation. Its launch sparked an AI revolution.

Global technology leaders are now committing trillions of dollars to develop AI tools designed to transform industries, drive scientific breakthroughs and integrate digital assistants into daily life. We believe that AI-led automation could add up to $10 trillion in global gross domestic product (GDP) over the next decade.1

Industrial companies are positioned to benefit enormously from this megatrend, offering compelling opportunities for implementing AI upgrades to decades-old technology that could dramatically improve productivity. While AI has helped industrials achieve modest efficiency gains so far, the next value-creation phase will require embedding more sophisticated agentic AI into core operations—and eventually physical AI tools such as humanoid robots—along with adopting a system-wide approach across workflows to further enhance efficiency and eventually expand revenue and margins.

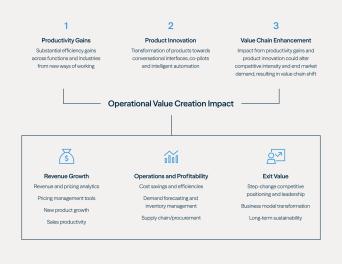

In private equity, success with AI will not be determined by who has access to the most advanced algorithms. It will be defined by who can successfully drive transformational change management, while embedding those capabilities into workflows in ways that generate measurable value for portfolio companies and returns for investors (see Figure 1). And it will require not only capital, but also deep operational expertise. In other words, it takes industry to turn potential into results.

Figure 1: AI Offers Enormous Opportunities to Create Long-Term Value

Why Industrials Stand Out for Operators and Investors

Industrial companies are often overlooked and undervalued because they are attempting to compete with outdated technology but lack the knowledge and capital to transform. With an urgent need to evolve and adapt quickly, industrials represent a compelling opportunity for private equity managers to unlock value through AI expertise and enhance returns for their investors.

Along with robotics, automated manufacturing and deglobalization trends, AI is contributing to the reindustrialization of the U.S. and Western Europe—what some are calling the Fourth Industrial Revolution.

Despite rapid progress, the gap between AI’s potential and realized business value in this sector remains wide. Recent studies show that only a small minority of industrial companies have achieved their AI performance targets.2

While industrials stand to benefit disproportionately from AI, barriers remain high. Unlike software businesses, industrial companies often operate with legacy infrastructure, analog workflows and decentralized decision-making. Embedding AI into these operations is not a plug-and-play exercise. It demands operational expertise, deep sector knowledge and the ability to redesign how work gets done.

In a manufacturing plant, for example, predictive maintenance is only the beginning. AI can also optimize production scheduling, manage energy consumption and coordinate complex supplier networks in real time. In logistics, AI enables dynamic routing, adaptive warehousing and demand forecasting. In industrial services, companies can deploy AI to anticipate client needs, automate safety monitoring and personalize offerings.

Because industrial companies traditionally have grown in line with or slightly above GDP, they tend to trade at lower multiples than high-growth technology companies. This often makes them attractive investment candidates for private equity operators with a track record of creating value through operational expertise. Far from being a disruptive force, AI tools have the potential to significantly enhance productivity and accelerate earnings growth at industrials without having to pay a premium multiple.

Private equity’s ownership model also allows for long-term investments and quick decision-making in process redesign, workforce training, technology and data integration across silos—tasks that are often harder to implement in public companies.

AI is poised to become the most impactful general-purpose technology in history, but only if it is accompanied by a buildout of the necessary capital-intensive physical infrastructure to support its adoption.

The Next Generation of AI

Most industrial companies are implementing generative AI point solutions, such as chatbots, that are easy to deploy but struggle to deliver material revenue or profit increases.3

The most impactful adoption of AI occurs with system-level solutions that create value by holistically improving multiple, interdependent processes.4 Employing autonomous agents has the potential to transform AI from a reactive assistant into a proactive, value-generating collaborator. As technology advances, modular agents with specific responsibilities will be able to connect and communicate with one another through their own network. (Agentic AI systems can plan, strategize and execute tasks independently, often adapting to changing conditions.)

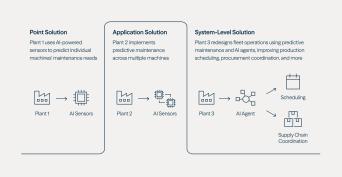

This distinction can be illustrated through three hypothetical plants, each approaching AI differently (see Figure 2).

Figure 2: From Point- to System-Level Solutions—And Beyond

The first plant pursues a point solution, using AI-powered sensors installed on individual machines to predict when each one needs maintenance.

The second plant adopts an application solution, implementing predictive maintenance sensors on multiple machines and linking them to the plant’s inventory and parts-ordering department. This solution keeps the right parts in stock when repairs are needed but does not fundamentally redefine the production process.

The third plant takes a system-level approach. In addition to implementing AI sensors on machines, management redesigns operations across its entire fleet of plants and adjusts production schedules based on AI-generated maintenance reports. It requires coordinating inventory and supply chains through connected agentic AI systems, retraining workers and refining key performance indicators. The result is reduced downtime and enhanced throughput, flexibility and efficiency.

When these autonomous AI agents interact, a machine showing early signs of wear could trigger an AI decision-making cascade: production slows, replacement parts are pre-ordered, delivery is optimized and work shifts are updated—all with minimal human intervention. While this vision is still developing, it underscores how AI’s future will move beyond task automation toward coordinated, system-level orchestration that creates enormous value.

System-level solutions require businesses to redesign core processes, workflows and even business models to fully capture AI’s potential. While such transformations are harder to execute, they are also where the largest competitive advantages lie.

Extending AI Into the Physical World

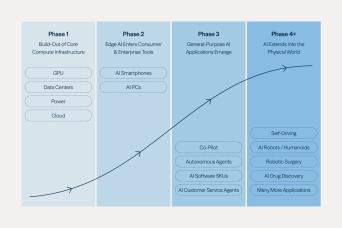

AI has evolved through successive phases, each fueled by accelerating breakthroughs and rapid adoption. It began with the buildout of core infrastructure such as data centers and power plants, later evolving to consumer applications like smartphones and then to general-purpose applications like customer service. AI is now poised to expand into the “physical world” for applications such as humanoid robots and self-driving cars—technology that offers significant opportunities for the industrials sector (see Figure 3).

Figure 3: The AI Revolution: Yesterday, Today and Tomorrow

Brookfield recently partnered with humanoid robot developer Figure AI to help the company:

- Develop the world’s largest and most diverse real-world humanoid pretraining dataset using video from Brookfield’s commercial office and logistics properties.

- Build AI infrastructure for scaling Helix, Figure AI’s vision-language action model.

- Deploy humanoid robots in Brookfield-owned real assets.

As part of this partnership, Brookfield also completed a balance-sheet investment during Figure’s latest round of fundraising.

Driving Results With AI

Brookfield continues to evolve how we leverage AI and other technologies at our portfolio companies. We started by adding point solutions, including robotics and automated manufacturing, several years ago. More recently, we have begun planning system-level AI implementation. In the future, we aim to redesign processes that turn agentic AI capabilities into tangible business value across our portfolio.

Recognizing AI’s growing ability to enhance operations, we have established an AI Value Creation Office to drive Brookfield’s AI strategy, including prioritizing projects, tracking results and sharing lessons learned to avoid common pitfalls. Combined with a global platform spanning renewable power generation, data centers and venture partnerships, the effect is a multiplier: Lessons learned in one business can be adapted and scaled in another, accelerating adoption and amplifying results. Brookfield’s strength is its capacity to drive organizational change. We partner with portfolio companies at any stage of their AI journey, embedding the capabilities needed to accelerate transformation.

The office is tracking and managing more than 800 use cases, including those at these two industrial companies:

Clarios: Optimizing Shipments and Fleet Operations

Clarios is the global leader in manufacturing low-voltage automotive batteries, powering one in three vehicles on the road. Two examples demonstrate how AI is unlocking value at Clarios:

- Order intake optimization: Each day, Clarios must determine which orders to fill, and in what sequence, across its vast network of facilities. Using AI decision models, Clarios can now process millions of data points daily—taking into account historical trends, projected demand and cost tradeoffs to generate optimal sequencing recommendations for each facility. This solution has helped avoid customer service penalties and improved U.S. on-time quantity fulfillment by 5%.

- Connected Services: Unpredictable maintenance and battery failure are age-old challenges for heavy-duty truck fleet operators. Clarios is developing a Connected Services platform—which includes “Internet of Things” sensors and gateways (i.e., data communication hubs) installed on trucks and their batteries—for multi-vehicle fleet operators to reconfigure workflows around predictive AI intelligence. The platform is already helping these operators reduce idling time, fuel consumption, and vehicle wear and tear, with the potential to monitor battery health remotely in the future. Customers in a recent platform pilot program reported fuel savings of $1,500 and carbon dioxide reductions of 2,500 kilograms annually for each truck. This platform underscores the growing industry demand for innovative, data-driven solutions that enable operators to comply with emissions regulations, cut costs and keep their trucks on the road.

Chemelex: Automating Manufacturing

A market leader and the inventor of electric heat-trace technology, Chemelex manufactures specialized cables and devices used in flow-control applications to regulate pipe temperatures in industrial plants and commercial buildings. The company has introduced AI and automation in two key manufacturing steps:

- AI-enabled polymer blending: Chemelex has implemented machine-learning sensors that monitor temperature, humidity and other factors in its production plants. This data trains an AI model that determines optimal polymer blending settings based on ambient conditions in a plant on any given day. By eliminating the manual, trial-and-error steps used previously to fine-tune the settings, the AI system has reduced yield loss and production variability in the blending process.

- Robotics and computer vision: After polymer blending, protective coatings—or “jackets”—are applied in several layering stages. Traditionally, operators manually unspooled and respooled cables and transported them to each jacketing station, and they also manually inspected the cables for defects. Chemelex automated these tasks by installing robotic equipment and computer-vision AI cameras. Now the robotics handle spooling and transportation while the cameras inspect the cable surface for flaws.

While Clarios and Chemelex are key examples of expanding beyond point solutions and leveraging advanced technology and AI to create system-level change, this approach can be applied to businesses in many other sectors.

AI’s impact on industrials is primarily enhancing productivity and innovation rather than transforming business models. This means AI implementation does not change Brookfield’s core value-creation levers—growth, efficiency, and optimizing costs and capital—it simply accelerates these strategies to deliver faster, cheaper and lower-risk outcomes that can drive revenue and margin expansion.

Keys to Leading the AI Value-Creation Era

Physical AI and advanced manufacturing are the natural next step in the ongoing modernization of industrial companies. Successful implementation would augment human capability, enabling businesses to operate at new levels of precision, adaptability and efficiency.

We believe that implementing AI tools today can ensure that companies realize AI’s full potential tomorrow, positioning them to play a leading role in the Fourth Industrial Revolution. Access to algorithms is important, but the real differentiator will be the ability to re-engineer workflows, align people and modernize systems so that AI can scale rapidly when capabilities mature.

Along with operational know-how with industry-leading access to the technology value chain, AI can evolve from a tool of incremental efficiency into a driver of lasting transformation—unlocking growth, resilience and long-term advantages for investors and portfolio companies alike.

The Edge in AI Investing Is Operational Know-How

The rise of AI is driving an unprecedented buildout of data, compute and energy infrastructure. In an interview with Private Equity International, Brookfield’s Stewart Upson explains how private investors with deep operational expertise are uniquely positioned to generate long-term value from this megatrend.

Endnotes:

- International Data Corporation, “The Business Opportunity of AI,” November 2023.

- World Economic Forum in collaboration with Boston Consulting Group. “Harnessing the AI Revolution in Industrial Operations: A Guidebook,” Oct. 2023.

- McKinsey and Company, “Seizing the agentic AI advantage,” Jun. 13, 2025.

- Ajay Agrawal, Joshua Gans and Avi Goldfarb, “Power, and Prediction: The Disruptive Economics of Artificial Intelligence,” Harvard Business Review Press, Nov. 15, 2022.

Disclosures

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities, related financial instruments or investment advisory services. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, "Brookfield").

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield's internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield's perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.