We invest in growing companies that operate at the intersection of technology and the built environment. Brookfield’s global platform and diversified asset base differentiate us as a provider of strategic capital.

Brookfield Growth

Brookfield At-a-Glance

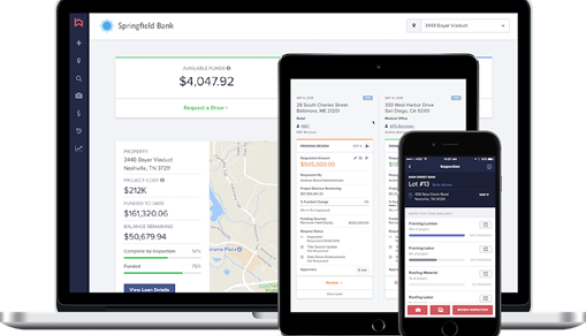

Brookfield Growth: What We Do

Leveraging The Brookfield Ecosystem

The Brookfield Growth Advantage

The digital revolution is rebuilding the world. For technology companies, our capital and resources can propel growth in large, resilient and diverse end markets where we have been operating for over 100 years.

We leverage our global footprint and extensive network across real assets to create partnerships, navigate new geographies and verticals, and further penetrate existing markets.

We offer access to Brookfield’s deep bench of subject matter experts and, as a pilot customer and advocate, provide management teams with insights for product and growth opportunities.

We provide strategic and operational support to tackle mission-critical issues, including buy-versus-build strategies, capital markets and financing, communications and marketing, and human capital needs.

Q&A: Technology and the Future of Real Assets

Brookfield’s Anuj Ranjan, Josh Raffaelli and Doug Bayerd discuss the opportunities emerging to invest in tech companies that are spurring the worldwide digital transformation of traditional industries.

Meet the Team

Cindy Chen

Cindy Chen focuses on investing activities for Brookfield’s Growth team. Ms. Chen joined Brookfield from J.P. Morgan, where she worked in the Technology Investment Banking group and advised companies across the technology industry on a variety of transactions across M&A, equity capital raises and debt financings. Ms. Chen holds a Bachelor of Science degree from the University of California, Berkeley.

Mike Fernandez

Mike Fernandez is a Vice President at Brookfield, responsible for sourcing, executing and managing investments at Brookfield Growth. Mr. Fernandez joined Brookfield in 2023 from B Capital Group, where he led venture investments in enterprise software and the Industrials & Transportation sector. Previously, he was a management consultant with Bain & Company. Mr. Fernandez holds a Bachelor of Arts in Economics from the University of Pennsylvania and a Master of Business Administration from the Stanford Graduate School of Business.

Jake Gross focuses on investing activities for Brookfield’s Growth team. Mr. Gross joined Brookfield from Goldman Sachs, where he most recently worked in the Investment Banking Division advising high-growth technology companies. Mr. Gross previously worked in asset management at Goldman Sachs, where he focused on alternative investments. Mr. Gross holds a Bachelor of Arts degree from the University of Washington.

Andy Kim

Andy Kim focuses on investing activities for Brookfield’s Growth team. Previously, Mr. Kim worked at Light Street Capital, a technology crossover fund focused on high growth technology companies globally. Prior to this, Mr. Kim worked in the Technology Investment Banking group at Houlihan Lokey where he focused on M&A transactions for technology companies. Mr. Kim holds a Bachelor of Science degree from the University of California, Berkeley.

Daniel Neczypor

Daniel Neczypor leads investor relations for Brookfield’s Growth team. Prior to joining Brookfield, Mr. Neczypor worked for Manulife Private Equity and Credit where he focused on capital raising and investor relations. Previously, he held positions at Silver Lake, Jefferies and Credit Suisse. Mr. Neczypor holds a Bachelor of Arts degree from Columbia University.

Stephen Pesche

Stephen Pesche focuses on investing activities for Brookfield’s Growth team. Mr. Pesche joined Brookfield from Goldman Sachs, where he worked in the Technology, Media and Telcom (TMT) Group advising companies across Education Technology, Information & Data Analytics and Semiconductors. Stephen holds Bachelor of Arts and Bachelor of Science degrees from Colorado State University.

Josh Raffaelli

Josh Raffaelli oversees the investing initiatives and management of Brookfield’s Growth team. Previously, Mr. Raffaelli was a Managing Director at Silver Lake and a Principal at Draper Fisher Jurvetson, after starting his career at JPMorgan. Mr. Raffaelli holds a Master of Business Administration degree from Stanford University and a Bachelor of Arts degree from Harvard University, and is a Kauffman Fellow.

Maura Roach focuses on investing activities for Brookfield’s Growth team. Ms. Roach joined Brookfield from M33 Growth, where she sourced and executed investments in bootstrapped, vertically focused software businesses. Prior to M33, Maura worked in investment banking at Barclays in the Real Estate Group. Ms. Roach holds a Bachelor of Science in Industrial and Labor Relations from Cornell University.

Matt Roberts

Matt Roberts focuses on investing activities for Brookfield’s Growth team. Mr. Roberts joined Brookfield from FT Partners, where he advised and evaluated strategic options for growth-stage clients in the financial technology sector. Mr. Roberts holds a Bachelor of Science degree from Tulane University.

Nick Sammut

Nick Sammut leads investing activities, including sourcing, executing and managing investments for Brookfield’s Growth team. Mr. Sammut joined Brookfield from Generate Capital, where he sourced, structured, underwrote and closed principal investments in the energy infrastructure, waste, water and renewables sectors. Previously, he was a private equity investor at Fortress Investment Group and was in equity research at Goldman Sachs. Mr. Sammut holds a Bachelor of Science degree from Northeastern University.

Kumar Shah

Kumar Shah focuses on investing and growth initiatives in international markets for Brookfield’s Growth team. Mr. Shah joined Brookfield in 2020 and helped launch the private equity program in enterprise software. Mr. Shah previously built the investment programs for growth-stage enterprise and consumer technology investments at Transit Capital, Micromax and GEF Capital. Mr. Shah holds an MBA from the Wharton School and a Bachelor of Engineering in Computer Science from the University of Mumbai.

Judah Siegal

Judah Siegal leads investing activities, including sourcing, executing and managing investments for Brookfield’s Growth team. Mr. Siegal has held a number of roles across Brookfield, including focusing initially on investment and strategic initiatives for Brookfield’s Real Estate Group. Mr. Siegal previously worked in Citigroup’s real estate investment banking division. Mr. Siegal holds a Bachelor of Science degree from the Wharton School at the University of Pennsylvania.

Featured News