Retail spaces have always been many things: a place to shop, a place to bring the family, a place to meet friends. The future of retail real estate will lean into this concept—and the best places will center on curated experiences, dining, entertainment, differentiated product offerings, and showcases for new and emerging brands.

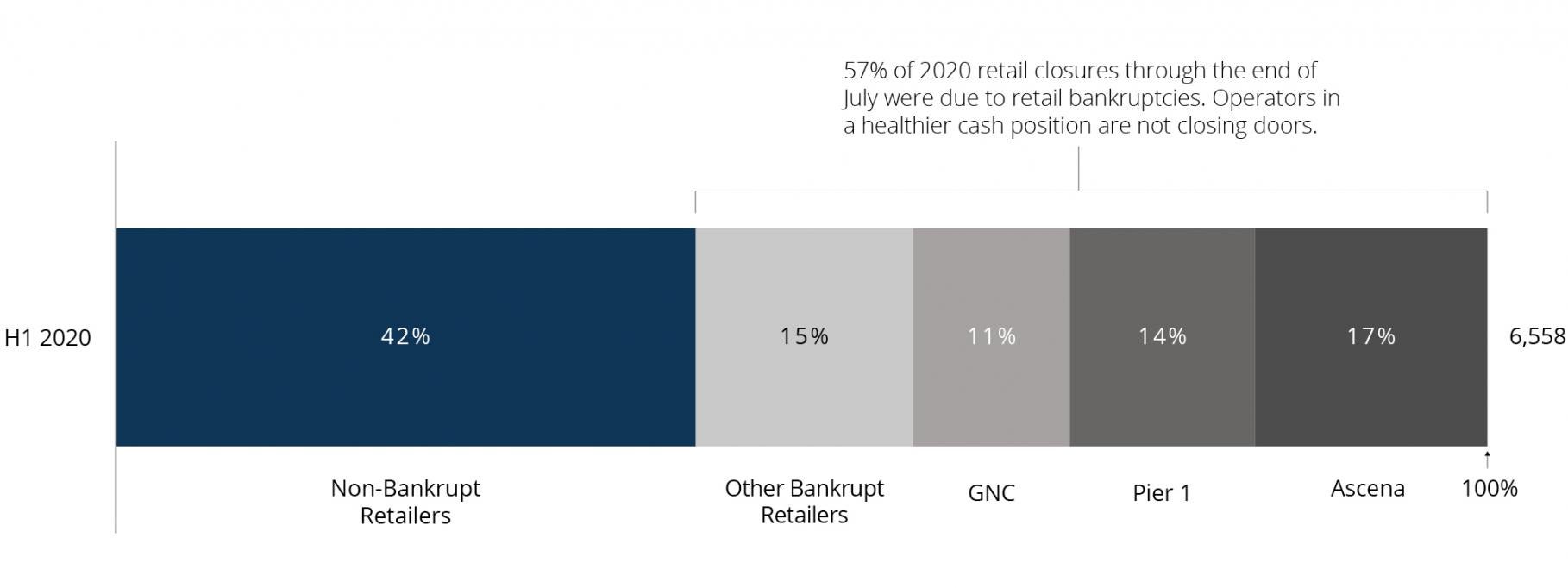

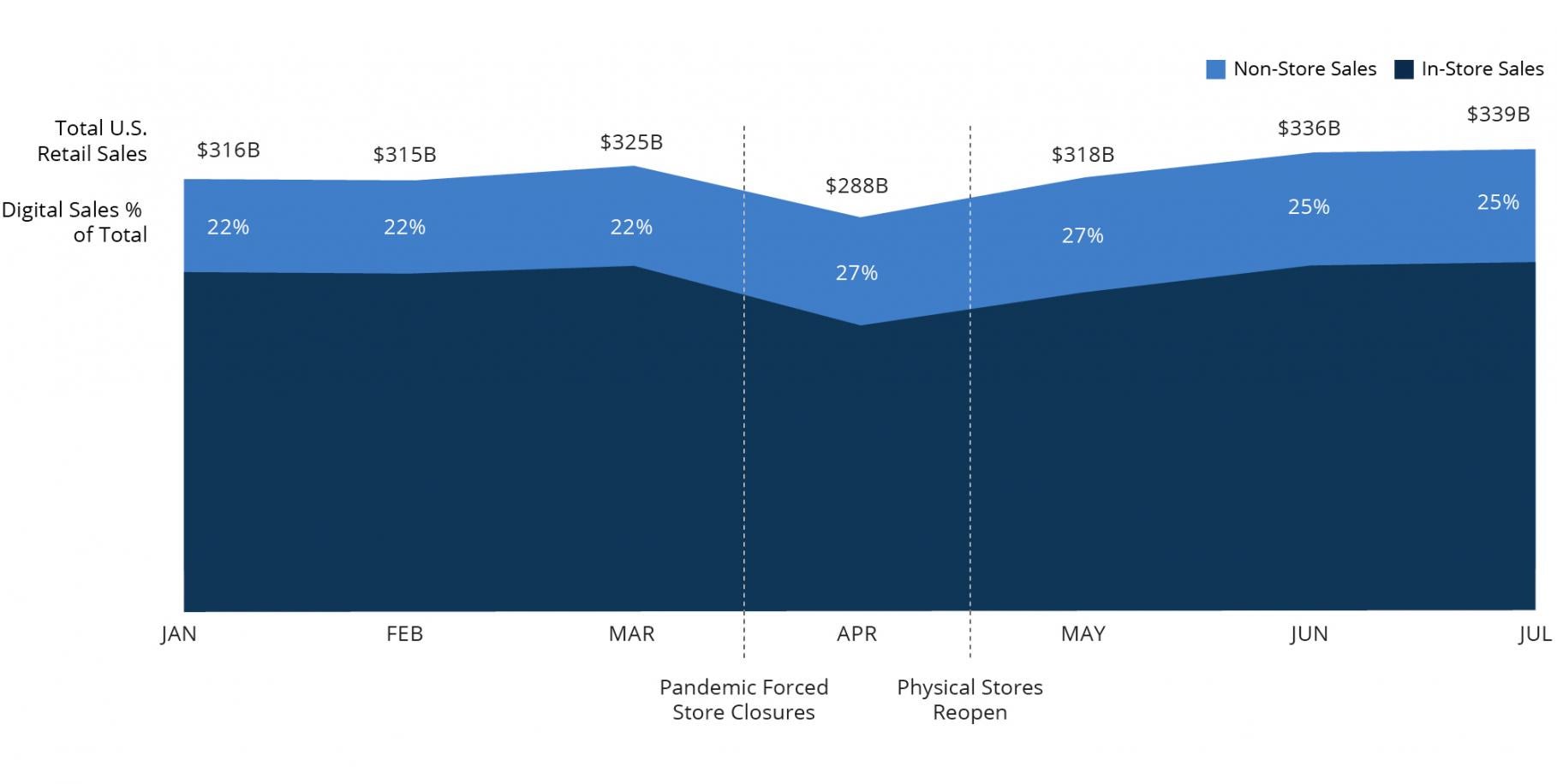

Today, the retail industry is quickly adapting to changes in consumer behavior brought about by the COVID-19 pandemic. Yet high-quality physical retail is alive and well in the U.S., as we are seeing every day. With 80% of sales continuing to come from in-store shopping, it continues to provide the bedrock for online sales success, rather than the other way around.

Through our research, first-hand experience and long-term interactions with leading retailers, we have identified three themes that are foundational to the future of physical retail:

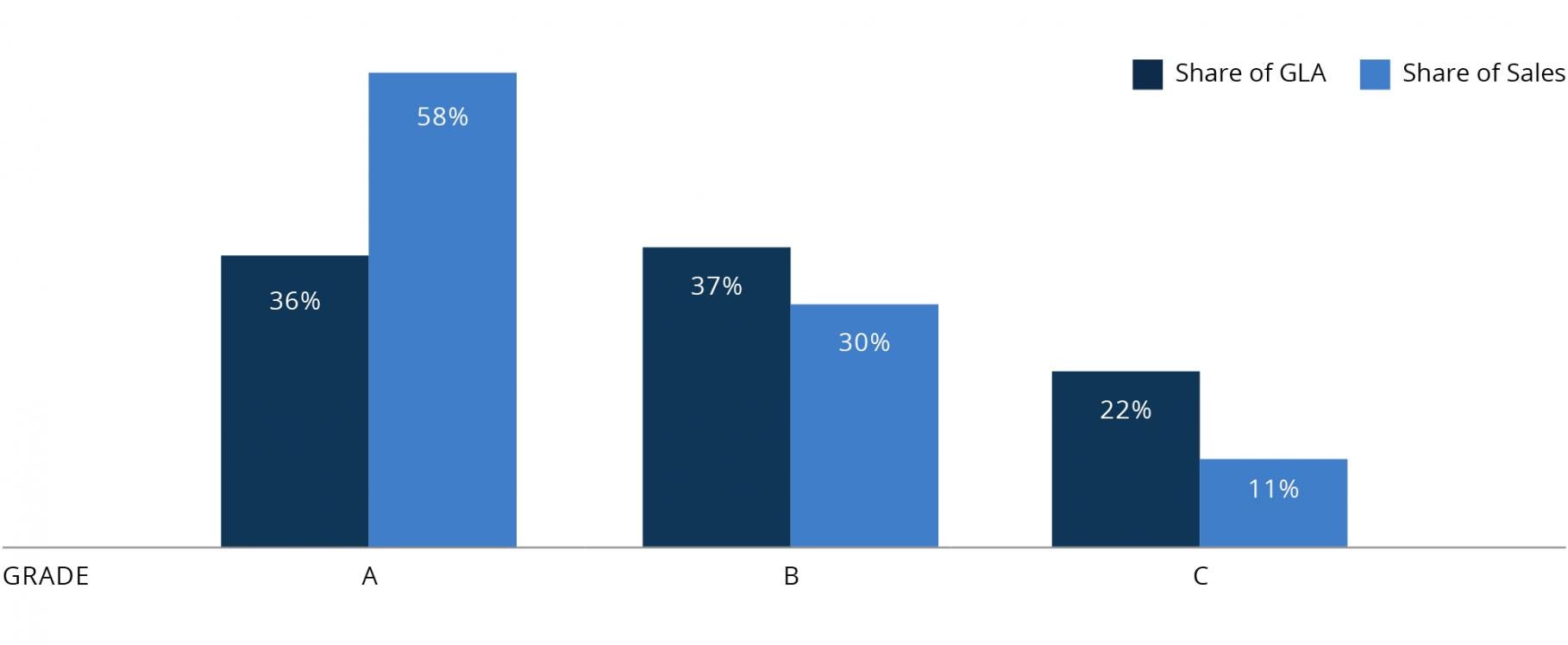

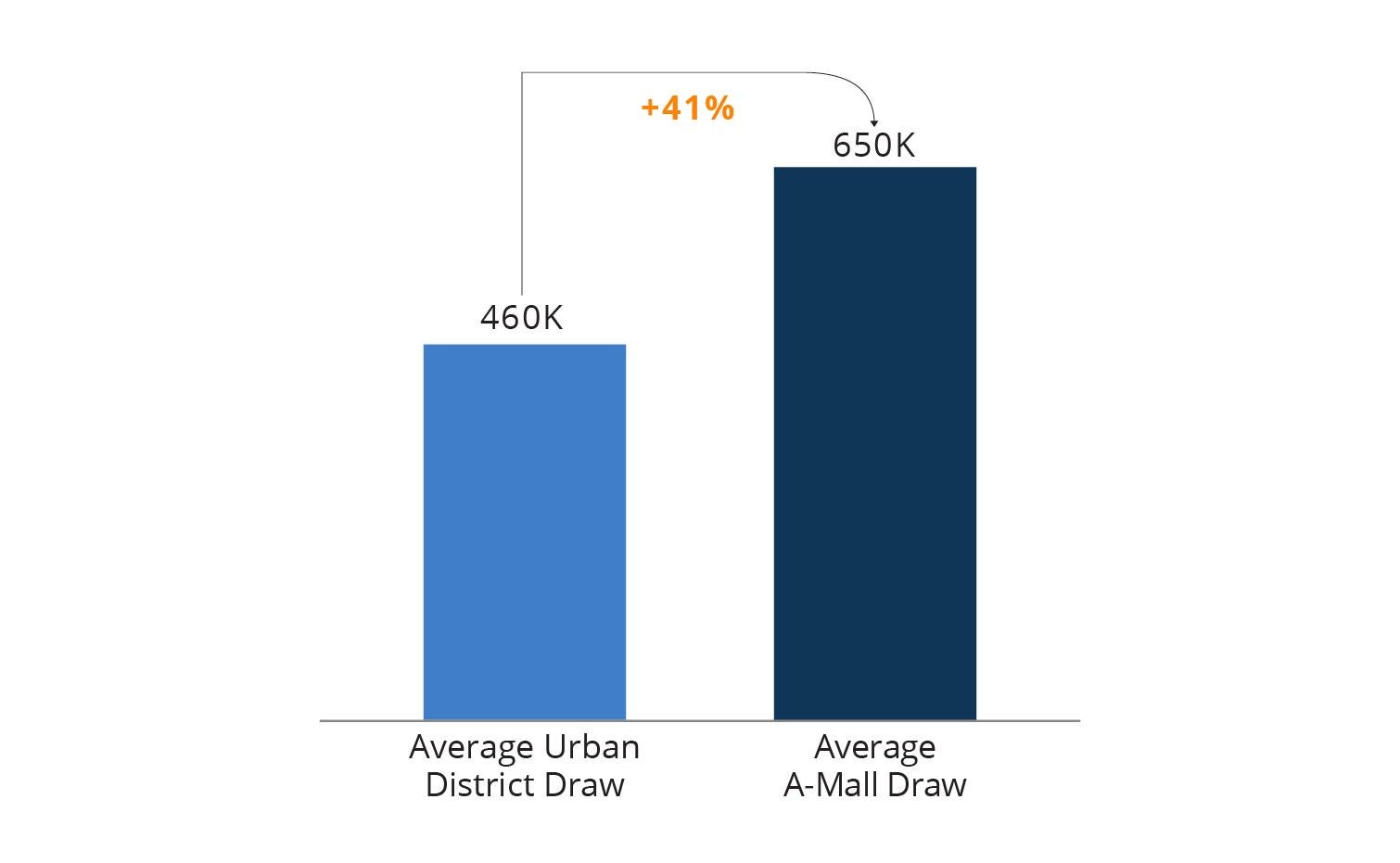

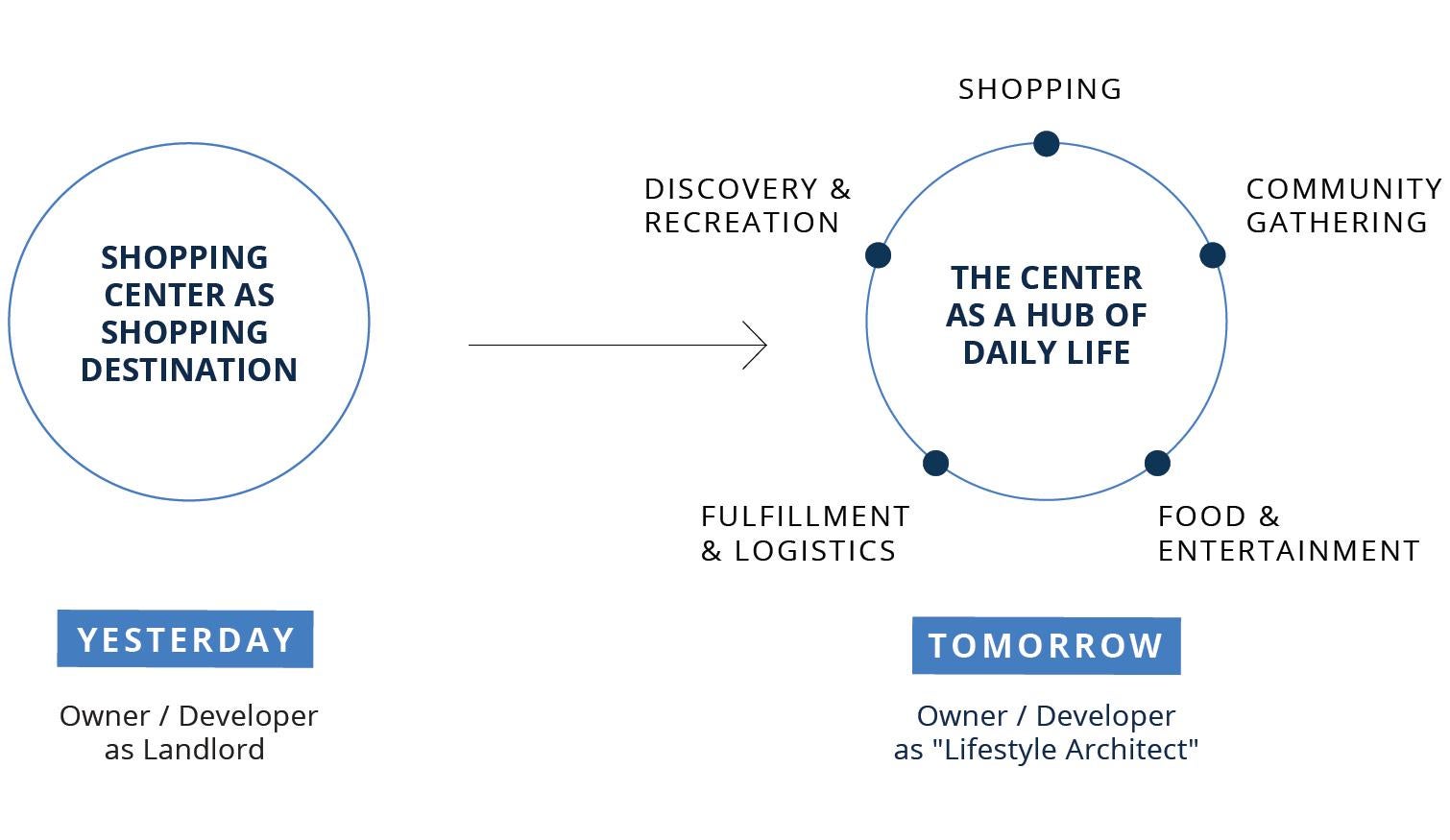

1. Focusing on high-quality retail real estate. Consumers, businesses and communities are seeking spaces that serve a wider range of needs. High-quality retail real estate is best positioned to meet this demand in the long term, with a focus on “placemaking”—that is, transforming properties into hubs of daily life and commerce.

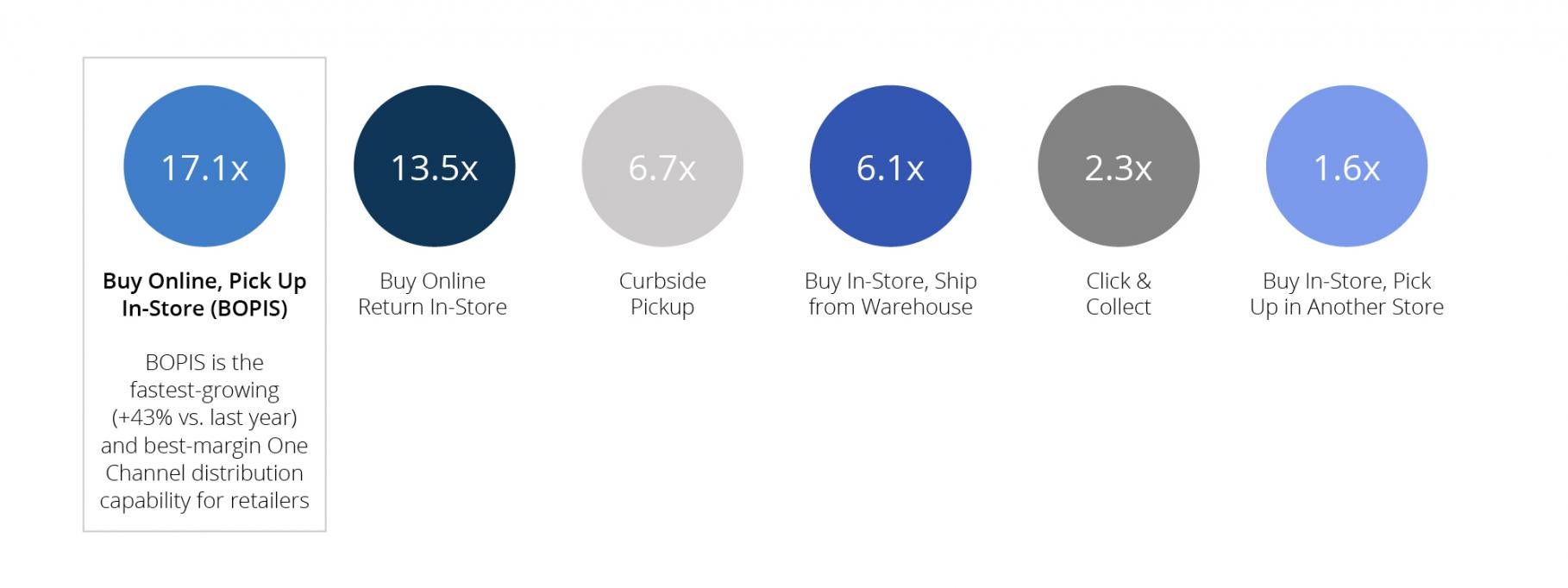

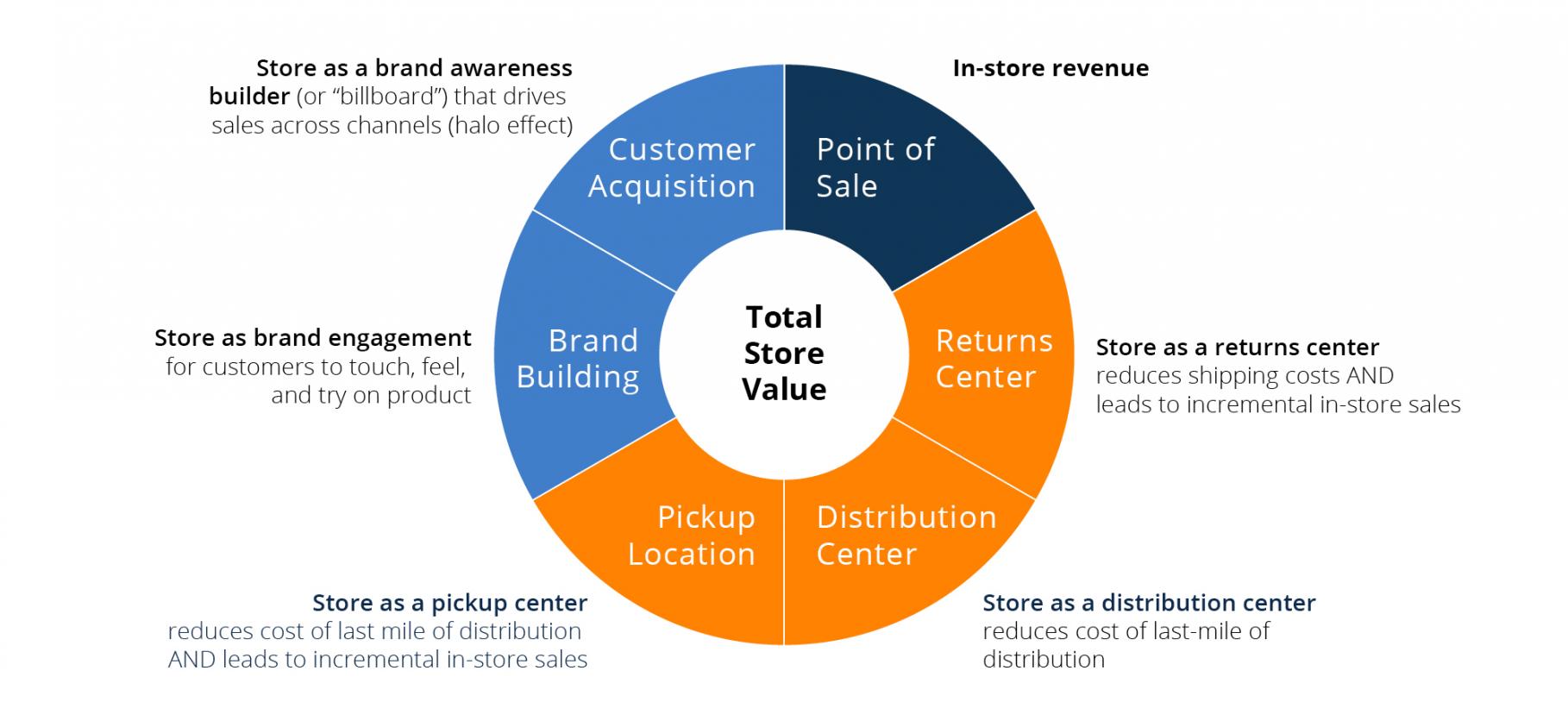

2. Transitioning to “One Channel” strategies.1 One Channel, the retail industry’s modernized take on “omnichannel,” provides the consumer with a relevant, consistent and individualized experience across both digital and physical assets to allow for seamless brand engagement. While the importance of this transition has been widely understood as critical for some time, the pandemic accelerated the trend.

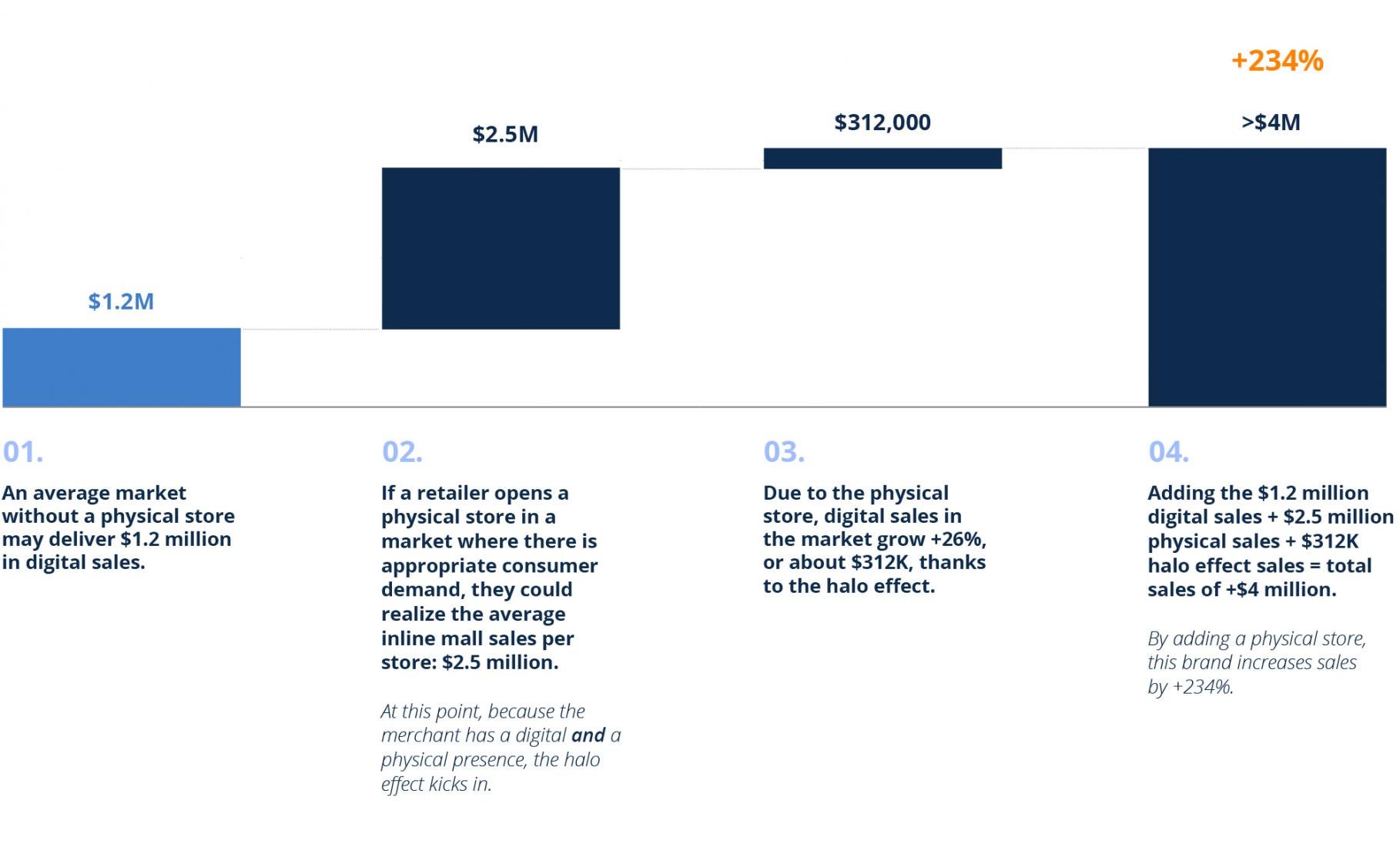

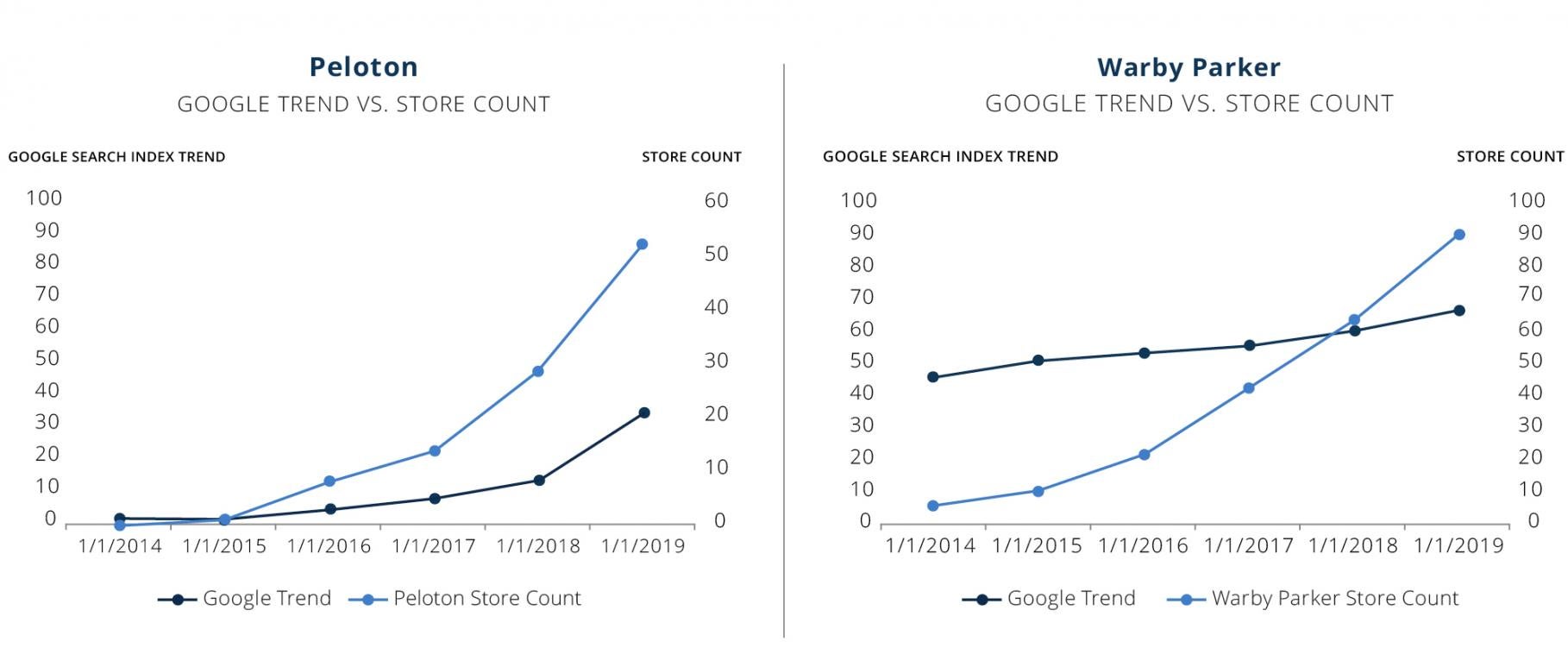

3. Harnessing the “halo effect.”2 Brick-and-mortar stores continue to be valuable profit centers. Retailers that have invested in a physical presence have been rewarded with an overall incremental sales lift of 26% in a single market.

As a result of changes in the way people live and interact, these themes will create opportunities for retailers—and those that can adapt and transform their offerings to answer the call will be the winners. Our experience has shown us that retailers and retail real estate owners can work together to implement One Channel strategies in high-quality locations in the U.S.—and pave the way for the next phase in the industry’s evolution.