The Appeal of Flexible Capital Solutions

Flexible capital offers an attractive solution for companies and investors alike - and expands the universe of solutions across private debt and private equity.

Markets are becoming increasingly unpredictable. While investors continue to seek the return potential of private markets, they’re now placing more emphasis on downside mitigation. Allocating to a flexible capital solutions strategy can allow them to do both—and capture additional potential benefits.

These solutions allow investors to diversify their portfolios with the potential for private-equity-like returns with the downside mitigation of private credit. Companies, meanwhile, gain an alternative funding source and a strategic partner with operational expertise to help meet their specific needs.

Hear Connor Teskey, Brookfield Asset Management’s President, and Frank Yu, Co-Head of our Special Investments Strategy, explain why flexible capital is an all-weather solution built for today’s market volatility.

Flexible capital offers an attractive solution for companies and investors alike - and expands the universe of solutions across private debt and private equity.

Market uncertainty has made it much more difficult for companies to secure traditional financing.

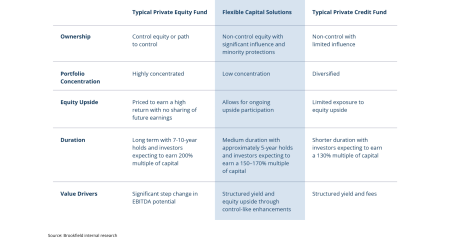

Flexible capital expands the universe of solutions across private credit and private equity. For investors, these opportunities combine the essential elements of debt and equity in a hybrid, tailored investment structure with a focus on strong downside protection, along with upside potential tied to equity performance.

Learn how Brookfield partnered with Sono Bello to help the company grow and achieve strategic initiatives

Deep dive into Brookfield’s partnership with the leading a global operator of private K-12 school in the Middle East and beyond

We use our decades of experience, scale and global reach to pursue value and impact at the same time.

Disclosures

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, "Brookfield").

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield's internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield's perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.