A Financial Infrastructure Evolution

As the world continues to innovate, consumers, businesses and governments will increasingly demand more. Businesses across industries like payments, capital markets, banking technology and wealth management must transform from analog systems to new-age digital operations so that they can not only keep up, but also thrive.

Bringing Finance Out of the Analogue Age

In a conversation with the Financial News, Sir Ron Kalifa explores the investment opportunity in facilitating the digital transition in finance.

What’s Driving the Financial Infrastructure Opportunity?

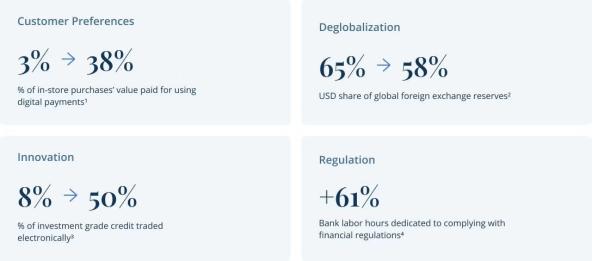

The global financial system is in the midst of a structural transition driven by changing consumer preferences, deglobalization, innovation and regulation. These trends are creating a need for strategic, large-scale capital paired with operating expertise to help financial infrastructure companies prepare for this transformation.

Contact Us

If you'd like to learn more about our views or capabilities, please request a follow-up.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Endnotes

1. Worldpay, “Global Payments Report," 2025. Time period from 2014 to 2024.

2. IMF. Time period from 2014 to 2024.

3. https://www.tradeweb.com/newsroom/media-center/insights/commentary/electronic-credit-trading-approaching-inflection-point-in-ig/ and https://www.tradeweb.com/newsroom/media-center/insights/blog/what-the-last-decade-of-electronification-tells-us-about-the-future-of-u.s.-credit-markets#:~:text=And%20that%20story%20continues%20to,directly%20in%20their%20trading%20workflow. Time period from 2013 to 2024.

4. https://bpi.com/survey-finds-compliance-is-growing-demand-on-bank-resources/#_ftn3. Time period from 2016 to 2023.

Disclosures

All investing involves risk. The value of an investment will fluctuate over time, and an investor may gain or lose money, or the entire investment. Past performance is no guarantee of future results.

Financial infrastructure companies may be subject to a variety of factors that may adversely affect their business, including interest rate fluctuations, high leverage, regulatory risks, economic slowdown and increased competition.