Transforming a Corporate Orphan Into a Carveout Champ

Once upon a time, a great business was trapped inside a global conglomerate—undervalued, underfunded and just plain unloved. It’s an oft-told story in the history of private equity carveouts.

Chemelex is an extreme example. This market-leading manufacturer of heat-control systems was a non-core asset for three different parent companies over 12 years. When it went on the auction block in 2024, many investors passed. Brookfield didn’t.

We saw value where others did not. Chemelex had been on our acquisition radar for years as a textbook carveout opportunity: an industrial business selling essential products with repeat customers, resilient cash flow and significant opportunities to improve operations.

Brookfield completed the purchase last year for $1.7 billion after five months of internal due diligence and extensive negotiations with the seller. The Brookfield Ecosystem—our global network of investment and operating employees who share insights across our five businesses—also played a crucial role in building conviction to pursue Chemelex.

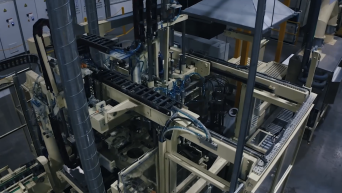

Watch the video to see Chemelex in action.

Watch the video to see Chemelex in action.

Making Mission-Critical Products

Chemelex’s electric heat-trace systems prevent fluids from freezing and pipes from bursting. Used primarily in manufacturing plants and commercial buildings, they combine cables wrapped around pipes and tanks with controls that maintain a consistent fluid temperature. These systems keep biofuels flowing in liquefied natural gas (LNG) pipes, prevent chocolate from hardening in confectionary vats and protect water pipes from rupturing in offices. The margin for error is thin, with downtime, lost sales and damaged reputations at stake. In other words, failure is not an option.

Chemelex’s core brand, Raychem, invented electric heat-trace technology in 1972 and remains the market leader today with a share twice the size of its next-largest competitor. While its products work behind the scenes in unsung businesses that form the backbone of the global economy, they also protect some of the world’s most iconic landmarks:

- The New York City subway, where a heat-trace network protects switches, signals and electrified third rails

- The Eiffel Tower in Paris, where Raychem cables prevent exposed fresh-water pipes from freezing and grease pipes from clogging

- Burj Khalifa in Dubai, the world’s tallest skyscraper, where a temperature maintenance system keeps pipes warm and water hot—all the way up to the 163th floor

Chemelex Products Protect Iconic Global Landmarks

New York City Subway

Eiffel Tower – Paris

Burj Khalifa – Dubai

Emirates Stadium – London

Beyond its traditional clients, Chemelex sees significant growth opportunities for its new leak-detection products, particularly in fast-growing data centers where expensive servers must be protected from their water-based cooling tubes. Each server tray in a data center is worth about $350,000, as much as a Lamborghini, while an entire server row is worth about $100 million, the cost of a Boeing 737. Even minor water damage can be catastrophic.

"Chemelex sees significant growth opportunities for its new leak-detection products, particularly in fast-growing data centers where expensive servers must be protected from their water-based cooling tubes."

A Successful Business Looking for a Home

After years of expanding, many global conglomerates are now pruning their portfolios, shedding noncore industrial assets through carveouts and take-privates to focus on faster-growing businesses. Chemelex knows the drill.

Despite its industry leadership, Chemelex spent more than a decade changing owners. In 2012, as the flow-control division of Tyco International, it was spun off and merged with Pentair. In 2017, Pentair split into two separate companies, with the heat-trace business landing inside nVent Electric under the name Thermal Management.

Several years later, nVent decided to focus on its higher-growth electrical connection and protection business to better position itself for the electrification, digitalization and sustainability megatrends. As a result, it put Thermal Management up for auction in March 2024.

For Brookfield, which had tracked the business for several years and realized its potential, the combination of a quality asset and strategic mismatch offered a compelling carveout opportunity. Brookfield also was looking to add industrial technology companies, particularly those focused on thermal management, to its portfolio.

With the heat-trace business that would one day become Chemelex finally on the market at a potentially attractive price, Brookfield joined the bidding.

An Auction Defined by Complexity

The auction was challenging, spanning several rounds and requiring extensive due diligence. Brookfield’s private equity operations team visited every major manufacturing site across North America, Europe and Asia, reviewed 250 sourcing contracts and built its own bottom-up understanding of the business. As the auction progressed, the field quickly narrowed.

What ultimately differentiated Brookfield was its disciplined and efficient approach to diligence. We developed a detailed understanding of the business, began separation planning early in the process and assessed execution risks that emphasized minimizing disruption. Senior Brookfield leaders also met with nVent executives to outline the company’s investment philosophy, corporate carveout expertise and ownership rationale.

On August 1, 2024, Brookfield agreed to buy the business at an attractive price that reflected our ability to complete the complex carveout and subsequently implement a comprehensive value-creation plan. On January 30, 2025, Brookfield completed the sale and renamed the business Chemelex after a legacy brand it had used decades earlier.

"Brookfield’s private equity operations team visited every major manufacturing site across North America, Europe and Asia, reviewed 250 sourcing contracts and built its own bottom-up understanding of the business."

The Ecosystem Advantage

A critical differentiator throughout the auction was Brookfield’s Ecosystem. Rather than relying solely on third-party research into Chemelex and its products, the private equity investments team spoke directly with engineers, operators and purchasers across Brookfield’s real estate, infrastructure and renewable power businesses, as well as those platform’s customers.

The head of maintenance at Brookfield Place, for example, explained how heat-trace systems are typically embedded into building specifications, making it difficult and costly for owners to switch suppliers. An LNG pipe manager vouched for the durability and dependability of the Raychem brand. As he noted: What Kleenex is to tissues, Raychem is to heat trace.

Those conversations provided unfiltered insights and real world validation that strengthened conviction internally, allowing Brookfield to move decisively through the negotiations and submit a winning bid.

"Rather than relying solely on third-party research into Chemelex and its products, the private equity investments team spoke directly with engineers, operators and purchasers across Brookfield’s real estate, infrastructure and renewable power businesses."

Standing Up Chemelex

Closing the deal marked the start of an equally demanding phase: standing up Chemelex as an independent company. Brookfield addressed this challenge by implementing its established carveout playbook and internal bench of experienced executives, many of whom had worked previously at other Brookfield-owned companies.

A working group collaborated to make sure departments such as payroll, procurement, accounting, legal, information technology and human resources would be self-sustaining after the sale closed. The group also reviewed staffing to ensure the new company had the right people in place in the right numbers to keep operations running smoothly. Firewalls were established between buyer and seller, and hundreds of systems were disentangled to ensure continuity.

A transition services agreement, which remained in effect for a year after the sale closed, played a critical role throughout this process, specifying which services nVent would continue to provide after closing, for how long and at what cost.

This detailed standup plan helped establish Chemelex as a standalone company, with separation costs totaling approximately $60 million.

Operational Excellence and AI Innovation

Brookfield has an extensive track record of enhancing value through operational improvements, especially at its industrial assets. With its independence established, Chemelex quickly pivoted to value-creation opportunities, including:

- Installing a new executive team, including the CEO, CFO and head of IT

- Consolidating suppliers and re-bidding contracts

- Streamlining product lines

- Upgrading a manufacturing plant to reduce waste

The company also introduced artificial intelligence in two key manufacturing processes. For polymer blending, sensors now monitor ambient conditions in production plants, and an AI model analyzes the data to determine optimal equipment settings. To detect cable production line flaws, AI-enabled cameras have replaced manual inspections to cut costs and improve quality control.

Chemelex is also making plans to deploy an AI tool that will identify new construction projects around the globe and estimate their heat-trace requirements based on geography and climate, equipping the sales team with targeted insights when making customer calls.

Meaningful Results Pave the Road Ahead

In just over a year, the Chemelex value-creation plan has driven more than $30 million in annual EBITDA run-rate improvements, and a deep pipeline of additional initiatives is expected to enhance cash flows further.

Chemelex was once a three-times unloved noncore industrial asset. Now it’s a portfolio priority with a clear strategic vision that highlights Brookfield’s ability to find value and extract it through complex carveouts. Backed by Brookfield’s scale, resources and operational expertise, Chemelex is positioned to maintain leadership in traditional markets and pursue opportunities in emerging growth industries.

Disclosure

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, a solicitation of an offer to buy, or an advertisement for, any securities, related financial instruments or investment advisory services. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, “Brookfield”).

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield’s internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield’s perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.