Private Equity Outlook: Resilience, Reset and Resurgence

Tailwinds and megatrends are energizing the industry after a challenging period.

Key Themes for 2026

- Deal activity is accelerating, fueled by normalizing interest rates, attractive asset values in aging portfolios and corporate rationalizations.

- Consolidation is anticipated as the industry resets after a rapid expansion, with opportunities flowing primarily to managers with scale and operational discipline.

- Industrial companies requiring operational transformation offer great opportunity as deglobalization and digitalization—led by the artificial intelligence (AI) revolution—drive necessary productivity improvements.

To us, the year ahead can be summed up in three words: resilience, reset and resurgence. In this new era, operational expertise is the dominant driver of returns.

Resilience

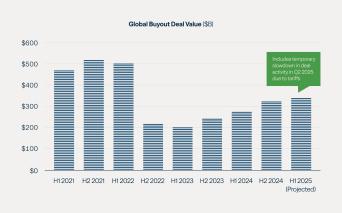

Private market deal activity is rebounding, with a noticeable recovery in buyout volumes seen through the first half of 2025 despite temporary tariff disruptions in the second quarter (see Figure 1). While deal values reached a peak in 2021–22 before dipping significantly, they are now back to more normalized levels and exceed values from 2018–19.

Figure 1: Deal Value Is Rebounding in Private Markets

Source: Bain & Company, 2025 Private Equity Midyear Report.

After expanding for a decade, private market transaction multiples have remained relatively flat for the past five years but have yet to show real capitulation. The industry as a whole has struggled with monetizing assets in recent years: Nearly one-third of all buyout capital is four or more years old, while the unrealized value of portfolios has climbed toward $3.5 trillion globally.1

This dynamic, along with additional potential rate cuts in the U.S. and Europe, points to higher deal activity in 2026. Portfolios can age for only so long before they must transact.

Owning Change in a Transforming World

This piece is included in our 2026 Investment Outlook Report, which is anchored by insights from the CEOs across our global platform.

Reset

Over the past decade, the private equity industry grew rapidly as managers used low-cost debt to buy assets and then benefited from market growth and expanding multiples to drive returns with limited margin improvements. This was an unsustainable trend. Many managers that purchased assets at elevated valuations several years ago are stuck holding businesses that now are worth less than what they paid, creating a supply of quality assets available at potential discounts.

The market is recalibrating after a decade of general partner proliferation. The number of firms has tripled relative to capital raised, creating a 3:1 imbalance between fundraising targets and available investor capital.2

In 2026, we see the industry beginning to reset, with the most scaled and operationally disciplined players thriving in an era of consolidation. We expect the next 24 to 36 months to mark the steepest phase of this consolidation, particularly among mid-market general partners with differentiated operating capabilities. As the industry shrinks, these capabilities will become the currency of survival, and the managers positioned to benefit most will share four traits:

- Scale to execute complex transactions

- Sector expertise for an informational edge

- Operating capabilities to drive post-acquisition value

- A focused, controllable thesis anchored in tangible performance levers

The new era is forcing managers to work harder and focus on margin expansion—not multiple expansion—to earn their returns. Brookfield Private Equity has historically employed this approach, with operational improvements accounting for over 50% of total value created.3

The math is unforgiving for managers continuing to rely on cheap leverage. For example, a transaction with a 5% interest rate and a 70% loan-to-value ratio would require 4–5% earnings growth to generate a 20% internal rate of return. But with today’s higher rates, a transaction with a 7.5% rate and 55% LTV ratio would require nearly twice the earnings growth—8.4%—to achieve the same 20% return.

In the new era of private equity investing, marginal deals that require financial engineering will underperform. Operational excellence is the new driver of returns.

Resurgence

Industrial Transformation

Sometimes compelling investment opportunities can hide in plain sight. Industrial companies are often overlooked and undervalued, not because their products are obsolete but because many have underinvested in modernization, capacity and operational capabilities. This leaves them less competitive despite strong underlying assets and market positions.

Private capital is increasingly required to transform these companies. Public market volatility is driving industrial management teams to pursue privatizing assets, recognizing that meaningful change requires a long-term outlook rather than quarter-over-quarter earnings scrutiny. Many large-scale conglomerates are rationalizing their noncore businesses, creating attractive buying opportunities for managers able to tackle complexity and drive change.

"Public market volatility is driving industrial management teams to pursue privatizing assets, recognizing that meaningful change requires a long-term outlook rather than quarter-over-quarter earnings scrutiny."

Beyond internal business strategies and pressure from outside investors, two unfolding global megatrends will drive this transformation in 2026—and likely for decades more.

The backbone of the global economy requires supply chain resilience. Yet events in recent years—Covid, geopolitical tensions and tariffs—have prompted industrial companies to seriously consider reshoring their essential manufacturing processes to avoid massive cost increases and disruption. This trend toward deglobalization offers private equity firms opportunities to provide the deep expertise and significant capital required to secure industrial company supply chains (see Figure 2).

Figure 2: Deglobalization Is Delivering Rapid Growth in the U.S.

Source: PwC, Strategy & Project Keystone Phase II: U.S. Manufacturing Activity Outlook, February 2025.

AI-led digitalization is the other megatrend reshaping businesses across the globe. For industrials, implementation is imperative. Unlike many pure technology companies, industrials often operate with legacy infrastructure, analog workflows and decentralized decision-making that add complexity to modernization efforts.

In our view, AI models will increasingly play an outsized role in transforming industrials, cutting costs, addressing labor shortages, innovating product lines and optimizing supply chains. This is not a plug-and-play exercise. It demands operational expertise, deep sector knowledge and the ability to redefine how work gets done.

Beyond the industrials sector, AI is creating opportunities in essential business services. In financial services, for example, AI is enhancing efficiency by automating underwriting, improving loss forecasting, and enhancing fraud detection and prevention. In financial infrastructure, banking platforms must transform their analog systems into new-age digital operations to remain competitive.

Productivity Potential

AI is poised to become the most impactful general-purpose technology in history, driven by the expected buildout of the necessary capital-intensive physical infrastructure to support its adoption and the efficiencies that result.

We anticipate that AI-led automation could lead to massive growth in global gross domestic product, potentially reaching over $10 trillion in economic productivity gains in the next decade.4 The companies that benefit from these gains won’t just be the technology platforms building the models but, importantly, the industrial and essential business services companies investing in automation and AI tools to accelerate their digital transformation.

Investing for Transformation

As capital markets continue to thaw, private equity opportunities are heating up and creating an optimistic outlook for 2026.

We expect to see significant activity in industrials, particularly in sub-sectors that are poised for AI-led digitalization such as specialized manufacturing. The critical need for supply-chain security and the unstoppable rise of AI drive industrial transformation, enhancing productivity and investor returns. We also see additional interest-rate cuts continuing to lower borrowing costs and accelerate deal activity, but likely among fewer managers as the industry consolidates.

For private equity, the age of financial engineering is over, and the defining go-forward narrative is operational excellence. Managers that are willing to roll up their sleeves, reimagine workflows and implement breakthrough technologies will be well positioned to capitalize on the opportunities ahead.

Endnotes

- Bain & Company, “2025 Global Private Equity Report,” March 2025. Figures are rounded.

- Bain & Company, “Leaning Into the Turbulence: Private Equity Midyear Report 2025,” June 2025.

- Prior performance is not indicative of future results and there can be no guarantee that the funds, future funds or their respective investments will achieve comparable results or be able to avoid losses.

- IDC, "The Business Opportunity of AI," November 2023.

Disclosures

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, a solicitation of an offer to buy, or an advertisement for, any securities, related financial instruments or investment advisory services. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, “Brookfield”).

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield’s internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield’s perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.

Explore More

Up Next for Industrials: An AI Transformation

Identify Value, Buy for Value, Create Value: A Private Equity Update