Office Update: A Flight to Quality Is Underway

Office is recovering, but we believe that recovery will be weighted toward the best office assets.

Executive Summary

- The office sector is undergoing a fundamental evolution as top global companies compete for the best talent in a tight labor market.

- These companies are seeking the highest quality and most sustainable buildings with modern amenities in prime locations. Office space with these characteristics can act as a catalyst to both retain and recruit talent.

- As a result, we are seeing increased bifurcation, globally, between these types of assets and lower quality properties.

Introduction

Two years after the start of the pandemic, the future of the office market continues to spur passionate debate.

Back in August 2020, we offered our take: that top-quality buildings in major urban centers with a “live, work, play” environment would fare much better than older office properties with high deferred capital expenditures or those in less desirable locations.1 In other words, demand would continue to be strong for the best quality office properties—and we have seen that trend play out.

Today, Green Street, a commercial real estate analytics firm, forecasts that office demand will decline approximately 15% due to flexible work.2 However, that forecast obscures the clear “flight to quality,” where the negative demand impact has skewed toward older, under-invested buildings—and strong demand has continued for high-quality space.

These office buildings can be new or recently renovated, and they tend to be filled with amenities and in gateway cities near transit hubs. For example, since the start of the pandemic, 84% of total leasing activity in midtown Manhattan has occurred in Class A or trophy assets, according to Cushman & Wakefield.3

84% of total leasing activity in midtown Manhattan has occurred in Class A or trophy assets.

We now see the difference between rents paid for top-tier space and low-quality space widening to record levels. As of February 2022, rents for the top 10% most expensive U.S. office buildings were 51% higher than the rest of the properties in their markets, according to data firm VTS.4 At Brookfield, we have seen similar trends in office markets around the world, including New York, Sydney, London, Seoul, Dubai, Shanghai, Berlin and Bangalore, a global tech hub in India.

Harvard Business Review

“Because employers are hard pressed to attract and retain talent—and to bring that talent onsite—the office of the future must be more inviting.

What does all this mean for city centers? Because they remain central to local transport networks, cultural activities, and high-quality entertainment, established city centers are the most natural location for the office of the future.”5

The Haves: Top-Quality Offices in Big Cities

We believe large global cities will continue to be the places where employers need to be to hire the best—and most diverse—talent in the world.

Given today’s tight labor market, it’s an access to labor issue for employers.

Technology companies are signing leases in world-class cities like New York, Shanghai, London and Berlin because that’s where the talent is.

Consider Facebook parent Meta, which increased its global employee headcount from around 58,000 at the end of 2020 to approximately 72,000 at the end of 2021, a year-over-year increase of 23%. In 2020, during the height of the pandemic, Meta signed a lease for 730,000 square feet in Manhattan—the largest New York office deal that year. Today, the company is forging ahead at the property, with employees expected to begin working there by the end of the year.

As growing companies expand their workforce and pay out top-tier wages, management teams often want these employees together, in person. Therefore, office owners need to create environments where employees want to be. Increasingly, that dynamic includes trophy office space with modern amenities, natural light, impressive views, clean air, sustainability credentials, and plenty of communal areas where people can interact. And we have found that tenants are willing to pay for it.

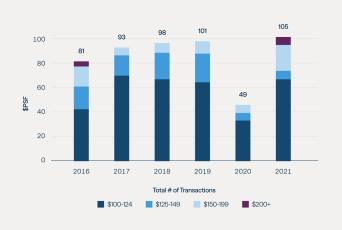

Figure 1: Tenants Are Undeterred By Price

$100+ Per-Square-Foot Transactions, 2016–2021

Source: CBRE Research. Data as of December 20, 2021.

In fact, CBRE reported in early 2022 that the high-end Manhattan office market—often new or renovated buildings with abundant amenities, modern building systems and easy access to public transportation—has rallied back to pre-pandemic norms. In 2021, 105 deals included a starting rent, priced per square foot, that was $100 or more (see Figure 1).6 While the amount of tenant-improvement allowances and free rent packages has increased, the number of $100 deals was up 114% from 2020 and 18% above the five-year historical average. Moreover, at Brookfield, our leasing team has seen a number of Midtown Manhattan deals exceed $200 per foot.

High-growth tech tenants are also showing up in many of the same cities looking for trophy office space.

Ruth Porat, Alphabet and Google CFO

“Google has been fortunate to call New York City home for more than 20 years, during which time we have grown to 12,000 employees. New York’s vitality, creativity and world-class talent are what keep us rooted here … It is why we continue investing in our offices around the world.”7

In 2021, Google announced the $2.1 billion acquisition of St. John’s Terminal, a recently renovated west side Manhattan office building it was already leasing. And the company is expanding in other cities as well.

In January 2022, Google announced it was increasing its investment in London by purchasing the Central Saint Giles development for £730 million. The company plans to refurbish the property, installing “new types of collaboration spaces for in-person teamwork, as well as creating more overall space to improve wellbeing.”8 Google’s investment in office effectively expands its U.K. capacity by 50%. With currently 6,400 employees in the U.K., Google will soon have capacity for 10,000 employees in the region.

It’s not just technology companies that are paying top-dollar rent for prime office space. In San Francisco, Citigroup is leaving its namesake tower downtown and relocating to a more expensive property at 1 Market Street.9 In New York, Chubb, a property and casualty insurance company, will relocate from its current headquarters near Times Square and lease 240,000 square feet as the anchor tenant at 550 Madison Avenue, a redeveloped trophy office property.10 Also in New York, Morgan Stanley signed a 15-year lease for roughly 400,000 square feet and will take additional space at Park Avenue Plaza, located at 55 East 52nd Street.11 Finally, in downtown Los Angeles, Adidas recently leased 107,000 square feet at California Market Center, a new office redevelopment owned by Brookfield.12

A Flight to Quality Office Properties

The Have-Nots: Lower Quality Spaces

“Welcome to the age of accelerated obsolescence,” the private markets publication PERE remarked in December 2021, “as more stringent ESG requirements and tenant demands have now rendered many properties no longer up to standard.”13

Most office assets require more capital than people might have underwritten five to 10 years ago. In turn, greater obsolescence risk has also led to a shrinking of the investable universe. For some of these Class B and C office assets, the money it would take to bring their buildings up to date—to modernize the elevators, overhaul the mechanical systems, complete a full facade reclad, and more—is just not worth it.

Instead, some will be converted to multifamily, some will be converted to life science assets, some will be converted to hotels, and some will be converted to industrial spaces. Others will continue to operate, but like zombies—attracting some tenants but struggling with chronic vacancy around 35%.

Conclusion

From a fundamental point of view, it’s important to remember that office buildings went into this pandemic-induced downturn highly leased—perhaps more than they ever had been. In the U.S., for example, roughly a decade of positive national net absorption followed the global financial crisis. And because many tenant companies made it through the pandemic without going bankrupt, they still have long-term leases, and are still paying their rent.

Of course, fully leased does not necessarily mean fully occupied, and some companies may come to decide they need less office space in the future. Then again, that would also suggest that the new office construction pipeline has likely peaked—and that, over time, this lack of new supply would increase demand for existing high-quality office properties.

Office is recovering, but we believe that recovery will be weighted toward the best office assets. These are exactly the types of assets that companies want to lease—and institutional investors, pension funds, and sovereign wealth funds would like to deploy their capital into.

Appendix

On The Ground: Manhattan

In December 2021, despite the negative sentiment resulting from the pandemic, two transactions occurred in New York City that highlight the strength of the investment market for high-quality assets.

The first is the redevelopment of One Madison Avenue. SL Green Realty Corp. sold a 25% interest to an unnamed institutional investor, who will commit at least $259.3 million of equity to the project.14 According to SL Green, “health and wellness is paramount to the building design”; in practical terms, this means the circulation of fresh air, oversize windows, lots of natural light and outdoor space.

The second is the sale of a 49% interest in One Manhattan West.15 A Brookfield-led group sold a 49% stake in a transaction that valued the 67-story, 2.1 million square foot office tower—which opened in 2019 and is now 94% leased—at $2.85 billion. Beyond the sale price, note that valuations for de-risked and cash-generating assets, like One Manhattan West, also benefit from the low-interest-rate environment.

In a city where roughly 90% of the office stock is more than 20 years old, these high-quality assets are the type we believe are best positioned going forward—both from a tenant demand and an investment sales standpoint.

Appendix

On The Ground: Sydney

In Sydney’s investment market, we’re seeing fierce competition for top-quartile assets—supported by, as the Australian Financial Review described in January 2022, “the weight of capital chasing long leases on quality buildings and the growing impact of environmental, social and governance considerations on investment decisions.”16

In 2021, one transaction that exemplified this flight to quality trend was 200 George Street. In July, Mirvac partnered with M&G Real Estate to buy the 50% of the property that it did not already own. The price was $575 million, which represented a 4.3% capitalization rate.

Another recent transaction demonstrates how the best office assets are attracting a significant bid in the investment market: the Darling Quarter office complex. Darling Quarter, which is leased to the Commonwealth Bank for the next 12 years, had a 50% stake marketed for sale by the Abu Dhabi Investment Authority, one of the asset’s two co-owners. In late January, according to the Australian Financial Review, a joint venture between Allianz Real Estate and the National Pension Service of Korea acquired the 50% stake.17 The purchase price was A$633 million, which represents a cap rate of less than 4%—a record low yield for the Australian office market.

Appendix

On The Ground: London

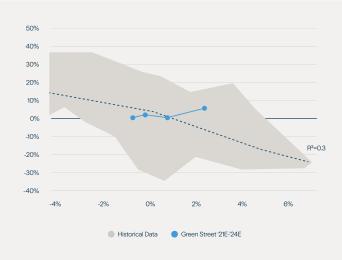

London provides another strong example of the office sector’s flight to quality. According to research produced by Green Street in September 2021, in Central London, prime office rents are “decoupling” from overall market vacancy rates (see Figure 2).18 In other words, even though occupancy levels declined during the pandemic, rental rates for prime properties went up.

Part of the explanation for this decoupling, according to Green Street, is that while the overall market availability rate in Central London hovers around 11%, the estimated figure for prime stock is likely somewhere between 5% and 9%.

In London, having new or renovated prime office space in gateway cities can be a competitive advantage to help attract talent. One example is Citigroup, which in January 2022 announced plans to transform its London headquarters, home to its Europe, Middle East and Africa operations.19 The company will completely refurbish 25 Canada Square, its 42-story office tower in London’s Canary Wharf district, that it had purchased for just over £1 billion in 2019. The refurbishment will place a greater emphasis on collaboration spaces and energy efficiency, alongside well-being zones for employees. The three-year undertaking is estimated to cost more than £100 million.

David Livingstone, Citigroup’s CEO for Europe, Middle East and Africa

“London’s position in Citi’s global framework and strategy is undiminished and is actually growing. It is a major project and a real commitment to the city and our staff. It will sort us out for the next 25 years … A tower in London is a valuable physical asset.”

Figure 2: London's Prime Office Rents ‘Decouple’ From Vacancy Rates

Quarterly Prime Headline Rent Growth vs. Vacancy Rate Change Since Preceding Quarter

Source: Green Street.

Appendix

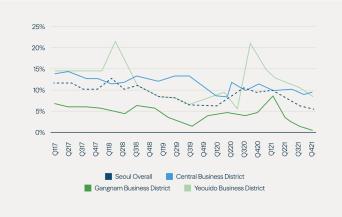

On The Ground: Seoul

Overall Grade A office vacancy continues to fall in Seoul. In a January 2022 report, Colliers remarks that the Seoul office market, which has been a tenant-favored market since 2010, has changed to a landlords’ market.20

Office demand is coming from the expansion of tech companies, including call center operators, as well as biopharmaceutical companies. As a result, the availability of rentable space is decreasing (see Figure 3).

Tech tenants continue to expand and are targeting all available prime grade office space. As it becomes difficult to find leasing options in the Gangnam business district, tech tenants are expanding to the central business district and the Yeouido business district.

Anecdotally, leasing activity last year at IFC Seoul, a mixed-use complex in the Yeouido business district owned by Brookfield and its partners, reflected these trends; in fact, office occupancy at IFC Seoul is now above 99%.

Figure 3: Class A Vacancy Rates Are Falling in Seoul

Grade A Vacancy Rates

Source: Colliers.

Appendix

On The Ground: Dubai

ICD Brookfield Place, equally owned by Brookfield and its partner, opened roughly two years ago and is a super-prime asset.

According to information tracked by CBRE, ICD Brookfield Place accounted for approximately 48% of new leases within the DIFC’s premier grade office buildings in 2021.22 Swiss luxury group Richemont is one example of a tenant who now leases space at ICD Brookfield Place.

Dubai average market rents continued to soften in 2021, according to CBRE. In fact, in 2021, Dubai average Class A rents in the central business district fell 0.1% year-over-year. Meanwhile, Dubai average Class B and C rents fell 4.4% and 6.8%, respectively, year-over-year.

Rents at ICD Brookfield Place, however, bucked this trend in 2021, increasing 5% year-over-year. Digging deeper, Dubai prime and Class A office rents are around $52.27 (AED 192) and $38.66 (AED 142) per square foot per year, respectively. Compare that with average ICD Brookfield Place rents, which are $69.42 (AED 255) per square foot. This means, in Dubai, not only are average ICD Brookfield Place rents 33% above prime office rents, they’re also 80% above Class A office rents.

Appendix

On The Ground: Bangalore

In India, technology companies continue to drive office demand. Indian IT multinational companies have been adding to their substantial headcounts—and this is expected to further create office demand.

Bangalore, for example, which is also known as Bengaluru, is the capital of India’s southern Karnataka state. It’s also the center of India’s high-tech industry. At Brookfield, we are seeing requests for proposals from tenants for significant footprints in this market—in total, almost 5 million square feet, with deliveries planned over the next two years.

Office vacancy levels are on the rise in Bangalore; however, as Savills remarks in a January 2022 report, “premium quality buildings in active micromarkets continue to be preferred by occupiers and have negligible vacancy.”21

This matches up with what Brookfield is seeing in other markets across India. Our assets have seen strong leasing with marquee tenants—for example, a 423,000 square foot lease with Mastercard at Bluegrass Pune, and a 377,000 square foot lease with Samsung at Candor Techspace N2—demonstrating the demand for high-quality, Grade-A institutional assets.

Endnotes:

- Brookfield, “The Future of the Office: Not What You Might Think, August 17, 2020

- Green Street, “U.S. Office Outlook,” January 13, 2022.

- Cushman & Wakefield, Q4 2021 Office Overview, January 2022

- Wall Street Journal, “Businesses Lease Trophy Space to Stoke Return to the Office,” Nov. 2, 2021

- Harvard Business Review, https://hbr.org/2022/01/why-companies-arent-cutting-back-on-office-space, January 25, 2022

- CBRE, “Strong Demand for Top-Quality Office Space Fuels Recovery of $100-per-sq.ft. Rental Market,” January 4, 2022

- Google, “Increasing Google’s investment in New York” September 21, 2022

- Google, “Increasing Google’s investment in the UK,” January 14, 2022

- The Real Deal, “Citigroup to leave longtime SF home, cut office footprint by half,” November 18, 2021

- Bloomberg, “Manhattan’s Former Sony Building Lands Chubb as Anchor Tenant,” November 18, 2021

- Bloomberg, “Morgan Stanley Bets on NYC With Lease for BlackRock Offices,” January 4, 2022

- Wall Street Journal, “Adidas Signs Downtown Los Angeles’s Biggest Office Lease in More Than a Year,” January 11, 2022

- PERE, “Deep Dive: Private real estate’s obsolescence problem,” December 6, 2021

- SL Green, “SL Green Announces Sale of 25 Percent Interest in One Madison Avenue,” December 6, 2021

- Wall Street Journal, “Blackstone Nears Deal Valuing Manhattan Office Tower at $2.85 Billion,” December 17, 2021

- Australian Financial Review, “Office tower trade set for record sales in 2022,” January 3, 2022

- Australian Financial Review, “Allianz fund buys Sydney office for $630m on record-low yield,” January 31, 2022.

- Green Street, “Office Insights: Same But Different,” September 9, 2021.

- Financial Times, “Citi plans £100m revamp of Canary Wharf tower,” January 26, 2022

- Colliers, “Transition to landlords’ market & lowest vacancy in Gangnam since 2010,” January 21, 2022

- Savills, “India Market Watch: Office Year-End 2021,” January 18, 2022

- According to CBRE, the competitive set for ICD Brookfield Place include five prime buildings in the Dubai International Financial Centre (DIFC), located in Dubai, UAE.

Disclosures

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, "Brookfield").

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield's internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield's perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.