Infrastructure Outlook: Accelerating Growth, Embedded Resilience

As the definition of infrastructure expands, supportive financial conditions and powerful secular trends are setting the stage for sustained growth.

Key Themes for 2026

- The infrastructure supercycle continues, fueled by the converging megatrends of digitalization, decarbonization and deglobalization—structural forces whose foundations have only strengthened.

- Artificial intelligence and data sovereignty are driving explosive demand for digital infrastructure and compute capacity, which has had a domino effect in driving the needs for power and supporting infrastructure.

- With rising institutional allocations to real assets, the sector stands at the center of the world’s largest investment cycle.

As we look toward 2026, the outlook for infrastructure is stronger than ever. The sector has delivered stable and growing results through every market cycle for decades, and it now stands at the intersection of powerful global forces—digitalization, decarbonization and deglobalization. Each is accelerating a structural investment cycle that is expanding in both scope and scale as institutional allocations to the asset class rise, providing the funding that will build out the backbone of the global economy.

An Infrastructure Supercycle

Global infrastructure investment needs are expected to exceed $100 trillion by 2040,¹ as the definition of infrastructure expands beyond traditional power and transport systems into the digital and industrial ecosystems that will underpin the next era of global productivity.

Transaction activity has increased in 2025, and we expect that momentum to continue into 2026. At the same time, many assets—from regulated utilities to contracted digital networks—benefit from inflation-indexed revenue streams that preserve real returns and continue to attract investor capital.

Owning Change in a Transforming World

This piece is included in our 2026 Investment Outlook Report, which is anchored by insights from the CEOs across our global platform.

The AI Revolution

AI is emerging as the next general-purpose technology, much like electricity or the internet before it. Its impact will span all sectors of the economy and demand unprecedented levels of supporting infrastructure.

Artificial general intelligence could unlock as much as $10 trillion in productivity gains over the next decade, but will require $7 trillion of infrastructure investment across the AI value chain² to realize its potential. This includes opportunities in data centers—or “AI factories”—dedicated power generation, compute infrastructure such as GPUs, and strategic adjacencies like semiconductor manufacturing and fiber networks.

The advent of AI has created a step change in infrastructure growth, with demand for data centers, fiber networks and utility-scale power grids far exceeding initial expectations.

Digital infrastructure is capital intensive by nature. Building a hyperscale data center requires over $10 million per megawatt, while the compute infrastructure within it can exceed $30 million per megawatt—driven by chip requirements.

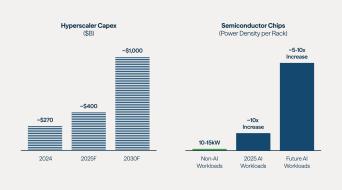

Despite global hyperscale capital expenditure projected to rise 50% between 2024 and 2025 (see Figure 1), more is required. AI workloads now consume up to 10 times more power per rack than conventional compute, with expectations of another five-to-tenfold increase as rack density increases.³ With sovereign governments facing record debt levels and large tech firms seeking to team with well-capitalized partners, there is a tremendous opportunity to formulate innovative capital partnerships to meet these capital needs and deliver the essential infrastructure to meet demand.

"AI is accelerating the need for data centers, fiber networks and modern power infrastructure—creating an entirely new class of investment opportunities."

Rewiring Supply Chains

Parallel to these technological shifts, deglobalization is redrawing the geography of economic activity. What began as a movement to reshore strategic industries has evolved into a systemic restructuring of energy, manufacturing and logistics ecosystems.

Governments and corporates alike are prioritizing supply chain resilience, energy security and technological sovereignty. In the U.S. and Western Europe, industrial policies are accelerating the repatriation of semiconductor, pharmaceutical and advanced manufacturing capacity, supported by trillions of dollars of public and private capital.

As a result, long-term investors with scale capital are uniquely positioned to capture the most attractive opportunities centered on the reshoring of critical and advanced manufacturing platforms, structured through long-term, infrastructure-style contracts that provide stable returns. This includes semiconductor fabrication, battery and robotics manufacturing, and other sectors underpinning technological sovereignty.

The opportunity extends across full supply chains—encompassing specialized processing, logistics, midstream and energy inputs, and industrial sites linked to AI and reindustrialization. The U.S. remains the deepest near-term market, followed by Western Europe and select Asia-Pacific economies. In each region, large-scale partnerships with corporates and sovereigns are becoming the preferred model to deliver capital efficiently and at speed.

Figure 1: Hyperscale Capex Soars

Source: Actual 2024 and forecasted 2025 annual capital expenditures for six hyperscale companies, based on publicly available disclosures. IoT Analytics, November 2025; Nvidia.

Meeting Power Needs

The rise of AI and electrification is intensifying the need to generate and transport energy. Electricity demand is climbing sharply across all regions, driven by both digitalization and the onshoring of manufacturing, while existing transmission infrastructure struggles to keep pace.

More than 70% of transmission lines are over 25 years old, with interconnection queues for new renewable projects stretching close to a decade.4 Analysts estimate that annual grid investment will need to exceed $600 billion by 2030 to replace aging assets,5 integrate renewable generation and ensure reliability. Hence, the need to “debottleneck" the grid has become a defining investment theme, creating opportunities for large-scale partnerships and private capital solutions across the energy value chain.

We are finding that the strongest opportunities lie in grid modernization and transmission upgrades to relieve interconnection backlogs, alongside utility-led capex programs that offer regulated, inflation-linked returns. An “any-and- all” approach to baseload generation—combining natural gas and nuclear with onshore wind, solar and storage—will be vital to meeting reliability needs. At the same time, behind-the-meter generation for data centers and industrial users is emerging as a key enabler, shortening time-to-power and bypassing grid bottlenecks while linking directly to the digital infrastructure buildout.

Resilient Performance

Independent of geopolitical or macroeconomic uncertainty, infrastructure investments are inherently built to weather market cycles. The sector’s resilience stems from its core characteristics: perpetual, long-lived assets with high barriers to entry; contracted or regulated revenue streams that are typically indexed to inflation; and stable, predictable cash yields with low correlation to public markets.

These structural features provide inflation protection and steady performance across environments. While short-term frictions may arise, they do not alter the fundamental trajectory of growth. The essential and enduring nature of infrastructure underpins its strength through periods of cyclical volatility.

Building for Global Growth

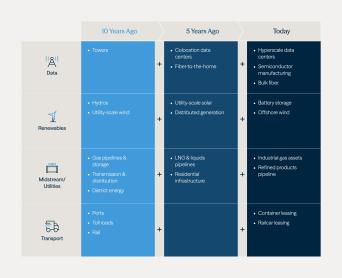

We believe that supportive financial conditions and accelerating secular themes are positioning the global infrastructure sector for enduring growth. The AI buildout cannot occur without clean, reliable power, grid modernization cannot proceed without private capital, and the reindustrialization of economies cannot succeed without the digital and energy infrastructure to support it. This convergence is creating a once-in-a-generation opportunity for disciplined, long-term investors to fund the physical backbone of the global economy’s next phase (see Figure 2).

Across the power, data and manufacturing ecosystems, the scale of required capital far exceeds what corporates and sovereigns can fund alone. This dynamic is driving a wave of large-scale partnerships, joint ventures and privatizations, as governments and hyperscalers seek off-balance-sheet solutions. These collaborations are enabling the rapid delivery of essential infrastructure—from sovereign compute facilities and AI ecosystems to behind-the-meter generation and next-generation manufacturing capacity.

Taken together, the sector’s resilience, rising allocations and deepening strategic relevance underscore an outlook that has rarely been more constructive. As we enter 2026, it’s clear that the Three Ds are no longer separate megatrends, they are the converging foundation of global growth, defining the opportunity set for the decade ahead.

Figure 2: The Evolving Infrastructure Opportunity Set

Endnotes

- McKinsey & Company, “The Infrastructure Moment,” September 2025.

- Brookfield internal research.

- Actual 2024 and forecasted 2025 annual capital expenditures for six hyperscale companies, based on publicly available disclosures; IoT Analytics, November 2025.

- U.S. Department of Energy, “What does it take to modernize the U.S. electric grid?” October 2023; Lawrence Berkeley National Laboratory, “Queued Up: 2024 Edition,” April 2024.

- IEA, "Electricity Grids and Secure Energy Transitions," October 2023.

Disclosures

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, a solicitation of an offer to buy, or an advertisement for, any securities, related financial instruments or investment advisory services. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, “Brookfield”).

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield’s internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield’s perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.