Real Estate Outlook: Investing Through the Next Cycle

The recovery is underway, with an active credit market supporting a rise in transactions.

In this video, Real Estate CEO Lowell Baron joins our global real estate leadership team to discuss the year ahead—what we’re seeing on the ground, where fundamentals are strong, where caution is warranted, and the opportunities we see to acquire and operate assets across real estate sectors around the world.

Key Themes for 2026

- Financing markets are normalizing, with renewed liquidity enabling price discovery and reactivating deal flow. We have already seen significant opportunities to execute attractive investments, and realize quality de-risked assets and operating platforms.

- Success in real estate investing will depend on selectivity and getting results from operational value creation as the asset class recovers.

- Areas of focus include housing, logistics and data centers, and hospitality across the equity and credit portions of the capital stack.

If 2025 was the year the real estate market reopened, 2026 will be the year savvy investors can shift fully into tactical mode to find even more attractive opportunities in which to invest and monetize high-quality assets as liquidity rebounds. As the turbulence that defined the early part of the decade subsides, price discovery has resumed and liquidity is returning.

With the recovery underway, it is important to remember that real estate has been here before. Real estate is a large, mature asset class that has delivered strong long-term performance across market cycles, providing stable returns in volatile or inflationary periods. To that end, nearly three-quarters of global respondents in a September Deloitte survey expect to increase their allocations to real estate assets over the next 12–18 months, with more than one-third doing so as a potential hedge against inflation.1

Liquidity Returns

The backbone of any real estate cycle is credit. And after nearly two years of restricted financing and elevated rates that constrained transactions, the tide is turning.

The reopening of the credit markets is a plus for both borrowers and lenders. In the U.S., commercial mortgage-backed securities issuance has accelerated sharply, with 2025 volumes on track to exceed $120 billion, the highest level since 2007, and origination activity is up year over year across almost every real estate sector.2 In other major markets, similar trends are unfolding as central banks pursue measured rate cuts and capital gradually reenters the system. Brookfield sees this liquidity in its own real estate business, with nearly $5 billion in originations on the credit side, and about $40 billion in financings completed on the equity side through November 2025.3

While liquidity is broadly returning to the market, that liquidity remains uneven. Many real estate assets and managers continue to face stress—with declining fundraising volumes and lower DPIs, together with debt and fund maturities. This is creating opportunities for scaled and well-capitalized investors to partner with small and midsized GPs to help recapitalize high-quality, de-risked real estate assets.

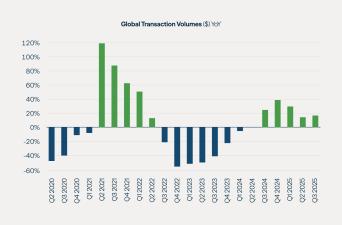

The reemergence of credit is critical, enabling capital to flow again. Transaction volumes have already rebounded, signaling renewed confidence (see Figure 1). We note that certain sectors are particularly well positioned to benefit from the convergence of strong fundamentals and areas of dislocation, thereby producing attractive opportunities in the year ahead: housing, logistics and data centers, and hospitality.

Figure 1: Deal Flow Rebounds

Source: JLL, November 2025. Data as of Q2 2025.

Housing

Housing represents one of the most compelling long-term investment themes we see around the world, with powerful demographic trends driving our investment focus.

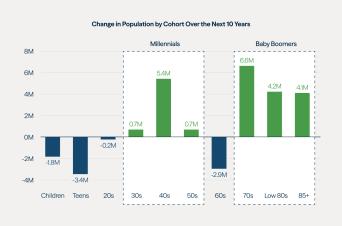

In the U.S., demand is being shaped by millennials and baby boomers, who together account for a substantial share of the population (see Figure 2). For millennials, affordability remains a core challenge. Home prices have risen 87% since 2016, and elevated interest rates further limit ownership, fueling demand for rentals and affordable alternatives such as manufactured housing. Manufactured homes, which cost roughly 30% less to own than traditional single-family houses, have seen virtually no new supply in the past decade and continue to demonstrate strong NOI resilience and sticky occupancy.4

At the other end of the spectrum, an aging population is driving a nationwide shortage in senior housing. More than 15 million baby boomers are expected to enter the 70–85 age group in the next five years alone. And supply is lagging after years of underdevelopment. By 2030, new inventory is expected to meet less than one-third of projected demand. Communities offering a full continuum of care, including independent living, assisted living and memory care, are particularly well positioned, though they require greater operational sophistication to support residents as their needs evolve. Managers with expertise and experience in complex operating models and improving resident experience will be best positioned to capture the wave of double-digit NOI growth predicted over the next several years.

Figure 2: Generational Drivers Across America's Housing

Source: John Burns, June 2025.

In Europe, rental demand is rising as renting becomes a permanent lifestyle choice for many households. Since 2010, the growth rate of rental housing has outpaced home ownership by 20 percentage points, and the region’s housing stock is among the oldest and least institutionalized in the world.5 In the U.K., more than 80% of homes are more than 50 years old, and only 2% of rentals are institutionally managed—compared with 41% in the U.S.6

Meanwhile, housing supply is at record lows. Land scarcity, labor shortages, longer planning cycles and weaker project economics have driven a 70% drop in new housing starts in the U.K. since 2022.7

These conditions create compelling opportunities to acquire, create and expand platforms, and institutionalize fragmented market segments across the housing spectrum.

Moving to the Asia-Pacific region, institutional rental housing is in the early stages across many countries. India stands out, with significant population growth and the projected migration of 350 million people to cities by 2050, one of the largest urban shifts in history.8 As India’s working and middle class continues to grow and urbanize, there is a deep opportunity to provide institutional-quality rental housing in a country where roughly 70% of rental housing remains informally managed.9

Owning Change in a Transforming World

This piece is included in our 2026 Investment Outlook Report, which is anchored by insights from the CEOs across our global platform.

Logistics and Data Centers

The same forces reshaping the global economy—technology, trade and power—are turning logistics and data centers into some of the most compelling real estate opportunities today. Digital infrastructure demand is redefining land valuations.

Companies are rethinking where they manufacture, store and distribute goods in light of geopolitical volatility. Regionalization defines the landscape. We are seeing distinct trade clusters emerging across the Americas, Europe and Asia Pacific, with each developing its own ecosystem. Intra-Asia-Pacific trade has surged since 2019—with container volumes rising 13% in 2024 alone—as production and consumption grow more interconnected.10 In some markets in the region, modernization is skipping legacy models altogether—adopting AI-driven fulfillment and multilevel distribution at scale.

In data centers, it’s no longer just about location—it’s about the ability to tap into affordable, sustainable power. Reliable energy access now determines where and how quickly new capacity can be built. We are also seeing industrial land intended for warehouses becoming data centers. There is increasing demand for converting high-quality industrial and business parks around the world into sites for AI factories, where development margins and land value upside are significantly greater. In a recent transaction, we sold a logistics parcel to a buyer seeking power access and land for their data center campus expansion, leading to a sale at pricing 1.5 times the logistics land valuation.11

Experience, operating capabilities and relationships tie everything together. Partnerships with utilities secure grid access, and cooperation with governments helps unlock incentives and approvals. And long-term leases with top-quality clients create stable cash flows built on reliability, speed and trust. Logistics operators who deliver consistently for clients can become these companies’ partner of choice across markets.

"The same forces reshaping the global economy—technology, trade and power—are turning logistics and data centers into some of the most compelling real estate opportunities today."

Hospitality

Around the world, certain hospitality markets have evolved beyond post-pandemic recovery into a stage of sustained growth. Record tourism volume, coupled with limited new supply, is driving up RevPARs and supporting favorable dynamics.

Asia-Pacific hospitality represents a highlight within the sector. Japan, for example, has seen a fourfold increase in tourist arrivals over the past 15 years. Travel spending in the region as a whole is projected to grow at an 8.9% CAGR from 2025 to 2030, and yet Asia Pacific remains significantly undersupplied—hotel density relative to population remains far below that of the U.S.12

In Europe, luxury travel is accelerating, reinforcing pricing power for best-in-class assets. While the European hotel market is larger than the U.S. by room count, it remains highly fragmented, with low brand penetration and roughly 80% of assets in private hands.13 That creates opportunities for consolidation-led value creation. Moreover, liquidity constraints and rising construction costs have led many owners to defer refurbishments, resulting in a significant capex backlog of undercapitalized assets and creating compelling value-add entry points for investors.

In this environment, high-quality assets in markets with high barriers to entry and supply constraints will only become more valuable.

Open for Business

As we enter 2026, credit is flowing, liquidity is returning and investors are recalibrating strategies for a commercial real estate market that is increasingly open for business.

As a result, disciplined, selective investors are presented with opportunities to deploy capital into some of the best assets, businesses and management teams, in some of the most exciting geographies and sectors—opportunities that simply are not often available.

These assets benefit from experienced owner-operators who drive value creation through thoughtful, hands-on business plans. Deals are made at entry and measured at exit, but much of the value of a successful investment is earned during the hold period.

In other words, operations matter—especially as we enter the next phase of the real estate cycle.

Endnotes

- Deloitte, “2026 Commercial Real Estate Outlook,” September 2025.

- Trepp, October 2025.

- Brookfield internal data, as of November 2025.

- CoStar, 2024; Green Street, 2024 & 2025.

- John Burns, 2025.

- M&G Real Estate based on Eurostat, March 2025; Syswov, March 2025. Data based on 11 Continental European markets.

- European Commission Joint Research Centre Data Catalogue, 2023.

- Savills, Q2 2025; UBS, March 2025; British Property Federation, May 2025.

- Global Change Data Lab, “Our World in Data,” 2024.

- Alphaliner, “Notable Container Shipping News: September 2025,” October 7, 2025.

- Prior performance is not indicative of future results and there can be no guarantee that the funds, future funds or their respective investments will achieve comparable results or be able to avoid losses.

- Statista, 2025; Euromonitor, 2024.

- Savills, Q2 2025.

Disclosures

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, a solicitation of an offer to buy, or an advertisement for, any securities, related financial instruments or investment advisory services. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, “Brookfield”).

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield’s internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield’s perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.