Q&A: It’s Prime Time for Prime Real Estate in 2024

Our real estate leaders share their on-the-ground insights on local markets across the globe.

To grasp where global real estate markets are headed in 2024, you need to go beyond the broad headlines. The reality is much more nuanced and requires an understanding of local market dynamics around the globe.

Lowell Baron, President and Chief Investment Officer, recently sat down with our Real Estate team’s three regional heads: Ben Brown for the Americas, Ankur Gupta for Asia Pacific and the Middle East, and Brad Hyler for Europe. They shared their on-the-ground insights—informed by our experience owning and operating nearly $300 billion of real estate assets globally.

Lowell Baron: What is the macro environment you are each seeing across your regions and how is that impacting real estate?

Ben Brown: I think the acknowledgment that rates have likely peaked is a reason for optimism. Although the pace of potential cuts remains uncertain, it’s a potentially healthy fundamental backdrop for real estate in the Americas. And depending on that pace and the rising odds of a soft landing, you could see some real potential. Still, that's moderated by how quickly the debt capital markets come back to real estate sectors in a meaningful way.

Ankur Gupta: In Asia, following the pandemic, we did not see the same monetary easing and subsequent inflation that some other Western economies saw. And as a result, the region’s economies today are stronger than they might have been over the last decade.

What that means for real estate investing is that we have a backdrop of global dislocation in capital markets, but at the same time, most of the economies are doing really well. With Japan, China, India and other Asia Pacific emerging economies contributing roughly half of global GDP, the region is an important economic driver.

We’re fortunate to have created local platforms and an operating presence in the region that can take advantage of growth and value dislocation.

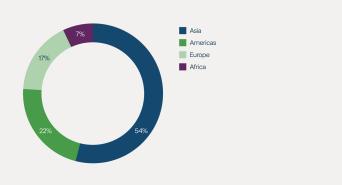

Figure 1: % Share of 2023 Global GDP

Source: World Economics, March 2024.

Brad Hyler: In Europe, growth is relatively anemic, with some variation across the continent. But markets held up better last year than most expected, with employment remaining resilient. And when employment is strong, real estate demand is generally healthy, particularly for higher-quality assets. Supply is structurally constrained in Europe, so we still see pretty healthy fundamentals in most subsectors.

We think interest rates have also pretty much peaked. But clearly, the absolute change in rates relative to how low they were previously has roiled the capital markets. Combined with strong real estate fundamentals, that’s creating interesting opportunities and far more activity ahead in 2024.

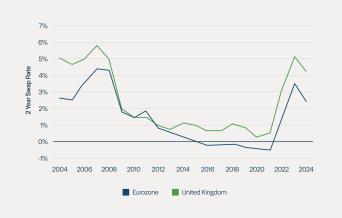

Figure 2: Europe & U.K. Interest Rates

Source: Oxford Economics, January 2024.

Baron: How are we sourcing investments differently now than in past cycles?

Hyler: The vast majority of opportunities we're looking at today are on a direct basis, through bilateral conversations with owners or businesses that need capital. Negotiating bespoke structures can be quite complicated. But we think it can help us come in at very attractive valuations and provide capital where it's needed. We have long monitored many of these situations, and we're well positioned when a catalyst creates an opening.

Speed, certainty and deliverability of capital are going to be critical in this environment. Counterparties want to know that the investor or capital provider they're speaking to can follow through on their promises.

Gupta: Past cycles show that higher quality assets tend to transact earlier. With our understanding of such assets’ operating characteristics, we have strong conviction that this will continue to be the case. The time for motivated sellers to act is coming sooner than later.

Baron: How does underwriting change in today’s environment?

Brown: The key point today is this: You have to buy cash-flowing businesses and cash-flowing assets. That leads to much higher unlevered IRRs (internal rates of return), far more return from cash flow and less from capital appreciation or yield compression. So, among underwriting inputs, you have to think about capitalization, which in most markets is still pretty muted. When debt is available, it's more of a cost construct, and that feeds into your underwriting.

Hyler: As rates stabilize, it gives us more certainty in how we underwrite our financing assumptions. And given where assets are repricing, we can still obtain accretive leverage, particularly in Europe where rates are somewhat lower.

Baron: What parts of Asia Pacific are you most excited about?

Gupta: Asia Pacific is really a super-region with diverse economies, but now we’re seeing great opportunities across the board. Equity capital for real estate is at a premium, which has given us an opportunity to explore high-conviction markets and sectors.

In the region, we’ve typically invested in high-quality science & innovation-led assets. But over the past few years, we’ve been able to increase our footprint in the hospitality sector, which has benefited from urbanization and foreign arrivals.

China is a good example. For decades, investors have sat on the sidelines looking for a good entry point into that market. The current dislocation from the homebuilder stress in the country provides opportunities to buy fantastic assets, certainly in industrial manufacturing and warehousing—China’s top growth sectors.

Further east, markets in Korea are fundamentally strong but have felt the most direct impact from the Western capital markets volatility. Equity is limited for good-quality projects with undercapitalized sponsors, creating an attractive window for us to transact.

Baron: In the U.S., what are some of our high-conviction sectors?

Brown: We are focused on sectors with a good macro backdrop, tailwinds and barriers to entry in terms of supply.

Take housing as an example. The U.S. has a structural undersupply, and a soft landing would strengthen consumers, households and home prices—but the cost to build new homes keeps rising. We like housing in all forms.

For logistics, we expect to see continuing e-commerce penetration. Changing consumer preferences are hard to quantify but could keep generating tailwinds. I don’t think consumers will stop expecting their goods and services to be available on demand.

The potential for science and technology in North America centers on onshoring or reshoring biomanufacturing. Life sciences will continue to benefit from strong demand tailwinds.

Baron: Turning to Europe, where are we focusing our attention there?

Hyler: We are evaluating sectors in several markets that traditionally were quite core and low yielding, such as multifamily in Germany and the Nordics. But now, yields and prices have reset, interest rates are generally higher and many business owners are stressed. We’re focusing more on where we can structure acquisitions of core assets at opportunistic pricing.

Slightly more on the growth side is the science & innovation space, which we expect to be quite active over the next few years. This is a relatively mature sector in the U.K., but in Western Europe it's more nascent.

Hospitality is another area of focus. Ben mentioned changing consumer preferences, and we see that in the desire for more flexibility in how people work and travel, often blending business and leisure. This has really benefited hospitality, but there's still some pandemic overhang.

Many owners were able to operate through the pandemic by preserving cash flow and often borrowing or taking on additional leverage. That debt is now coming due at higher rates or rolling off to higher rates, while owners need investment capital. So, a backlog has been building, and we're seeing more situational stress in hotels. We think current travel trends will persist and we see opportunities emerging in the hotel market.

Baron: So overall, what we’re seeing on the ground is that the interplay between the still-stressed capital markets and strong real estate fundamentals is creating opportunities across regions and sectors. While some investors may be concerned about the real estate cycle or coming debt maturities, we believe these are what create great opportunities. This dynamic requires forward-thinking capital to seize the moments you wouldn’t want to miss as a real estate investor.

Disclosures

The commentary and information contained in this paper is for educational and informational purposes only and does not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments offered or sponsored by Brookfield Corporation, Brookfield Asset Management Ltd. and/or their respective affiliates (together, "Brookfield"), and under no circumstances is this paper to be construed as a prospectus, product disclosure statement or an advertisement. In addition, the information set forth herein does not purport to be complete. Any offer to invest in a private fund sponsored by Brookfield will be made only to qualified investors and only by means of such fund's offering materials, which contain risk disclosures that are important to any investment decision regarding such fund and is subject to the terms and conditions contained therein.

This paper includes live and extemporaneous statements by certain Brookfield employees that reflect their personal views on various matters, including broad market, industry or sector trends, other general economic or market conditions and forward-looking statements, and should not be construed as the views of Brookfield in general or relied on as a promise or guarantee that the views expressed will prove to be accurate. Nothing contained therein should be deemed to be a prediction or projection of future performance of, or provide an overview of the terms applicable to, any investment, fund or program managed by Brookfield.

Past performance is no guarantee of future results. An investment in any security is speculative and involves significant risks, including loss of the entire investment. Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.

©2024 Brookfield Corporation