Credit Outlook: Discipline Is an All-Weather Strategy

Continued investor appetite for private credit underscores confidence in the asset class.

Key Themes for 2026

- Private credit’s growth is accelerating in areas such as infrastructure, real estate and asset-based finance, as the asset class continues to mature.

- We see the potential for return dispersion to rise as investment results could increasingly depend on borrower, sector, collateral and structural differentiation.

- Disciplined underwriting focused on asset quality and credit fundamentals is essential in identifying attractive investment opportunities.

Heading into 2026, credit markets are demonstrating signs of both resilience and restraint. After several years of elevated base rates and tightening financial conditions, spreads across public and private credit are compressing. Yet credit fundamentals remain broadly sound, and continued investor appetite for private credit underscores confidence in the asset class and its role in diversified portfolios.

Navigating Market Noise

Credit remains attractive across liquid and private markets, but investors should continue to be discerning in the year ahead. In an environment where capital is plentiful and spreads have tightened, disciplined underwriting anchored in credit fundamentals and risk management is as important as ever. Despite recent headlines around isolated credit stress in private credit and loans on bank balance sheets, we do not see evidence of a systemic wave of defaults.

Nevertheless, these defaults serve as an important reminder that credit investors should be focused on downside mitigation and capital preservation. When liquidity is abundant, discipline and skills of experienced investors become paramount in mitigating default risk.

At the same time, credit investors view periods of market volatility as windows of opportunity. They provide moments of repricing and dislocation, where disciplined capital can be deployed on favorable terms. Managers with dry powder and flexibility can position themselves to be a provider of stability—and liquidity—when others pull back.

Owning Change in a Transforming World

This piece is included in our 2026 Investment Outlook Report, which is anchored by insights from the CEOs across our global platform.

Real Estate Credit: Liquidity Unlocked

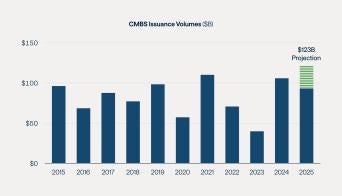

Current conditions create a favorable setup for higher-yield deployment. For example, real estate credit markets are experiencing recent record liquidity and rising transaction volumes, with 2025 CMBS issuance on pace to exceed $120 billion (see Figure 1), the highest since 2007.

CMBS serves as a key barometer of private real estate credit, and today’s issuance momentum reflects renewed market depth. And, following a meaningful value reset, real estate equity valuations remain about 17% below prior peaks,1 creating a tailwind for attractive valuations with a deeply insulated entry point into the capital stack for credit investors. In addition, roughly $1.9 trillion of loans will mature over the next two years, while 2025-originated loans are priced about 150 basis points higher than those maturing in that window.2

Figure 1: Real Estate Runs on Credit and Markets Are Experiencing Recent Record Liquidity

Source: Trepp, September 2025.

Amid this backdrop, alternative lenders and insurers are gaining share in the $8+ trillion commercial mortgage market. Meanwhile, bank loan originations are rising in comparison to a pullback witnessed in recent years, but banks’ focus has shifted to becoming larger providers of back leverage and working with private lenders through co-origination platforms, strategies that operate alongside and enhance the offerings of alternative lenders. With banks holding nearly twice the market share they do in the U.S., Europe offers compelling opportunities for alternative lenders as the market evolves, especially in the senior part of the capital stack.

Housing remains a high-conviction sector, supported by deep structural undersupply with about four million homes needed in the U.S., and housing completions down 22% year-over-year.3 Opportunities such as office-to-residential conversions and homebuilder financing directly address sustained demand, offering investors differentiated, high-yield exposure in select markets.

We also see selective tactical upside in the office sector, with values 40% below 2022 post-Covid peaks, prime assets commanding 15% premiums, and limited new supply, creating favorable dynamics for lenders seeking exposure to a sector with quickly improving fundamentals and attractive credit metrics. While real estate is a highly diverse sector that requires building-by-building and neighborhood-level diligence, today’s backdrop presents one of the most attractive environments in over a decade for disciplined real estate credit deployment.

"Real estate credit markets are experiencing recent record liquidity and rising transaction volumes, with 2025 CMBS issuance on pace to exceed $120 billion, the highest since 2007."

Infrastructure Debt: Outsized Opportunities

The outlook for infrastructure remains strong. Lower borrowing costs are improving refinancing conditions and transaction activity. Moderate inflation also remains a tailwind for the sector. Because many infrastructure assets can pass through inflation in their pricing and maintain steady demand, they tend to preserve their real (inflation-adjusted) returns better than many other types of investments.

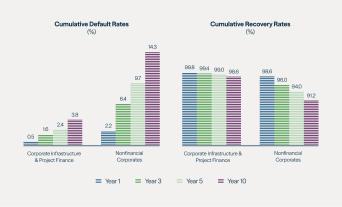

Infrastructure continues to demonstrate the defensive qualities of essential businesses with high barriers to entry and predictable cash flows with embedded inflation protections. These qualities naturally translate into low defaults and high recovery rates (see Figure 2). By focusing on proven operating assets with long-term contracted cash flows and avoiding areas such as untested technologies or large and complex construction risk, investors can preserve downside protection. Infrastructure private credit also provides effective portfolio diversification into essential non-cyclical sectors and is generally not well represented by public market high-yield issuances. In the current environment, infrastructure debt also offers compelling cash yields, providing resilient income and attractive risk-adjusted returns—an enduring advantage as markets navigate a shifting macro environment.

Looking ahead, a defining growth driver will be the financing of digital and energy infrastructure, particularly AI-related data centers that are supported by strong counterparties and long-term contracts, and which require massive investments in power, cooling and compute capacity. With global AI infrastructure needs estimated to exceed $7 trillion over the next decade,4 investors can capture durable, inflation-resilient yields through infrastructure debt.

Figure 2: Strong Underlying Assets Can Result in Lower Defaults and Higher Recoveries

Source: Moody’s Infrastructure Default and Recovery Rates, 1983-2022.

Non-financial corporates represent loans to parent corporations, not supported by a specific collateral pool of assets.

Corporate Credit: Quality Over Quantity

Issuance in both leveraged finance and investment grade markets has been driven by refinancings and repricings. Credit spreads across public and private markets remain near historical tights, relative to the last 15+ years, but the ~150 basis-point premium5 on direct lending private debt remains accessible—underscoring ongoing investor demand for illiquidity compensation even as competition intensifies.

Default rates across direct lending and high yield were in line with historical averages in 2024 and 2025—well below global financial crisis and Covid peak default rates. In contrast, broadly syndicated loan defaults became elevated in that same period. While we still view direct lending as attractive on a relative basis, we are exercising significant caution in this environment with disciplined credit selection.

Our outlook for corporate credit is guided by a sharper distinction between sub-investment grade direct lending and private investment-grade credit, with the latter offering particularly attractive risk-adjusted returns through exposure to credit-worthy highgrade borrowers seeking private market flexibility. We currently expect that capital to increasingly flow toward these higher credit-quality strategies as investors look to generate incremental spread while maintaining—or even improving—their risk profile.

ABF: Positioning for What’s Next

The asset-based finance landscape is entering a period of renewed market focus that could unlock compelling opportunities. Within the consumer segment, tighter underwriting standards are expected as lenders respond to evolving credit conditions as well as investor and regulatory scrutiny. The resulting portfolios will likely exhibit stronger credit fundamentals, lower delinquency rates and healthier excess spread profiles. This environment favors platforms that emphasize disciplined, data-driven underwriting, deep fundamental analysis, rigorous servicing oversight and selective capital deployment into higher-quality assets.

At the same time, prospective easing in interest rates could catalyze renewed activity in mortgage markets. Lower borrowing costs will likely drive higher lending volumes and greater transaction velocity across housing markets. Strategic mortgage platforms with integrated verticals combining origination, securitization and asset management stand to benefit from operating leverage and diversified revenue streams. These end-to-end models can capture value across the mortgage lifecycle, from loan production to secondary market activities.

We remain focused on identifying attractive credit opportunities under all market conditions but are also cognizant that dislocations often create value-driven entry points for sophisticated asset managers. Firms with deep expertise in underwriting and asset selection are well equipped to identify sector opportunities and pockets of asymmetric risk and reward.

Investing Discipline

In an environment of tighter credit spreads and pockets of macro uncertainty, discipline can serve as both a defensive posture and an advantage. Managers who stay the course—focusing on fundamental value, prudent underwriting and long-term alignment—can position themselves to deliver attractive risk-adjusted total returns compared with their peers.

Whether through real estate credit benefiting from an active market, infrastructure credit supported by long-term contracts, corporate lending to defensive businesses with strong fundamentals, or ABF that reaches into areas of the everyday economy, private credit is poised to grow as an integral part of a diversified portfolio. The key will be to remain selective and flexible in the year ahead.

Endnotes

- Greenstreet CPPI, October 2025.

- S&P, September 2025.

- Cushman & Wakefield, Q2 2025.

- Brookfield internal research.

- Pitchbook Leveraged Commentary and Data, September 2025.

Disclosures

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, a solicitation of an offer to buy, or an advertisement for, any securities, related financial instruments or investment advisory services. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, “Brookfield”).

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield’s internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield’s perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.

Explore More

Renewable Power & Transition Outlook: Scaling Power to Meet Relentless Demand

Infrastructure Outlook: Accelerating Growth, Embedded Resilience