Renewable Power & Transition Outlook: Scaling Power to Meet Relentless Demand

Energy is a strategic priority, and meeting today's unprecedented demand for power requires an “any-and-all” approach.

Key Themes for 2026

- Global electricity demand is accelerating faster than supply, propelled by the combined forces of digitalization, electrification and industrialization.

- Electricity is the bottleneck for global growth and therefore a strategic imperative. Corporates and governments are increasingly prioritizing energy security and domestic supply, reinforcing investment in renewables, nuclear and gas, alongside upgrades to grid infrastructure.

- No single technology can meet future load needs alone. Meeting this unprecedented rise in demand needs an “any-and-all” approach, with a focus on: renewables—the lowest cost source of bulk power in most regions of the world—for its economic advantage and speed; battery storage for flexibility; nuclear for scale and reliability; and natural gas for stability. Scaling these technologies in tandem will require significant investment over the next decade and beyond.

In a few short years, power has become a strategic priority around the world. It is now the bottleneck to growth for both governments and corporates.

Energy will define economic development in the years ahead. It is the most significant gating requirement for nearly every major economic opportunity we have today, from manufacturing to artificial intelligence. AI’s promise of transformational productivity gains across almost every part of the economy is further pushing energy to the center of national and corporate competitiveness. Without sufficient power, those gains and future growth and competitiveness are at risk.

Renewable energy costs have fallen dramatically, leading to a rapid buildout of wind, solar and batteries—yet global power systems are still struggling to keep pace with surging demand. Gas represents an important part of the solution in most countries, although growth is similarly constrained by resource limitations and lack of necessary infrastructure. As a result, many countries are looking to nuclear as another source of stable power to meet load growth.

Fundamentally, we have all the technologies we need to meet increasing power demand. The constraint today is scaling investment and development fast enough to meet this demand—creating an environment where players with the right mix of capabilities and access to capital are positioned to generate significant value.

While our 2026 view is anchored in the same fundamentals that defined last year’s outlook, the investment landscape has evolved in important ways. Demand is accelerating, increasing the opportunity for those that can provide scale energy solutions to global grids, with cost, speed to market and energy security being the key priorities when investing in new energy capacity.

Reflecting the world’s need for “any-and-all” energy solutions, global power investment is expected to reach $3.3 trillion in 2025, with over 60% directed toward renewables, storage and grid optimization.1

Owning Change in a Transforming World

This piece is included in our 2026 Investment Outlook Report, which is anchored by insights from the CEOs across our global platform.

Energy Is a Clear Strategic Priority

Energy demand is shaped by three powerful forces: deglobalization, as nations pursue energy independence; digitalization, as AI and data storage increase demand for reliable power; and decarbonization, as industries electrify and invest for sustainable growth. Each is accelerating towards the same outcome: delivering low-cost, reliable and scale energy, faster than ever before.

To achieve growth and partake in the evolving economy, governments and corporates are onshoring critical supply chains and investing significantly in domestic energy sources. In particular, economic drivers are reinforcing investment in low-carbon energy systems because they deliver the most affordable and secure power. The world’s largest corporations are seeking to procure low-cost, quick-to-market and scalable power to ensure their competitiveness and continue to partner with energy suppliers directly, reducing reliance on grids and utilities as intermediaries. We expect this dynamic to continue in 2026 and well into the next decade.

Hungry for Power

The most significant development of the past few years is the surge in electricity demand driven by digitalization and the rapid adoption of AI.

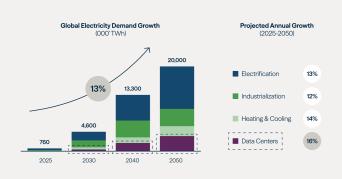

The data center buildout is the fastest growing source of electricity demand and will transform global power needs (see Figure 1). The forecasts struggle to keep up: BloombergNEF now projects U.S. data center power demand to reach 106 GW by 2035, a 36% jump from its forecast just seven months before.2 Four hyperscalers—Amazon, Google, Microsoft and Meta—now account for around 90% of global clean energy contracting for data centers.3 At Brookfield, we have seen our contracting to these businesses double in less than two years and expect electricity demand forecasts to keep rising.

Figure 1: Data Centers Are the Fastest Growing Demand Driver

Source: BloombergNEF

"Four hyperscalers—Amazon, Google, Microsoft and Meta—now account for around 90% of global clean energy contracting for data centers."

And while data centers are the fastest-growing source of demand, broad-based electrification and industrialization are the largest volume drivers, at over 70% of demand growth until 2050.4 The reindustrialization of the world’s largest economies, the electrification of major sectors—such as industrials and transportation—and the urbanization across emerging markets are creating sustained demand growth for generation capacity that will last for decades to come.

The need for power is particularly acute in the emerging markets. These economies are industrializing at an unprecedented pace, and energy security has become a national imperative. Despite the fact that emerging markets (outside China) are seeing some of the fastest growth in electricity demand, today they only receive an estimated 20% of total annual investment in the power sector.5 Here, the cost advantage of renewables provides a durable foundation for growth independent of subsidies or short-term policy shifts.

"Any-and-All" Solutions

Corporates and governments are now converging around the same objective: securing affordable, clean and reliable power at scale and quickly. Only a diverse, “any-and-all” energy solution—scaled with private investment—can power the global economy in the years ahead.

Renewables lead on cost and speed

Renewables remain the lowest-cost source of new electricity and the fastest to deploy and scale. Solar and wind projects anchor new-build pipelines, supported by long-term, inflation-linked corporate and utility offtake agreements.

We believe renewables will continue to represent the largest share of new capacity additions in 2026 and beyond. The International Energy Agency (IEA) forecasts solar and wind to provide almost 20% of global electricity by 2026, a nearly fivefold increase from a decade ago.6 Between now and 2030, it expects renewable power capacity to double.

Recent headlines suggest a potential slowdown for renewable investment, driven by changing policy priorities; in reality, the fundamental advantages of these technologies—and energy demand growth from corporates—are driving increasing investment, with no sign of abating. In fact, that dynamic is most significant in the U.S., where we are seeing the greatest ever demand for renewables despite recent policy changes.

Some projects and businesses have been affected by changing U.S. policy over the past year. But for those like Brookfield with a disciplined approach, access to scale capital and high-quality projects, the opportunity is growing. Many of the largest and most capable businesses have safe-harbored projects securing tax credits through to the end of the decade, maintaining underwritten returns. Even when these credits are phased out, renewable technologies will continue to stand on their own given their economic advantages: speed to market and energy security.

Storage enables round-the-clock clean power

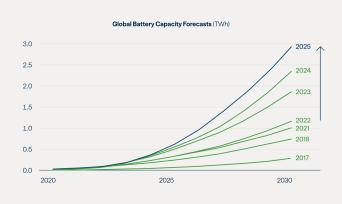

Batteries are now central to meeting energy demand as they transform wind and solar into round-the-clock power solutions and provide increased reliability. Costs fell by roughly 95% since 2016,7 enabling large-scale deployment alongside renewables and traditional thermal technologies.

In addition to enabling the supply of 24/7 clean energy, batteries provide critical grid stabilizing services when growing loads and a shifting energy mix have resulted in congestion and intermittency. We expect investment in grid-connected storage to continue to increase in 2026 as a solution to these challenges and, in particular, note that colocated solar-plus-storage developments are emerging as a preferred model for new capacity. In the U.S., over half of the utility-scale storage coming online by 2026 is paired with solar.8

By 2030, global demand for batteries is now expected to be double what anyone thought possible just a few years ago, reflecting the improving economics and evolving needs of the grid (see Figure 2).

Figure 2: Batteries Have Become the Cornerstone of Power Systems

Source: BloombergNEF

Nuclear returns to the mainstream

Nuclear energy is a critical source of scale, carbon-free baseload power, and governments around the world are increasingly looking to it as they form their energy strategies and policies. The U.S. government has made it a strategic priority to start construction on 10 new reactors by 20309 and recently announced it would invest a minimum of $80 billion to kickstart this program with Westinghouse—a nuclear technology leader owned by Brookfield since 2017. The U.K., Poland, Czechia and Bulgaria, to name a few, are building new reactors, and around the world countries are extending the life of their currently operating fleet and restarting non-operational reactors. This renewed focus is, in turn, driving supportive regulation and improved capital access, which is expected to continue reviving investment interest.

Our view is that over the coming decades, hundreds of gigawatts of new nuclear capacity will need to be deployed. Through Westinghouse, we are witnessing a step change in the nuclear reactor buildout that exceeds anything seen this century, creating investment opportunities not only in the construction of new generating plants, but also in securing the decades-long fuel and servicing requirements for those reactors.

Gas + carbon capture as critical balancers

Natural gas continues to play a critical role in meeting energy demand and stabilizing grids. While we see vast demands for power driving a resurgence of nuclear, we are observing similar trends in gas, especially in markets that have an abundance of this natural resource domestically.

What’s more, carbon capture and storage (CCS) is increasingly economic and can be paired with gas to provide cleaner, more reliable and flexible energy solutions. Projects such as Entropy’s Glacier CCS facility, the world’s first decarbonized gas plant through carbon capture,10 further demonstrate commercial viability of CCS and help solidify the position of natural gas as a transitional yet indispensable power source.

Other decarbonization technologies expand the toolkit

Beyond power generation, a new wave of decarbonization technologies is emerging for sectors that are difficult to electrify. eFuels—including sustainable aviation fuel and other biofuels produced from captured carbon dioxide and green hydrogen—offer pathways to cut emissions from aviation, shipping and long-haul transport. Brookfield’s investment in an eFuels project with Infinium—supplying low-carbon fuel to airlines and logistics customers—demonstrates how these solutions are moving to commercial scale. Green hydrogen and advanced recycling technologies are also helping heavy industry reduce emissions where high temperature heat and complex feedstocks are involved. Together, these technologies complement renewables and storage and expand the toolkit for decarbonizing hard-to-abate sectors.

Managing grid limitations

Utilities and grid operators are planning significant levels of transmission investment. In 2024 alone, a record $390 billion was invested to ensure that grids could manage additional power.11 However, we expect grid connection to remain one of the biggest obstacles to meeting demand. This should contribute to continued growth in batteries, which reduce grid congestion, and distributed generation, which can add capacity without relying on the grid.

Looking Ahead

The future needs an “any-and-all” approach to energy investment. The forecast demand is too high, and the existing technologies too established, for there to be a zero-sum or winner-takes-all outcome. Investors who work with governments and corporates to deliver diversified energy solutions are poised to best capitalize on this dynamic.

Disciplined capital allocation is increasingly important, as generating returns in such an environment requires adherence to the same rules that define success in other forms of infrastructure investing—focusing on securing long-term contracts backed by creditworthy counterparties and delivering technologies that stand to win on the fundamentals. Similar to previous growth periods, as policy incentives normalize and competition intensifies, those attributes will separate durable value creation from cyclical growth.

In this environment, we see an opportunity for disciplined and experienced operators to capture significant value by enabling the largest energy buildout in history.

Endnotes

- IEA, “World Energy Investment 2025,” June 2025.

- BloombergNEF, “AI and the Power Grid: Where the Rubber Meets the Road,” December 1, 2025.

- S&P Global, “2025 Corporate Renewable Energy Update,” February 2025.

- BloombergNEF. Data shows net growth from 2024, not including legacy demand.

- IEA, “Growth in global electricity demand is set to accelerate in the coming years as power-hungry sectors expand,” February 14, 2025; IEA, “World Energy Investment 2025,” June 5, 2025.

- IEA, “Electricity Mid-Year Update 2025,” July 2025.

- Bloomberg NEF.

- Deloitte, “2026 Renewable Energy Industry Outlook,” October 2025.

- World Nuclear News, “Trump sets out aim to quadruple US nuclear capacity,” May 24, 2025.

- Entropy Inc. website, as of November 2025.

- BloombergNEF, “Global Investment in the Energy Transition Exceeded $2 Trillion for the First Time in 2024,” January 30, 2025.

Disclosure

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, a solicitation of an offer to buy, or an advertisement for, any securities, related financial instruments or investment advisory services. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, “Brookfield”).

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield’s internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield’s perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.