From Speed to Scale: The Next Decade of Power

Diversifying the energy landscape will unlock the future of growth.

Key Takeaways

- The next decade will be powered by “any-and-all” forms of energy. Modern energy systems must integrate renewables for cost and speed, battery storage for flexibility, nuclear for reliability and natural gas for stability. Scaling these technologies in tandem is the only way to meet exponential load growth—but it will require major investment.

- Renewable energy is a fixture of the global energy landscape. Following a decade of technological advancements and falling prices, renewables are now the cheapest, fastest and most scalable form of bulk electricity generation in nearly every major market.

- Corporate demand is shaping power markets. It will continue to dominate as global energy demand, driven by AI and electrification needs, outpaces supply.

- Energy security is paramount. Countries are moving away from dependence on imported fossil fuels by investing in domestic, diversified energy systems for strategic independence. Energy is the defining bottleneck for economic and productivity growth.

- A disciplined investment approach based on long-term fundamentals can weather energy volatility. Deep operational and development capabilities, as well as sustained diversification across technologies and geographies, can continue to deliver attractive returns and long-term value.

In a remarkably short time, electricity has shifted from a stable, assumed resource to the defining bottleneck for economic and productivity growth across the world’s governments and corporations. Energy is one of the most significant gating requirements for nearly every economic development opportunity, from manufacturing to artificial intelligence (AI).

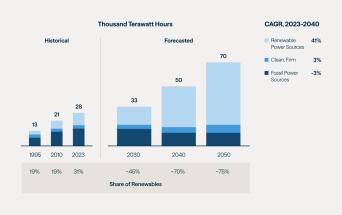

And right now, supply is struggling to keep up with growing demand. Global electricity demand—driven by electrification, industrialization and the rapid expansion of AI—is accelerating faster than at any time in modern history (see Figure 1). At the end of 2020, forecasts predicted that it would take 10 years for global energy demand to increase by 25%. It took only four.2

Figure 1: Global Power Generation Is Accelerating Fast

Source: See endnote 1.

Governments and corporations are driving this transformation, shaped by three powerful forces: deglobalization, as nations pursue energy independence; digitalization, as AI and data consumption accelerate demand for reliable power; and decarbonization, as industries electrify and invest for sustainable growth. Each is accelerating the same outcome: delivering cheap, fast and scalable energy—power, in every form, faster than ever before.

No single form of energy will be sufficient to meet this unprecedented level of demand. It will take “any-and-all” power solutions: Clean, conventional and hybrid systems alike have distinct and complementary roles to play. Renewable energy will be at the center of this mix, providing the scalable, low-cost foundation for the future grid.

Savvy investors will find tremendous opportunities for long-term value creation in developing diverse power solutions. Capitalizing on this moment requires a deep understanding of the past, present and future of energy technologies and markets.

"At the end of 2020, forecasts predicted that it would take 10 years for global energy demand to increase by 25%. It took only four."

While the previous decade was defined by technological advances—the rapid buildout of clean energy projects, falling costs and early transition wins—the next decade must be defined by building out supply and flexibility at scale. To meet this step change in load growth, energy sources will need to scale—quickly—across every market.

A Decade of Falling Costs and Rising Opportunities: 2015–2025

The renewable energy market that powers today’s global economy was largely built over the past 10 years. While government support was an important driver in the first half of that decade, renewable energy quickly proved it could stand on its own over the second half, thanks to supportive market dynamics, dramatic improvements in technology and reductions in cost.

The rise of gas in the U.S.

After the global financial crisis, flattened energy demand led utilities to shift their capital and focus toward grid maintenance and upgrades. New generation favored gas plants, driven by the shale boom’s low prices, lower capital costs and faster build times, as well as facilities’ inherent operational flexibility. This shaped the energy sector’s trajectory.

A government push for sustainability and security

Governments around the world led the charge toward emissions reductions, passing stronger policies and regulations and joining together to sign the 2015 Paris Agreement, ushering in historic political and market signals for decarbonization. By COP26 in 2021, over 90% of global GDP was covered by some form of net-zero national commitment3 —with corporates following suit, unleashing capital into renewables at unprecedented scale.

Government policy also prioritized energy independence and security. Investments in domestic natural gas, which was replacing coal as a source of baseload power, offered countries relative stability to manage any geopolitical challenges. For countries that do not have a natural gas supply, renewables have proved to be a powerful method to ensure energy security and self-reliance.

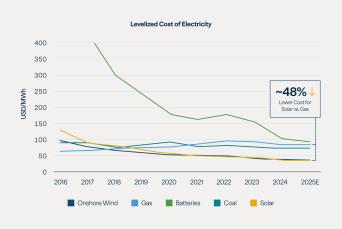

The emergence of renewables

As energy demand started growing again, renewables soon became an attractive choice to corporates, thanks to their low cost and scalability. Renewable energy technologies went from development to deployment at a breakneck pace to meet new demand. Battery costs also began to fall. Regional power markets in the U.S. further spurred the growth of renewables, proving that renewables could be cost-competitive without relying on subsidies. By 2019, solar and wind, a small but growing component of the energy mix, had generally achieved cost parity with conventional sources of energy (see Figure 2).4

Figure 2: Renewable Power Is the Lowest Cost Form of Bulk Electricity in Most Markets

Source: BloombergNEF.

Corporates seeking the lowest-cost scalable resources started going directly to renewable suppliers to meet their power needs and decarbonization goals through power purchase agreements (PPAs) that increasingly offered stability over longer terms. Since 2015, the PPA market has grown by an average of 33% annually.5 These PPAs proved vital during periods of geopolitical instability and price volatility.

Byzantine bureaucracy and other limitations

This decade was not without its challenges, as clean energy buildout was constrained by limited transmission capacity and complex permitting; transmission buildout for all forms of energy slowed sharply starting in 2014 until 2023.6 Around the globe, projections for energy demand significantly underestimated the need for energy—well before the AI demand soared. Less than 20% of projects in the U.S. transmission queues between 2000 and 2018 were built by the end of 2023.7 The effects of slower growth will require sustained focus and managed solutions for decades to come.

Specific forms of energy faced specific challenges. Offshore wind, for example, contended with escalating capital expenditure costs and regulatory delays. Nuclear power saw early growth but soon faced stop orders and major losses.

Developers with strong supply chain relationships, deep operational and power market expertise, and a disciplined development approach could weather these challenges and capitalize on the growing demand. They were able to avoid the significant supply chain crunches usually associated with rapid scaling, steer clear of risks associated with very early-stage pipeline projects, and align construction costs with long-term contracted revenues from well-positioned counterparties.

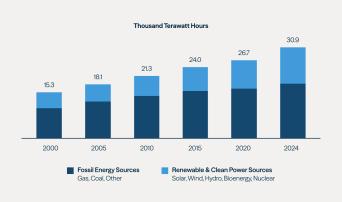

Growing demands for energy capacity increased prices and have impacted the ability of utilities to keep the lights on. Clean power had surpassed 40% of global electricity generation by 2024, reflecting its emergence as both an affordable and stable option for power (see Figure 3).8 The expansion was driven primarily by solar and wind, supported by steady output from hydro and nuclear. Overall, the previous decade marked a decisive shift in which renewable energy evolved into a cost-competitive, scalable and indispensable component of global energy supply.

Figure 3: Clean Power’s Share of World Electricity Generation Has Steadily Increased

Source: Ember.

Current Market Dynamics

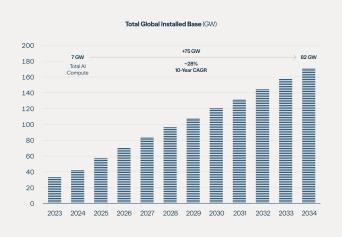

We are now in an era defined by soaring power demand, compounded by a shortfall in supply from the past decade’s limited growth. The largest demand driver is the explosive growth of data centers—reshaping energy consumption, while still needing to supply basic energy needs. Total data center capacity is expected to reach roughly 82 gigawatts by 2034—more than a tenfold increase in a decade (see Figure 4).

The growth in power demand has catalyzed a 12x surge in PPAs since 2016, tilting decisively toward clean energy suppliers.9 Corporations worldwide are seeking cheap, reliable, clean power that can scale quickly. For example, in 2024, Brookfield signed a landmark renewable energy framework agreement to develop more than 10.5 gigawatts of renewable capacity globally for Microsoft. And in June 2025, Brookfield announced the world's largest framework agreement for hydroelectricity with Google. These relationships provide unique insight into corporate power demand and evolving needs, enabling asset developers and operators such as Brookfield to build bespoke solutions and secure additional landmark agreements.

Figure 4: We Forecast Data Center Capacity to Reach 82 Gigawatts by 2034

Source: Brookfield internal research.

In parallel, energy independence remains a defining policy priority for many governments. The recent decade underscored the vulnerability of nations overly reliant on imported fossil fuels and exposed to the volatility of international natural gas prices. Governments are accelerating domestic investment in renewable generation, nuclear power and other low-carbon sources to strengthen energy security and stabilize long-term costs.

As governments pursue this new era of energy self-sufficiency, technological progress is reinforcing the shift— bringing greater reliability and consistency to power systems. Nuclear power is uniquely positioned to deliver that stability, supported by improved public sentiment, but also from better capital market access and supportive regulatory frameworks. There is no credible net-zero pathway without a substantial and expanding role for nuclear power.

As nuclear power shows great promise for providing the baseload capacity needed to meet demand, advancements in battery technology are unlocking the potential of solar and wind. Batteries are fast to install and scalable, and pairing them with renewables is increasingly effective at tackling intermittency and spot pricing challenges—moving us closer to delivering around-the-clock clean power. Large-scale lithium-ion batteries are more effective at storing excess energy and discharging it when needed. The price of these batteries has fallen by 92% since 2010, including a 50% drop in the past two years alone—one of the fastest price declines of any energy technology in history.10

Finally, with intermittent renewables expanding and coal in decline, natural gas will remain a vital component of the energy mix. It plays a dual role: meeting immediate surges in demand while acting as a flexible, dispatchable source to ensure stability during peak periods and balance grids as renewables scale. This dynamic is especially pronounced in emerging markets, where continued demand growth heightens the need for reliability.

"The growth in power demand has catalyzed a 12x surge in PPAs since 2016, tilting decisively toward clean energy suppliers."

More opportunities will arise as the U.S. and many other governments seek to onshore their energy production through protectionist policies like tariffs, as well as through incentives for domestic development. Doing so not only strengthens energy security and independence, but also expands domestic power supply—the foundational input to compute capacity, which is increasingly treated as a national strategic resource. As compute and AI infrastructure become primary drivers of productivity of future economies, governments are acutely focused on ensuring that sufficient power generation is available to support and scale these capabilities. Governments are increasingly prioritizing the reshoring of supply chains for critical technologies—from domestic mining of rare earth minerals to manufacturing solar panels, wind turbines, nuclear reactors and batteries. This shift confirms that national energy strategies are also about independence and security, alongside resilience, affordability and decarbonization.

Still, renewable energy faces significant bottlenecks and permitting challenges. Transmission issues continue to hamper clean energy penetration, with many renewable energy projects held up in interconnection queues—long waiting lists that are created because the existing grid lacks the capacity to absorb new generation. Moreover, large parts of the electricity grids in advanced economies are over 20 years old—and require significant modernization and investment to keep up with demand or absorb energy from new sources.

In sum, both corporate-driven demand for scaled power and decarbonization, as well as government-driven demand for energy independence, are significant and persistent. As long as there is a supply and demand imbalance, buyers will be willing to pay a premium for dispatchable baseload power. These dynamics create opportunity for large clean energy developers and operators with access to capital, understanding of the market, and strong corporate partnerships to develop assets for value.

This past decade proved that policy can catalyze markets, but technology and capital ultimately sustain them. It is clear that the most successful operators are not those who chase subsidies, but those who are disciplined and build diversified portfolios, balancing exposure across geographies, technologies and counterparties to capture enduring value.

“Any-and-All” Energy to Power the Next Decade: 2026-2035

Looking ahead, meeting the enormous power needs of the future will require maximizing energy options. Future productivity gains from AI will be governed by the speed of the energy buildout. Global electricity demand is expected to grow by 4% each year through 2027,11 with 85% of that growth driven by emerging markets.12 Only with a diverse energy landscape—“any-and-all” forms of energy scaled with the focused investment of private capital—will it be possible to power the global economy into the years ahead.

While industrialization and electrification of sectors like transportation and heating will remain the largest use of power, data centers are expected to represent the single fastest incremental source of electricity growth, potentially reaching 9% of total U.S. electricity generation by 2030.13 Global electricity needs from data centers alone are expected to nearly triple by 2030, to a level that is slightly higher than the entire electricity demand of Japan today (see Figure 5).14 15

Figure 5: Global Electricity Consumption for Data Centers and AI Are Expected to Triple by 2030

Source: Gas Exporting Countries Forum.

Hyperscalers are likely to prioritize contracted capacity with a flat generation profile, reflecting a focus on operational risk mitigation over marginal cost optimization. Specifically, hyperscalers need energy now, so they will increasingly seek out partners that can quickly deploy guaranteed reliable power at scale to prevent any disruption in business functions.

With technological advancements, some energy sources can offer benefits beyond simply meeting energy demand: Batteries and hydro, for example, can help stabilize the grid and increase project revenue. In turn, they improve the economics of those projects, compared with other power sources that have exposure to curtailment, weather-event and intermittency volatility.

In emerging markets, the surge in power demand is being driven first and foremost by rapid population growth and the expansion of the middle class—reinforced by strong macroeconomic trends such as rising GDP per capita. Urbanization and industrialization are further accelerating this demand, with data centers increasingly becoming part of that industrial landscape—Malaysia, in particular, is rapidly emerging as a key hub for data centers and semiconductors. Renewable energy has become a mainstay in these markets, especially after it became difficult to import natural gas due to war in Ukraine. Together, these forces are creating an urgent need for large-scale infrastructure investment, not only in energy generation but also in the transmission and distribution networks required to support sustained economic growth. To capture these opportunities, local operating teams with deep knowledge of regulatory environments and market dynamics are essential.

“Global electricity needs from data centers alone are expected to nearly triple by 2030, to a level that is slightly higher than the entire electricity demand of Japan today.”

In the next decade, governments’ commitment to energy independence and security will continue to accelerate decarbonization trends. With greater domestic energy resources, nations are less vulnerable to volatile global energy markets and supply chain disruptions. An increasingly electrified global economy can mitigate threats of energy manipulation as nations gain the ability to generate more power from resources within their own borders. The need to strengthen energy security provides powerful motivation for expanding clean energy capacity while decreasing fossil fuel dependence. This requires investment in comprehensive energy systems and supply chain approaches that will be critical for ensuring future security.

As demand accelerates, the commitment to an “any-and-all” energy strategy will only grow. Private investors will play a pivotal role in bridging the gap between technological innovation and the large-scale deployment required to power the next decade.

Nuclear power

The role for nuclear power is growing as it becomes a critical technology for providing low-carbon baseload power and as developers continue to advance its commercial viability.

Nuclear continues to benefit from strong policy support and renewed prioritization, highlighted by the U.S. commitment to build 10 new reactors by 2030 with up to $80 billion in investment using Westinghouse technology, a company owned by Brookfield. This initiative will cement nuclear’s role as a key element of U.S. energy and AI growth, providing a reliable, carbon-free source of baseload power to meet rising demand.

This transformational commitment is set to catalyze a large-scale buildout of the domestic nuclear supply chain—from component manufacturing to workforce development and engineering capacity—while creating meaningful opportunities for Westinghouse, whose AP1000 remains the only new reactor design to be deployed in the U.S.

Batteries

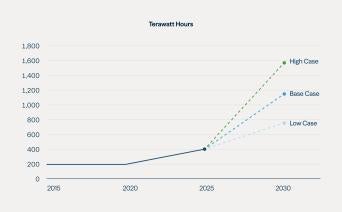

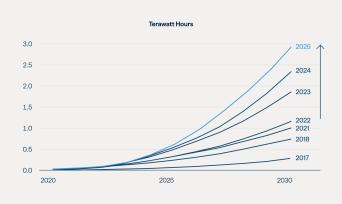

Battery technology is advancing rapidly, and costs are falling, setting the stage for accelerated large-scale deployment worldwide. Batteries have become a cornerstone in power systems, with forecasts more than tripling in the past five years—representing a significant investment opportunity (see Figure 6).

Figure 6: Global Battery Capacity Forecasts Are Over 3x Higher Since 2020

Source: BloombergNEF.

Governments and corporations are increasingly prioritizing renewable sources that co-locate batteries next to solar and wind projects and share a grid connection. Efficient and cost-effective, these co-located systems create a major opportunity to turn intermittent wind and solar generation into a more reliable and consistent power source. They are also increasingly able to provide storage over longer time periods: The average duration for utility-scale storage today is around four hours and is expected to continue to lengthen in the years ahead as the need for longer-duration storage grows.

The applications for batteries are wide-ranging and global. In the Middle East, they can help meet surging peak demand, while in markets with rapid data center growth, they can firm up quick-to-market renewable projects and provide the reliability customers require. As penetration of renewables into power grids increases, demand for storage solutions will only intensify.

Natural gas and carbon capture and storage

As renewables scale and coal usage declines, natural gas will play a key role in keeping the grid balanced and easing the intermittency of renewables. This reliability is especially critical in emerging markets, where rapid growth requires stable power to support industrialization, urbanization and data center development.

When paired with CCS, natural gas becomes one of the few technically and commercially viable options for low-carbon baseload power production, reducing emissions intensity by more than 80% when compared to unabated plants.16 In this way, natural gas is a critical link in the global transition to a more diversified, lower-carbon energy system.

CCS can be deployed in new greenfield gas power projects and in brownfield retrofits of existing sites that have suitable technical characteristics. In addition, CCS technology is flexible enough to be utilized across the full range of commercially available gas power generation facilities, including reciprocating engines, simple cycle turbines and combined cycle turbines.

Energy for AI, and AI for energy

Finally, it is notable that AI is not simply driving up demand for energy but making important contributions to transforming and modernizing grid operations. For instance, some grid operators in the U.S. have been piloting AI-driven platforms to forecast solar and wind generation more accurately, allowing them to balance supply and demand more efficiently.

AI is increasingly embedded in battery dispatch and optimization platforms, enabling owners and grid operators to maximize real-time battery performance. These battery storage systems help power grids balance fluctuating demand and intermittent supply with sub-second response times. With grid operators increasingly requiring new load to be paired or to come with a firm dispatchable power solution at relevant locations, batteries are seen as the technology of choice to help new load obtain interconnections from grids. As grids worldwide are already strained, these new applications of AI can help ease the additional strain from future data centers.

How Electrification and AI are Reshaping Power

Renewable Power & Transition COO Natalie Adomait shares how Brookfield is helping to build the foundation for an electrified, AI-enabled world.

From Innovation to Speed and Scale

Undoubtedly, the next decade will be defined by unprecedented energy growth—future global productivity, competitiveness and economic expansion will depend directly on scaling energy supply at speed. Vast amounts of incremental power will be required to support economic growth never before seen in our lifetimes.

Nations and corporations will take the lead in the trends of deglobalization, digitalization and decarbonization, demanding energy independence and fast, but sustainable, growth. The main drivers for this unparalleled demand will come from growth in data centers, industrialization and electrification. Offtakers will rationally seek the lowest-cost, most readily available electrons first, making renewables the first-choice alternative for new generation. But renewables alone cannot meet the challenge.

Renewables deliver cost-effective and low-carbon power; storage provides consistency; nuclear adds reliable baseload; and natural gas remains a critical backstop. All will be required to balance availability, cost, reliability and decarbonization. And all need to scale as quickly as possible.

The stakes for striking this balance are significant. The imbalance between rapidly growing demand and constrained supply could drive energy prices higher if new capacity fails to keep pace. Worse, it could limit global growth and productivity. Such an outcome would trigger a cascade across the economy, raising production costs and ultimately the cost of living. International macroeconomic conflicts can also add to the volatility in energy prices, mostly from fossil fuel sources. To avoid these risks, governments will continue to pursue energy independence and will remain central in catalyzing investment and accelerating the growth of all forms of power—and especially the most cost-effective sources, such as renewables and storage. While such technologies can stand alone economically, supportive regulatory frameworks and targeted policies will be helpful both to attract the scale of private capital required and to maintain affordability and stability in the broader economy.

With unprecedented energy demand comes compelling investment opportunities. But capitalizing on these opportunities requires more than capital. The best outcomes will come from applying a disciplined investment philosophy: maintaining a long-term horizon, exercising rigorous due diligence, recognizing complexity at every stage, hedging project costs against revenues, locking long-term contracts with strong counterparties, and protecting against other development risks. Equally, if not more critical, are the operational capabilities behind the capital. A global procurement team that can negotiate in different regions—and with scale—will be better positioned to protect against supply chain disruptions. Deep local expertise and strong operating teams are also essential to navigate regulatory frameworks, supply chain challenges and geopolitical uncertainty—and drive value, wherever the winds may shift.

Meeting this moment demands an “any-and-all” strategy with disciplined capital, operational excellence and long-term vision to galvanize today’s constrained supply to meet tomorrow’s massive demand. Those who can deliver scale at low cost and high speed will shape not only the next decade of energy, but the next decade of global growth.

Endnotes

- McKinsey, “Global Energy Perspective 2024,” September 2024. Note: Excludes generation from storage (pumped hydro, batteries, LDES). Includes coal and gas with CCUS (carbon capture, utilization and storage), geothermal, hydrogen and nuclear.

- IEA, “World Energy Outlook 2020,” October 2020.

- Accenture, “Accelerating Global Companies Toward Net Zero by 2050,” 2022.

- Bloomberg, “New Energy Outlook 2019,” July 2019.

- Bird & Bird, “Corporate PPAs: An International Perspective,” 2024.

- Americans for a Clean Energy Grid, “Americans for a Clean Energy Grid and Grid Strategies Release New Report on Declining Large-Scale Transmission Construction in the U.S.,” July 2024.

- The University of Chicago, “How the Interconnection Queue Backlog Is Slowing Energy Growth,” July 2025.

- Ember, “Global Electricity Review,” April 2025.

- BloombergNEF, “Corporate Clean Power Buying Grew 12% to New Record in 2023,” February 2024.

- BloombergNEF, Contemporary Amperex Technology Co., Limited.

- IEA, “Growth in global electricity demand is set to accelerate in the coming years as power-hungry sectors expand,” February 2025.

- IEA, February 2025.

- U.S. Department of Energy, “Clean Energy Resources to Meet Data Center Electricity Demand,” September 2022.

- The Oxford Institute for Energy Studies, “Global electricity demand: what’s driving growth and why it matters?,” January 2025.

- Assumes base-case scenario.

- Carbon Direct, “Carbon capture for natural gas-fired power generation: An opportunity for hyperscalers,” March 2025.

Disclosure

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, a solicitation of an offer to buy, or an advertisement for, any securities, related financial instruments or investment advisory services. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, “Brookfield”).

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield’s internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield’s perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.